Luke – The Big Picture – Investor Profile

This article is part of our ‘Guru’ series – investor profiles of those who have succeeded in the markets, with takeaways for the private investor in the UK.

You can find the rest of the series here.

Today’s investor profile is of Luke, one of 12 UK millionaire investors profiled in a book by Guy Thomas.

Contents

Guy Thomas

Guy Thomas worked as an actuary with a firm of pension consultants and then became a university lecturer.

He has published academic papers on insurance economics, actuarial mathematics, taxation and investment. He has been an independent investor since 1999.

Free Capital

Guy’s book Free Capital profiles 12 millionaire UK private investors. Guy’s aim was to show how each investor’s personality and career background shaped their investment style.

The idea is that this will help readers of the book to identify an investment style which suits their own personality and background.

This makes the book an excellent fit for our Guru series, even though the subjects are not the typical investment gurus. They are not managers of public money, but private investors.

Guy makes no secret of the fact that the recommendations of the various investors sometimes contradict one another.

The only completely consistent people are the dead. – Aldous Huxley

Anonymity

In most chapters of the book ((The exceptions being a couple of people who are readily identifiable, since they already had public profiles )) Guy deliberately obscures details of jobs, home towns and other identifiable details. to encourage frankness.

Man is least himself when he talks in his own person. Give him a mask, and he will tell you the truth. – Oscar Wilde

This is the case with “Luke”, whose real identity is unknown to me.

Investment details and those elements of the investors’ backgrounds that influenced their development are accurate.

Geographers, surveyors, activists and eclectics

Guy classifies his twelve investors into four categories, based on differences in approach:

- Top-down analysis, focusing on macroeconomic trends and conditions versus bottom-up analysis,

focusing on the characteristics of individual companies – Guy calls these investors geographers (top-down) and surveyors (bottom-up).- The metaphor actually comes from Luke, who is both the investor in the book with the greatest top-down emphasis and also a former professional geographer

- Other examples of geographers include George Soros and Sir John Templeton

- Famous surveyors include Warren Buffett and Peter Lynch

- John Maynard Keynes began as a geographer and became a surveyor after the 1929 market crash

- Activists are those investors who interact with the management of the companies in which they invest

- apart from this, they have many similarities with surveyors

- Eclectics is a catch-all term for those who don’t fit in the other three categories:

- one investor uses top-down and bottom-up analysis equally

- another uses only news flow and price action (technical analysis)

Luck

Guy also examines whether the 12 have been lucky. He distinguishes between “lottery luck” and the idea that exposure to some opportunities can only happen through deliberate and unpopular/eccentric choices.

In the fields of observation, chance favours the prepared mind. – Louis Pasteur

The more I practice, the luckier I get. – Gary Player

Luke – background

Luke was aged 55 at the time of his interview (2010) and had been a full-time investor for 8 years. He grew up fairly poor but not deprived in South London, but has now moved to the Suffolk Coast.

His career background was as a geographer, working in transport planning. After going to London Business School in the 1980s he switched to investment banking in the run-up to the Big Bang, eventually working in debt origination.

Compliance rules meant that Luke couldn’t actively invest during his banking career. His biggest financial bet was moving from London to a cheaper house in Suffolk in the early 90s. In 2006, after his children had left home, he downsized again.

Guy sees this as a good call – and maybe it looked that way in 2010 – but to me, this seems a mistake (at least financially). London prices slumped until around 1995 but have since outperformed the rest of the UK by some margin.

In addition, there is no tax on capital gains from your home which makes an expensive house in London a useful shelter ((In both senses )) during the accumulation phase of investment.

Regardless of the outcome, it does demonstrate how Luke’s decision-making is always influenced by macro trends.

Investing style

Luke’s investing style is top-down. He holds very few companies at the same time – usually six or fewer – and usually holds each company for several years.

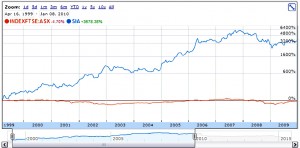

He is particularly focused on the oil exploration and production sector. Guy estimates that Luke made 30% pa from 1995 to 2008.

Guy feels that Luke’s style was established during the period he spent working in medium-term notes (MTNs). “The MTN market is global, so you need a model of the whole world in your head”.

Luke set up MTN deals in 15 to 20 currencies under different legal and tax regimes. MTNs often include embedded optionality related to the commodity or equity markets, so Luke needed to keep abreast of those markets too.

Concentrate on quality of decisions, not quantity of decisions. – “Luke”

Luke is unusual in that he spends several hours each day thinking about the markets, but makes only a few trades each year. He focuses on “quality of decisions, not the quantity of decisions” and believes in “strategic lethargy.”

One of the big mistakes in investing is that you’ve always got to be doing something. Most investors would have better performance if they thought more and did less. One of the great tricks is learning to be happy doing nothing. – “Luke”

His stocks are largely held in ISAs, which meant at the time that no AIM stocks could be held. ((AIM stocks are now allowed in ISAs ))

Luke has some problems with pulling the trigger on investments (for example, on banks in 2009 when he felt they were cheap. He has resolved to invest whenever he can see upside of 20% or more.

Picking the right train

By switching careers – from local government into bond syndication, and then to MTNs – Luke greatly accelerated his career progression.

He has carried this idea of “picking the right train” over to investment – “it helps enormously to choose a field with long-term secular growth.”

