Weekly Roundup, 13th December 2016

We begin today’s Weekly Roundup in the FT, with the Chart That Tells a Story. This week it was about the impact of the bond sell-off on infrastructure funds.

Contents

Infrastructure funds

Aime Williams plotted the share price premium – the excess of the share price above the underlying net asset value – of the four largest UK infrastructure investment trusts against the UK 10-year bond yield.

The four funds she used were:

- 3i Infrastructure

- International Public Partnerships

- HICL Infrastructure, and

- John Laing Infrastructure.

Sadly, she only looked at data from the last year, which is too short a timeframe for my liking.

During the year, the trusts have traded at a premium to net asset value, as investors chase “safe” income from “bond proxies”.

- The premium is inversely related to gilt yields.

- So as yields have risen over recent months (and prices have fallen), so have the premia reduced.

This is on top of the valuation effect – infrastructure fund managers value the underlying assets partly by discounting future payments using the gilt yield, and so as this rises, the net asset value falls.

- Note that Aime points out this effect, but conflates it with the shrinking of the fund premia.

The shrinking premia probably reflect the closing gap between the funds’ yields and bond yields, which could make bonds seem more attractive.

- Of course, if interest rates continue to rise, the price of bonds, infrastructure funds, and the size of fund premia could all continue to fall.

On the other hand, fiscal stimulus could boost infrastructure projects in the US and the UK, and the funds offer some protection against possible rising inflation.

I wouldn’t buy bonds at the moments, and with infrastructure trusts, I would look for a bottom before piling in.

- There should be better opportunities sometime in 2017.

House prices

Merryn was wondering whether property price falls might ripple out from London.

We don’t quite see eye to eye on this topic.

- Merryn is observing from afar (she lives in Edinburgh), whereas I’m in Zone 2.

Stamp duty and Brexit have definitely affected the top end of the market (let’s say above £2M, and particularly above £5M)

- Even on my more modest house, I could convert the loft and the basement for less than I would pay in tax to move.

- It’s possible, though, that the fall in sterling could have an opposite effect on the market in time.

But for regular folks (which in London is something like the £700K to £1.8M market), I’m not expecting a crash.

- Working families don’t like to take a hit on the sale of their house.

Rather than a crash, what usually happens is that the market slows and nominal prices remain flat for a while, as inflation quietly reduces them in real terms.

- Handily, we could have a few years of higher inflation around the corner.

Merryn concluded that the chance of a crash outside London was probably low, since there wasn’t a boom to begin with.

- But there are risks from rising interest rates (and hence mortgage costs) and the “war” on buy-to-let.

We agree on this part of the market.

Spread betting

The FCA announced this week that CFDs (contracts for difference) are risky.

- What, those things on which 82% of users lose money – who knew?

- The average loss reported by the FCA was £2.2K, which I must admit was lower than I expected.

More importantly, they think that many investors don’t understand the risks.

- They want to cap leverage and add more risk warnings.

Maximum leverage would be 25:1 for new traders, and 50:1 for more experienced traders.

- The share prices of the spread-betting firms duly slumped by 30% to 50%.

I can’t say that I have a problem with limiting leverage, and I’m no fan of the “binary bets” that seem to be the fashionable way to separate the unwary from their cash. ((It seems that binary bets are officially classified as gambling, and so fall outside the FCA’s remit ))

But I can’t agree with Claer Barratt (for example), who implies that CFDs and spreadbetting are gambling. ((I don’t use CFDs, but I do use spread-bets, which have tax advantages ))

- These products allow you to modify your risk profile, and provide easy and relatively cheap exposure to asset classes that are otherwise difficult and / or expensive (FX, for example, or foreign listed shares).

- You can also short and hedge, which is often useful.

Claer appears to make a moral distinction between “investing on the stock market”, which is a “wealth-creating engine for our long-term savings” and the “casino”.

I think that people should be free to do what they like with their money.

- And people who want to lose money will always find a way to do so.

People make poor financial decisions with all kinds of financial products.

- We might as well shut down the credit-card and insurance industries as ban the spread bettors.

And as for Cash ISAs, well, don’t get me started.

- Caveat emptor.

