Weekly Roundup, 21st March 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about dividends.

Contents

Dividends

Vanessa Houlder reported the shocking news than incentives still matter.

- Faced with the prospect of higher tax on dividends from April 2016, higher-rate taxpayers brought forward their dividend payments to the 2015/16 tax year.

- Around £10.7bn was brought forward, around 40% more than expected.

- The tax saved on this was estimated at £800M.

100 individuals were responsible for £3bn of the money brought forward.

- And about a dozen AIM companies (where directors often hold large stakes) also brought forward their dividends.

Now that the annual dividend allowance has been cut to £2K from £5K, we can expect more of the same in this tax year, though probably on a much smaller scale.

- ISAs and SIPPs – which protect dividends from tax entirely – are clearly the way to go.

Stamp Duty

Jame Pickford described the problems that the new Stamp Duty rules were creating for parents who want to help their children get on the property ladder.

- Since April 2016, parents underwriting their children’s mortgage have had to pay the 3% stamp duty surcharge on second homes.

- This takes stamp duty on the average London home (£484K) to almost £29K.

- Parents appear to be gifting cash to their children or offering interest-free loans instead.

I realise that many readers will have little sympathy for rich parents and their rich offspring, but I’m more interested in the market distortions caused by transaction taxes.

If you tax something, you get less of it, and I’m not sure we want fewer property transactions.

- A healthy market needs to be liquid.

Transaction taxes need to be very broad (like VAT or sales taxes, which apply to almost everything) if they are not to lead to distortions.

- Stamp Duty is locking up the London property market – not surprisingly, with a top rate of 15% on a second home costing more than £1.5M – and needs to be reformed.

Wills

Lucy Warwick-Ching brought better news from the Supreme Court, which overturned a previous ruling that a woman disowned by her mother at age 17 could challenge her will.

- Melita Jackson left a letter explaining her decision to leave £486K to animal charities and instructing her executors to fight any claim from her daughter.

Although now middle aged and with five children of her own, Heather Illott argued that her mother had the duty to maintain her.

- She does still receive £50K from the estate.

I’m reassured by the new ruling, though it doesn’t go as far as I would like.

- I had feared that I might be forced to construct a trust, which offers better legal protection than a will.

Wills need to be implemented as written, otherwise what is the point of writing them?

Crowdfunding

Aime WIlliams reported that venture capital funds are starting to get involved with crowdfunding.

- Crowdcube reports that deals involving institutional investors have quadrupled over the past two years.

- And research group Beauhurst say that professional investors were involved in 14% of deals during 2016.

- Syndicate Room only features deals that have a professional investor on board.

This is obviously a welcome trend.

- The closer that crowdfunding gets to VC and private equity, the more useful it will be.

More on this in a future post.

Space

Aime’s second article of the week was on the space industry.

- It’s an interesting read but disappointingly short on ways to invest.

Space Net Ventures offers an EIS, but that’s about it.

Stretched valuations

David Stevenson is starting to worry about equity valuations, particularly in the US.

- But with the global economy picking up (see below) he expects stocks to outperform for another six to twelve months.

Here in the UK, his target is 7,500 for the FTSE-100 – we’re only 90 points below that as I write.

- Once we get there, he plans to start hedging.

His weapon of choice is an “infinite turbo” from Societe Generale (SG).

- This is part of a range of listed structured products from SG.

- These products are popular in Europe, but interest is muted over here because of the tax-free nature of spread betting profits.

Some of SG’s products can be held in tax wrappers, but they just seem to be too much trouble for most investors.

- I like them in principle, and plan to write about them in more detail in the future.

- The problem I had last time I looked into them was finding a broker who would let me trade them online (rather than over the phone).

The two turbos that David is looking at are MF68 and MF69.

The both increase in value as the FTSE falls:

- MF68 goes up by 15.6% for each 1% fall in the FTSE-100

- MF69 goes up by 7.6% for each 1% fall

- MF68 becomes worthless if the FTSE moves above 7,663 (quite a risk, I feel)

- MF69 goes to zero when the FTSE passes 8,139

He also recommended a few investment trusts:

- Scottish Mortgage

- Witan

- Personal Assets

- RIT Capital Partners

- Ruffer IT

- Alliance Trust

Each of these is on our IT master list already.

