Social Trading and Black Swans

Today’s post is about Social Trading, and how this endeavour can be disrupted by Black Swan events.

Contents

Social Trading

Regular readers will recall my New Year’s resolution to get back in to active trading. One of the avenues I planned to explore was Social Trading. The idea is that you follow other “expert traders”, allocating your capital between them. When these “signal providers” trade, the platform (eToro, ZuluTrade, Ayondo, Tradeo etc.) automatically copies their trades for you. The main products traded are FX pairs, indicies and commodities.

When I carried out a little due diligence on the bulletin boards and social aggregator sites, I found tales of woe. Some of the issues reported include:

- too few successful expert traders available

- most of the successful ones were only trading paper money

- lack of transparency of experts’ trading records

- high minimum leverage (eg. 400x on FX)

- more worryingly, there were reports of successful investors being unable to withdraw their funds

But perhaps the biggest issues are those of survivor bias and the risk profile of the “expert” traders.

Black Swans

Last week I came across a blog post by Lewis Robinson on his excellent blog Expecting Value. Lewis normally writes about value investing but back in January when the Swiss Franc peg against the Euro was removed, he wrote about the dangers of crowdsourcing.

The post was based around a screen cap of a Swiss Franc trader from ZuluTrade. The guy had been trading the Swiss Franc in the expectation that the peg to the Euro would remain indefinitely. When it was removed (when “the SNB went nuts”) his account was wiped out, impacting all of his followers. To him, the removal “was not forseeable.”

This is a good example of the kind of risky trading to be found on Social Trading sites. Whilst the timing of the peg’s removal might be difficult to predict, ((In the end it was the ECB’s decision to finally begin QE that prompted the removal)) it was a fair bet that it would be removed at some point, with obvious consequences for the exchange rate. To be fair to ZuluTrade, there is a “Reckless Trading” warning on SwissRunner’s profile, though I can’t be certain that this was present before the catastrophic losses.

This strategy is referred to in Nassim Nicholas Taleb’s book The Black Swan. You bet against an extreme event – a catastrophe – and make small steady profits. Before Taleb’s book came out it used to be known as “picking up pennies in front of a steamroller.” Traders often combine such strategies with leverage to increase their small gains, but this only magnifies the impact of the catastrophe when it eventually occurs.

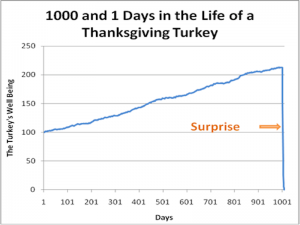

To illustrate the dangers of projecting from the past, Taleb uses a chart of Turkey happiness ((The bird, not the country)) in the run-up to Thanksgiving (or Xmas here in the UK):

Remember this chart, as its shape is a recurring theme of today’s post.

Survivor bias

The social trading sites are a fine example of survivorship bias, where the competitors who fail to survive are conveniently ignored. Until the Swiss Franc peg was removed, SwissTrader’s chart would have indicated that he was a successful trader.

Lewis made a simple Excel model of this kind of system, using the following daily outcomes:

- 51.7% chance you make 1.6%

- 48% chance you lose 1.5%

- 0.3% you blow up

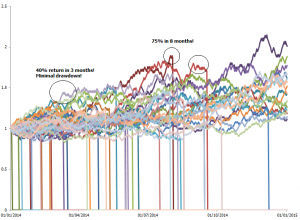

The chart below shows the account values for 50 traders after one year of trading:

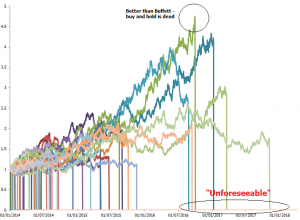

After two years of trading, some of the results are even more spectacular, but they all blow up in the end:

Long Term Capital Management

The most famous example of this approach was the hedge fund Long Term Capital Management (LTCM). LTCM was founded by Salomon Brothers bond trader John Meriwether and was run by Nobel Prize-winning economists.

The fund used high-risk arbitrage bond trading strategies. High leverage was needed to make good returns from these small gains. By 1998, the fund had $5 billion in assets and had positions worth more than $1 trillion (roughly 5% of the global fixed-income market at the time).

Following the 1997 Asian financial crisis and 1998 Russian financial crisis (government bond defaults) LTCM made massive losses and was in turn in danger of default on its leverage loans. This might have triggered a global financial crisis, so in September 1998 LTCM was bailed out by the Federal Reserve and taken over by its creditors.

Accumulation of marginal gains

It’s these kinds of results which make the evaluation of investment managers – even all-time greats like Buffett – so difficult. It’s always possible to devise a model to show that any amount of individual outperformance over any period of time is just down to chance, and that reversion to the mean (or even a spectacular blowup) is just around the corner.

The same applies to a lesser extent to back-tested market strategies and historical analyses which show that equities outperform bonds or small companies do better than large ones. There are no guarantees that the same thing will be true in the future, but what else do we have to go on?

I subscribe to the philosophy of “the accumulation of marginal gains” as popularised by Dave Brailsford of the British Olympic cycling team – the architect of Bradley Wiggins’ Tour de France win. If we practice everything that gives a small advantage, we have the greatest chance of success.

In investment, the list includes:

- diversification across geographies and asset classes

- valuation (buy cheap)

- momentum

- small cap outperformance

- minimise costs

- take advantage of tax breaks

Put it all together and you might just stand a chance.

Conclusions

I remain convinced that Social Trading is a good idea in principle, but I am yet to find a practical implementation that persuades me enough to part with any cash.

In an ideal world I would like to effortlessly track and mirror the portfolios of my favourite bloggers and Twitter friends. I believe that this would be a great improvement on the typical closet tracker active fund.

Maybe what we need is an online investment club. Perhaps I should start one.

Until next time.

1 Response

[…] a negative skew (the rise slowly and fall rapidly). Strategies with negative skew are the “picking up pennies in front of a steamroller” activities that we have described before. Selling puts against an index and buying junk […]