Weekly Roundup, 13th June 2017

We begin today’s Weekly Roundup in the FT, where David Stevenson explained the tax advantages of his recent marriage.

Marriage and tax

David Stevenson explained why he recently married his partner of 20 years – for tax reasons.

This is a subject of some interest to me, since I’ve spent 17 years with my partner without getting married.

- I was married once before, and didn’t enjoy the divorce process.

- But as I get older, I’m aware that without matching wills, the lack of a certificate from the government could cause us problems.

Common-law marriage was outlawed in England back in 1753.

- Despite this, 35% of cohabiting couples believe that they have the same rights as married couples.

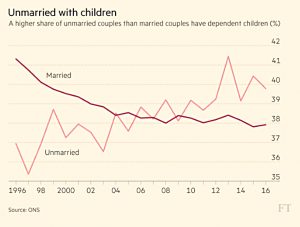

There are a lot of cohabiting couples these days – the total is up from 1.5M in 1996 to 3.2M in 2016.

- And more and more of them have children.

The big problem with not being married is that if one of you dies, the other only inherits jointly owned assets.

- Solely owned assets go back to the family of the deceased.

- With luck, this will be joint children, but it could be parents, brothers or sisters.

The second problem is IHT.

- Spouses can pass on their entire estate without IHT, but there is no exemption for cohabiting couples.

- There is an option to make a claim for a financial settlement, but it’s not guaranteed.

A third potential problem is pensions, where the pension was originally designed to pass to a spouse.

- But the legalisation of civil partnerships and gay marriage means that it’s usually straightforward to assign the beneficiary of your pension pot.

- You will have to fill in a nomination form.

What we need is an opposite-sex civil partnership, like they have in France.

- Malta is about to bring in a similar system.

In the meantime, you could draw up a cohabitation contract, drawn up as a legal deed.

- This is like a pre-nup – we could call it a no-nup.

- They have no legal force, but many courts will allow them.

You can also register a property as joint tenants, which will mean the survivor will own the entire home.

QE

Also in the FT, Ros Altmann looked at QE – in an article which an over-enthusiastic sub-editor unfortunately retitled “There is a magic money tree“.

- Ros is worried that although QE looks relatively successful at this point, we are only half-way through the game.

QE is needed when the central banks want to provide further monetary stimulus, but short-term interest rates are already close to zero.

- New money is used to buy bonds, which forces long-term rates down, too.

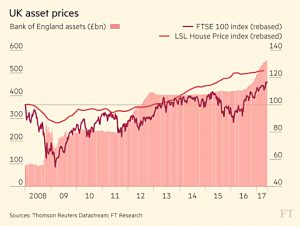

This in turn boosts asset prices (houses and shares) and lowers the cost of governmental deficit financing.

- Which leads to intergenerational tension, since older people naturally have more of these assets.

- Ros speculates that QE has had a role in the rise of populism, Trump and in Brexit.

Ros highlights one of the problems with QE – that the low interest rates inflate the size of pension fund deficits.

- I agree, but I’m more worried about the misallocation to projects (and assets) that wouldn’t show sufficient returns under a harsher environment.

As Ros notes, QE also converts government bonds from “risk-free returns” into “return-free risks”.

- And it makes annuities very poor value.

The big question is how to unwind QE.

- Will the central banks sell trillions of dollars of bonds?

- Or will they allow them to mature, without demanding repayment from the Treasury?

This would be the monetisation of a fiscal deficit, and a massive spell of debt forgiveness.

- But with sovereign bonds in a sovereign currency, as in the UK, it’s hard to identify a loser.

This in turn leads to the temptation to use QE to fund social policies – the NHS, or social care, or pension deficits – and / or infrastructure.

- This is where the reference to Corbyn’s magic money tree comes in.

Ros seems relatively keen, but I think that at present, it’s an unnecessary risk.

The problem is that nobody knows how far you can push it before there’s a loss of confidence from the bond markets, and we skid towards banana republic hyperinflation.

- And by the time we find out, it will be too late.

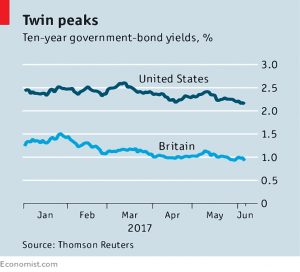

Bond markets

In the Economist, Buttonwood looked at bond markets.

Every year we all say that bonds are in a bubble and are bound to fall in price (pushing up yields).

- And every year the opposite happens.

Stocks are doing well, on hopes of a global economic recovery and an increase in corporate profits at the expense of wage rises, but there is little sign of persistent inflation.

- Which means that interest rates don’t have to rise.

This is underlined by the absence of the Trump stimulus package that underpinned the “reflation trade”.

- And China might be slowing down again.

We might now all be in the same boat as Japan, which has endured low bond yields for more than two decades.

