SmallCap Growth Aim Portfolio 18 – Company Reviews

Today’s post is a review of the stocks in the SmallCap Growth AIM portfolio, in order to decide what should happen to each of them.

SmallCap Growth AIM Portfolio

A couple of weeks ago we reviewed the SmallCap Growth AIM Portfolio (SGAP).

- It’s done very well over the two and a half years of its existence, but it’s time for a change.

The recently formed AIM IHT portfolio has significant overlap with the SGAP, and they need to be separated.

We came up with the following framework for reviewing the 37 stocks in the SGAP:

- Duplicate holding of stock in IHT AIM portfolio = sell

- Good metrics but too large (more than £4.6K) = top slice

- Good but too expensive = move to spread bet

- Good and around £4.6K = hold

- Good and too small = top up

- Bad metrics = sell

The AIM IHT rules

If we have time, we’ll also start to look for replacement stocks for the SGAP.

When we find a promising candidate, we’ll use the following AIM IHT rules to decide which portfolio it’s better suited to:

- No financials, property companies, miners or energy stocks.

- No market caps below £50M.

- No loss-making companies (PE missing in Stockopedia).

- Risk Rating of Conservative / Balanced / Adventurous (3 from 5).

- Positive or Neutral Stock Style.

- Stock Rank above 50, sub-Ranks all above 20.

- PE below 20 (ideally) or 25 (hopefully).

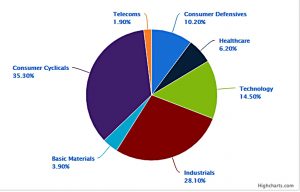

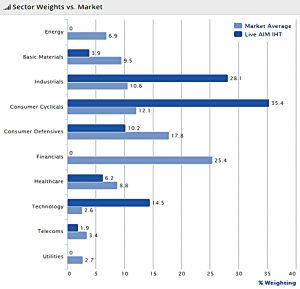

We’re also very overweight in consumer cyclicals.

- Given where we are in the economic cycle, this is worrying, and we’ll look to make the AIM IHT portfolio more defensive where possible.

We’re also overweight in industrials, but this is less worrying.

Note that the sector composition of the SGAP is not so important, since this is an actively-managed, speculative portfolio.

37 stocks

Let’s go through the stocks, in alphabetical order.

- 32 Red (TTR)

- This stock was taken over in July, between the last two updates to the SGAP.

- Kindred paid 196p for each of our 1,750 shares, generating £3,430 in cash.

- Ab Dynamics (ABDP)

- This is an Adventurous High Flyer with a PE of 22.

- The Stock Rank is 69 (QVM = 79, 13, 94).

- The value of the holding is £3.2K.

- So this is a Good, Top Up stock.

- Andrew Sykes (ASY)

- This is a Balanced, Style Neutral stock with a PE of 17.

- The Stock Rank is 77 (QVM = 95, 49, 54).

- The value of the holding is £3.5K.

- Unfortunately ASY is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Animalcare Group (ANCR)

- This is a Balanced, Falling Star stock with a PE of 21.

- The Stock Rank is 39 (QVM = 87, 11, 40).

- The value of the holding is £1.7K.

- This stock has bad metrics, so it is a Sell.

- Anpario (ANP)

- This is a Balanced, High Flyer with a PE of 25.

- The Stock Rank is 82 (QVM = 93, 26, 85).

- The value of the holding is £1.3K.

- Unfortunately ASY is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Arbuthnot Banking Group (ARBB)

- This is a Balanced, Neutral stock with a PE of 17.

- The Stock Rank is 50 (QVM = 45, 73, 39).

- The value of the holding is £0.9K.

- Technically, this is a Top Up stock, but if we have too many holdings at the end of the process, it will be at the bottom of the pile.

- Bioventix (BVXP)

- This is an Adventurous High Flyer with a PE of 27.

- The Stock Rank is 81 (QVM = 97, 17, 88).

- The value of the holding is £2.6K.

- This is a decent candidate for a Spread Bet.

- Whether / how quickly we move stocks over to the Spread Bet portfolio will depend on how many stocks remain standing in the SGAP at the end of this review process.

- Boohoo.com (BOO)

- This is a Speculative High Flyer with a PE of 59.

