Portfolio construction – Stockopedia revisited

Today we’re going to catch up with the Stockopedia service, which we first looked at more than a year ago. This time we’ll look at Portfolio construction.

Contents

Stockopedia

It’s been more than a year since we looked at Stockopedia, the stock ranking and data service, so it’s time for a catch-up.

As luck would have it, Ed Croft ran a webinar last week looking at portfolio construction. His slides and a transcript are up on the website, so that’s as good a place as any to start.

This article is probably going to read like an advert for the service, so I should point out that I have no connection to Stockopedia whatsoever. I’m not a subscriber, and I haven’t even had a chat with Ed at any of the many investor shows I’ve been to over the last year and a bit.

I’ve been put off joining by two things:

- I’m too mean to pay the £15-25 a month

- the free trial period is only 5 days – I’d need at least a month and ideally six months to get the hang of the service

So Ed, if you’re reading this, a free subscription – strictly in the interests of science – would be much appreciated.

Last year we covered the basics of how the StockRanks worked. Today we’re going to look at how to build a portfolio, and at the performance to date of various StockRanks-driven portfolios.

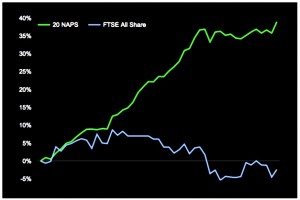

NAPS portfolio

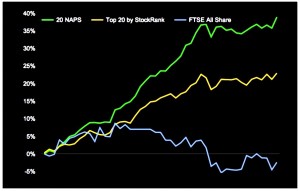

At the beginning of the year, Ed put together a list of 20 NAPS (stock tips, but with some science behind them). Over the 11 months since, the portfolio is up close to 40%, while the FTSE All Share is down a bit.

Ed confessed to being surprised. If he’d known it would do this well he would have stuck a lot of money into it.

The good news is that he builds his real-world portfolio along similar lines. He adds in more diversification and some short-selling, and has actually outperformed the NAPs.

The NAPS were selected as follows:

- rank stocks by descending StockRank

- exclude stocks with market cap less than £20M

- exclude stocks with Bid-Ask spread of 5% or more

- pick the two highest ranking stocks from each of 10 sectors

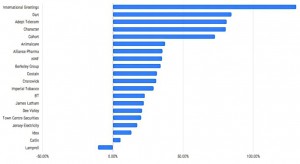

The big winners are International Greetings (LON:IGR), up 130%, Dart (LON:DTG), up 85% this year, Adept Telecom and Character. There are not many glamour stocks on the list.

There was only 1 loser – Lamprell (LON:LAM) in the Oil and Gas sector. The second-worst performance was Catlin, which delisted after four months.

Ed also mention a couple of subscriber portfolios that have also done well. Mechanical Bull is up 67% over 2 years and Grinder Trader is up 38% over one year.

Portfolio construction

Ed has four rules for managing a portfolio:

- Manage the monkey – this is Ed’s term for dealing with behavioural biases.

- Like me, he thinks that the only way around this is to use rules and checklists to guarantee a more systematic process.

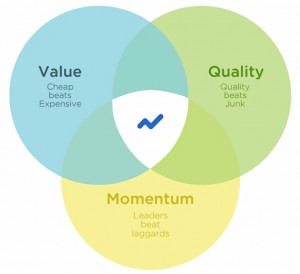

- Aligning with the payoffs – this means using the stock factors that outperform (value, momentum and quality)

- These are the three individual ranks than combine to make the StockRank

- Give every stock a role – in practice, this just means diversify across sectors

- this guarantees that the portfolio will have defensive shares as well as cyclical shares, and so on

- you could also diversify across market caps

- Keeping the balance – this just means systematic rebalancing to manage the risk from each share

- rebalancing can be time-driven (eg. annual) or size-based (maximum percentage of portfolio)

- in the case of a mechanical portfolio, rebalancing can also be score-based (replace low StockRanks stocks)

Rebalancing is one of the simplest and yet one of the most powerful ways of buying low and selling high. – Andrew Ang

Super stocks and Sucker stocks

The goal of the StockRanks is to find “good, cheap, improving” shares – the ones Robert Haugen called “Super Stocks”.

