Weekly Roundup, 17th January 2017

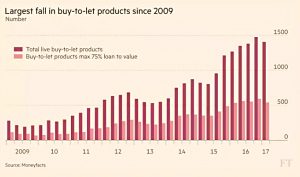

We begin today’s Weekly Roundup in the FT, with the Chart That Tells a Story. This week it was about buy to let.

Contents

Buy to let

I think that James Pickford wanted to say that buy-to-let is in retreat, but it’s a bit early for that.

- Instead, he reported that the number of buy-to-let (BTL) mortgage products on the market is falling.

Clearly, lending conditions have been tightened, and tougher tax rules (preventing the offsetting of mortgage interest against higher-rate tax) have been introduced.

Landlords now need to show they could afford the mortgage even if interest rates went up to 5.5% pa. (( This might take decades ))

- This could cause problems for some landlords if they need to remortgage.

But despite the recent fall in BTL mortgages, there are still five times as many available as in 2009.

- I think we need better data before we can write off BTL.

Financial personality types

Naomi Rovnick looked at the six financial personality types.

- The basic idea is that if you understand which type you are, you can better work on your weaknesses.

Here are the six they came up with:

First, the Anxious Investor

- quite rich, thinks they have an edge, trades frequently

- often trails the market, partly because of high fees

- at the extreme, these guys morph into day traders

- solutions include: stick to a set of rules, use stop losses and rebalancing, have a small “play money” portfolio for higher risk ideas

Second, the Hoarder:

- they stockpile cash that would be better invested (or in later years, spent)

- the proposed solution here was to find an IFA to sort out your portfolio

- but of course, I recommend the DIY route

Third, the Social Value Spender:

- these are people who spend (on themselves or others) to boost their self-esteem

- women tend to buy clothes and cosmetics, men buy flashy cars

- they are using money as a proxy for love

- the solution here is to monitor your spending, and come up with a sustainable budget

- then pay down the credit card debts that you probably have

Fourth, the Cash Splasher:

- apparently, someone paying the bill in a restaurant means that the meal is “all about them” and their generosity (( That’s saved me a few quid, then ))

- along with paying for meals, these guys (mostly they are guys) buy things at auctions and pay for expensive memberships (and cars)

- they want to be admired / loved (which sounds a lot like the Social Value Spender)

- the solution is to buy experiences rather than things (which I would have thought might include meals) ((To be fair to the FT, I think they’re looking at the guy who shares photos of expensive things on social media, not the one who just quietly pays the bill ))

Fifth, the Fitbit Financier:

- this guy does too much tracking of his finances and loves comparison sites and apps

- the theory is that too much control in this one area is compensating for a lack of control in others

- in this respect it’s a bit like an eating disorder

- the suggested solution was once again a financial planner (just say No)

Sixth, and last, comes the Ostrich:

- as you may have guessed, they bury their head in the sand (( Which of course, ostriches don’t do – they have underground nests and regularly turn their eggs, so it looks as if they do ))

- they ignore bills and bank statements, and avoid long-term investment decisions

- they’d rather make no decision than the wrong one

- workplace auto-enrolment, with it’s default of opt-in, should help here (( Though only after the contribution levels are raised to 15% pa or more ))

- another version of the ostrich is the wealthy investor who delegates to an adviser, then never checks what they are doing (or how large the annual fees are)

- the solution once again is monitoring and budgeting, and gradually putting together a long-term financial plan

Did any of that help?

- I thought not – unless perhaps you are an IFA looking for new clients. (( The Weekend FT does seem to be suffering from a bad case of dumbing-down over the past year or so – it’s almost a consumer paper now ))

BrewDog mini-bond

Aime Williams reported on the recent launch of a £10M unsecured mini-bond to UK retail investors by BrewDog.

BrewDog has now raised a total of £35M from retail investors, mostly in the form of highly-valued and non-transferable shares.

- At least with the mini-bond, the attractions of the high coupon are immediately apparent.

But it too is illiquid and effectively non-transferable.

- So investors are fully exposed to default risk, at a time when BrewDog is attempting to expand internationally, particularly into the competitive US market where its brand counts for little.

- And BrewDog already has £30M of bank debt (secured against its assets).

The 7.5% interest rate is superficially attractive, but would anyone feel bullish enough to invest sufficient funds for this to make a material difference to their portfolios?

- It’s 30% over four years of worry, and inflation will probably eat at least 10% of that.

The attractions of mini-bonds, like equity crowdfunding, are lost on me.

Stocks will boom

Ken Fisher was as usual, optimistic about the prospects for stocks.

- He took a few swipes at the media and the pollsters about getting Trump’s election wrong, but he expects the new president to struggle.

Ken expects Trump to do / achieve less that is currently imagined, which will have a benign effect on stock markets.

- The Senate contains enough Republican’s who don’t like him to block the more controversial measures.

This should produce a relief rally and Ken expects big first-year returns.

- His favoured sectors are tech, drugs, and consumer discretionary and staples.

- Eventually US stocks will lag, as Europe starts to lead.

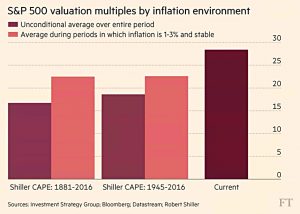

Look beyond Wall Street

Meanwhile, John Authers was worried that the US market is expensive.

- This is probably true, but the US is often expensive, and you still need a catalyst for things to change.

Certainly being out of the market (market timing) tends to lose you more money than sitting tight through corrections and crashes.

- John quotes a study from the London Business School using price to dividend ratios to time the market.

