Stocks to Short and to Avoid – Excess Returns 4

Last week we looked at where investors can find bargain stocks. Today we look at the opposite – which are the stocks to avoid and the stocks to short.

Contents

Stocks to Short and Avoid

There’s an inevitable overlap with bargain hunting since in general the opposite of bargains will be the stocks you don’t want to bother with.

- But we can take this a step further and distinguish between stocks that are best ignored, and those where there is money to be made, if you are prepared to sell them short.

Stocks in the spotlight

Stocks that are covered by many analysts and are popular and admired in the media are less likely to be mis-priced than their opposites.

- If anything, they may be overpriced because investors are willing to pay more for familiar stocks which they feel must be safe.

They are likely to have significant institutional shareholders and carry the additional risk of a sell overhang if those institutional investors change their minds about a stock’s prospects.

Ways to identify stocks in the spotlight include:

- stocks with cool names in attractive industries

- stocks in stable industries about which there is a strong consensus view

- hot stocks with exciting stories in growth sectors

- Peter Lynch warned particularly against the hottest stock in a hot industry

- “blue sky” companies with no earnings or a single product

- companies on “most admired” lists

- companies that are rated “strong buy” by all analysts, with high projected earnings growth

- stocks in high-growth industries that may be cyclical

- high growth leads to increased competition and lower profits

- high growth masks weaknesses that will emerge when the growth slows

- high-growth industries have unstable competitive dynamics that are difficult to evaluate

- stocks recommended by non-investor friends

- industries that are popular with new graduates, especially business school graduates

- competition for talent will lead to salary inflation and pressure on profitability

- blue chips whose growth has stalled

Most IPOs

Companies which go public – apart from privatisations and de-mutualisations – tend to significantly underperform the market. This is particularly true of smaller companies.

- Attractive IPOs will often be placed with friends, family and connections of company insiders and the brokers bringing the company to market.

- The investing public is more likely to participate in the least attractive offers.

Company insiders, whether entrepreneurs or venture capital and private equity firms, make more money, and give up less stock, the higher they price their IPO.

- So it is likely to priced as high as the market will support, and they have access to much more information than the public.

- They have a much better idea of what the business is really worth.

- They are likely to use the most optimistic projections possible.

- They will also bring their company to market when it looks its best (before large expenses) and when they can get the best price (during bull markets, or when people are excited about their industry).

As well as price, IPOs are likely to be of young, unstable and perhaps barely profitable firms.

- The potential for disappointment is large, and coupled with high expectations, this means that the risk of a price fall is also significant.

New trends

New trend companies tend to be overvalued because they are hot.

- They are also at risk of being displaced by cloners or established firms threatened by a trend.

Incumbents can also be a bad risk where a trend is irreversible and they are unable to respond.

Tips

Most tips should be ignored.

- These include those from friends, company employees, newspapers and obviously shoeshine boys.

- More importantly, analyst recommendations should generally be disregarded.

In addition, reversing the rules on tips that are worth following will identify other stocks to ignore:

- those not rated by their competitors

- those sold or publicly criticised or even shorted by trusted gurus and fund managers

- those with strong insider selling

- note that insider selling is not as strong a signal as insider buying, since people need to generate cash and diversify their portfolios for all kinds of reasons

- it has more significance at smaller companies, and when several insiders (including the CFO and CEO) are involved

- it is more significant when the share price has recently fallen, or the stock appears cheap

- investor hedging via derivatives is also a bad sign

Stocks added to an index

Stocks added to an index will have recently out-performed.

- They will have momentum, but also multiple expansion.

- So though the short-term prospects may be okay, in the long-term they may be expensive.

This is made worse by all the index-tracking and benchmarking funds having to buy the new additions.

- At the end of this process they will be even more expensive.

Speculative stocks

Buying a speculative stock is not investing, it is gambling.

- Your chances of success usually depend on finding a Greater Fool that you can sell the stock to at a higher price.

Speculative stocks can be broken down into a number of categories:

- Post-bankruptcy stocks

- “Blue-sky” companies with no earnings history

- these companies cannot fund themselves, and are likely to place shares at a discount, diluting existing shareholders

- Stocks with insufficient or inscrutable information

M&A arbitrage stocks

In most takeovers, the valuation gap closes very soon after the initial announcement, leaving a small potential gain with a large risk attached.

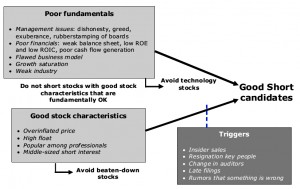

Shorting

Short selling (or shorting) involves an investor borrowing shares from another investor to sell them in the market.

