State Pension Is Unfit For Purpose – CPS

Today’s post is about a report from the Centre for Policy Studies, which claims that the State Pension is unfit for purpose.

Contents

State pension is unfit for purpose

The State Pension is in the news at the moment.

- The new State Pension scheme went live in April 2016, and a couple of weeks ago we had the Cridland interim report on the future of the State Pension (aimed largely at working out how fast the qualification age – retirement age – should rise.

Now we have a new report from the Centre for Policy Studies which claims that the State Pension is no longer fit for purpose.

- This is strange considering that the Cridland report concluded that the State Pension would remain affordable for another 50 years.

The author of the new report is Michael Johnson, who we’ve met several times before.

- Back in March 2015 we looked at another of Michael’s papers which claimed that pensions are finished.

- And in June 2016 he produced a report recommending a Workplace ISA as a stablemate to the Lifetime ISA (of which I am not a fan) and the new auto-enrolment (AE) workplace pension.

Let’s take a look at a few of the points that the CPS makes this time.

NI fund in deficit

The CPS notes that the National Insurance Fund (NIF), which nominally funds the State Pension, is now in deficit:

- in 2015-16 it received £86 bn of NIC and paid out £95 bn in benefits (of which £89 bn was State Pension)

- this £9.6 bn shortfall was up from £4.6 bn the previous year

This is a red herring, and the wrong way to look at pension funding.

- It’s a pay as you go system, with the current generation of workers funding the current generation of pensioners.

- The amount paid in will rarely line up with the amount paid out.

Depending on the demographics, you will either have a surplus or a deficit.

- Given the rising numbers of baby boomers about to hit pension age, we are likely to see deficits for a number of years.

- This doesn’t undermine the funding mechanism.

The Cridland report instead used a percentage of GDP (8% in fact) as a funding target.

- Cridland reported that the cost of the state pension would remain below 8% of GDP for the next 50 years.

Poor subsidise the rich

The CPS wants to get rid of the idea of a single state pension age (SPA) for all.

- But they think that personalised pensions would be expensive to administer, highly contentious and potentially litigious.

The “issue” here is that because wealthy people tend to live longer, they will receive more in pension payments.

Well, that’s actually fine.

- Ignoring the fact that the wealthy are also likely to have paid a lot more NIC and tax into the system, the State Pension doesn’t guarantee the same amount of payments to everyone.

It’s an insurance scheme against living too long (longevity risk).

- The promise is that for every year you are alive beyond a minimum age, you’ll receive a maintenance grant.

Life expectancy depends on many factors, some of which are under an individual’s control.

- If we start penalising people for making good choices (healthy eating, moderate drinking, not smoking) we are starting off down a slippery slope.

CPS proposals

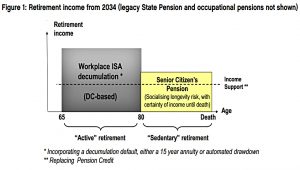

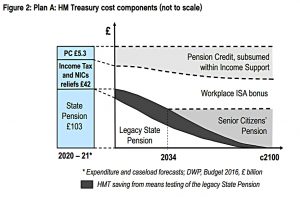

The CPS makes a number of proposals to “fix” the State Pension, under two separate plans – Plan A and Plan B.

For our purposes we can treat the plans as one:

- put the State Pension into “run-off” from 2020

- this means that no more entitlements would be created

- means test this legacy state pension (LSP), along with all other pensioner benefits

- create a new Senior Citizen’s Pension (SCP) payable from age 80

- this would be residency-based, rather than calculated from NI contributions

- full entitlement would require 40 years of living in the UK between age 30 and age 80

- 20 years would get you nothing, with 5% of the SCP for each year after that

- the SCP should be around £200 per week (£10K pa), some 25% larger than the new State Pension

- the SCP would remove the rationale for NICs, allowing them to be merged with income tax to form an Earnings Tax

- with no SCP until age 80, the obstacle of pensioners potentially paying NIC on earnings during retirement would also be removed

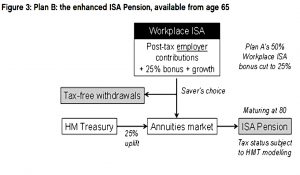

- the Workplace ISA should be introduced to receive employer contributions under AE

- this would receive a 50% bonus from the state (equivalent to 33% tax relief), up to a “modest” annual limit

- the WISA looks like an extension of the LISA to include employer contributions, with the LISA remaining for employee contributions

- no access to this pot would be allowed before 65

- this pot is intended to be run-down (or annuitised) before qualification for the SCP at age 80

- the “ISA Pension” – effectively an annuity – could be used to cover this period; with only 15 years of payments to be made, annuity rates might be of practical use, if still not good value

- the self-employed should be added to AE, with the state funding the employer contributions

- the self-employed should also be required to pay regular rates of NICs

- Income Support should be extended beyond the SPA, so that Pension Credit can be scrapped.

