Quality Shares 4 – Valuation

Today’s post is our fourth visit to How to Pick Quality Shares by Phil Oakley. Today we’re looking at valuation.

Contents

Our previous three visits to Phil Oakley’s book looked at how to find a high-quality company that isn’t carrying too much debt.

Today’s post is about the third leg of the stool – value.

- It’s no use finding a good, safe company if you then pay too much for it.

Phil accepts that most high quality companies will come with fairly high valuations, and they can rarely be bought on the cheap.

- But there is still a price that is too high for any firm.

Phil’s method involves looking at how much of a company’s share price is based on its current profits, and how much is based on growing profits in the future.

- He even provides a maximum price that you should pay for a share, and a target price for selling it.

Fair value

Valuing shares is not a precise science.

- The best approach is to err on the side of caution.

One common starting point is “fair value”, which usually involves a discounted cash flow (DCF) calculation.

- This involves estimating the future cash flows to the shareholder that the company will produce

- And then discounting them back to the present day, to find out what is known as the “present value”.

The problem with this method is its extreme sensitivity to the chosen discount rate, and to a lasser extent the unreliability of cashflow forecasts that are a signficant period into the future.

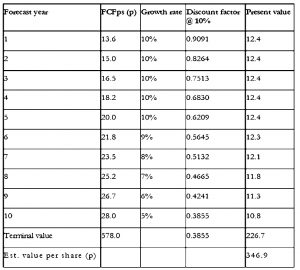

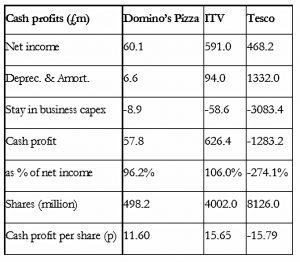

Phil uses Domino as an example.

- In July 2016 the shares were priced at 320p.

There are four steps to the DCF calculation:

- Estimate free cash flow per share for, say, 10 years.

- Phil assumes 10% growth for the first 5 years, then a 1% decline per year, to reach 5% at the end of 10 years.

- This is the long-term growth rate, or g.

- Choose the discount rate, or d.

- Phil cleverly characterises this as the “interest rate you want to receive in order to invest in the shares”.

- Since stocks are risky, this will obviously need to be higher that the risk-free rate. (( Which is pretty low and therefore easy to beat at the moment ))

- Phil uses 10% pa, which seems pretty high to me, but presumably he’s building in a “margin of safety”.

- Work out the potential value of the shares in 10 years, and discount that value back to today.

- Add in the present value of the cash flows in the years up to year 10.

Phil uses a terminal value formula to calculate the value of the shares in 10 years:

Terminal value = year 11 FCF / / (d - g) = year 10 FCF * (1 + g) / (d - g)

With the discount rate at 10% and the long term growth rate, the calculation is:

Terminal value = 28 x 1.05 / (10% - 5%) = 588

For some reason this is shown as 578 in the table.

Each year in the table has a discount factor which is calculated by dividing the previous factor by (1 + d) = 1.1

- Each FCF is discounted by the appropriate factor to calculate its present value.

- The total value of the shares is the sum of the discounted FCFs plus the discounted terminal value.

This works out at 347p – slightly more than the share price.

- Which means that Domino’s must grow at these rates for the share price to be slightly higher than it is today.

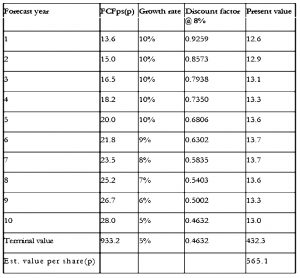

Using a discount rate of 8%, the value of the shares is 565p implying that the shares are cheap.

- Phil suggests that a higher discount factor be used for small and / or indebted firms, since they are more likely to go bust.

- The higher d includes a margin of safety into the calculation.

I think that the sensitivity of DCF calculations to the discount rate makes them a tricky tool to use, though there may be some merit in using DCF to compare quite similar companies (in the same sector, say).

