Master Investor Show, 25th April 2015

On Saturday I made it over to Islington for the 13th edition of the Master Investor Show at the Business Design Centre. I can’t remember when I last attended, but it was at least a couple of years ago.

For those of you who don’t know the BDC, it’s a converted Victorian agricultural hall that looks like a railway station. It’s close to a Zone 1 tube stop, next to a Hilton hotel, and there are plenty of shops, sandwich bars, pubs and restaurants in the area. Not a bad location for an investment show.

Morning

The show features the usual mix of headline speakers, breakout sessions and company stands, but I was mostly there for main stage. ((At the time of writing, most of the slide packs have not been made available, so I will briefly summarise the gist of the talks and then update this page later))

First up was James Ferguson with a talk entitled “In Praise of Equities”. In fact the presentation was mostly about the abnormal returns that bonds have enjoyed over the past 35 years. James predicted that we are now due an equally long period of underperformance from bonds, and so that means that equities are the place to be.

Next up was Gervais Williams, who manages the Diverse Income trust as well as Miton Group, the independent fund management group. He has just raised £50m for a UK MicroCap investment trust which he said would target stocks which are “overlooked” by the bulk of fund managers.

Gervais also wrote the book Slow Finance, which I have read and can recommend. His talk was called “Moving Beyond the Credit Boom” and was about the attractions of the AIM market.

The final session in the morning was from Jim Mellon. Jim is worth £850M, made originally in emerging markets in the 1980s and 1990s. Since then he has invested in mining, property and most recently biotech and robotics.

Jim’s talk was called “Seeing through the mist to the fast forward future.” It was a mix of market analysis and futurology, tied to the publication of his new book. Jim’s slides have been released, so I’ll go through the presentation in more detail below.

Afternoon

Over lunch I headed to a side meeting – the Technical Traders’ Lunchtime session. While I think there is a role for (certain aspects of) technical analysis to play in investment, I’m not convinced about TA as a spectator sport. Certainly I didn’t get much from this session.

The panel was chaired by Zak Mir and included John Piper (“the Psycho Trader”), Maria Psarra, Robert Tratt, A Karim Yousfi and Francis Hunt (“the Market Sniper”).

The format was a strange one. To begin with, each member of the panel got five minutes to introduce themselves. Most severely over-ran and spent significant time pushing some kind of training course or subscription website they operate. ((Apologies to any panel members who didn’t do this))

Then after 45 minutes, the Q&A began – Zak threw his prepared curve balls at the panel, who could choose whether or not to respond. I gave up after the first few questions. The whole thing had the feel of a “touch the hem” session where private investors could come and meet in the flesh the people they’d seen on Twitter and in the magazines.

Back to the main stage, and Nigel Farage arrived to tell us about what conditions for investors would be like under a UKIP administration.

Notwithstanding the remoteness of that possibility, Nigel gave an entertaining speech. Many of his proposals chimed with the views of the audience, and he even had the nerve to tell the assembled financial planners that he would abolish inheritance tax completely.

The closing speech of the show was by Merryn Somerset Webb, who was in great form. Her speech was in three parts. The first half covered the delusions common to all people and particularly investors, set against the context of the promises of the SNP in her Scottish constituency to both increase public spending and simultaneously reduce “the need for austerity” (ie. the deficit and the national debt). They can’t both be true.

Next Merryn discussed the scary demographics of Europe, and how they doom the continent (including the UK) to weak growth in the years ahead. The final part of her talk was a re-hash of her Weekend FT column describing the similarities between present-day China and Japan just before the 1980s boom (which we covered in yesterday’s Weekly Roundup).

Jim Mellon

I’ll just cover the main points of Jim’s speech. For those of you who want more detail, here is the complete slide pack. He began with the market outlook, which is summarised in the two slides below.

Jim is worried that QE in Europe won’t work as it’s supposed to, and most UK electoral outcomes are negative. There’s also the risk that Europe will drag the UK down.

The only thing keeping equity markets high is the lack of alternatives. Valuations have only been higher (especially in the US) in 1929 and during the dot com boom.

Jim moved on to talk about the future, and the looming advances in automation and robotics:

- Driverless cars could lead to an 80% reduction in the number of vehicles on the road. Drones will also have an impact. The reduction in road deaths and wasted travel time could lead to a significant increase in global productivity.

- Jim showed an animation of a robot that can build a house, and discussed how construction, another of he largest “real-world” activities is about to be disrupted.

- Energy efficiency, including solar generation and battery storage, will improve significantly

- The internet of things (on an industrial scale, not just the the connected home) will have a big impact

- Social communication (sharing economy, peer-to-peer) will continue to be a major trend

- Perhaps the biggest change is longevity. Through gene editing, robot surgery and stem cell therapy, people might live to 150, but will they be “wellderly” or “illderly”?

Jim then moved on to discuss the difficulty of private investors getting involved in this revolution. The “PayPal Mafia” – VC investors in California who made their money in earlier start-up hits like PayPal – are reaping all the rewards.

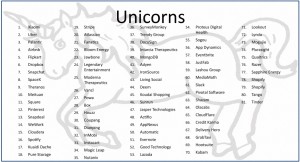

Here’s Jim’s slide of 80 potential “Unicorn” companies, many of which will be uninvestable for PIs:

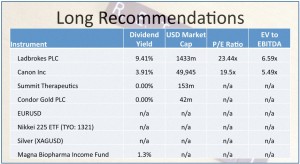

Finally, the next four slides cover Jim’s “tips”, starting with his Conviction Ideas:

Conclusions

Another nice day not in the office, with plenty of interesting speakers to make the easy trip worthwhile. My only regret is that it came so hot on the heels of the previous weekend’s UK investor show. For those investors who find face to face meetings with small companies rewarding, the day would have been even more valuable.

Until next time.