Naked Trader 1 – Getting Started

Today we’re going to look at one of the most popular investing books in the UK – The Naked Trader.

Contents

Staying humble

Xmas and New Year is the traditional period for reflection on how your life is going, and how you might change it.

- It’s a time to count your blessings and spare a thought for those less fortunate than you.

- It’s a period of humility.

In many ways, writing an investment blog is also an exercise in humility.

- You write hundreds of articles (and hundreds of thousands of words) each year, and almost nobody reads them.

- Even fewer people comment on them, and yet fewer still share them on social media, recommend them or discuss them on bulletin boards.

In a way, this is to be expected.

- Investment is like chess, or squash – they are great fun to play, but it’s difficult to find people quite at your level.

- Too inexperienced and the game / discussion is too simplistic.

- Too experienced and the game / discussion is beyond you.

Regular readers will know that I have found it extremely difficult over the thirty years of my investing career to persuade anyone I know to follow in my footsteps.

- It seems to be a similar situation with the blog.

Most people aren’t interested in investing, and the few that are have already discovered their guru, usually from a book. (( This is the only argument I can find in favour of writing a book, since it’s a lot of work and the pay is terrible ))

The discussions I’ve had with people here in the UK tend to focus on just a couple of books:

- the passive guys usually go for Tim Hale’s Smarter Investing

- the active trader types prefer Robbie Burns’ Naked Trader

I’ve read both of these books before, and to be honest I didn’t get too much from them.

- But a thousand guys on the internet can’t be wrong.

- So in the seasonal spirit of humility, I’m going to take a break from analysing economics books, and take a second look at these two popular books.

Today we make a start on The Naked Trader.

- Next week we’ll take our first look at Smarter Investing.

Robbie Burns

Robbie is an ex-journalist who at the time of writing (2017) must be in his fifties.

- He lives in a riverside flat in Fulham (( He mentions living opposite the Wetlands Centre, which is in Barnes, and it’s where he ran a cafe ))

He initially worked on local papers, and then on Teletext for ITV and C4, before freelancing for nationals like the Independent and the Sun.

- He was also a gambler on the horses for a couple of years in the 1990s, and even owned a couple of horses.

- But he never made big money from this.

He went back to Teletext for BSkyB (now Sky) and set up a shares / finance service.

- He also set up “entertainment” phone services, making £250K from a “Buffy The Vampire Slayer” line by around 2000 (well into the era of the internet).

- He also wrote a share trading diary for Sky, which was the genesis of his later website, and eventually this book.

He quit work in 2001 and made some money from running a cafe in Fulham.

- He also made a lot of money from a commission scheme operated by Telecom Plus. (( A stock that I own, but don’t earn commission from ))

- He sold phones, cheap calls and energy and still earns commission from his sales in the 1990s.

He set up his website and wrote a column in the Sunday Times about his SIPP.

- By 2007 the SIPP was worth £165K, but his total profits from share trading were £500K.

His website is less active these days but he also writes occasional articles for ADVFN and Master Investor.

- He also runs trading seminars around six times a year.

The key points here are that Robbie has no formal financial trading.

- To most people, he’s an approachable guy with an enviable lifestyle.

He’s selling the dream of full-time trading and living by the river in a leafy corner of London.

- His schtick is “If I can do it, so can you”.

- He aims to keep things simple, and avoid jargon.

Three things set him apart from the average guy who wants to be a full-time trader, however:

- Journalistic contacts, which led to him being featured in the national press.

- Wealth from previous ventures (phone lines, cafe, Telecom Plus commission).

- Non-trading income to live on (books, website and seminars).

On the plus side, he does make it clear in the introduction that his is not a “get rich quick” approach.

- He’s scathing about the ads for systems and methods that will make you a millionaire.

- Discipline and avoiding mistakes are key for him.

The Naked Trader

I’m using the second edition of Robbie’s book, published in 2007, which is unfortunately just before the financial crisis.

- There have been two further editions since then, and it would be interesting to hear from readers if much has changed.

- Please let us know in the comments.

The style of The Naked Trader could be best described as “blokey”.

- From the attention-seeking title (( Apparently he does trade naked from his bedroom, but that’s too much information )) to the cheesy cover photo (see the top of the page), it’s aimed at the kind of guy who likes the footy and a pint. (( As do I, interestingly enough ))

- It’s way too chatty and jokey for me, but seems to hit the spot for many people.

Let’s see if we can squeeze out some pearls of wisdom.

Trading style

Robbie is a medium-term investor rather than a day trader.

- He says that’s because he’s lazy.

- He also says that his approach will work for those in full-time work (so long as they have internet access at work, which most people will have on their phone these days).

He uses spread bets as well as direct shareholdings.

A day in the life

In the first chapter after the introduction, Robbie walks us through his typical day:

- He gets up at 7am and starts to read the Sun, the Times and any new investment magazines.

- Between 7am and 8am he reads the company news releases (RNS).

- When the markets open at 8am he makes any trades he has planned (and reacts to what’s in the RNSs).

