Weekly Roundup, 11th February 2015

For a change, we do not begin our weekly roundup in the FT. Instead we will take a look at AltFi.

Contents

AltFi / P2P / Mini-bonds

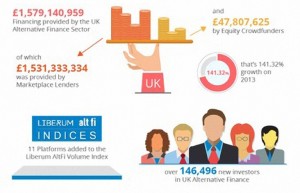

AltFi, the alternative finance website, came up with a pretty infographic summing up the year in P2P and CrowdFunding. ((Thanks to David Stevenson – @advinvestor – for alerting me to it))

The whole thing can be seen here, but the headlines were:

- the market is now close to £1.6bn, up 141% on 2013

- of that only £50M is equity, the rest is debt

- Rate Setter, Funding Circle and Zopa have more than 50% of the market between them, with each of them lending more than £250M

- almost 150,000 new investors joined the market in 2014

In less good news for the sector, Judith Evans reported in the FT on FCA intervention in the P2P market:

- The watchdog found problems with most of the equity crowdfunding websites it looked at, with benefits being publicised but not the risks.

- The FCA also warned P2P lending sites not to compare themselves with savings accounts, and to give more information on taxation and APR equivalents.

- Mini-bonds need to be marketed as an illiquid and high-risk product, with investors made aware that (as with P2P & Crowd Funding) they are not covered by a compensation scheme. They also can’t usually be traded on an exchange.

Judith also mentioned that Hargreaves Lansdown plans to set up its own P2P lending platform, rather than teaming up with one of the big three. This may be 18 to 24 month away, however, by which time many existing P2P investors may be comfortable with another provider for their P2P ISA needs.

Pension Wise

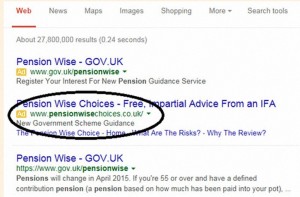

Josephine Cumbo wrote about Treasury action to close a website passing itself off as the government’s official PensionWise advice service. The government is introducing legislation to make this passing off a criminal offence, but this is not due until late February.

The fake site – registered the day after the Treasure announced the Pension Wise brand – was simply a marketing operation funneling people to traditional IFAs. In the Google SERPs it used a meta description indicating that it offered “New Government Scheme Guidance”.

BT pension scheme

Elsewhere in the paper, Neil Collins was struggling with the maths. He can’t believe that £150K per pensioner (£47bn in total) isn’t enough to satisfy the BT pension scheme. Instead, the actuaries have decided that the scheme is £7bn in deficit, double what it was at the last review.

Of course, in the interim, bond yields have fallen, so the £47bn can’t be expected to produce the same returns. It also means that the future pension payments have to be discounted at a lower rate, meaning they have a bigger present value. ((Neil uses quotes for this term, as if he doesn’t belive it exists.))

Although he seems to have put his finger on the problem, Neil claims that no-one can follow the actuaries’ maths, as if they are pulling a fast one. ((Neil seems to have a thing about actuaries, judging from the number of articles about them on his blog; we can only speculate why. I’m the same way about annuities, because they offer such terrible returns.))

There is a serious point here. DB pension schemes don’t work any more, because people just won’t die like they used to, and the returns they were predicated on aren’t available anymore. But the promises were made, and they can’t just be wished away. Blaming the maths doesn’t add up.

US corporate tax reform

The Economist looked at President Obama’s corporate tax reforms. The US levies a globally-high 35% tax on all corporate profits, but foreign cash is only hit when it returns to the US. Most countries have lower rates and allow tax to be levied according to local regimes.

These two approaches explain the gigantic cash piles held abroad by large US companies, most famously by Apple, though GE has more than $100bn abroad. The grand total has now passed 2 trillion dollars.

Obama has proposed a one-time 14% tax on the foreign cash, and a future foreign rate of 19% with no deferrals. The US domestic rate would be reduced to 28% (still high by international standards).

Companies will complain, but corporate tax has reduced from 42% of profits in 1960 to 21% in 2013. The ratio of personal income tax to corporate tax has risen from 2:1 to 5:1. They aren’t likely to get much sympathy from the man in the street, though Republican politicians may yet scupper the plan.

It’s also possible that some internationally focused firms might re-incorporate abroad or at least shift operations abroad if the plan goes ahead.