- all of these proposals would be funded by:

- removal of all tax and NI reliefs on pensions (including the 25% tax-free lump sum at age 55)

- the gradually diminishing cost of the legacy State Pension

Transitions

I find it highly unlikely that these proposals will ever be adopted, but let’s imagine for a moment that they are.

- I’m 56 years old, so I’m a reasonable guinea-pig to test what would happen.

At the moment, I’m 10 years from receiving a State Pension of close to £8K.

- I already have around £7K from past contributions, (( I have the necessary 35 years for a full pension, but some of them were contracted out, and have been docked )) and my part-time work over the next 5 years or so should lift that to around £8K.

Under the CPS plan, I will be able to get close to the £8K qualification by 2020, and will still receive this pension (LSP) at age 66.

- But oh, no – I won’t get anything because the LSP is now means tested, and I’ll be too rich to qualify.

Never mind, at age 80 (in 2040), I might get the SCP, since I will have 40 years residency (50 actually) from age 30 to 80.

- But maybe I wouldn’t even get that, because perhaps the SCP qualification clock will only start running from 2020.

So it’s quite likely that 40 years after starting to pay towards my State Pension, and 10 years from receiving it, I would suddenly be told that I get nothing.

- That puts the current WASPI controversy into perspective.

My one consolation is that I am old enough to have saved into a SIPP with tax relief on the contributions.

- Even here, I would have to rush to take my 25% tax-free lump sum before the CPS snatches that away.

For someone 10 or 20 years younger than me, the problem is less the shock of the State Pension being snatched away just before being paid out, and more the reduced and delayed pensions available:

- state pension age would rise from 67 to 80 at a stroke

- there would be no taxpayer help to build up a private pension (apart from the “modest” annual contributions to the Workplace ISA)

- the Workplace ISA can’t be accessed until age 65 (compared with 55 for SIPPs at present, and no age restrictions on regular ISAs)

Conclusions

Here are a few things I don’t like about this plan:

- It’s not fair to those of us who have made decades of NIC payments in the expectation of receiving a State Pension.

- It’s not fair to those who live well and hope to live long compared to those who shorten their own lives through bad choices.

- The AE workplace pension will probably not provide a large-enough pot for people to live on from 65 to 80, and the new SCP of £10K will not provide an adequate standard of living after that.

On top of all this, there’s no need to change the existing State Pension, since the interim Cridland report has indicated that it will remain affordable for many decades.

- In the worst case, the State Retirement Age will rise gradually from the current 67.

Luckily, the CPS report hasn’t gone down well.

Tom Selby of AJ Bell said that the proposals would cause “uproar” and “riots in the streets”.

- Fairly genteel riots perhaps, since most of the protesters would be over 50, but I think you could count on a few strongly worded letters to the press and to MPs.

- He’s basing his conclusion on the reactions to recent moderate increases in the SPA (from 60 to 67 for women, and from 65 to 67 for men).

Kate Smith, Head of Pensions at Ageon said that:

The simplicity of the new, [fixed State Pension] system is appealing while [the CPS’s] proposal is complex and has many parallels with the system the government has just done away with, whereby people built up both a basic and second state pension based on their own NI contributions.

Former pensions minister Ros Altmann called the proposals “dangerous, retrograde and wholly misguided”.

- She said that means-testing “misunderstands human psychology” and would disadvantage the “majority of the country”.

- It would undermine incentives to save and help the privileged few at the expense of ordinary people.

- I’m pretty sure that I’m one of the privileged few that she’s talking about, but I can’t see how the plans help anyone that much.

She also points out the irony of the CPS calling for the abolition of the State Pension when we are only six months into a new scheme which will fix many of the problems with the system it replaces.

The legacy of contracting out, and of equalising state pension age between the genders means that the New State Pension will continue to get bad press.

- But it will also be a big improvement over time, and we should stick with it.

Until next time.