Phil says that there are two reasons why share prices move up and down:

- a change in expectations of future profits

- a change in interest rates

I’m far from convinced that many investors use DCF analysis to value shares.

- Though it stands to reason that after a profit warning, people can work out that a share is worth less.

A rise in interest rates means that shares are worth less to those who value them like bonds.

- A rise in general interest rates means that the “interest rate” people require to hold shares will also rise, pushing down the breakeven purchase price.

I would argue that not everyone in the market values shares as if they are bonds.

- At the same time, I accept the underlying principle that low interest rates (as today) underpin high share prices.

Phil accepts that most people use “shortcuts based on multiples of a company’s profits, cash flows or assets” instead.

The PE ratio

Phil doesn’t like the PE ratio, the most commonly used valuation ratio:

PE = price / earnings per share (EPS)

At first sight, a high PE is expensive and a low PE is cheap.

- But earnings are easier to manipulate (via accounting policies) than cash flow is.

And earnings can be “bought”:

- through investments in assets or through buying another company.

Phil prefers a rise in earnings to come from increased sales of existing products and services.

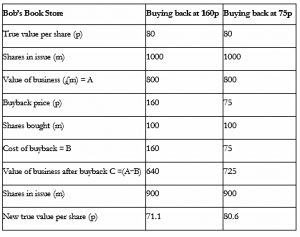

Share buy-backs will also boost EPS, as Phil illustrates using Bob’s Book Store.

Bob is making £100m of trading profits every year but finding growth difficult.

- He has no debt and £160M of cash,

The stock market is high, and the firm has a PE of 20, valuing it at £1.6 bn (despite low growth).

- There are 100M shares, each priced at 160p

Bob buys back 10% of these for his £160M of cash.

- EPS rises from 8p to 8.9p

Buybacks are popular with executives for several reasons:

- they boost EPS, which can support the share price (many execs have a remuneration component made up of share options, and others have bonuses directly linked to EPS)

- they offset the issue of new shares as options

- there can be tax advantages, particularly in the US

Whether buybacks add value really depends on the price at which they are made.

- If the shares are bought at less than fair value, they add value.

- If the shares are bought at more than fair value, they subtract value.

Warren Buffett has a buyback policy at Berkshire Hathaway which reflects this analysis.

- Berkshire only buy back shares when the stock price is at a significant discount to intrinsic value (as calculated by Warren, in a non-transparent fashion).

For the purposes of illustration, Phil assumes that a year later Bob’s shares are worth 80p, a PE of 9 on the new EPS of 8.9.

Buying at 160p has reduced the value of the stock to 71p.

- Had Bob paid 75p, the shares would now be worth 81p.

Phil prefers special dividends, though this is obviously with the benefit of hindsight.

- Sometimes “bad” share buybacks work out, because the share price goes up.

- And special dividends can create tax problems for some investors.

EPS

Phil has some more criticisms of EPS (and by extension, PE ):

- EPS is not the same as cash profits

- EPS may be based on unsustainably high profits (or temporarily low ones)

- This is particularly true of cyclical firms.

Cash profits

In our previous visits, Phil looked at cash flow as a better (less easy to manipulate) number than profits.

- Now he tells us that cash flow can be manipulated in the short term.

- We need to work out cash profits instead.

One of the things a firm can do to boost free cash flow is to cut back on capital investment (capex).

- Other distortions include tax refunds, pension fund top-ups, restructuring costs and litigation.

Phil uses Close Cut Lawnmowers as an example.

To boost cash flow (and hence the share price), the firm decides to:

- reduce inventory from 20% to 15%

- chase customers for payment, reducing debtors from 8% of sales to 7%

- delay paying suppliers and increase trade creditors from 15% to 17%

Phil seems to view these measures as something close to manipulation.

- But I see them as legitimate and welcome (albeit one-off, non-recurring) efficiency measures.

The changes bring in £5M, £1M and £2M respectively.

- From a £2m outflow in working capital the previous year, this is a swing of £10M.

Free cash flow increases from £14M to £24M.

- Since the company has been valued at 10 x FCF, this should add £100M of value to the share price.

