Hargreaves Lansdown Active Savings

Today’s post is about a new service from market-leading broker Hargreaves Lansdown. It’s called Active Savings.

The invitation

Last week I got an invitation from Hargreaves Lansdown.

- It offered me the chance to become one of the first people to try it’s new Active Savings service.

Apparently:

Our clients have told us they want their savings to work harder.

They want it to be easy to choose and switch between savings products, to get great rates from a range of UK banks and building societies – all in one place, all online, all without any forms or fuss.

We’ve listened, and that’s why we’ve launched Active Savings.

It appears to be a soft launch, as:

We’d be delighted if you’d be one of a select group of clients to experience it.

Places are limited, so applications are on a first come, first served basis.

Active Savings could change the way people save, forever. Why not change the way you save, for the better?

So let’s take a look at what the service offers, and whether it lives up to that billing.

Active savings

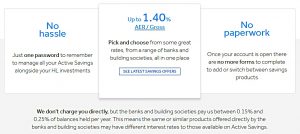

Active Savings is being sold on the basis that it’s easy:

- no extra passwords

- no paperwork to take up offers

It’s certainly not being sold on returns or costs:

- the highest available return is 1.4% pa

There are no SIPPs or ISAs available, so your only protection against income tax is the savings allowance.

- Admittedly, at 1.4% pa, you could sock away £70K before you breach that.

HL are paid between 0.15% and 0.25% by the institutions providing the underlying offers

- which means that if you applied direct, you might get a similar product from them with a higher return

How it works

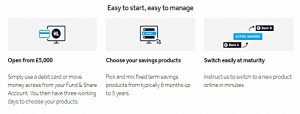

You need £5K to open an account, and after that you have just three days to allocate the cash into some offers.

- If you don’t, the cash is moved into your (taxable) Fund & Share account.

- If you don’t have a Fund & Share account, your money is returned to the debit card you used to transfer it in.

Partners

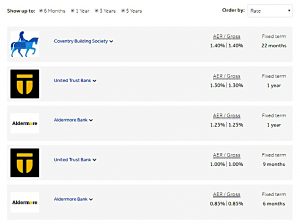

The current partner line-up is less than sparkling.

- It’s a set of challenger banks, plus Coventry building society.

I suppose it’s plausible that the smaller outfits would offer the best deals (though great deals aren’t much in evidence at the moment).

- They are also much more likely to put up with HL’s commission rake.

Offers

HL says the platform will offer products with terms from 6 months to 5 years.

- The top offers at the moment range from 6 months to 22 months.

But as I mentioned earlier, the return rates are uninspiring.

A missed opportunity

I find it hard to believe that HL is responding to demand from it’s clients.

- I think rather its exploiting the preferences of its large and docile user base.

They have demonstrated their affection for simple interfaces, smooth marketing and reassuring support over market leading prices.

- If interest rates pick up, and returns sneak above inflation (we’re more than 1.5% away from that at the moment) then HL could be on to a winner.

I also think that there’s a missed opportunity here.

What people really want is a product with the following features:

- Security of capital (you can’t lose money)

- Market-leading returns (above inflation)

- Ease of implementation (Do it for me, rather than DIY)

- Flexibility (some level of instant access)

- Available in a tax shelter

P2P lending fails tests 1, 3, 4 and / or 5 – depending on how you approach it:

- vanilla P2P is taxable, largely manual and fixed term – and it also lacks proper diversification

- the IF-ISA provides a tax shelter but reinforces the lack of diversification

- and aggregators fix diversification but don’t provide a tax shelter

Money market ETFs are available, but since I can see that some of them lost money over the past 12 months, they fail test 1.

NS&I are probably best-placed to provide my ideal product, but HL run them pretty close.

- Unfortunately, Active Savings (in its current form, at least) is a long way from what I’m looking for.

Until next time.

I come into the widows and orphans category but I wouldn’t touch this. How lazy would I have to be to accept such low returns for the same of a single password? I’m currently with Fidelity for a SS ISA and HLfor a sipp and some funds. I could transfer the isa to HL then it would already be under one roof. I don’t quite understand who this is for. If you don’t understand the options at all it wouldnt be for you. If you have some knowledge like me there are already widely advertised safe options like Vanguard Lifetime funds. If you really know what youre doing there are far better rewards available.