Weekly Roundup, 12th June 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about the end of the bonds boom.

Contents

Bonds boom ends

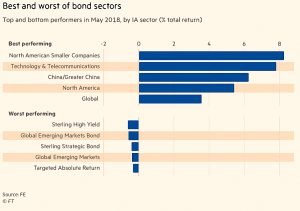

Kate Beioley reported that bond funds slid to the bottom of the sector performance tables in May 2018.

- Bonds have been in a thirty year bull market on the back of falling interest rates and central bank bond-buying programmes.

Now the threat of inflation and rising interest rates is pushing down bond prices.

- Political problems in Italy haven’t helped, either.

It’s only one month’s data, but perhaps we’ve reached a turning point.

- Short-term investors might feel that they need bonds for diversification, but longer-term investors might think that the low yields on offer are outweighed by the risks.

Auctions for everything

Bonkers idea of the week comes via Tim Harford.

- He’s been reading a book from Eric Posner and Glen Weyl called Radical Markets.

[amazon template=thumbnail&asin=0691177503]

Auctions are a good way of allocating scarce resources, and the first half of Tim’s article looks at recent developments in the technique – namely product mix auctions.

Posner and Weyl want to use auctions to ensure more taxes are collected.

The basic idea is that you need to declare a value for each of your possessions in your tax return.

- And you would pay a wealth tax on that value.

The twist is that in order to avoid people low-balling their valuations, they would be forced to sell any and every item to any bidder who met their valuation.

- To be certain of hanging on to anything, you’d need to put a high valuation on it.

- Which would of course mean that you paid more tax.

This is crazy in so many ways.

- Ignoring the idea of a wealth tax, which basically says “don’t get wealthy”, enormous amounts of time and energy would be wasted on protecting your possessions and bidding for those of others.

Property rights are fundamental to prosperity, and this system essentially revokes them, turning us all into short-term traders.

- What’s more, inequality would likely get worse, since clever people would run rings around the economically challenged.

The tax collection part is fine (if you support wealth taxes, which I don’t).

- It might be possible to devise a system whereby a bid could be countered by paying the extra tax on the higher valuation.

- Though the gaming of such a system by lobby groups with deep pockets would need to be protected against.

But whatever happens, property rights are sacrosanct.

Student loans

Martin Lewis wrote about five changes that are needed to fix student finance.

- Under the current system, graduates pay 9% of earnings above £25K towards their debt, with interest charged on top.

After 30 years of paying this tax, any remaining balance is wiped.

- Only the top 17% of earners will clear their balance.

So lower tuition fees would be regressive, with the highest earners paying less, and middle earners paying proportionally more.

- And of course, the lower revenue would affect the quality of universities.

The same argument applies to the interest rate charged on the loans.

- A lower rate helps the highest earners the most.

Here are Martin’s suggestions:

- Call it a “graduate contribution system” rather than a loan system.

- I prefer the simpler “graduate tax”.

- Increase the maintenance (cost of living) loans.

- Tell parents to make up the shortfall from mean-tested loans.

- Refocus loan statements towards current and future repayment levels, rather than outstanding loan amounts.

- Guarantee that there will be no negative retrospective changes.

They all sound pretty reasonable to me.

Invesco

Merryn wrote about the Invesco fees row.

- It’s been a bad few weeks for retail investors, and for shareholder democracy.

- First the Beaufort ring-fencing scandal, and now this.

The row started when the directors of the Invesco Perpetual Enhanced Income trust (IPE) asked the managers of the fund (Invesco) to reduce their fees.

- The management fees was 0.9% pa and the total ongoing charges were 2.15% pa.

The performance of the fund has been good (96% over 10 years, compared to 30% for the sector average).

- But over the same period, Invesco’s fees were £12M on a £120M market cap fund.

Invesco said no and resigned, which is fair enough.

- The IPE directors found replacements willing to charge between 0.35% pa and 0.65% pa.

Then Invesco called a shareholder vote next month to sack the directors that complained about its fees.

- Via holdings in its other funds, Invesco controls 17% of IPE.

So Invesco might win the vote and continue to charge its high fees.

- It turns out that they won’t be quite as high, as Invesco has agreed to a cut down to 0.77% pa.

Invesco’s behaviour here is appalling, but even worse is that fact that they might win a vote with only 25% support because so many of IPE’s shares are held by retail investor on nominee platforms.

- This needs to be fixed, since current technology means it should be easy for individual investors to vote on issues that matter – like this one.

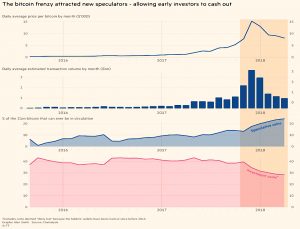

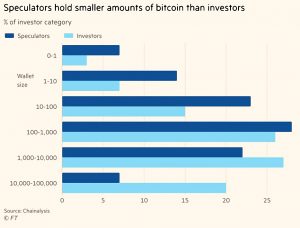

Who owns bitcoin?

Hannah Murphy looked at data suggesting that long-term holders and early adopters of cryptocurrency have sold out at huge profits to speculators.

It’s very important to stress, this is not in any sense a rational market. It’s very thinly traded, very badly structured . . . and it’s stupendously manipulated. – David Gerard, author of Attack of the 50 Foot Blockchain.

Sovereign money

The Economist reported on a Swiss referendum to change the way that money is created.

- The Vollgeld initiative would take away the right of private-sector banks to create money.

Currently most money is from deposits in such banks, rather than the cash in circulation and the reserves of the central bank.

- The commercial deposits are created by lending.

- Which means than lending greatly exceeds central bank reserves.

The Vollgeld crew want the public to have current accounts with the central bank instead.

- Commercial bank lending would be restricted to the balances held in savings accounts.

This would lessen the likelihood of bank runs and bailouts.

The main drawback is that banks would need more expensive sources of funding and interest rates would rise.

- And the central bank would need to control inflation by restricting the amount of currency in circulation.

Critics point out that (a lack of) interbank lending brought down Lehman’s, which had no retail deposits.

As it happened, the Vollgeld initiative failed to pass, with only 24% voting in favour.

Euro stocks

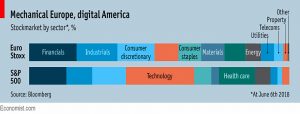

Buttonwood came up with a case for owning Euro-zone shares.

- The basic argument is that now that all their defects are known, this could be a good time to buy.

Europe is ageing, and its firms are largely old-fashioned and industrial (cars, petrochemicals and machinery).

- It has a lot of deadweight banks and few digital technology stocks.

And of course, the euro, or even the EU might yet split apart.

- To add to this, the Stoxx 50 index is back where it was 20 years ago.

But the index has an earnings yield of 6.4% pa and looks cheap compared to the S&P 500 (4.8%).

- And there is room for earnings to improve.

Quick links

The Economist looked at the rise of Ocado.

And it also reported on recent investments in student property.

That’s it for today.

Until next time.

I think you are wise to say that it is only one month’s data to show Bonds slipping down the performance table, especially as it was the absolute opposite story in Q1 for 2018 where the top performing sector was a bond one-that of IA UK Gilts.

In fact, Gilts and Cash were the only sectors showing a positive return in the first quarter compared to some equity funds that were down some 15% in the first 3 months of the year to date.

We shouldn’t be surprised by that as the sell off in February (US jobs data and trade wars etc) seems to have forced investors to a flight for safety – cash and bonds

Despite the apparent low attraction for bonds, in any kind of sell off, people still seem to diversify in things they know give them security of some capital – government backed bonds and dear old cash. Nothing changes!