Trumpian investing

Adventurous investor David Stevenson looked at how to invest “in a Trumpian world of uncertainty“.

He liked:

- US banks, and suggested the iShares US Regional Banks ETF (US ticker IAT).

- US energy – Pioneer Natural Resources (US ticker PXD) and Riverstone (LON:RSE), plus Premier Oil’s retail bonds (PMO1)

Although he expects rate rises in 2017, he expects cuts in 2018 as the US economy slows.

- Indeed, he expects “a sub 2.5% interest rate environment for many decades”.

- But he thinks there will be opportunities in corporate bonds yielding more than 4.5% during 2017.

He also liked the Target Healthcare REIT, which invests in nursing homes and yields 5.6%.

- The sector is suffering from local authority cutbacks, but Target only owns leases and doesn’t operate any assets itself.

He’s staying clear of emerging markets for now, though he’s watching India.

- He would buy India Capital Growth (LON:IGC) below 70p (it was 72.4p this morning).

He also repeated his earlier suggestion that GlobalWorth Real Estate (LON:GWI) – a Romanian property developer – is worth a look.

Over in MoneyWeek, David had one more suggestion – the Civitas Social Housing trust (LON:CSH).

- This investment trust focuses on the affordable housing sector, and should yield 5% (but only 3% in year one).

- It’s already trading at a premium to net asset value, and David expects that to increase.

Trumps winners and losers

In the Economist, Buttonwood looked at the winners and losers from Trump’s election and the subsequent stock market rally.

- Financials and smaller (domestically-focused) companies have done well.

- The S&P is up by around 5%.

- Utilities – which are not so linked to the general economy – have underperformed.

So the market is predicting a mini-boom, fuelled by tax cuts, corporate cash repatriation and infrastructure spending.

- Even excluding an oil sector recovery, corporate earnings are predicted to grow by 8%.

Meanwhile the cyclically-adjusted PE (the CAPE) is up to 27.3, 63% above the long-term average.

Fed raising rates

The newspaper also reported on the likely interest rate rises from the Fed.

- The first is expected tomorrow, but there could be more in 2017.

That said, this week’s raise would be the first of the four that were signaled for 2016.

- Whether we get more in 2017 will depend on the jobs market, and on inflation (both of wages and prices).

Some think that labour participation has maxed out, and there is no slack in the market.

- Others (myself included) note that participation has only regained one third of the losses since 2008.

- There are also lots of part-timers who would like to work full-time.

Inflation remains below the 2% target, but is getting closer.

- Infrastructure spending, tax cuts and a recovering oil price could get it closer.

With the Brexit vote and the US election out of the way, the odds on more rises in 2017 are definitely better than they were this year.

Oil

The Economist also looked at the oil price in two articles (1 and 2).

- The OPEC oil cartel agreed on 30th November to limit production to shore up the price (which duly increased by 15%).

- Then Russia and the non-OPEC producers agreed to production cuts.

Money is flowing to US shale firms, pushing down their junk-bond yields.

- And the majors have signed new deals to explore in Mexico and Iran.

For the first time in a couple of years, there’s a bit of excitement in the industry.

- The Economist thinks this is misplaced, and that the oil market is becoming harder to control.

The key problem is that the US shale producers can quickly ramp production up and down.

- They’ve also learned to survive at prices below $50 a barrel, and will now have locked in future sales at prices above $50.

There’ s also the growing threat from wind, solar and other renewables, plus new battery technologies.

We could be at “peak demand” for oil.

The trick for oil producers is to bring costs down by sticking to developed fields rather than prospecting in remote regions lacking in infrastructure.

- They should also run down existing reserves (while they can) rather than looking for new ones.

India’s cash bonfire

Back in the FT, Ken Rogoff – no fan of cash – wrote that India’s cancellation of banknotes was “too much, too soon“.

The big problem was that the central bank hadn’t printed enough of the new notes in advance.

- It will take months to produce them, and the economy is crippled in the meantime.

- GDP growth is likely to be 1% to 2% lower this year.

Ken is still against high denomination notes, which “mainly serve to facilitate tax evasion and crime”.

