Company Culture – Excess Returns 6

Today’s post is another in our series on the lessons to be learned from guru investors. It’s about Company Culture and the Management Team.

Contents

Company Culture

Last week we looked at the section in Frederik Vanhaverbeke’s book on Fundamental Analysis.

We covered the stuff that most investors recognise as fundamental analysis:

- quantitative – ratio analysis of the financial statements

- qualitative – competitive analysis of the company and its industry

I’ve added another couple of sections – on maintaining a competitive position and managing growth – to that post, so you might want to give it another look.

Frederik also devotes a lot of space to the softer elements of fundamental analysis, centred around company culture and the management team.

- We won’t be spending quite as much time on these topics, not because they aren’t potentially useful, but because this is not an area where good information is readily available to the private investor.

That said, there will be situations – when you are working in the relevant industry, or when you have contacts inside a firm you are analysing – where this kind of analysis will be useful.

And besides, you can never have too many checklists.

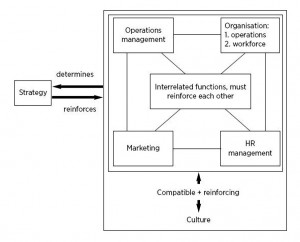

Pillars of competitive strength

“Pillars of competitive strength” is Frederik’s term for the internal functions that support the execution of the company’s strategy and business model.

They are the instruments through which the company manages its competitive position in its industry. Frederick lists six important features:

- Culture

- HR

- Structure, organisation and process

- Marketing

- Research and development

- Operations (back office)

Culture

Culture is defined as the “values, norms, attitudes and beliefs” that guide the behaviour of employees.

- It motivates employees to work towards common goals.

- Staff should know what is expected without direction from above.

- It creates a cult-like environment where people feel special.

Many successful managers attribute their success to company culture, but I don’t know of many great investors who specialised in sniffing out a great culture.

- Buffet certainly promotes a common culture in the subsidiaries of Berkshire Hathaway, but this is a common sense, old-fashioned, “customer first” culture rather than a cult. ((That said, the yearly gatherings in Omaha around the Annual Letter are fairly cult-like ))

- Ray Dalio certainly has a strong culture at Bridgewater, but that isn’t mirrored by a search for cultish investments.

I suspect that the prevalence of “culture” as a success factor in business memoirs reflects the desire of the author to cast himself as the central Christ-like figure in a famous success.

Some of the “strong culture” identifiers that Frederik picks out include:

- Commitment to excellence in everything

- Integrity and honesty, openness and trust

- Concern for all stakeholders: customers, employees, shareholders, and suppliers

- Long-term thinking

- Candid and abundant communication

- Thirst for innovation

- Bias to action and risk-taking, tolerance for failure

- Informality and fun

- Simplicity in operations and processes

- Staff ownership (of shares, company-wide bonuses)

HR

Companies that top the lists of “best employers” tend to beat the market.

- Low turnover, access to talent, and employee motivation and loyalty are all factors here.

Things to look for include:

- Low turnover and low unionisation

- Above-average wages

- Lots of training

- Attention to needs outside the company (medical insurance, support for family time)

Structure, organisation and processes

Things to look for here include:

- A balance between rules and informality

- Lean management structure (few layers, high span of control) and low HQ headcount, meaning more delegation

- Small business units

Marketing

Frederik uses a wide definition of marketing, from the selection of markets, through product design, to winning over customers by exceeding their expectations.

- The point here is that marketing (branding) means differentiation, which means higher prices and higher profits (think Apple).

Some things to look for are:

- Exceptional customer service (consistency, availability, communication)

- Product consistency and quality

- Focus on the right customer (that matches the brand)

- Brand management – avoid brand dilution or confusion at all costs

- Creativity in product design and advertising

Research and development

Look for:

- R&D spend – size (this is broadly correlated with stock returns) and consistency

- R&D effectiveness – contribution of recent products to sales

- Ambition – disruptive change, not evolution (this will also attract the most ambitious researchers), “skunk works” departments

- Innovation – bet on opportunities, not the past, celebrate mavericks and heroes, early demos and prototypes

Operations (back office)

Operations are a source of competitive advantage, as these systems can take a long time to develop (think Amazon and logistics, or Toyota’s manufacturing)

There are three things to look for:

- Constant improvement by examination of best practices

- Wariness and discipline when integrating new technologies

- Doing things differently (from competitors)

Management

On balance, the role of managers in a company’s success or failure is overstated.

- The impact of any single individual is limited – managers depend on the people around them, and the structure and circumstances of the firm.

- General media adulation is not linked to actual contribution, and may not even be directed at the right person.

- There are many examples of “stars” who couldn’t fix a broken firm (Marissa Meyer for a current example).

