Financial Capability in the UK

Today we’re going to look at financial capability in the UK, through the lens of three government reports and an opinion poll.

Contents

Misconceptions – Ipsos Mori poll

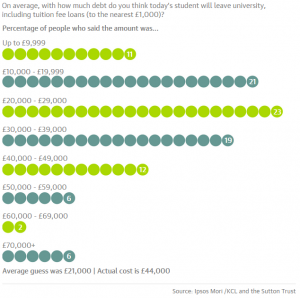

The recent Ipsos Mori poll interviewed 1,100 people in June 2015. They found that British people have the wrong idea about a lot of things:

- the cost of raising a child to the age of 21

- student debts on graduation

- how much money they need to save for a pension

- people thought that a £25K annual pension could be achieved by saving £124K, when pension calculators suggest that they actually need to put away £300K, even after the state pension is added in ((Sounds like a dodgy calculator to me – I think they need even more: at least £425K including the state pension, or £625 for a clear £25K pa))

- people thought that a £25K annual pension could be achieved by saving £124K, when pension calculators suggest that they actually need to put away £300K, even after the state pension is added in ((Sounds like a dodgy calculator to me – I think they need even more: at least £425K including the state pension, or £625 for a clear £25K pa))

- the average deposit for a house

- they thought that only £20K was needed when the average is actually £72K

- this was despite people correctly estimating the average value of a house (£190K vs the actual value at the time of the survey of £194K)

- the number of people earning more than £150K per year

- they guessed 10%, when actually only 1% earn that much

- when told that only 1% earned £150K+, people underestimated the tax they paid

- we guessed 10% of all income tax, when the real share from the top 1% is 28% of tax

- the average interest rate over the past 40 years

- they said 4%, when it is actually 7%

ONS financial capability report

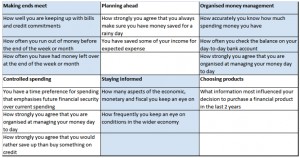

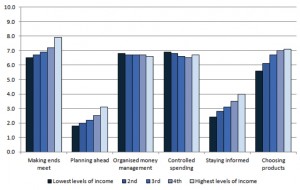

A report published last week by the ONS scored people in the UK from 1 to 10 in six areas of financial capability:

- making ends meet

- ability to live within means – someone who can make their money last until the end of the month, keep up with payments, and has more savings than consumer credit debts

- planning ahead

- having money saved for a “rainy day” – making provision for future expenditure from current income

- organised money management

- knowing much they spend day-to-day, their bank balance and the cash they have available for everyday spending

- controlled spending

- preference for longer-term financial security over current spending capacity

- staying informed

- keeps up to date with changes in the wider economy – inflation, interest rates and taxation

- choosing products

- sources of information that most influence the purchase of a financial product – shopping around, consulting best buy information or using a comparison website

The research was carried out by the University of Bristol from 2010 to 2012, using data from the 3rd edition of the ONS Wealth and Assets survey (of which more later). Eighteen measures were mapped on to their underlying dimensions of financial capability, with a focus on behaviours rather than knowledge or skills.

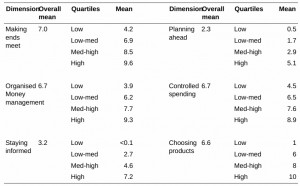

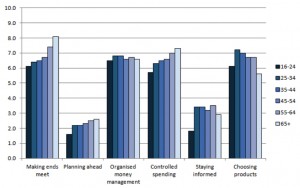

People scored best at making ends meet (7.3) but badly at planning ahead (2.3) and staying informed (3.2). The remaining scored were in the middle of the range.

Only 1% of the population was deemed to be financially astute (scored higher than average on all six measures), but 30% had no low scores.

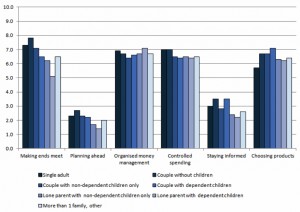

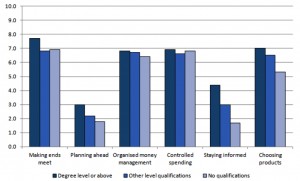

More than one in five (22%) did not score highly on any measure, and almost 10% of the population had four or more low scores. These people were more likely to be young, male and poorly educated.

People living in couples with children, and single parents were also over-represented. Scotland, Wales and the East of England were the regions where most of these people lived.

Richer people (whether measured by income, wealth, pension size or amount of financial assets) performed better than poorer ones, and the old did better than the young.

Couples without children score higher than those with children; lone parents do even worse.

Better educated people also scored more highly, as did those in higher socio-economic groups.

The effect of gender is generally small. The exception is staying informed, for which men score better by approximately three-quarters of a point.

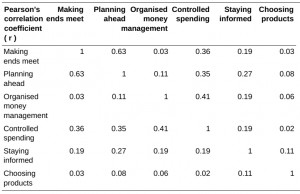

The report also looked at the correlations between the six measured dimensions. Correlations were positive (someone who was good at one thing was more likely to be good at another) but generally weak.

ONS wealth and assets survey

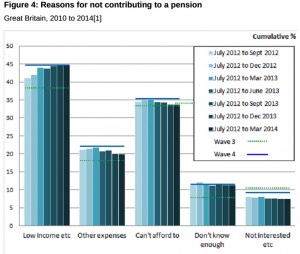

Last month the ONS released preliminary data from the 4th edition of the Wealth and Assets survey, covering 2012 to 2014.