But it’s a one-off boost.

- As sales and profits increase by 5% with no further squeeze on working capital, FCF falls back to £16.6M.

Owner earnings

Warren Buffett calculates the cash profits of Berkshire Hathaway – what he calls the “owner earnings” – each year in his letter to shareholders.

Owner earnings = net income + depreciation + other non cash items - maintenance (stay in business) capex

Any extra working capital (for more stocks or generous credit terms) is added to maintenance capex.

Owner earnings / no of shares = cash profit per share.

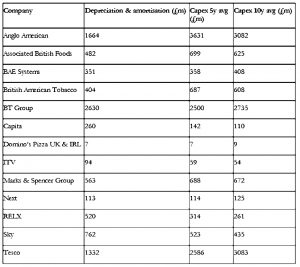

Maintenance capex

The hardest part of Buffett’s formula is working out maintenance capex.

Phil offers three solutions:

- The company tells you.

- Phil gives Whitbread as an example.

- Use a multiple of depreciation, say 120%

- This won’t work if the cost of replacing assets is falling.

- Use a five- or ten-year average of capex

- Some of this will have been spent on growth, but it all needs to be replaced over time.

- Phil prefers this option to the multiples method.

- He uses the higher of the 5yr and 10yr averages.

Sometimes, in asset intensive companies like Anglo American (mining) or Tesco, depreciation is higher than average capex.

- This leads to poor FCF and modest ROCE and CROCI

In media companies (ITV, Sky), capex is less than depreciation.

- This can look like under-investing, but usually reflects the writing down of intellectual property like programme libraries.

Phil uses three methods:

- Cash yield, for comparison with interest rates on savings or bonds.

- Earnings power value (EPV)

- This is the value of the shares if the current cash profits continue forever.

- From this, you can work out the proportion of the current share price that can be explained by current cash profits (more = cheaper).

- The remainder is due to growth expectations (more = more expensive).

- A maximum target share price

- Phil bases this on the yield on government bonds

Cash yield

Cash yield = cash profit per share / share price

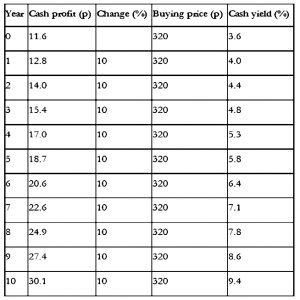

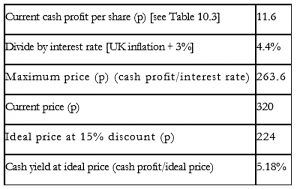

So for Domino’s at 320p, with a cash profit per share of 11.6p, the yield is:

- 11.6 / 320 = 3.62%

This is better than cash or bonds, but is it enough to hold the stock?

Cash profits will need to increase significantly to produce a good return.

- Phil includes a table assuming 10% pa growth in cash profits to illustrate this.

With 10% annual growth for ten years, the cash yield still doesn’t reach 10%.

Phil likes to see a starting cash yield of 5%.

- For Dominos with a cash yield per share of 11.6p, that gives a buying price of 232p.

Earnings power value (EPV)

The EPV is the value of a share if its current cash profits stay the same forever.

It’s a long calculation:

- Start with profits (normalised trading profits or EBIT).

- Add back depreciation.

- Take away “stay in business” capex.

So far this is Buffett’s “owner’s earnings”, or Phil’s cash profit.

Next:

- Tax the cash profit

- Phil suggests using the standard corporation tax rate, to be conservative.

- Divide by your required interest rate to get an “enterprise value”.

- Phil suggests a rate of 7% to 9% for FTSE 350 companies.

- or 10% to 12% for smaller and / or more risky companies (including those with volatile profits and / or lots of debt)

- Take away debt, the pension fund deficit, preferred equity and minority interests to value the equity.

- Add any surplus cash.

- Divide by the number of shares to get EPV per share.

Domino’s EPV of 151p is only 47% of the share price at the time (not good).

- Phil recommends 50% of share price as a minimum level for EPV.