- He also noted that the Guinness Energy trust he mentioned in February didn’t launch, and he suggested Riverstone Energy as an alternative.

Global upturn

The Economist led with a story about the upturn in the global economy.

- They even used the dreaded phrase “this time really does feel different”.

- A second article on the same theme provided more detail and the charts shown here.

Almost ten years after the 2007/08 financial crisis, America, Europe, Asia and emerging markets are all growing at once.

- Things are good enough to support a second interest rate rise in three months from the Fed.

But oil prices are still low and China has a lot of debt.

- And productivity and wage growth in the developed world is weak.

The newspaper is also worried that populist politicians will try to take credit for a recovery that it explains in terms of balance sheet repair, loose monetary policy and fiscal stimulus where appropriate.

- As usual, this translates into fears that Trump’s tax cuts will pump up the US economy more than is needed, and his protectionism will risk a trade war.

Smart beta

Buttonwood looked at smart beta, which now controls $534bn of assets.

- Growth over the past five years has been 30% a year. (( In terms of assets under management, not investment returns ))

The danger with smart beta is data mining, or curve-fitting – developing a strategy which performs well on historical data, but might not in the future.

- This is particularly true the more complex and esoteric is the “factor” used to select the stocks.

Dimson et all (LBS and Cambridge) have identified 316 possible factors to date, but the key four remain:

- small company size

- value (also approached via high dividend yield)

- momentum (recent price rises)

- low volatility (less well studied, and applicable only to the US and UK)

Momentum has the largest impact, with returns of almost 10% pa.

- But it suffers from severe downturns (46% in the UK in 2009), so using it with leverage is dangerous.

Size and value offer lower returns of 2% to 4% pa, but are much easier strategies to implement (as buy and hold).

Buttonwood suggests trying to buy the right factors at the right time, but this is not easy.

- Rob Arnott of Research Associates found reversion to the mean from five year outperformance.

Buttonwood remains sceptical that smart beta will continue to outperform, but I suspect that smart beta may not care too much about this.

Life expectancy

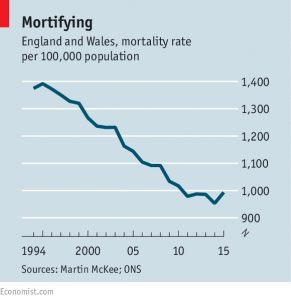

The Economist also covered the bottoming out of Britain’s mortality rate.

- 2015 saw the biggest rise in the number of deaths for 50 years.

In the previous decade, life expectancy for men rose by 3 years.

- Ageing boomers weren’t expected to push up the death rate until 2025, when they would have been in their late 70s on average.

So is this a blip, or a turning point?

- Disappointingly, but perhaps inevitably, nobody knows.

Most of the extra deaths in 2015 were of the over-75s, and it’s possible that a mismatch between the flu vaccine and the type of flu abroad at the time is to blame.

- It could also be a general crisis in health and social care.

- And deaths from dementia have risen significantly, but partly from a change in the way that the ONS codes deaths.

The data from the next five years will be watched carefully.

Oil

There’s a lot of oil in storage, and it’s part of the reason why the oil price has collapsed below $50 a barrel once more.

- We’re back to where we were before the OPEC cuts in November.

When the OPEC cuts pushed up the price, US shale producers pumped more oil.

- There are now 617 rigs compared with 386 a year ago.

- 400,000 more barrels a day are being pumped than in September, and a lot of it is heading to storage.

There’s also OPEC oil from pre-November only now arriving at US terminals.

And the oil futures market is now in contango (short-term prices are lower), which makes it worthwhile to buy oil and store it.

- Storage costs are 41c per barrel per month, and the one-month contango is 65c.

- And the more oil is stored, the lower the short-term price goes, increasing contango.

OPEC might announce that its cuts will last beyond June.

- But then the shale producers could just increase their own production.

Until next time.