The main findings were:

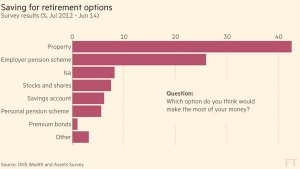

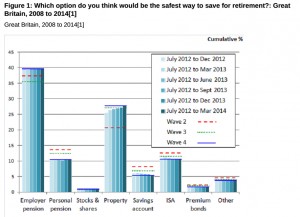

- Workplace pensions are considered the “safest” way to save for retirement, and knowledge of the “workplace pension reforms” has increased substantially over the period of the survey (July 2012 to June 2014) ((We touched on this in last week’s roundup post))

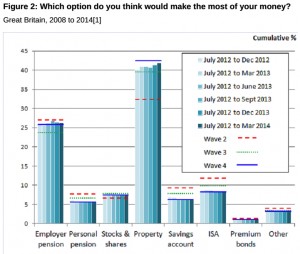

- Property was seen as the the second-safest way to save for retirement, and the one most likely to “make the most of your money”

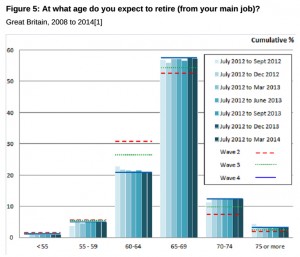

- More people felt that they would retire at an older age than previously (eg. 58% estimating age 65 to 69, up from 54% in the third edition of the survey; those predicting a retirement age from 60 to 64 fell from 27% to 21%)

- 59% were not confident of having enough income in retirement to maintain the standard of living they were hoping for

- The main reasons for not contributing to a pension were all related to income: can’t afford to, low income, other expenses; this suggests that people are aware of the need to save for retirement, and recognise a pension as the right way to do so.

Money Advice Service Financial Capability report

The Money Advice Service (MAS) published its own report on financial capability back in November 2013. The report was based on two MAS research projects:

- Money Lives, a large-scale longitudinal study of financial behaviour, and

- a quantitative survey of 4,000 adults that followed on from the 2006 baseline of financial capability report published by the Financial Services Authority (FSA)

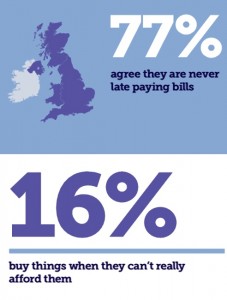

The MAS found that more people were struggling with their finances than in 2006 (up from a third to more than half).

- People were worried about their ability to make their money last until the next payday

- Because of this, they focussed more on the here and now than on planning for the future.

- Less than a third were paying into pensions, though more than half were still saving something

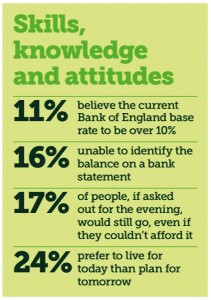

Financial skills were still poor, as the 2006 survey had found:

- 16% of people were unable to identify the available balance on a bank statement.

- one in five people would rather take £200 now than £400 in two months’ time.

The surveys identified four different groups of people, with different money habits:

- 9 million people needed help with managing their money

- 13 million were too focussed on the now rather than the future

- 9.5 million were ‘on the edge’ and beginning to struggle

- 17 million had ‘healthy finances’

The MAS reported that behavioural sciences research had shown that approaches based only on education and information – to improve knowledge and skills – were not successful in improving financial capability. Decisions were influenced by how options were presented – by ‘framing’ and ‘contextual’ factors.

In response, the MAS built a five factor model of capability:

- A wide range of skills are needed, including mathematical planning, self-control, decision-making and problem solving.

- The emotional, cognitive and behavioural capacity to take the correct action is also important.

- The report noted that full disclosure of financial information does not help a large proportion of the population, who remain unable to translate the terms and conditions into implications for themselves

- Knowledge is required to act sensibly in the financial arena – closing this gap was the original raison d’être of the MAS, as well as the Citizens Advice Bureau, and more recently, Pensionwise.

- Pensions, inflation and interest rates were not well understood.

- 16% couldn’t read a bank statement correctly

- Attitudes are important and are influenced by peer pressure and social norms – initially by parents’ beliefs, values and habits.

- ‘Struggling’ families often prioritise pay TV holidays and cigarettes, as well as branded clothes and expensive cars.

- Parents often want to make sure their children are not ‘different’, and so provide things they can’t really afford.

- The MAS was not clear on what could be done to change these attitudes.

- Motivation was found to be a key problem for older families. Those who were 10 to 15 years from retirement had lived through periods of hardship, and saw little motivation to save for the future.

- Younger families were typically disadvantaged by lack of opportunity (in its widest sense). Many had little support for education, and their job market opportunities were limited.

Whilst this is a plausible enough model, the MAS report used it in a descriptive rather than prescriptive fashion. It seems there are lots of reasons why people fail financially, but the MAS had little to say on how to change that.

Conclusions

- People underestimate how much a lot of things cost.

- They underestimate how much they need to save for retirement.

- They think a lot of people earn lots of money, and that those people don’t pay much tax.

- Only 1% of the population scores highly over six measures of financial capability, though 30% have no low scores.

- More than one in five people do not score highly on any measure, and almost 10% of the population has four or more low scores. These people were more likely to be young, male, poorly educated, have children, be lone parents and live in Scotland, Wales and the East of England.

- Workplace pensions are beginning to be recognised as a safe way to save for retirement.

- Property is still seen as the best way to make money.

- “Not enough money” is the main reason for not contributing to a pension, suggesting that people are aware of the need to save for retirement, and recognise a pension as the right way to do so.

- Recessions force more people to focus on the here and now, and put off planning for the future.

- Financial knowledge is simple to provide, and skills can be developed to a certain extent, but the lack of the psychological capacity to act, and the development of the underlying attitudes that allow social norms to be resisted, are less straightforward problems to solve.

Until next time.