John Lee – Defensive Value and Dividends

Today’s post is a profile of Guru investor Lord John Lee, who appears in Guy Thomas’s book Free Capital. His chapter is called Defensive Value and Dividends.

This article is part of our ‘Guru’ series – investor profiles of those who have succeeded in the markets, with takeaways for the private investor in the UK.

You can find the rest of the series here.

John Lee

Lord John Lee is a familiar figure to most private investors in the UK.

- We previously met him in the first article of our PiggyBack series on learning from other investors with public portfolios.

John still writes regularly in the weekend FT (his column used to be monthly, but appears only a few times each year at present) and he was on a panel at the investment show I attended a couple of weeks ago.

John was already well known as a politician (first in Margaret Thatcher’s Conservative government, but later as a Liberal Democrat peer), but he shot to investment fame as possibly the UK’s first “ISA millionaire” – an investor who managed to multiply his ISA contributions many times over, until they totalled more than £1M.

- John achieved this way back in 2003.

Because of this fame, John is one of only a couple of investors in Guy Thomas’ book Free Capital who are identified by their real names.

[amazon template=thumbnail&asin=1906659745]

At the time of his interview (late 2009), John was 68 years old and had been investing in shares for 50 years.

Career

John began as a chartered accountant, but soon joined Henry Cooke stockbrokers in Manchester, becoming PA to the senior partner.

At the age of 22 I was being paid to practise my hobby - investing.

He left Henry Cooke to found Second City Securities – a regional corporate finance business which became an advisor to Slater Walker.

- Six years later his sold his stake and went into politics, working a day job in corporate finance at Paterson Zachonis (later PZ Cussons) – a stock he seems to have held since 1976.

He finally became an MP in 1979, aged 36, serving until he lost his seat in the 1992 election, aged 50.

- In 2001 he joined the Liberal Democrats and in 2006 he became a Lib Dem peer.

Trading style

The title of John’s chapter in Free Capital is “defensive value and dividends”, which sums up his style.

- John says that the defensive part of this is “focusing on assets, and on avoiding losses before thinking about profits.“

It acts as a discipline for a company to pay a dividend, the profits have to be real.

John is a bottom-up investor, focusing on individual companies rather than macro-economic trends.

- He likes to buy companies on moderate valuations, and reads a lot into the signals conveyed by increases or cuts in dividends.

He usually holds companies for years and sometimes for decades.

- He is not a believer in short-term trading, or in shorting.

I believe long-term investment in growing businesses is worthwhile and in the national interest, at least in a modest way. But funds focused on leveraged positions and short selling contribute nothing to the real economy.

His initial approach was to look for “Double Seven” shares – those with a PE below 7 and a yield above 7%.

- Sadly, few such shares exist these days.

John avoids speculative mining, oil and biotech stocks, shell companies, and recovery situations.

- He prefers to wait until a firm has proven profitability.

- He will buy property companies, but only at a discount to net asset value.

John mentions a number of early warning signs for spotting bad stocks: results delayed, auditors or directors resigning, change of accounting year-end, and “too many acquisitions.”

- He tends to give management the benefit of the doubt initially, which sometimes leads to losses.

At the time of the interview, John typically held around 50 stocks, around half from the main market and half on AIM.

- In recent years, as AIM stocks have been allowed into ISAs, and John presumably sees more value in the IHT shelter benefits of these stocks, his portfolio seems to have become more based around AIM stocks.

Many of his largest holdings are relatively obscure and illiquid, so he usually builds up (and sells off) positions over a period of weeks or months.

Since he is a working peer, John is not a full-time investor.

- But he is a great believer in DIY investing, and doesn’t believe in paying for fund management or investment advice.

He does his trading (and some research) via the phone, speaking with his brokers in the morning and the evening.

- Dividend decisions (increase, hold or cut) are the most important piece of information for John.

- He also keeps six years of paper copies of trading statements, plus annual reports on file.