Maximum price

Low interest rates have recently pushed up the price of “bond proxies” – reliable blue chips, often branded consumer goods companies (Unilever, Reckitt Benckiser, Coca-Cola, Diageo).

- Good companies will never be cheap, but how much is too much?

Buffet divides the cash profits by the yield to maturity (gross redemption yield) of government bonds.

So if cash profits were 10p per share and bond yields 5%, the maximum value of the share is:

- Maximum value = 10p / 5% = 10 / 0.05 = 200p

This is a “cash PE” of 20 (= 1 / 5%).

Of course, bond yields are much lower today (UK 10 year yields are 1.3%, and were only 0.9% when Phil wrote the book) and a multiplier of 77 could be justified on this basis.

- The best way to think about this is that when bond yields are so low that you don’t want to buy bonds, it makes no sense to use the bond yield as the target interest rate for the shares you plan to buy.

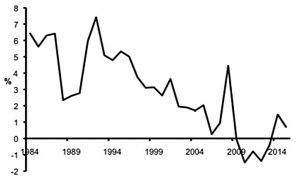

Phil suggests using the average gilt yield over the last 30 years.

- This was 6.4% when he wrote the book. (( I had trouble finding an updated figure, so shout if you know where I can get it ))

- This gives a multiplier of 15.6 (= 1 / 6.4%).

An alternative is to use the average real yield over 30 years and add in current inflation.

- When Phil wrote the book, the average real yield was 2.93%, which he rounds up to 3.0%

- Inflation was 1.4%, so his target return is 4.4%

- This gives a multiple of 22.7 (= 1 / 4.4%).

CPI for October 2017 was 3.0%, giving a target yield of 6%.

- This gives a multiplier of 16.7 (= 1 / 6%)

That’s a fine target for a stock, but I wouldn’t expect to find too many qualifying stocks in the current bull market.

- The FTSE all-share has a forward PE of around 15, slightly higher than average.

But we would be using trailing cash profits rather than forward ones.

- And we would be looking for the best companies, which are likely to be more expensive than average.

Domino’s price target

It looks like Dominos is too expensive.

- The maximum price is 263p, compared with an actual price of 320p.

- With a 15% margin of safety, the target price is 224p.

Phil also adds a sell rule at 25% above the maximum buying price.

- In his example this would be 329p.

Growth

Growth is very important to Phil, since high share prices can fall quickly when profits stop growing.

He uses the Restaurant Group in 2016 as an example.

- The shares were priced at over 700p, on a PE of more than 20.

- After a series of profit warnings, the valuation halved to a PE of 10 and the price dropped by 60%.

A lower valuation on smaller profits means a nasty price drop.

Quality vs price

Phil notes that “over-paying” for the best companies can work out in the long run.

- This is the Buffet approach – long-term holdings of high-quality shares that earn high returns on capital.

Phil provides some examples of shares with high and stable returns on capital (and rising share prices) in the decade to 2016. (( Note that this period includes a massive crash and a very nice bull market recovery ))

- The examples are: AG Barr, BAT, Cranswick, Dignity, Diploma, Domino’s, Fidessa,InterContinental Hotels, Paddy Power Betfair, Reckitt Benckiser, RELX, Rightmove, Sage, Spirax Sarco and Unilever.

- Few could have been bought at any point for cheap prices.

Checklist

Phil ends the section with a checklist:

- Value companies using cash profits.

- Work out the cash yield – is it high enough?

- Calculate the earnings power value (EPV) to work out how much of the company’s share price is explained by its current profits (and how much depends on future profit growth.)

- Don’t buy shares where more than 50% of the price depends on future growth.

- Work out the maximum price you will pay for a share.

- Try to buy at a discount of at least 15%.

- Use an interest rate of at least 3% more than inflation.

- Only over pay when you are very confident in future profits growth.

- The higher the price you pay, the more risk you are taking.

And that’s it – we’ve completed our journey through Phil’s book.

- I found today’s section very straightforward to follow and very useful.

I’ll be back in a few weeks with a summary of the whole book and the lessons we can learn from it.

Until next time.