General Election

I’m sure you’re sick of hearing about the General Election by now, so I’ll keep this as brief as I can. (( I’ve been pretty quiet during the election because I didn’t think that much of interest was happening, but the result itself is quite different ))

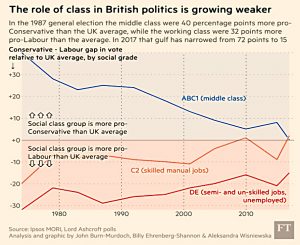

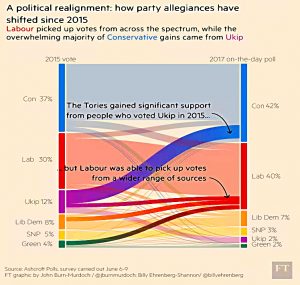

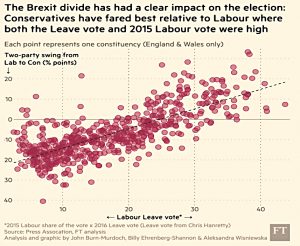

Regardless of whether your team lost ground or gained it, this was an election that solved nothing. (( Graphs below are from the FT ))

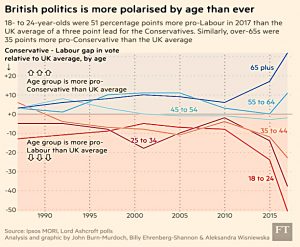

- The country remains divided – left against right, in against out, city versus shire, and most seriously, young against old. (( Similar divisions started to emerge in the US decades ago, but I didn’t see them being reproduced here ))

The old outward-looking, neoliberal consensus is gone forever, as Robert Shrimsley noted in the FT.

It was also – as Bagehot wrote in the Economist, and I have been saying for the past year – an election between two “second elevens“.

- The Tories lost their best people over Brexit, and Labour bungled their membership rules, leading to a communist coup.

Another election within twelve months – our fourth national vote in as many years – seems very likely.

- We are pressing against the limits of democracy here.

Despite a poor campaign from May, with many unnecessary own goals – hiding away, strong and stable, foxhunting and the dementia tax, to name just four – the Tory vote held up well.

- In fact it increased to 43%, and May got more votes than any Tory since Thatcher.

- Nevertheless, she lost ground in terms of seats, so this narrow victory will be seen as a defeat.

A Tory leadership election will no doubt follow, and Boris will be favourite – but we said that last time.

- Perhaps this is a good thing, since May’s rule has been two dependent on a small number of like-minded individuals.

- It also seems to be a team in denial, if the post-election message to date are anything to go by.

So now we have a minority government , though not quite a coalition.

- I’m no fan of the DUP, (( And I see the irony in the Tories being propped up by a party with terrorist links )) but the deal ought to provide enough continuity to get the Brexit negotiations started in a few days.

- It’s a bad team, but it’s a lot better than the alternative.

- It seems hard to believe that the new regime will survive for five years.

The truly shocking part of the result was that a man with the history and policies of Corbyn could attract 12.8M people to vote for him. (( And someone like Diane Abbott – who with the most charitable view in the world had a bad campaign – could increase her majority by 11,000 votes ))

- He is not a gentle geography lecturer, however successfully he might present as such.

- And his position as Labour leader is now entrenched for the foreseeable future.

This is the most worrying election result of my life, and I see no way to resolve the tensions in the nation.

- For the first time ever, the mythical youth vote has been mobilised, including lots of students (and some parents of students and potential students) – bribed with free tuition and debt cancellation. (( Both regressive policies, as noted by almost no part of the mainstream media ))

We oldies may increasingly outnumber the young, but social media means that they are far easier to manipulate into groupthink. (( I’m aware that they feel the same way about the tabloid press, but there are plenty of older people who avoid both ))

- I shudder at the thought of government policies chosen by a naive rent-a-mob from Facebook, Twitter and YouTube.

It’s only a few days since the vote, and I may be overreacting to raw emotion, but it feels like time for a plan B.

- For the first time ever, I felt myself wondering on Friday whether I could tolerate spending the rest of my days in this country. (( As a Leave voter, I’m aware of the additional irony ))

- So expect some articles in the future on how to get a second passport, and on how to retire abroad. (( Can it be too long before I’m telling you to stock up on beans, gold and ammunition ? ))

Until next time.

Hi Mike,

Thanks for sharing as always. Like you – I am also thinking at some point that marriage will happen purely on tax grounds. I am not religious, and I don’t see it changes any of our relationship, so why take the expense? But for safety, then at some point I am sure we will.

In terms of the outcome of the election – I try to avoid posts or comments about politics, but I am with you – I read somewhere a horrifying story where McDonnell was saying they would fund things without borrowing, they would just sell government bonds… pure scary.

I really do fear where this country will end up as well, so I look forward to reading your posts on second passports, and alternative locations to live (Monaco is a bit expensive for me!)

Cheers,

FiL