Going full-time

By 2000, Luke was working at a consultancy and realised that the monthly movements in his share portfolio had become larger than his salary.

He concluded that he should be spending more time on investing. ((Something similar – but with annual rather than monthly movements – was behind my own decision to stop work )) When his market slumped after the 9/11 attacks, he quit, aged 47.

Luke’s early focus was on the oil sector, just as the Economist predicted that the oil price was heading to $5 a barrel.

He bought shares in a handful of what he thought were the best-value UK-listed oil explorers and producers. In time his portfolio came to be dominated by SOCO International.

This stock rose by 75 x from his earliest purchases in March 1999 to a peak in September 2007, and was still up 42 x at the end of 2009. So Luke’s story is really that of finding a single transformational share and sitting tight.

The oil exploration sector

Oil exploration as a sector has a learning curve – the meaning of terms like proven reserves, proven and probable (2P) reserves, possible reserves etc are important.

Once Luke holds a stock, he focuses on confirming that it retains “low downside and substantial upside.” He is indifferent to short-term price movements and does not switch frequently to stocks with potentially better prospects.

Better to have a few good long-term friends, rather than change your friends every week for short-term advantage. – “Luke”

Luke has a bullish long-term view of the oil sector because resources are limited (the “Peak oil” theory). With the 20:20 hindsight of 2015 and oil prices back down below $50, this doesn’t look so smart.

Nor would the over-concentration on a single sector whose prospects rely on the price of a single commodity.

Shorting and leverage

Luke is also an expert on the banking sector, but he won’t short, so his bearing stance through the mid-2000s didn’t lead him to open positions.

His aversion to shorting stems from personal experience of executing a short squeeze during his bond origination days. He never wants to be on the other side of that.

He also doesn’t use leverage, partly because the oil sector is operationally leveraged and volatile to begin with.

Activism and analysts

Like is not interested in meeting with management before investing, though he does attend AGMs of his larger holdings. He reads analyst reports simply “to see the extent to which the market is already discounting my own views.”

He feels that analysts systematically under-value assets that will not be explored during the next year. For some companies, that is most of the firm’s value.

Bulletin boards

Luke is a prolific poster on bulletin boards, where he uses a more confrontational style than in real life. ((This seems to be the case with many investors on Twitter, blog comments and the boards )) He is active on the boards – more than 30,000 posts over ten years at The Motley Fool – for four reasons:

- He uses the boards as a filing system, and has few paper records.

- He uses posting as a substitute for the morning meetings held in trading rooms.

- He gets useful information from geologists and other experts in the oil and gas sector.

- Guy also suspects that he gets personal validation from the positive feedback to his posts.

Epilogue

In 2013, three years after the original interviews, Guy contacted all of the investors for an update on their subsequent results.

Markets had been mostly benign over the period, with 2011 the most difficult. AIM suffered, and in particular oil and mining stocks, which had some effect on Luke.

Luke made 15% in 2010, down from a high of 50% following disappointing drilling results from SOCO – still his largest position. In 2011 he was down over 20%, but in 2012 he had a gain of nearly 30%.

It would be interesting to know how Luke has coped with the oil bust of the last 12 months.

Conclusions

Here’s are a few of Luke’s investing rules:

- Try to choose areas for investment with long-term secular growth.

- Concentrate on quality of decisions, rather than quantity of decisions.

- Look for a minimum 20% upside.

- Stick with your best ideas for the long haul.

- Don’t double up on operational leverage with financial leverage.

- There is often value beyond the equity analysts’ time horizon.

- Strategic lethargy – learn to be happy doing nothing.

My first instinct is to be sceptical about Luke’s story. Most of his gains came from a single sector which is now bombed out. Indeed, most of his gains came from a single share.

But on reflection, I think that this is largely to do with my own personality. I could never ride a “once in a lifetime” stock all the way to the top.

Or rather, I might stick with it, but every time it amounted to more than 2% or 3% of my net-worth, I would be likely to sell some of it. So even if I did stay in for the long-haul, it wouldn’t have the same transformational effect on my wealth.

I share Luke’s interest in macro – though not his expertise – but his sector and stock concentration hold no appeal to me. I would go further and say that the majority of private investors – and particularly the successful ones – are not like Luke.

But his story does go to show that you only need one or two really good (and big) ideas to transform an investing career. So long as you know how – and have the personality – to deal with them.

Until next time.

This is a bit freaky… I just was listening to Free Capital on audible over the weekend… and the story of Luke was one of about 6 I listened to. Have listened to it once already this year and thought I’d listen to it again as I had 8 hours of driving to get through the book.

I really liked the stories, especially of Lord Lee, SuChil (sp?), and Luke too. I wish there were more biographical type books like this which look at investors in the UK, rather than the US.

One other book in a similar vein I read recently was “Go: An Airline Adventure” by Barbara Cassani. I found it really interesting to see how they built the airline from the ground up over a few years and ended up making a huge profit when they got bought out by easyJet.

That is a coincidence. I’m afraid I’ve forgotten most of the chapters as it’s about a year since I read the book, but I’ll be working my way through them all again.

I agree with you about the lack of UK investor profiles. I’ve come up with a list of 7 books like this, but the other six are American. That seems to be the way with investing – 80% to 90% of the material is US-focused.

Still, there’s usually something of interest with a US investor if they are good enough.

Yes that’s true, there is usually something interesting, still wish there were more stories from our side though! investing is a much bigger part of their culture though…