When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact. – Warren Buffett.

It’s a good idea for a good business to have good managers, but they won’t fix a bad business.

The things to look for in management are:

- personality (integrity, modesty, ambition, non-complacency, independence)

- experience and track record

- skills (capital allocation, strategic thinking)

- focus

- allegiance to the company

- passion and energy

- value promotion – management must promote and defend the company’s values – they must be role models.

Integrity

In evaluating people you look for three qualities: integrity, intelligence and energy. If you don’t have the first, the other two will kill you. – Warren Buffett

Cheap companies headed by unreliable managers are value traps.

Here are a few indicators of integrity:

- Straight talk, including a discussion of challenges and failures

- Clear financial statements with no manipulation or stress on adjusted earnings

- Not overly optimistic about the future

- Taking responsibility: no looking for excuses or scapegoats

- No conflicts of interest (eg. related-party transactions)

Modesty but ambition

Great leaders are humble but ambitious – they let the numbers speak for themselves.

Here are some indicators:

- They don’t claim to have all the answers:

- They admit mistakes and fix them.

- They listen to others and try to learn new things.

- They are willing to change their mind.

- They keep their egos under control:

- They use “we” rather than “I”

- They shun the media and avoid a leadership cult

- They aren’t interested in their “legacy”

- They won’t accept excessive compensation or executive perks (the ratio of highest and lowest paid employees is negatively correlated with company performance)

- They don’t hype the company.

Non-complacency

Complacency is a danger to successful companies, because if they don’t change a winning formula, a competitor will (think Kodak, or Sony with the Walkman).

Great managers must look for obsolescence in the status quo.

- They must be willing to abandon the past regardless of emotional bonds and sunk costs.

Independence

Everyone feels comfortable when they follow the crowd, even when they follow them off a cliff.

- But conventional actions lead to conventional results.

- Great leaders must not imitate their competitors.

In particular, they should not get caught up in waves of M&A activity at unattractive valuations and increasing levels of leverage.

A good portion of IBM’s success was due to all of the deals it didn’t do. – Lou Gerstner.

Experience and track record

Investors should prefer management with successful track records in similar businesses.

- Buffett suggests looking at old annual reports to see what management said about strategies for the future, and how this has panned out.

Capital allocation

Capital allocation is providing funding to functions and projects so as to maximise shareholder value.

- It’s hard, and few top executives have relevant experience

- Most are promoted for operational excellence, and not many have financial training.

The manager of a tightly-run operation usually continues to find additional methods to curtail costs, even when his costs are already well below those of his competitors. – Warren Buffett

Here are some indicators on whether management uses capital well:

- Cost-conscious approach, monitoring expenses and avoiding excess and corporate overhead.

- note this doesn’t mean skimping on salaries, advertising or R&D.

- Focus on opportunities rather than problems.

- Long-term thinking.

- Little use of leverage.

- Few acquisitions

- because most acquisitions do not create value

- acquirers overpay, overestimate synergies and underestimate the complexities of integration, including corporate culture mismatches

- acquisitions of smaller, private companies (where pricing is less efficient) can be more successful

- Shrinking the capital base when appropriate

- spin-offs, share buy-backs when shares are cheap – below intrinsic value, special dividends

- Retaining earnings when a high return can be made – Buffett has never paid a dividend.

Strategic thinking

Strategy is how the company maintains and strengthens its position in the marketplace.

- This is the core responsibility of top management.

Top managers have a strategy that is different from their competitors – it forms part of their moat.

Focus

Top managers don’t like to move outside their area of competence and stick to the core business instead.

For most companies, diversification is diworseification:

- it’s easy to waste resources on less profitable businesses

- it can alienate customers (both end-users, and other business that you are now competing with)

- it can dilute the brand

- you are competing with more experienced companies

Allegiance to the company

Investors want managers to feel responsible for the company and its stakeholders. Indicators include:

- Succession planning, rather than over-reliance on current leaders.

- High insider holdings

- Long tenures

- Long-term thinking (again)

- Fair compensation (again)

Energy and passion

Excellent managers love their company, their job and the products they make (services they provide).

- Unfortunately, the key indicator investors use here is the number of hours worked and the amount of holidays taken.

I’m no fan of workaholics or presenteeism, but I haven’t managed to think of another measure to replace this.

The Board

Too often, directors are selected simply because they are prominent or add diversity. – Warren Buffett

The Board of Directors’ job is to defend the interests of shareholders.

- Their power is limited, but they select top management (and themselves, subject to shareholder approval), set compensation and review of strategic decisions (e.g., acquisitions).

Big problems with board members are:

- a lack of experience and skills

- keeping silent when management underperform

- and excessive or short-term focused compensation (usually for management rather than the board).

