Bill – Just the Facts – Investor Profile

Today we’re going to look at “Bill” from Guy Thomas’s book Free Capital. His chapter is called Just the Facts.

This article is part of our ‘Guru’ series – investor profiles of those who have succeeded in the markets, with takeaways for the private investor in the UK.

You can find the rest of the series here.

Contents

Bill – first of the Surveyors

“Bill” is the first of what Guy calls the “surveyors”.

- Unlike the top-down geographers, this group of investors starts from the bottom up, analysing the attributes of individual companies first, and adding relevant macro economic data afterwards.

Guy says that investment is zero-sum, and each investor needs an edge. ((I think that investment is not zero-sum – even if you match the market you will generally get richer over time, and your edge can start from keeping your costs low, avoiding unnecessary taxes and finding the appropriate asset allocation ))

This edge can be based around relationships and contacts, or focusing on facts and numbers.

- Bill uses the second approach, which works best when warm relations with the companies being analysed are avoided.

He thinks that attending company meetings would make him less objective about selling, which is hard enough anyway.

I never visit companies, hardly ever go to an AGM, and speak to hardly anyone. I’m not looking for soft information. I’m looking for shares where the raw numbers scream at me to buy. – Bill

I am a poor judge of character – Bill

Early life and career

At the time of Guy’s interview in 2010, Bill – a former electronics engineer who grew up on a Welsh farm – was in his 40s.

- He had been a full-time investor for eight years during which time he had multiplied his money ten times over.

- This works out at a compound growth rate of 30% pa.

His lifestyle had not grown with his capital, and he lived with his girlfriend in a modest suburban house in an English university town.

I still love shopping at Aldi. – Bill

Bill grew up poor and went from the local comprehensive to study Natural Sciences at Cambridge. After switching to electronic engineering he graduated in 1982. ((I have this in common with Bill, other than that I switched to psychology and graduated a year later )).

Finding a job was difficult in the early 1980s, and he ended up at a home computer company near Cambridge, which soon went bust. As did the similar firm he joined next.

He appreciated the autonomy. Like most of the investors in Guy’s book, his focus on substance over form works well for DIY investing, but not for career advancement in big firms.

Bill was always a saver, and turned to investment by stagging privatisation shares, beginning with Rolls Royce in 1987. He bought every privatisation through the 1990s.

- But he liked his job and had no intention of becoming a full-time investor.

Ironically, his inside knowledge of tech project over-runs and commercial failures made him slow to get involved in the late 90s tech boom.

- When he did join in, he lost half his savings on Ionica.

- Stagging non-privatisation new issues was not the same easy money.

He bought other tech and media firms, but often overpaid for growth.

Going full-time

In 2001 the telecoms firm he worked for was going slowly bust.

- Bill used his free time and internet access to research stocks and read investment books.

- After reading The Intelligent Investor, he became a value investor.

When the firm went bust, he decided to take his time on finding a new job.

He switched from tech stocks ((Surely now mostly bust by 2001? )) and bought old economy stocks trading on PEs around 5.

- This simple approach worked, and Bill became attracted to the idea of using just a few metrics.

Crucially, the internet and the information available on it meant that Bill’s new approach to investing was now viable for the private investor.

I probably learned more in that first few months as a full-time investor than I had in the previous 15 years of dabbling. – Bill

Spread betting

The second factor in Bill’s success was (tax-free) spread betting.

- He used spreads as proxies for medium-term share holdings rather than for day-trading. ((As do most of the successful spread-bettors I know from Twitter ))

Spread-betting can be competitive over a few weeks or months:

- there’s no stamp duty

- profits are tax-free (and losses are not deductible)

- leverage and guaranteed stop losses means that significant exposure can be achieved at low-cost and moderate risk

- the use of leverage means that an interest charge has to be paid on the balance

- a wide range of assets is available

- you can easily sell short as well as go long

- for more information on spread-betting, start here

Within a few weeks, Bill started shorting telecom stocks he thought would go bust.

- Within a few months he was doing so well that he stopped looking for another job as an engineer.

A few months after that, over-confident from his early successes, Bill starting using too much leverage and had some close calls with positions that might have cost him 25% of his (now larger) portfolio.