- The short seller hopes to make money by buying the shares back at a lower price (to return them to the original owner).

- A similar effect can be achieved via spread betting on the price to go down

The big problem with shoring is the asymmetric risk, since the downside is theoretically unlimited (there is no limit to how high a stock price can rise), whereas the upside is limited to 100% (when the stock price falls to zero.

- This means that shorters need to be careful and selective, and will need more than just the red flags (given above) which indicate that a stock should be avoided.

Stocks with poor fundamentals (management or financials) offer the best protection to shorters.

- Bad news on fundamentals will normally make the share price fall.

Poor management

We can identify four characteristics of bad management:

- dishonest – they hide or put a positive spin on bad news, and they may be cooking the books

- finance and insurance companies are good prospects here,

- as are companies that make serial acquisitions to hide the poor performance of the core business

- greedy – they put themselves before shareholders;

- excessive compensation (salaries, easy bonuses, golden parachutes)

- and transactions with related parties are good indicators

- exuberant – they throw money around at the top of the company’s earnings cycle;

- perks (eg. company jet),

- flashy new HQ building

- and pricey acquisitions are good indicators

- an ineffective board that obeys the CEO’s orders, with ineffectual non-execs

Poor financials

We can also identify four aspects of poor financials:

- Poor balance sheets, usually with overvalued and/or illiquid assets.

- Poor return on equity, which usually means they are not self-funding and rely on raising extra capital

- Poor cash flows, which risks a liquidity crisis –

- it’s ideal (for shorters) if they not only generate little cash but also need cash

- Flawed business models, as indicated by a high cash burn or a buildup of inventory.

Growth saturation

Shorters like to see that a company is desperate for growth.

This could be because:

- A fad product is reaching peak popularity

- Distribution channels are full

Proposed expansion into emerging markets (or the US) – is the ideal corporate reaction, as is expansion into a new line of business.

Other shorting stock characteristics

Here are a few more things to look for:

- Poor industry:

- This can be an industry in decline that the market has not yet factored in,

- or a supplier to an industry where capital expenditures are deferred (as in oil production at the moment).

- Over-inflated prices, especially in a competitive market

- High float

- This makes it easier to borrow stock to sell, and harder for management to operate a short squeeze

- High institutional popularity

- These stocks are often overpriced and are susceptible to a change in institutional sentiment (due to unpleasant surprises)

- Medium short interest (number of shares sold short relative to the float) – say 5% to 10%

- This shows that some shorters are in place, but the risk of a short squeeze (a sudden price increase from a panic among shorters attempting to cover their positions) is low

Short triggers (catalysts)

Shorters look for something that can make the price collapse quickly:

- Insider sales, particularly when unexpected (after a bullish announcement) or suspicious (before an IPO lock-up period expires)

- Unexpected resignation of a Chairman / CEO / CFO / head of sales

- the reason given for the departure should be ignored

- Change of auditor

- Late filing of accounts

- this probably means that management is trying to hide something

- Rumours that are denied by management

Shorting traps

There are three potential shorts that are best ignored:

- Overvalued but good companies

- high valuation is not sufficient reason to short

- companies that are self-funding may take a long time to run into difficulties

- and the price may even rise in the meantime

- Tech firms

- these are hard to evaluate and can stay highly-rated for years

- Stocks that have already fallen in price

- once everybody knows about the problems, the risk profile is reversed

- a rebound is more likely than a fall to zero

Conclusions

It’s easy to come up with a list of the kinds of stocks to ignore:

- Stocks in the spotlight

- IPOs, apart from privatisations and de-mutualisations

- Companies associated with new trends, and the incumbents affected by them

- Tips and analyst recommendations

- Stocks added to an index

- Blue-sky companies

- M&A situations (unless you react very quickly)

To go further and actually short the stock, you need more evidence, because the downside risk in shorting is theoretically unlimited.

Here are the main things to look for:

- poor management – dishonest, greedy, exuberant or weak

- poor financials – weak balance sheets, poor returns on equity, poor cash flows and flawed business models

- growth saturation coupled with plans for expansion into new territories or lines of business

- companies in declining industries, or supplying to one

- high prices in a competitive market

- high float, with high institutional interest and medium short interest

There are also some types of company that are bad ideas to short:

- Over-valued but good companies

- Tech firms

- Stocks that have already fallen in price

Shorters need to identify a catalyst – something that will make the share price fall in the short-term.

Candidates include:

- insider (Director) sales, especially after bullish announcements or a recent IPO / placing

- resignation of the Chairman / CEO / CFO

- change of auditor

- late filing of accounts

- rumours denied by management

Until next time.