- The Stock Rank is 43 (QVM = 78, 9, 58).

- The value of the holding is £5.9K (we top-sliced already).

- This is another candidate for a Spread Bet.

- Brady (BRY)

- This is an Adventurous Falling Star with a PE of 28.

- The Stock Rank is 33 (QVM = 65, 36, 24).

- The value of the holding is £1.3K.

- This stock has bad metrics, so it is a Sell.

- Brooks Macdonald Group (BRK)

- This is a Balanced Falling Star with a PE of 16.

- The Stock Rank is 47 (QVM = 81, 33, 38).

- The value of the holding is £1.3K.

- This stock has mediocre metrics, so it is a Sell.

- Burford Capital (BUR)

- Cenkos Securities (CNKS)

- This is a Speculative, Style Neutral stock with a PE of 11.

- The Stock Rank is 89 (QVM = 81, 88, 49).

- The value of the holding is £0.5K.

- Despite its poor performance to date, this is a Top Up stock.

- Cohort (CHRT)

- This is a Balanced, High flyer with a PE of 14.

- The Stock Rank is 57 (QVM = 74, 32, 65).

- The value of the holding is £1.5K.

- This is another Top Up stock.

- Crawshaw (CRAW)

- This is a Speculative Value Trap with no PE (no profits).

- The Stock Rank is 38 (QVM = 41, 73, 20).

- The value of the holding is £0.7K.

- This stock has bad metrics, so it is a Sell.

- Crystal Amber fund (CRS)

- Stockopedia doesn’t provide numbers for funds.

- The value of the holding is £1.3K.

- CRS has a decent long-term record, though it’s had a bad few months recently.

- Technically this is a Top Up stock, but whether that happens will depend on the results of this review on the whole portfolio.

- Dart (DTG)

- This is an Adventurous, Style Neutral stock with a PE of 14.

- The Stock Rank is 60 (QVM = 51, 71, 52).

- The value of the holding is £1.6K.

- Unfortunately DTG is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Dewhurst (DWHT)

- This is a Conservative Super Stock with a PE of 13.

- The Stock Rank is 77 (QVM = 71, 69, 59).

- The value of the holding is £1.2K.

- This looks like a good candidate for the AIM IHT portfolio, and indeed it appeared on the final list of 50 stocks to buy.

- But I had some problems placing the trade, and so it didn’t make the final cut.

- So now it’s a Top Up stock.

- DotDigital (DOTD)

- This is an Adventurous High Flyer with a PE of 29.

- The Stock Rank is 79 (QVM = 99, 9, 92).

- The value of the holding is £2.6K.

- This is another candidate for a Spread Bet.

- Finsbury Food Group (FIF)

- This is a Balanced, Contrarian stock with a PE of 11.

- The Stock Rank is 73 (QVM = 73, 79, 40).

- The value of the holding is £2.1K.

- Unfortunately FIF is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- FW Thorpe (TFW)

- This is a Balanced, High Flyer stock with a PE of 31.

- The Stock Rank is 61 (QVM = 99, 18, 58).

- The value of the holding is £2.5K.

- This is another candidate for a Spread Bet.

- IQE (IQE)

- This is a Speculative, High Flyer stock with a PE of 35.

- The Stock Rank is 45 (QVM = 53, 13, 84).

- The value of the holding is £8.9K.

- This is another candidate for a Spread Bet.

- James Halstead (JHD)

- This is a Balanced, Falling Star with a PE of 25.

- The Stock Rank is 45 (QVM = 99, 28, 23).

- The value of the holding is £1.3K.

- Unfortunately JHDis in the AIM IHT portfolio.

- So this is a Sell (IHT).

- James Latham (LTHM)

- This is a Balanced, Style Neutral stock with a PE of 16.

- The Stock Rank is 67 (QVM = 63, 47, 74).

- The value of the holding is £1.4K.

- Unfortunately JHDis in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Judges Scientific (JDG)

- This is an Adventurous High Flyer with a PE of 16.

- The Stock Rank is 78 (QVM = 94, 25, 80).

- The value of the holding is £1.3K.

- JDG is a Top Up stock.

- Manx Telecom (MANX)

- This is a Conservative, Style Neutral stock with a PE of 13.