Timing and leverage

He will not borrow money to invest, and has never used leveraged products like CFDs and spreadbetting.

John is an optimist, and doesn’t believe in market timing. He doesn’t believe in trading as if Armageddon is just around the corner:

If Armageddon is averted, then with hindsight shares will have been a massive bargain. And if Armageddon materialises, you would have bigger worries than your share portfolio.

Family firms

John prefers small companies because “they are less well researched, they are more likely to be takeover targets, and the directors are usually accessible to the serious private investor.”

He has a preference for UK companies, and also for firms where there is a significant family holding.

- These firms often focus on preserving the business rather than on taking major risks in order to grow it quickly.

- They may have non-working family members who rely on the dividend income from the firm.

- John calls these “proprietorial companies”, but I’ll stick with family firms.

John likes to attend AGMs, going a dozen or more each year.

- He does recognise however that establishing a relationship with a company means that “you can feel a bit of a heel about selling – sometimes you are inclined to stay aboard too long because of that.“

- That worry is my own reason for mostly avoiding meeting companies.

ISA mathematics

ISAs were introduced (as PEPs) in 1987.

- By 2003, John had made maximum contributions of £126,200, but his pot has accumulated to more than £1M.

- He wrote about this in the FT, “to illustrate the long-term advantage of compounding regular contributions“.

The 2003 article listed 18 holdings; as of late 2009, John still held 11 of these.

- Five of the others had been taken over, and only three had been sold.

Because of John’s FT column, Guy was able to produce a performance record for his portfolio.

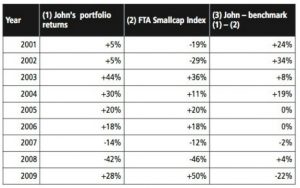

He provides a year by year breakdown of 10 years of returns, with a comparison to the FT SmallCap index:

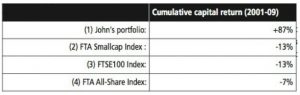

And a summary table of cumulative capital returns (dividends are ignored) compared to the FT SmallCap, the FTSE-100 and the FTSE All-Share indices:

John’s cumulative return over 10 years is +87%, while all three of the indices are down over the decade.

- This is a great result, but most of the outperformance occurred at the start of the period.

Conclusions

There is much to admire in John Lee’s investing track record, and yet I have my reservations about holding him up as a role model for others today:

- His focus on mostly small cap stocks, and entirely on UK ones goes against my own belief that diversification – both across asset types and internationally – is the safest approach for almost every investor.

- He is a great believer in the tax advantages of ISAs, but those of SIPPs are even greater for most people.

- Nor does he seem particularly interested in keeping costs low – he uses telephone brokers and builds up and sells off positions slowly.

His belief in family firms is an interesting one, and something that I can appreciate, but the “Double Seven” valuations at which he bought many of his most successful positions are no longer available to us.

- I follow some of his principles in the SmallCap AIM portfolio I have been running for the past couple of years.

- But this is still at an experimental stage, and is unlikely ever to amount to more than 10% of my total net worth.

John’s story is a romantic one, and will no doubt encourage some investors to dabble in UK small caps and AIM stocks.

- This is probably a good thing on balance, but it will be difficult for those investors to emulate John’s success by starting from here.

Until next time.

Thanks for the overview Mike. I thought John Lee’s book was quite good; a bit lacking in detail but doused in very sensible basics. As you point out, the “ISA millionaire” thing is romantic, and might pull in the get-rich-quick investor, but on balance I think the world is better with John’s contribution than without.

I totally agree, and I wish I was an ISA millionaire (I was paying more attention to my SIPP until recently). I just think that doing it all over again starting in 2016 would be a lot more difficult.

I also think that people should try to master several approaches to investment, as they don’t all perform well all of the time. So even when someone is as successful as John with a single style, I prefer the pick ‘n’ mix perspective.

I realise that everyone is different, and some styles suit some people better than others. But since 2008 I haven’t felt comfortable with a single approach.