Do Short Trackers Work As Hedges?

Today we’re going to look at Short Trackers (Inverse ETFs) as portfolio hedges. Does their daily rebalancing mean that they drift off course?

Contents

Short Trackers

Over the weekend, there was a discussion on Twitter about the use of Short Trackers (Inverse ETFs) as portfolio hedges.

- A short ETF (also called an inverse ETF) is an Exchange Traded Fund that delivers the opposite of the daily return from its underlying benchmark.

The one under discussion on Twitter was XUKS, which is the db XTracker FTSE 100 Short Daily ETF from Deutsche Bank. In theory it produces the opposite return to the FTSE 100.

- If the FTSE 100 falls 1% in a day, XUKS will rise 1%

- If the FTSE 100 rises 1% in a day, XUKS will fall 1%

In the back of my mind I remembered reading that these trackers didn’t work well because of their daily rebalancing.

- If you hold them for more than a few days this daily compounding effect meant that you didn’t get the returns that you might expect.

But this was just theory, and the guys on Twitter with practical experience said that they worked pretty well. So I thought that I would do a bit more digging.

Alternatives

Before we look at the theory of inverse ETFs, let’s think about alternative approaches to hedging.

There are three obvious approaches that spring to mind:

- asset allocation: I have only 40% of my net worth in equities, and more than 10% in cash, so a 20% fall in the market might only translate to an 8% hit to my portfolio – if stocks make you too nervous, lower your allocation

- spread-betting: you can buy a 3-month short on the FTSE-100 that shouldn’t suffer from this daily compounding effect, and if you are a good stock picker, your existing holding may outperform the declining market in any case – but not everyone has a spread-betting account

- ignore it: if you are still in the accumulation phase, and are saving into the stock market each month, volatility can help you – you get more shares for your money during a downturn

Monevator

Now for the maths bit. This is something that Monevator looked at, almost four years ago.

- He came out against the inverse ETFs, after looking at their performance in a range of scenarios.

Apart from the regular counterparty risk issues with a synthetic ETF ((I’m not sure these are major problems )), the problem arises with the maths of compounding.

Monevator looked at how these ETFs would behave in three different markets:

- a steady decline

- a volatile decline

- a volatile but flat market

There are also leveraged short ETFs.

In each case he began with £10K in the ETF.

Steady decline

Here the index goes down by 2% each day for five days in a row.

- The short tracker out performs – it’s up 10.4% by the end of the week, rather than the 9.6% that the index has declined.

- The leveraged short ETF does even better, and is up 21.7% rather than 19.2%.

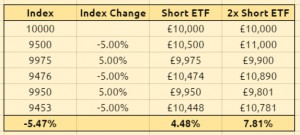

Volatile decline

Here the index has alternate 5% declines (three of these) and 5% rises (two of these):

- the index ends down 5.5%

- the Short ETF is up only 4.5% – it hasn’t hedged the portfolio fully

- the leveraged short ETF is up 7.8%, much less than the 11% you might have expected

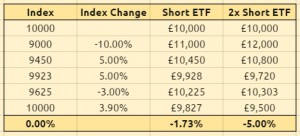

Volatile but flat

Here the market zigs down 10%, then zags up 10% (over 2 days), then down 3% and finally up 3.9% to bring us back to level for the week:

A practical example

It’s actually somewhat ironic that we were discussing hedging at this point in the market, since the FTSE-100 is already down almost 20% from its 2015 peak.

- With the benefit of hindsight, April is when we should have been hedging.

But that does also present an opportunity. I thought I would take Monevator’s work a stage further and look at the actual performance of XUKS during the recent decline in the FTSE-100.

- Would XUKS have worked as a portfolio hedge?

Here’s the tragic decline of the FTSE-100 since it peaked at 7,104 on the 27th April 2015.

- It’s down 1,300 points to 5,804 as at Friday 15th January 2015

- This is a fall of 18.3%

Here’s the chart of XUKS over the same period. It looks to be a pretty good inverse of the FTSE chart.

- It’s up from 510.25 to 592.5

- This is a gain of 16.1%

- So the tracking is off by 2.2% over around eight and a half months – this is about 3% pa

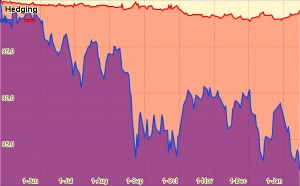

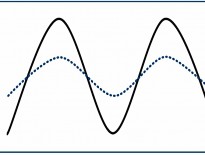

The next chart shows the two returns on a single chart. I’ve rebased them both to 100 on 27th April 2015 to make this work.

This chart shows the inverse of the XUKS performance, to show the steadily widening “tracking error”.

But perhaps the most interesting chart is the last one, which shows the performance of a 50/50 split of the FTSE-100 and XUKS, plotted against the FTSE-100 chart.

- The hedged portfolio is down only 1.1% over the period, compared to the 18.2% decline in the FTSE-100

- As expected, this 1.1% fall is 50% of the 2.2% tracking error

So XUKS has hedged 88% of the 18.2% fall in the FTSE-100, which I would say is a pretty good performance.

It’s also somewhat better than XUKS performs on average.

- I looked at the scores after each of the 183 trading days since the FTSE-100 peak, and on average, XUKS has hedged 74% of the decline

- Which is still pretty good, but not as impressive as the current performance.

Conclusions

I have to own up to being surprised at how well XUKS has worked as a hedge since April 2015.

- I think the key is the kind of market that we’ve had since then. It’s been a pretty smooth decline, with the exception of the extra steep falls in August and September.

- These seem to be the conditions that bring the best out of an inverse ETF. So if you are good at picking when to hedge, XUKS might work well for you.

- The converse is that if you think that the market is going to fall, and it doesn’t, you will be losing money on the hedge in a volatile sideways market.

The other issue for me is the perennial one of the FTSE-100 not being a representative index for UK stocks. It’s not necessarily the index I want to hedge against.

But if you do want to hedge, and you don’t have a spread betting account, XUKS might work for you.

Until next time.

Thanks mike. Much clearer than what is on the db-trackers website.

According to the fact sheet, the XUKS ETF tracks the “FTSE100 Total return” index, which has not fallen as much as the FTSE100, so the tracking error is less when compared against what it tracks.

Thanks for pointing that out and sorry I missed it.

That’s actually better in two ways:

– as you say the tracking error is less,

– and also that’s a slightly better index to track for real-world hedging.

Hi Mike,

Really interesting stuff. I guess my first question is why would you want to hedge against your portfolio in this way? Surely the two things just cancel each other out (plus a small dip for charges and tracking error). I just literally don’t see any point in it. Surely you are better just selling equities and keeping cash/bonds instead?

Cheers!

Three reasons:

1 – it’s cheaper to make one trade in XUKS than 50 sales of the stocks in your portfolio

2 – when the market bottoms out, you can take the hedge off cheaper – and more importantly , more quickly – than re-buying your 50 stock portfolio

3 – stock-pickers would say that their stocks are better than the market and will fall less on the way down, so by hedging the index you make money

It’s almost never a good idea to sell your whole portfolio.