- The Stock Rank is 66 (QVM = 80, 45, 57).

- The value of the holding is £2.4K.

- Unfortunately JHD is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Pennant International (PEN)

- This is a Speculative, Style Neutral stock with a PE of 12.

- The Stock Rank is 56 (QVM = 50, 81, 36).

- The value of the holding is £1.1K.

- PEN is a Top Up stock.

- Personal Group Holdings (PGH)

- This is a Balanced, Style Neutral stock with a PE of 16.

- The Stock Rank is 48 (QVM = 45, 69, 39).

- The value of the holding is £0.7K.

- This stock has mediocre metrics, so it is a Sell.

- Polar Capital Holdings (POLR)

- This is an Adventurous High Flyer with a PE of 15.

- The Stock Rank is 92 (QVM = 97, 33, 96).

- The value of the holding is £1.2K.

- POLR is a Top Up stock.

- Science Group (SAG)

- This is a Balanced, Style Neutral stock with a PE of 16.

- The Stock Rank is 82 (QVM = 68, 48, 90).

- The value of the holding is £1.5K.

- Unfortunately SAG is in the AIM IHT portfolio.

- So this is a Sell (IHT).

- Sprue Aegis (SPRP)

- This is a Speculative, Style Neutral stock with a PE of 17.

- The Stock Rank is 82 (QVM = 83, 52, 69).

- The value of the holding is £2.4K.

- SPRP is a Top Up stock.

- Stanley Gibbons (SGI)

- This is a Highly Speculative Value Trap with no PE (no profits).

- The Stock Rank is 15 (QVM = 8, 69, 1).

- The value of the holding is £0.1K.

- This stock has terrible metrics, so it is a Sell.

- Touchstone Innovations (IVO)

- This is an Adventurous, Style Neutral stock with a PE of 97 (it’s a VC fund).

- The Stock Rank is 38 (QVM = 16, 69, 50).

- The value of the holding is £0.7K.

- This should be a Sell on the metrics, but it’s a diversifying fund in the midst of merging with another VC fund.

- So for now it’s a Top Up stock, but we’ll review that status at the end of this process.

- Trifast (TRI)

- This is a stock from the Main List which was mis-classified at the time of purchase.

- It will be moved to the PiggyBank (Main) portfolio.

- Luckily its gains (108%) are very similar to those of the overall portfolio (111%), so it hasn’t skewed the track record of the portfolio.

- It’s a Balanced, Style Neutral stock with a PE of 16 and Stock Rank of 86 (95, 49, 70).

- Tristel (TSTL)

- This is a Speculative High Flyer with a PE of 32.

- The Stock Rank is 74 (QVM = 96, 14, 84).

- The value of the holding is £3.9K.

- This is another candidate for a Spread Bet.

- United Carpets Group (UCG)

- This is an Adventurous, Contrarian stock with a PE of 6.

- The Stock Rank is 95 (QVM = 95, 96, 49).

- The value of the holding is £0.7K.

- UCG is a Top Up stock.

- XL Media (XLM)

- This is a Speculative Super Stock with a PE of 14.

- The Stock Rank is 97 (QVM = 95, 53, 96).

- The value of the holding is £2.3K.

- XLM is a Top Up stock.

- Zytronic (ZYT)

- This is an Adventurous, Style Neutral stock with a PE of 17.

- The Stock Rank is 90 (QVM = 92, 47, 82).

- The value of the holding is £2.5K.

- Unfortunately ZYT is in the AIM IHT portfolio.

- So this is a Sell (IHT).

The results

Phew – we got through them all.

Let’s have a look at what this means for the portfolio:

- 6 stocks are to be sold because they have bad metrics

- 9 are to be sold because they are duplicates of holdings in the AIM IHT portfolio

- 6 are candidates to be moved over to a Spread Bet account

- 1 is to be Top Sliced

- 13 are to be Topped Up

- 1 stock was moved to the Piggyback (Main) portfolio

- 1 stock was sold as part of a takeover

The priority is to sell the bad stocks.

- The duplicates and spread bets will be actioned once we have replacement stocks for the spare cash.

So next week I’ll be back with the search for candidates.

Until next time.