- He’d like to see an upper limit for transactions carried out in cash (as in parts of Europe) and the wiring of cash registers to transmit data on movement of notes (as in Sweden).

- He would also get rid of bills larger than $50 (albeit over five years rather than overnight).

Why don’t stockpickers win?

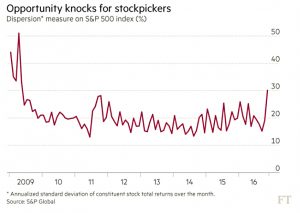

In the last part of a series of articles that the FT has been running on ETFs, John Authers looked at the rise of indexing (not limited to ETFs) and how it has forced stock pickers to adapt.

The point is that if all money was invested passively, the price discovery function of markets would be undermined.

- Even before that point, passive funds should cause distortions that active investors can exploit.

In the short-term, the election of Trump seems to be having a similar effect on prices.

- The dispersion of US stock returns (the amount that they differ from each other) is now at its highest since 2009.

- This should allow funds to beat the index by choosing a few winners.

But in a flat S&P 500 from May 2014 through July 2016, 109 firms went up by 20% or more, and 96 lost 20% or more.

- Yet market-neutral funds (which make “pairs trades”, selling one stock and buying another) went up only 0.6%.

Active managers are not beating the index, and haven’t been for the last 50 years.

- It may not be a coincidence that during this period, retail investors – who once had 90% of the market – have been displaced by institutional ones using lots of computers.

- It’s not surprising that price anomalies are harder to find.

So passive investing is probably not the problem at the moment.

- But that doesn’t mean that it won’t become one in the future.

Dallas pensions crisis

The Economist reported on an unusual run on a pension fund in Dallas.

- Policemen and firefighters are pulling their money out of the city’s pension scheme, and the mayor is suing them to stop.

The fund had $2.8bn in assets at the start of 2016, but $600M has been withdrawn this year.

- $500M of that is since 13th August.

Even at the start of the year, the plan was only 45% funded.

- This compares to the US public sector average of 74%.

- Each withdrawal makes this worse, since leavers get the full value of their benefits, leaving a smaller pot behind.

- The funding ratio is now 36% and the city’s bonds have been downgraded.

We’ve discussed US public sector pensions before – there are three issues:

- generous pensions

- daft accounting rules

- funds are allowed to choose an optimistic future return on their investments – Dallas used 8.5% pa

- using normal accounting, US public sector funds are only 45% funded on average

- bad investments

- risky property and private equity in the case of Dallas, leading to $650M of write downs over the past two years

Dallas has a particular problem with deferrals (know as DROPs).

- Workers who stay on beyond normal retirement age are guaranteed annual growth in their benefits or around 9% pa.

- There are 500 DROP accounts worth more than $1M, and the average account is almost $600K.

- DROPs account for around half of the Dallas fund’s liabilities.

- The annual growth rate has now been reduced to 4% pa.

Because of an 1984 referendum result, the city is not allowed to contribute more to the fund.

- To close the deficit, payments of 73% of payroll would be needed for 40 years (!)

The alternative is a one-off payment of $1.1 bn in 2018, which would mean that local property taxes would be doubled. ((This all sounds scary but far away, but in fact we face similar pressures in the UK – by 2019, 34% of council tax will go towards council workers’ pensions ))

- The city wants to retrospectively cut the DROP indexation, but that will be opposed in the courts.

It’s not yet clear what message this canary will deliver.

UK railways

The newspaper also reported on moves to give UK train companies a bigger role in maintaining track.

- The two jobs were split when British Rail was privatised in 1994.

- Track is now owned and run by public-sector Network Rail. ((Successor to the doomed Railtrack ))

The idea is that allowing multiple train companies to use the same track would boost competition.

- For a while this seemed to work, and by most measures UK trains are better than in 1994.

- The distance travelled by passengers (over the same amount of track) has doubled.

But over the past five years, fares, delays, cancellations and overcrowding have all increased.

- A particular problem is the disruption from repairs and upgrades to the world’s oldest rail network.

The Southeastern and East Midlands franchises are up for renewal in 2018, and the transport minister wants to award them on a train and track basis.

- It’s worth a shot, I suppose.

Until next time.