Do the math – how much is enough?

We have already decided that the range of retirement incomes and ages we are interested in is:

- 25K pa from age 65

- 42K pa from age 65

- 42K pa from age 55

In this post we will answer the question how much is enough? How big do the retirement pots of our 7C investors need to be? To do this, we need to decide on a withdrawal rate. This is a subject I will return to in a future post, but for now we will use the 4% rule, which says that investors withdrawing 4% from their pot each year will not run out of money.

Working backwards, this means that the pot required is 25 times the income needed (1 divided by 4%). For 25K this is 625K and for 42K this is 1,050K (or 1.05 million).

As well as the retirement pot, our investors will need somewhere to live and an emergency cash fund. Renting vs buying is another topic that I will pick up in a later post, but for me buying is superior, in the UK at least. The rental market is poor in this country and there is a large tax benefit to owning your own home (the principal private residence is free of capital gains tax, CGT).

Property costs vary wildly across the UK, so for now I will use the nationwide average property value of £272K. If you want to live in London or the South East you will need to save a bit / a lot more.

For emergency cash I decided on 6 months’ money, based on required income (so 12.5K for the 25K pa investors, and 21K for the 42K pa investors). So the scores on the doors are:

- 25K pa from age 65 = 625 + 272 + 12.5 = £909.5K required

- 42K pa from age 65 = 1,050 + 272 + 21 = £1,343K required

- 42K pa from age 55 = 1,050 + 272 + 21 = £1,343K required

Note that the last two groups need the same amount of money, just at different ages.

To calculate the level of contributions needed, we have to choose an annual growth rate for our portfolio. I have decided to use two rates, one of 4% real (after inflation) and one of 2% real. The former is simply the replacement rate for our 4% withdrawals, and has historically been quite achievable for the private investor.

The latter reflects the low growth, low inflation, low interest-rate conditions that we have seen since the financial crisis of 2008. It is possible that growth rates will one day return to 4% and beyond, but this is far from certain. The 2% rate will give an indication of how much a prudent investor will need to save.

The 2% growth rate does conflict with the 4% withdrawal rate in the sense that portfolios will shrink from the date that retirement income is taken. We are in effect spending the capital, an investment no-no, but the impact is so gradual that we should be safe to follow this approach.

The 25K at age 65 investors will not run out of cash until age 125 (though they will be spending the equity in their house for the final 10 years). The 42K at 65 investors will run out aged 115. The 42K at age 55 investors run the greatest risk, since they begin to withdraw at an earlier age. They will run out of cash aged 105.

It is to be hoped that higher growth rates will return in the next 50 years, but if they do not, the 42K pa investors would be well advised to reduce their consumption and move their annual withdrawals down towards 25K pa.

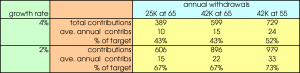

I will leave the pattern of annual contributions to the next post in this category, but it is instructive to look at the total and average level of contributions required to reach the various targets, and the effects of retirement age and growth rate:

To retire at 65 with 25K pa with 4% growth requires average contributions of 10K per year, and investment growth will be responsible for 57% of the final pot. Using the 2% growth rate increases annual contributions to 15K, and growth only contributes 33% of the final pot.

At the other end of our spectrum, the investor planning to retire on 42K at 55 needs to contribute 24K per year with 4% growth, or 33K per year with 2% growth – their investments have 10 fewer years to grow. Investment growth is responsible for 48% and 27% of the respective final pots.

3 Responses

[…] Much Is Enough? This (how much is enough) is a subject we touched on a couple of weeks ago, albeit in the narrow sense of how much dosh is needed to declare financial independence and […]

[…] You can find out how much you might need to save here. […]

[…] isn’t enough: taking the somewhat risky 4% rule as a guide, someone with a £1M pot can draw £40K a year. Not bad, but not a […]