- He also reviews what’s happening to his existing portfolio.

- From 9am he works on emails (he replies to around 100 a day).

- At lunchtime he checks in again with the markets.

- Then out for lunch, and another check when he gets back.

- At 2.30 the US markets open, and Robbie checks the impact over here.

- At 4pm he takes a final look as the UK market prepares to close.

- In the evenings he sometimes goes to an investor meeting (company presentation) in London.

- When he gets back he checks where the US markets closed.

Not too strenuous, was it?

Is trading right for you?

Robbie moves on to a section warning gamblers – and those lacking spare capital that they can afford to lose – against taking up trading.

He next describes a few kinds of trader, and his estimate of their chance of success:

- day trader (5%)

- chart guy (30%)

- safe and steady (blue-chips – 60% short-term, 90% long-term)

- system addict (20%)

- long-term investor (80%)

- medium-term investor (like Robbie, 85%)

- analyser (25%)

- accountant (40%)

- shorter (10%)

- quick in-and-out (10%)

- bottom picker (catches falling knives – 30%)

- scaredy cat (sells when market falls – 30%)

- bulletin board addict (???%)

- penny share addict (5%)

- footsie player (indices, 10%)

I’m not sure that many people fall into just one of these categories, but the analysis is revealing of how Robbie sees each type of activity.

What do you want from trading?

In the next chapter, Robbie advises would-be investors to think about what they hope to gain:

- what returns?

- how much risk?

- fun or long-term wealth?

- school fees or retirement?

- part-time or full-time?

All worthwhile questions.

He also talks about how age will affect your trading:

- people in their 20s can afford to take more risks than those in their 60s.

He stops short of recommending that retirees avoid shares altogether, instead preferring dividend stocks.

- I’d probably go for a blended, diversified, multi-asset portfolio, but

- The key message is don’t rely on cash or fixed-income (or even worse, an annuity) when you might have another 30 years of retirement ahead of you.

Robbie believes that it’s easier to make money from the markets if it’s not your main source of income.

- He certainly eats his own dogfood on this one, and I think he’s largely right, but

- It’s easier to invest when you have more free time (ie. don’t work a full-time job), and

- If you are good at this stuff, eventually you will make more from investing than from your job.

At that point it’s difficult to stay motivated enough to do the job rather than more investing.

Robbie recommends passive income streams, but the ones he used (the Buffy line and the Telecoms Plus commissions) are no longer available.

The Toolkit

Robbie’s requirements for trading are simple:

- a computer and the internet (or these days, a tablet or even a phone)

- an execution-only broker (he recommends having two accounts)

- real-time share prices and market information (perhaps from your broker)

- a trading log (Robbie suggests a notebook, but I prefer an online spreadsheet like Google Sheets)

At the time of writing the book, Robbie was using Selftrade, Barclays and E-trade.

He recommends ISA accounts because they shelter you from capital gains tax (when your portfolio gets big enough for this to matter).

- In fact, using a SIPP will be better for many people as you get tax relief on the way in rather than on the way out.

For prices and market information, Robbie uses ADVFN.

- I find this site very garish and difficult to use, but for the purposes of analysing Robbie’s book, I’ll just have to grit my teeth. (( Lots of other investors find the site very useful, but most will admit when pressed that it’s visually busy ))

Alternatives include Digital Look and Interactive Investor.

ADVFN tour

Here’s the front page of ADVFN:

I’m running an ad-blocker and a script-stopping tool, but some adverts still get through.

- If you don’t click on anything for 30 seconds (or sometimes as little as 10 seconds), a pop-up ad will obscure your view.

A paid account will make this disappear for around £20 a month.

- I think this kind of money would be better spent on a service like ShareScope or Stockopedia.

The menu is at the top.

Robbie’s favourite pages are:

- Monitor (your watch list)

- Financials (to research a share), and

- Toplists, which ranks stocks by various criteria (top movers etc.)

The News page is also useful as it lists RNSs and other news stories for a particular stock.

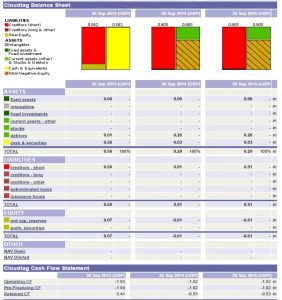

Here’s the monitor page:

I’m not particularly impressed with this – it mostly shows the kind of information you can put in a Google Sheet.

- It does have the spread, but you’ll get that from your broker anyway when you want to trade.

- And like the main page, if you ignore for 30 seconds, it disappears.

Robbie uses the Monitor function to operate around 10 watchlists, for different sections of the market.

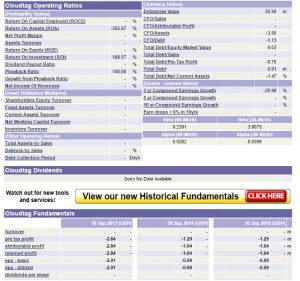

Here’s the financials page (in four parts), which is much better:

It’s quite comprehensive for a free service, but there’s a bit of information overload and I don’t think that you can tailor it down to the essentials.

