Build your own Bond Ladder

Today we’re going to look at how you can build your own bond ladder. Is this a good option for private investors?

Contents

Building a Bond Ladder

Me and bond ladders go way back.

- In 2006 and 2007 I was looking to diversify away from stocks as I approached retirement age (I was 45 at the time – I’ve always been a long-term thinker).

- The bond yields on offer then were pretty good – around 5%+.

- I didn’t know much about bonds at the time so I started to study.

I got weekly updates from a website that I think was Investors Intelligence (I haven’t visited for many years and the site looks very different today).

- Then the credit crunch hit, and interest rates went down, and so did bond yields.

- I forgot about my ladder.

But a couple of things have made me revisit the idea:

- An article by Bengt Saelensminde in MoneyWeek about how to build a bond portfolio (Bengt used to run a free email newsletter called the Right Side, but this seems to have disappeared)

- The looming introduction (in April 2016) of Innovative Finance ISAs (IF-ISAs)

The IF-ISA will allow you invest your ISA allowance on a P2P lending platform (Funding Circle and Zopa are the two that I’ve seen announcements from, but I’m sure that many more are on the way).

Me and P2P go way back, as well.

- I joined Zopa when it started

- I even applied for a Consumer Credit Licence so that I could lend through my limited company, which helped with tax planning.

But again, when the credit crunch hit, I got cold feet. I thought that there would be lots of defaults.

- I was wrong.

- I didn’t see seven years of historically low interest rates coming.

P2P lending

I still like the idea of P2P lending (but not crowdfunding, which is very risky equity investment in tiny firms).

- P2P cuts out an expensive middleman, and there should be decent returns available.

But the credit risk (counterparty risk) is still there, waiting for interest rates to eventually rise.

- And the massive expansion of the sector since I first got involved means that the people taking out loans today are necessarily of lower credit quality.

There are two other snags:

- P2P interest hasn’t been tax-sheltered until now (except through a limited company)

- this cuts the 5% headline rate (before defaults) to 4% for basic-rate taxpayers, and to 3% for higher-rate taxpayers

- the IF-ISA sort of fixes this, but £15K per individual P2P platform is a bit lumpy for me

- the credit risks are usually under-estimated

- this means that people are prepared to lend money on the cheap, and returns (interest rates) from the platforms – typically around 5% pa – don’t quite reflect the risk involved

I took the last of my cash out of Zopa earlier this month. Going forward, I plan to take advantage of P2P lending in two ways:

- a £20K portfolio spread across 3 or 4 platforms that will yield £1K pa in interest, which I can shelter from tax under the new personal savings allowance

- this will probably use the same laddering technique discussed below

- through the investment trusts lending on the platforms (there are three or four already), which I can shelter in an ISA or SIPP

Back to bonds

So I’m basically looking at a bond ladder in the context of P2P lending.

- Can we get the same returns as P2P at lower risk?

Most people approach bonds through funds or ETFs.

- Once upon a time, that used to be a reasonable approach, but with yields this low the management fees on funds will eat up quite a bit of the yield.

- ETFs are cheaper, but they still suffer from not holding bonds to maturity (redemption). More on this later. ((In fact, “hold to maturity” bond funds are starting to appear now in the US – check out term maturity iBonds from BlackRock – and they are heading over here to the UK ))

So it’s worth looking at the idea of buying your own bonds directly.

- with no prospect of interest rate rises (which depress bond prices) in the near future

- and worries over energy firm bond defaults pushing prices down (to push yields up)

- this is not a bad time to be buying.

Bengt’s article reminded me that since I last looked, the London Stock Exchange has introduced the “order book for retail bonds” (ORB).

- This is a platform aimed at private investors.

- It lists a sub-section of company and UK government bonds that can be traded through normal stock-brokers in deal sizes appropriate to PIs.

- In general corporate bonds are aimed at institutions and trade in eg. £50K blocks.

The ORB bonds can be held in an ISA or a SIPP, so the income is tax-free.

Bond characteristics

Now for a quick sketch of how bonds work.