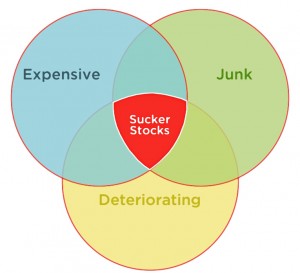

The opposite of these are the Sucker Stocks – “expensive, deteriorating junk”. We shouldn’t buy these, but lots of private investors do.

The reasons for this are psychological:

- cheap stocks often have problems

- good stocks are usually boring

- improving stocks look expensive after their good run

So the best stocks to buy are the hardest ones to buy.

Stockranks performance

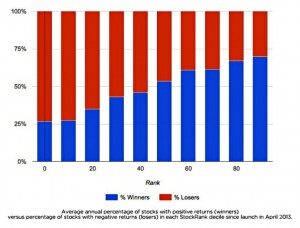

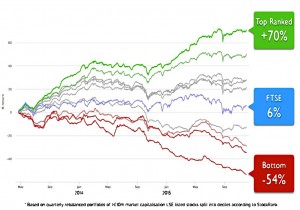

Ed used a couple of slides to show how effective the StockRanks system has been so far.

- The slide above shows the likelihood of picking a winning stock within each decile of Stock Rank score. The higher the decile, the more likely you will pick a winner.

- The diagram below shows the performance of portfolios made up of each decile. After eighteen months, there’s no overlap between them – higher score equals better performance.

Diversification

If you are doing a limited amount of work on individual stocks or no work at all like most investors, diversifying with 20 or 30 stocks is most definitely the right plan for you. – Joel Greenblatt

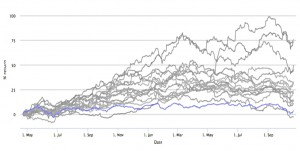

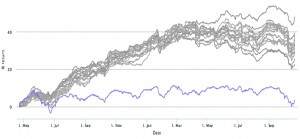

Ed likes portfolios of at least 20-25 stocks – his own portfolio has around 35 stocks. To illustrate he used slides showing the performance of random portfolios of each size, chosen from the top decile of Stock Ranks.

- You can see that the 5-stock portfolios have a wide range of outcomes. You might do well, or you might not.

- The 25-stock portfolios are very tightly grouped, and you are much more likely to do well.

Obviously, investors with small portfolios will find it expensive (in percentage terms) to buy and sell 20+ stocks, and may want to use fewer.

Sectors

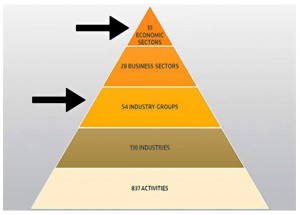

Ed uses the Thomson Reuters sector classification. It has:

- 10 economic sectors

- 28 business sectors

- 54 industry groups

Ed uses the 10 sector model.

To illustrate why, he compared the NAPS to the top 20 stocks from the StockRanks. The top 20 are up 22%, compared to 38% from the NAPS.

Ed also recommends diversifying across market cap sizes.

Conclusions

Even if you have no intention of subscribing to Stockopedia, Ed’s webinar is worth checking out simply for the guide to portfolio construction:

- use rules to beat your biases

- use value, momentum and quality factors to pick stocks that are likely to outperform

- diversify across sectors and by market cap

- rebalance annually, or by using size thresholds or through a scoring system

Stockopedia can help primarily with stock selection, though it will also make implementing the other three rules simpler and easier. But that convenience comes at a price.

Working out whether this is a good trade-off is up to you.

Until next time.