Weekly Roundup, 10th April 2018

We begin today’s Weekly Roundup in the FT, with Tim Harford. This week he was writing about opportunity cost.

Opportunity cost

It’s a short roundup this week, as many of the country’s financial journalists appear to still be away on their Easter breaks.

In the FT, Tim begins with a quote:

Judge the value of what you have by what you had to give up to get it.

This fits with Tim’s definition of opportunity cost – “whatever you were going to do instead, but couldn’t”.

He recommends bringing the alternatives into the decision making process, particularly with spending:

Would you rather have the [$1,000] Pioneer, or the [$700] Sony and $300 worth of CDs?

This is a quote from an old (hence CDs) and presumably American (hence dollars) paper.

- It’s an example of framing a question to help suggest the “right” answer (which is in turn a form of “nudge”).

Tim also cautions against double- (or triple- ) counting:

If you save £100 in some act of thriftiness, that is £100 you can spend on a case of wine, or a good shirt, or dinner for two. But you cannot spend the same £100 on all three.

If only.

New tax year

A new tax year is upon us, so don’t delay in using up your new ISA and SIPP allowances.

Amongst the numbers that changed on 6th April 2017 are:

- The personal tax-free allowance went up by £1,075 to £11,850.

- And the basic rate (20%) tax band was increased to £34,500.

- So the point at which you start to pay higher-rate (40%) income tax is now £46,350.

- The NIC threshold goes up from £8.2K to £8.4K pa.

- The Dividend Allowance comes down from £5K to £2K.

- Above this, basic rate taxpayers pay 7.5%, and higher rate taxpayers 32.5%.

- The CGT allowance goes up from £11.3K to £11.7K.

- The National Living Wage is up from £7.50 to £7.83 per hour for those over 25.

- The triple-locked state pension went up by 3% to £164 per week (£8.5K pa).

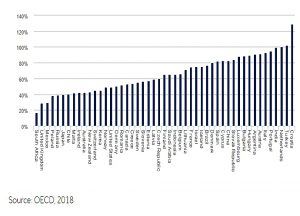

- This is still very low by international standards – see below.

- The salary threshold at which graduates pay back their loans has increased to a much more sensible £25K pa.

- Buy to let landlords can now only deduct 50% of mortgage interest costs from their income when calculating the tax due.

- Next year this will drop to 25%.

- Council tax can also be increased by up to 6%, depending on which council you fall under.

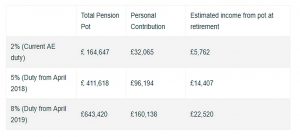

Workplace pension contributions have also increased, from 2% pa to 5% pa.

- Employer contributions go up from 1% to 2%

- More importantly, employee contributions increase from 1% to 3%.

Commentators are worried that the higher contributions (still woefully inadequate) will mean higher opt-out rates.

- Employees can also decide to continue paying at the old rate (known as “opting down”).

As you can see from the chart above, Fidelity have calculated that after next year’s increase to 8% total contributions (3% ER + 5% EE) a 25-year-old on £35K would end up with a £643K pot at age 68.

- This assumes earnings increase by 3.75% pa and investments grow by 5% pa.

- That’s apparently enough to produce an income of £22.5K (sounds like a withdrawal rate of 3.5%).

So workers would be well-advised to remain invested, and to contribute even more if possible.

Trade war

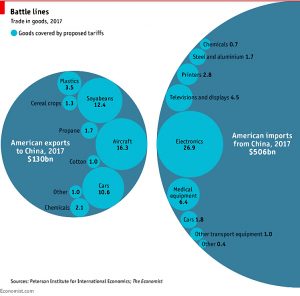

The Economist looked at the developing trade war between US and China.

- America published a list of 1,300 Chinese products that would be hit with a 25% tariff.

- China retaliated with a list of 106 product categories.

The US list covers $46bn (9%) of Chinese imports.

- The Chinese list covers $50bn (38%) of US exports.

In the product categories targeted, Chinese imports make up 20% of sales in the US.

- Consumer products make up less than 20% of the affected imports, though TVs and cars are on the list.

The Chinese list seems to aim at US industries with powerful lobbies and products from politically sensitive states.

But there is no deadline for the US tariffs to come in to force (in effect, it’s just a consultation process) – and the Chinese have said that they will wait for the US to move first.

Work and pensions committee

In the Times, Mark Atherton reported on new recommendations from the Commons Work and Pensions committee:

- Pension schemes should offer a default fund suitable for drawdown, with a charge cap of 0.75% pa, as per workplace auto-enrolment schemes.

- NEST should be allowed to offer drawdown to its five million members.

- The government should establish a single pensions dashboard, rather than allow each pension provider and fund platform to develop their own.

Of course, the industry reaction was that a charge cap would be “restrictive”.

- I think it should be perfectly possible to offer default funds for less than 0.4% (as Vanguard, NEST and PensionBee do), let alone 0.75%.

I am less comfortable with the concept of a single default fund, since how you want to invest your pension during drawdown will depend on your other assets, and to an extent your age.

- I think we might need a range of five or six options.

Wealth gap

Under a sensationalist headline (“Baby boomers 17 times wealthier than millennials”), Holly Black wrote in the FT Adviser about the wealth gap between generations.

- The average person between 60 and 62 has net household property wealth of £165K, compared to just £1) for those aged between 30 and 32.

Given the average price of housing in the UK, the average duration of a mortgage and the increasing age at which people buy their first property, that doesn’t seem like a shocking statistic to me.

- What’s slightly more concerning is that ten years ago the ratio of property wealth across those two age groups was just six to one.

Even more worrying was the average financial wealth (this wasn’t defined in detail) for the two groups.

- Those between 30 and 32 had a pitiful £750 on average, but even those aged between 60 and 62 had just £17.5K on average.

Twitter pics

I only have one picture for you this week, and even that isn’t from Twitter.

- It’s from the monthly HL mailshot. (( Yes, I still have investments with them ))

It shows pensions relative to average salaries for all the countries of the OECD.

- In case you can’t spot the UK, we’re second from the left on 29%.

- Only South Africa has a worse state pension than us.

- The EU average is 71%, almost 250% of the UK pension.

The best place to retire is Croatia, where the pension is 129% of the average wage.

- The Netherland and Turkey also have pensions higher than the average wage (above 100%).

Until next time.