- In 20 different markets, buy and hold did better.

He also makes the interesting point that stocks tend to go up with bond yields until 10-year bonds hit 3.9%.

- This is because rising rates signify optimism over growth, which is a more important factor that rising interest costs at first.

- US 10-year yields are currently 2.4%, so we have some way to go.

He further notes that a crash in China wouldn’t impact the US as much as people fear.

- China accounts for 1.9% of S&P 500 sales, and only 0.7% of profits.

John still thinks that – on a 10-year view – Europe, Japan and emerging markets look more attractive.

- But maybe the US will get through 2017 without a disaster.

Return of inflation

The Economist welcomed the return of inflation to the rich world – and the banishing of deflation fears. (( As I write, UK CPI has just increased from 1.2% to 1.6% – hardly roaring along, but a step in the right direction ))

- The recovery in the oil price (from $30 to $50 a barrel) is a key driver for most countries, though here in the UK, the collapse in sterling will also help.

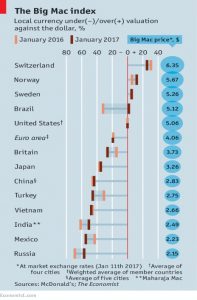

Big Mac index

The Economist also provided an update on its Big Mac index of FX rates.

- The worst-performing currency is now the Turkish lira, which has fallen to 46% undervalued against the dollar.

- The Mexican peso is now 56% undervalued, and the Russian rouble is even lower.

- The euro is 20% undervalued and the pound 26%.

The newspaper also produces a version of the index adjusted for local labour costs.

- This brings the Chinese yuan’s undervaluation up from 44% to just 7%.

- But the dollar is now so strong that this adjustment no longer corrects the euro’s undervaluation.

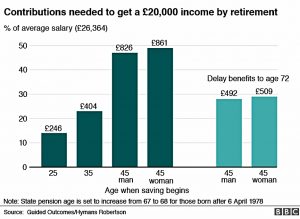

Saving for a pension

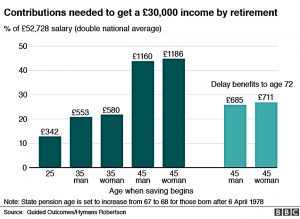

The BBC had a useful article on saving for retirement.

- It showed how much you need to save at various ages to produce a pension of £20K a year, and also one of £30K a year.

I’ll let the graphs do the talking, but you need to save hundreds a month even at age 25.

- And if you don’t get started by age 40, it will be an uphill struggle.

The pecking order

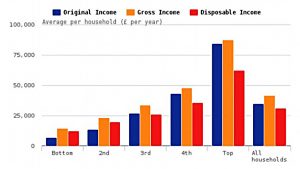

This is Money had an article about the ONS figures on UK income and wealth.

Median household income was £35K, though because of the way maths works, the median income for the median quintile (the middle fifth) was only £27K.

- Median disposable income is now up to £26K, £1K higher than before the 2007/08 financial crisis.

And disposable incomes are now more equal than since 1986.

- The Gini co-efficient is now 0.32 (zero is perfect), whereas the same figure on gross incomes (before redistribution through the tax system) is 0.49.

The ONS also provided a wealth distribution:

- median household wealth is now £225K

- 40% of wealth is in pensions, and 30% in property

The bottom 10% own less than £13K, and the top 10% own more than £1M

- the top one percent had a minimum of £2.87M

- the bottom one percent owes money – their wealth is minus £4.4K or less

Optimist’s guide to 2017

Back in the FT, after a 2016 that most of the mainstream media found difficult to swallow, Tim Harford was looking on the bright side:

- He thinks that noticing the good news as well as the bad is “essential for making reasoned policies”.

He came up with five reasons to be cheerful:

- global life expectancy is now above 70, up from 35 a century ago, and 60 when Tim was born

- improved sanitation is the key driver, along with cheap medicine

- the only people whose life expectancy is going down are middle-aged white guys in the US, which is part of the reason that Trump won

- world population growth has fallen to less than 1% pa

- the global economy is still growing at more than 3% pa, which means it doubles every 20 to 25 years

- extreme poverty has fallen from 95% two centuries ago to 60% when I was born, to around 10% today

- despite what Oxfam would have you believe, global income equality is falling, as China and India become richer

- income inequality has risen in the US, but not in the UK (since the 1980s)

- there’s been a lot less violence in the world since 1945

So cheer up, people.

Two charts

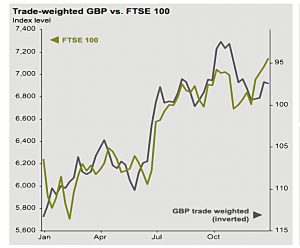

And finally, a couple of charts that I came across last week on Twitter.

The first neatly shows how the the rise in the FTSE-100 was driven by FX, by reversing the trade-weighted GBP exchange rate to plot it along side the rise in the index.

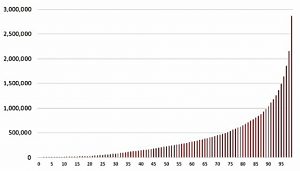

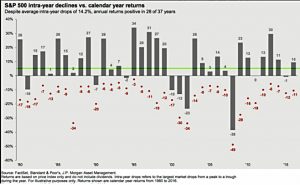

The second follows on from last week’s chart which showed that there’s always a reason not to buy stocks.

- This one shows that over the last 37 years, the average intra-year drop on the S&P 500 has been 14.2%.

- But you shouldn’t let this volatility shake you out of the market.

- Despite the drops, the index finished in positive territory in 28 out of 37 years.

Until next time.