A more interesting question for the UK investor is where this leaves potential buy-out activity in Europe. Speculating on who Apple might buy to reduce its cash pile is a regular activity in the Twittersphere. Perhaps that squeaky noise we hear is the sound of a window closing.

Too much debt

Buttonwood ‘s column was about a report from McKinsey [Debt and (not much) deleveraging]) that demonstrates the inability of the developed world to reduce its debt levels.

Eight years after the subprime crisis, debt is $57 trillion higher than in 2007, a compound growth rate of 5.3%, not much slower than the annual 7.3% during the 2000-07 credit bubble.

The main risk once again is property. When lots of debt is secured against houses, extending credit pushes up prices, which gives banks apparently more valuable assets to lend against. Falls in prices hurt bother debtors and creditors.

A second problem is the need to refinance. Ten countries with debts of more than 300% GDP must refinance 60% each year. ((With average debt maturity of 5 years)) Any problems in rolling over the debt will mean a crisis appears very quickly.

What is needed is rapid growth, but the demographics in developed nations are against this. Currency depreciation to boost exports would help, but not everybody can depreciate at once. McKinsey suggest shared-equity mortgages and removing tax incentives for debt, but is there any appetite for these?

Currency turmoil again

The newspaper also looked at the drivers behind the current currency turmoil. The basic problem is divergence: the Fed has begun to look at rising interest rates, whist Japan is in the middle of QE and Europe is just about to start. The US has decent growth while Japan and the Eurozone are struggling, and facing deflation.

The article also suggests there may be more problems to come in Asia from an appreciating dollar, as in the crisis of the late 1990s and the Latin American crisis of the 1980s.

Are financial services working?

In the Evening Standard, Anthony Hilton questioned whether financial services are working properly. Its purpose, in the words of Lord Rothschild “is to move money from where it is now, to where it is needed”. The benefit to society is that capital is then in the hands of those who can make use of it to generate wealth.

The City produces 10% of national income from around 7% of the working population. But is it efficient, and would it be better for the country the mega-brains it employs were working in science and medicine?

Anthony had attended an LBS presentation from Thomas Philippon of Stern Business School in New York. Philippon thinks that financial services are no more efficient that they were 120 years ago, since the charges made to move cash around have not been reduced:

- 120 years ago, cash flows were equal to GDP, and finance earned 2% of GDP; this was still the case in 1960

- by 1980 cash flows were 3 x GDP, and earnings were 6% of GDP

- by 2007, cash flows were 4 x GDP and earnings were 8% of GDP

There is also evidence from the US that as the financial sector expands, national growth slows.

Since financial services are clearly more efficient (deregulation, product innovation, computers etc.), the conclusion is that productivity gains have not been shared with the customers. Instead pay within the industry has risen.

It’s an interesting analysis but the question for me would be why no lower-cost providers have emerged to reduce these profits? Is it simply a matter of scale, or could the global nature of capital and the competing short-term interests of national governments have something to do with it?

And how would any solution be implemented? Global coordination on an unprecedented scale ((look at international trade talks, for example)) would be needed. We may be stuck with high banking salaries for some time.

Digital Financial Passport

The FT Adviser reported on some research carried out by TISA (the Tax Incentivised Savings Association) which suggested that almost 40% of people would like all their financial details held in one place.

Other findings included:

- 31% of respondents (and almost half of 18-24 year-olds) would save more if opening and transferring accounts was easier

- 90% of people felt comfortable using technology to access their finances, but those aged 55 and over were least willing

Altmann calls for Care ISA

Finally, the Telegraph reported on proposals from Ros Altmann, the government’s “business champion for older workers” that a “Care ISA” be introduced alongside the existing NISA to fund social care in old age. Half the population are expected to spend at least £20K on this, and one in ten will spend more than £100K.

The proposed Care ISA would be a simple extra annual £10K allowance dedicated to care bills, with no upfront tax relief. I can’t see this plan appealing either to the Chancellor or to an investor, even one who has already maxed out their ISA and SIPP.

Who wants to save money in a product that can only be used for one purpose, years down the line, no matter what happens in the meantime? This looks like one of the rare situations where insurance might be the answer, but without tax-relief or some other incentive, I’ll be keeping all my savings in the usual vehicles.

Until next time.

1 Response

[…] the FT letters section there was a reply to an article we mentioned last week – by Neil Collins on the maths of the BT pension fund deficit. Mark Tennant pointed out that […]