- A bond is a debt

- when you buy a bond you are effectively lending money to the firm or government that issued it

- just as when you deposit money in a bank account you are effectively lending that money to the bank

- Bonds pay interest (the coupon payment) over a fixed lifetime

- usually once or twice a year

- At the end of the bond’s term, it is redeemed by the issuer

- holders get their capital back, at the £1 face value paid by the original investors

What makes bonds different from savings accounts is that they are traded. Their prices move up and down in response to two things:

Bond risks

So bonds come with two risks:

- credit risk – that the issuer of the bond can’t repay

- interest rate risk – if interest rates rise, the value of your bonds will fall

The way to deal with both of these is to build a bond ladder.

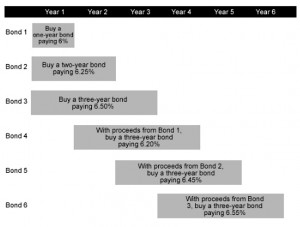

What is a bond ladder?

A bond ladder is a set of bonds which mature at different points in the future.

- You stagger the maturities so that the proceeds can be reinvested at regular intervals.

- Each of the holdings has the same weight in the portfolio.

Here’s a diagram from Investment Answers to make things a bit clearer:

Let’s say that your portfolio is large enough to fit ten bonds (at a deal size where commissions aren’t too painful).

- Then you might decide to hold one bond per year stretching out for 10 years into the future.

- Or you might decide to hold bonds that mature every six months and a ladder that only stretches five years into the future.

- These are idealised designs, and your actual ladder will depend on what maturity dates are available from which providers.

As each bond matures, you use the proceeds to buy a new bond at the far end of the ladder.

- So it’s more like a conveyor belt of bonds constantly moving towards you.

Advantages of a bond ladder

The bond ladder protects against credit risk through diversification, in the same way that a fund or an ETF would.

- we’ll buy ten or a dozen bonds from different issuers in different industry sectors

- this also means that there is a steady stream of interest payments through the year

- a diversified portfolio of bonds will also be less volatile, as with equities

The bond ladder protects against interest-rate risk because you hold the bonds to maturity (until they are redeemed)

- this means that you have a guaranteed return (the yield-to-maturity or YTM) that is known in advance

- there’s also a second effect – only useful if you need to sell the bond ladder early in an emergency – that the spread of maturities in the ladder will lessen the impact of interest-rate changes

Note that since you are re-investing the proceeds of each maturing bond, there are still long-term impacts from interest rate rises (up or down) on the prices of the new bonds that you buy.

Building a bond ladder

So the big questions are:

- what yields and YTMs are available?

- what maturities are available?

- do we like the credit risk of the issuers?

- will we use government or corporate bonds, or a mix?

- in the present interest rate climate, government bonds offer poor returns

- how long do we want the ladder to stretch in the future for?

- how many bond (“rungs”) do we want on our ladder?

Bengt’s model portfolio

Here’s Bengt’s model portfolio from February 2016, designed around a £15K ISA investment.

With luck, your SIPP / ISA broker will charge you the same dealing commission for ORB bonds as he does for stocks.

- This means that deals around £2K are practical and Bengt has gone for 7 bonds.

At first glance, the spread of issuers looks good (apart from the doubling up on property firms).

The yield to maturity of 5.2% is also attractive.

Bengt has gone for a large spread of maturities, from 4 to 20 years, with an average of close to 10 years.

- I might not stretch things out this much with seven bonds, depending on what alternatives are available.

- I’d also want to do a bit more digging about the credit-worthiness of the firms involved.

But as a proof of concept, it looks pretty good.

Conclusions

- Bonds look like a viable alternative to P2P for income

- The ORB platform makes it practical for private investors to build their own bond ladder

- A bond ladder provides diversification to protect against credit risk

- It also protects against interest rate risk by holding bonds to maturity

I’ll be back next week with a closer look at the ORB platform and the bonds on it, a look at how to evaluate credit risk, and my own model bond ladder.

I’ll also look at the practicalities of constructing an ORB bond ladder using my existing brokers, and check out the term maturity iBonds from BlackRock.

Until next time.