Here’s the Toplists page:

Note that many of the lists are not free.

And here’s an example Toplist – percent gainers:

Trading rules

In the next section, Robbie lists eight trading rules:

- You make money by taking losses.

- Robbie is very keen that you take lots of small losses and make money from running a few big winners.

- He usually cuts losers at a 10% loss but will look to run winners up by 30% or more.

- Stay in control of your emotions.

- It’s your emotions that make you hang on to losers and take quick profits.

- Don’t try to get revenge on the markets.

- Don’t over trade.

- Don’t gamble

- Do your research on the stocks you invest in.

- The trend is your friend.

- Buy stocks that are going up through new highs.

- Don’t buy stocks that are trending down through new lows.

- Stocks that have gone down (falling knives) are rarely bargains.

- Don’t bottom pick.

- And don’t be a Chicken Little, the sky is not about to fall in on a stock that has risen.

- Stay cool through losing streaks.

- Don’t panic.

- You don’t have to trade.

- Stay out of the market if you can’t find any opportunities.

- Don’t trade because you are bored.

- Specialise

- Get to know what you are good at.

- Robbie is good at picking shares, but bad a trading indices.

- When researching a new area, paper trade for as long as possible to make sure that you know what you are doing.

The knowledge

In the next section, Robbie covers some of the things that you need to know about before you start trading.

I’m going to assume that most readers are already familiar with:

- spreads (bid, offer, mid-market price) and spread percentages

- commission and stamp duty (no stamp duty on AIM stocks)

- normal market size (max. guaranteed trade size in number of shares – shown on ADVFN)

- trading hours (8am to 4.30pm on the LSE)

- market makers and tree shaking (hitting stops and provoking sales)

- volume (of shares traded)

- dividends and ex-dividend dates (shown on ADVFN)

Robbie won’t buy shares where the spread is more than 4%, even for a small (eg. AIM) stock.

Many people will answer that share prices go up because “there are more buyers than sellers”, but of course for every buyer there is a seller, so that isn’t true.

- Share prices move because expectations about the future have changed.

Robbie has a useful section on the most common drivers of price changes:

- broker upgrades / downgrades (of future earnings and profits)

- wider market move (based on the country’s economic prospects, or the currency)

- sector move (read across from similar firms)

- institutional buys and sells

- insider (director) buys and sells

- results / news story

- going ex-dividend

- a tip in a newspaper, magazine or online

- bulletin board manipulation (ramp, de-ramp)

- this is particularly common with smaller shares, and now happens as much on Twitter as on bulletin boards

- market maker tree-shake

- world news surprise (terrorism, earthquake, tsunami)

- rights issue at discount to market price

- takeover / merger / stake building in preparation for bid

Conclusions

I’m going to leave it there for today.

- We’ve already covered more than a quarter of the book.

Of course, this is mostly pre-amble.

- Robbie has sold us the dream of full-time trading from a leafy riverside, but

- He hasn’t said too much about how to make a profit yet.

Neither has he said much that I disagree with.

- I still don’t like the ADVFN interface, and

- I prefer SIPPs to ISAs for most people.

But his list of what you need to trade is nice and simple, and he does warn the wrong kind of personality from getting involved.

- I also like his trading rules and his reasons for share price moves.

The next section of the book should be more interesting.

- In this he covers how to find shares, and some of his trading strategies.

Until next time.

Mike, an excellent summary on what you have read so far. The Naked Trader book was the first investment book I read having bought and sold shares for some 20 years previously. It is an excellent introduction to investing (or trading as he calls it) for an absolute beginner. For me the best thing about the book is the criteria he uses to identify a good company. (In forthcoming chapters of the book). As my experience has increased I have discovered that although ADVFN is an excellent source for share price information care should be taken on the company accounting figures and ratios provided by ADVFN. Always check the figures against the Company reports. I look forward to your next blog about this book.

Hi Mike, I often have investment conversations with people and refer them to your blog but sense that there is almost universal denial about the subject. I think we are in a period of great transition as DB pensions dissolve into history with two possible outcomes that will drive change. Either a generation will grow old in complete poverty which will in turn motivate the following generation or a brave Government will rachet up mandatory contributions.

On the subject of the Naked Trader, I bought the book many years ago and fell into the trap of trying to pick winners. Since investing in a mix of instruments (ETFs, ITs, Stocks etc) across a balanced asset allocation, along with seeking out the lowest fees, my fortunes have changed completely – Keep up the good work Mike – the7circles it is by far the best source of personal investment information I have found on the web!

Hi Mike, I’ve started following your blog. Been investing for about 1yr in the Aim market, and have managed to get through my first year approximately 200% up. However going to focus my efforts this year on broadening my knowledge and my skill base. Just down the northern line from you in Balham too. Cheers

Hi Wayne,

200% is pretty good going. How concentrated is your portfolio, and what kind of stocks are they?

Mike