Measures of board members are:

- Their experience – each board member should have unique expertise and knowledge, plus relevant business experience

- Independence – board members should not be linked to management, or each other (eg, as family members)

- They must be willing to challenge management.

- Interestingly, Buffett does not believe that board members need to be outsiders – it’s their past behaviour when insiders that counts.

- Board size – a large board (> 7?) usually includes members who are there as a reward

- Management compensation and director pay

- Separation of Chairman and CEO

- Decision-making process – unanimous consent and / or the presence of the CEO should not be required or incentivised.

- Director shareholdings – skin in the game, purchased with director money rather than granted by the company.

- Buffett also refuses to use officer liability insurance – this deters directors who might do their job badly and end up being sued.

- Number of other directorships – a good director should have three or less in total

- Board meetings – regularity, frequency and attendance.

Sources of information

We’ve reached the end of our series of checklists for what makes a good company culture and a good management / directorship team.

- The problem is that when an investor comes to analyse a company, much of this information will be unavailable.

The good news is that most investors will limit themselves to skimming the public financial statements, so more thorough research can have a payoff.

The bad news is that the more difficult stuff takes the most time, and unless you are a full-time investor you will find it hard to make the time.

- In this section, we’ll look at what might be in the public domain, and how to get hold of it, and how you can go the extra mile as an investor.

Public information

Public (and free) information includes:

- Official regulatory documents (financial statements etc.) – directed by management and spun by PR, these need to be taken with a pinch of salt.

- Match what they are saying this year back to what they have said in previous years, to see whether they deliver on their promises.

- Inconsistencies and unclear documents are red flags.

- Broker reports – public, but not easy for private investors to get hold of without spending money.

- Company websites

- Annual meetings – if you are a (small) shareholder, you can attend the annual meeting.

- Bulletin boards of the more reputable investment sites

- StockoPedia and ShareScope seem best at the moment

- neither charges for much of their commentary around companies

- they make their money from repackaging data and developing sexy software to make use of it

- Twitter is excellent once you’ve been using it for a few months, and you get to know the right people to follow

- Brokers and platforms

- most of the main brokers and platforms have areas where you can research companies

- Commercial sites like Morningstar and Digital Look have free offerings

- Investor shows often provide direct access to management

- Smaller companies in particular also turn up to give presentations to private investors at both the larger shows and smaller evening gatherings

- Many of these presentations will be recorded and published on the internet

- Some websites also run audio interviews with company management and successful private investors.

Scuttlebutt

Scuttlebutt is Philip Fisher’s term for “everything else”:

- visiting shops or other premises

- using the products and services

- talking to employees, customers, competitors and suppliers – including financiers, bankers and auditors – and their friends and acquaintances.

This can obviously provide juicy information, at the expense of lots of leg work.

- Fisher recommended that scuttlebutt should be the final step in due diligence as the information is then easier to interpret correctly.

Conclusions

That’s it for fundamental analysis proper.

- Next stop in this particular series of posts is company valuation

- But before that, we’ll look at a few more individual gurus

Here’s a summary of what we’ve covered today:

- Company culture and management are important to fully understanding and valuing a firm, but this is an area where good information is not readily available to the private investor

- Six internal functions help a company to maintain its competitive position:

- Culture

- HR

- Structure, organisation and process

- Marketing

- Research and development

- Operations (back office)

- The role of management in a company’s success is generally overstated

- The things to look for in management are:

- personality

- experience and track record

- skills (capital allocation, strategic thinking)

- focus

- allegiance to the company

- passion and energy

- value promotion

- The board of directors defend the interest of shareholders

- they need to speak up when management underperform

- Measures of a good board include:

- experience – each board member should have unique expertise and knowledge

- independence

- board size <= 7

- management compensation and director pay

- separation of Chairman and CEO

- good decision-making process

- director shareholdings

- small number of other directorships

- regularity, frequency and attendance of meetings

- Information in many of these areas is difficult to come by

- Sources of public information include:

- official regulatory documents (financial statements etc.)

- broker reports

- company websites

- annual meetings

- bulletin boards

- brokers and platforms

- commercial sites like Morningstar and Digital Look

- investor shows

- Investors can also make use of scuttlebutt – “everything else”:

- visiting shops or other premises

- using the products and services

- talking to employees, customers, competitors and suppliers

- this can provide juicy information, at the expense of lots of leg work

Until next time.

A very interesting read.

Sadly, it really highlighted (to me) how the company I used to work for had a VERY strong culture and the company I work for now is somewhat…lacking in their culture.

Having worked at the old company for so long, their culture is pretty much ingrained in me – adapting to the new culture feels like I’m having to drop my standards!