- He had to sell shares to meet spread-bet margin calls, and took this as a warning for a while.

But a few years later he got into trouble again shorting the estate agent Countrywide, losing 20% of what was now a big portfolio.

- That was the last time that he over-traded, though he still spread-bets and shorts.

Stop losses

Bill doesn’t use stop-losses, usually buying more when a share price falls. ((In contrast, I completely reject averaging down, and recommend at least mental stop losses, particularly with leveraged spread bets – but doing the exact opposite seems to suit some people’s personality ))

- For me, this is an indicator of an emotional attachment to an existing position, or at least extreme confidence that the initial decision to invest is correct.

I think that one of the greatest psychological weaknesses in people is the inability to quit while they are behind. I use stop losses – even if they are only mental – to give myself “permission” to abandon a position.

- On many occasions, I haven’t actually sold out when my stop is hit. But I have stopped caring about the share, which helps with the rest of my portfolio.

Some people claim not to have this personality trait, but it shows up reliably in the psychological literature, and I suspect that they are in denial.

Just the Facts

The art of being wise is knowing what to overlook. – William James ((This is basically what I spent two years – and around £20K in today’s money – learning on an MBA ))

Warren often talks about these DCF calculations, but I’ve never seen him do one. – Charlie Munger

Bill still finds PE to be the most useful metric, though he accepts that this can lead you into value traps.

He’s also interested in earnings visibility, predictability and variability.

- For recovery situations, he uses price-sales ratios, or EV/sales ratios (enterprise value divided by sales).

- For mining stocks, he uses net asset values.

- For takeovers, he looks at the probabilities of various outcomes.

He doesn’t used discounted cash flow (DCF) analysis.

Bill will buy large companies, from certain sectors.

The asset value of a bank is always suspect because it is the small difference between two large numbers. – Bill

Radar charts

Bill’s focus on numbers is to be expected from an engineer.

- In fact I would expect even more quantitative analysis, but there is no data mining, or back-testing to be found.

- I’m sure this is partly because Bill relies primarily on fundamental data rather than price action.

I’ve done fine with simpler methods, and I spend too much time on investing as it is. – Bill

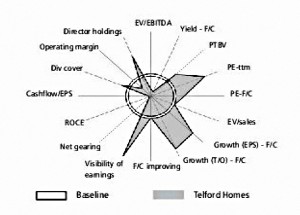

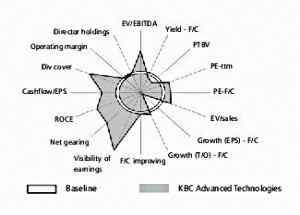

But he has developed the “value spider” – a radar chart of company financial metrics compared to average metrics.

- There are a couple of examples from the book below. ((Apologies for the quality of the pictures – I couldn’t find any high-res versions ))

The circle in the middle is the average value for all companies, and the zig-zag in and out shows where the company in question is better or worse than the average.

- The right hand side mostly covers value metrics, and the left hand side generally covers quality metrics.

- Telford Homes is strong on value metrics, particularly trailing PE and growth, but relatively weak on quality measures.

- KBC Advanced Technologies has only moderately good value metrics, but is strong on quality measures.

I really like these charts, and if I could find average values of these metrics for the market ((Suggestions on a postcard, please )) I would look into building these for myself.

Conclusions

Guy had a book to write, and needed to bring out the contrasts between the various investors he interviewed.

- I’m not convinced that Bill is a 100% cold unemotional surveyor – a lot of his early investments were in firms that he knew from his business career.

- His reluctance to use stop losses and willingness to average down also strike me as characteristic of an investor with an emotional relationship to his holdings.

- Having said that, he clearly does avoid the face-to-face contact that some other investors enjoy so much, and he does look at the numbers.

- His track record is impressive, and it’s particularly admirable that he does so well through using only a few metrics.

- I also like the radar charts, but I don’t know where to get the average market metrics.

But despite the similarity in our backgrounds, I don’t feel I’ve learned too much about how Bill manages to perform so well, or how I can adapt elements of his style to improve my own investing.

Perhaps this is because my style is already close to his:

- I choose which stocks to buy using only a few numbers

- I’m not interested in face-to-face contact and I try not to get emotionally attached to any firms

Until next time.