Weekly Roundup, 29th August 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about inheritance disputes.

Contents

Inheritance claims

Lucy Warwick-Ching looked at the rise in disputes between family members over inheritance.

The chart looks scary until you check the Y-axis:

- The number of disputes has risen from 166 in 2015 to 158 in 2016.

- Back in 2005 there were only 15 cases.

She puts the rise in claims down to the complexity of family structures, which means that there are more people to fall out with each other, and that a “fair” distribution is harder to come up with in the first place.

- Some claims are also brought by cohabitees, who the law doesn’t protect.

There was also the Ilott v Mitson case in 2015, which awarded an estranged daughter £143K that had been left to animal charities.

- Rising property prices in the south are also part of the reason.

But with more than 500K deaths in the UK each year, 158 disputes doesn’t seem that bad.

Small investors

Aime Williams wrote about retail shareholders.

- M&S have recently set up a private shareholders’ panel, and RBS recently hosted an event (though those in nominee accounts weren’t invited).

There are two main lobby groups for small shareholders – Share Soc and the UK SMall Shareholders’ Association.

- There’s also the campaign group ShareAction, which wants “an investment system that is a force for good” – they seem to be focused on “communities” and the environment.

There was a lot in the article about AGMs and voting, but I didn’t really grasp what Aime was getting at.

Housebuilders

Gemma Tetlow and Judith Evans wrote about housebuilders, whose recent success has been underpinned by the Help To Buy scheme.

- When there were (unfounded) rumours on 4th August that the scheme might be scaled back, the share prices of the major firms fell back.

Something funny is going on in the housing market:

- normally sales and constructions move together, but very recently the number of houses being built has been going up, while the number of sales has started to come down.

This divergence is also explained by the scheme, which has boosted demand for new homes at the expense of the second-hand market.

- The scheme is staying until 2021, but will then be reviewed.

Gemma and Judith point to Brexit as a factor in falling transactions generally, but I would also add stamp duty, at least in London.

Transactions have been in a downtrend since the late 1980s, and are unlikely ever to return to that level.

- The base rate from the 1960s and 70s is a more likely target.

The excess transactions since then are partly down to easier credit, and the emergence of property as a financial asset for ordinary people.

- Rising prices encouraged people to try to move up “the ladder”.

But that cycle has probably now played out as houses are so much more expensive to begin with.

- First time buyers are much older and will probably make fewer moves in their lifetime.

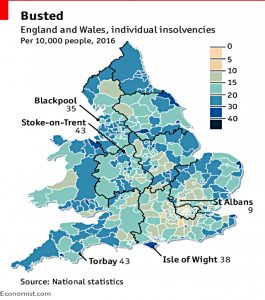

Bankruptcies

The Economist reported that for the first time since the financial crisis, more people in the UK are declaring bankruptcy.

The article makes the link to rising consumer credit.

- This was on average 150% of annual income before the 2008 crisis, with 75% of this in mortgages.

- After the crisis it fell to 130% of income, but it’s now back up to 135%.

Cuts to welfare are probably another reason.

The rate of insolvencies is now 20 per 10,000 people, compared with more than 30 during the crisis.

- And average net assets now stand at four times disposable income, one of the highest figures for decades.

Free stuff on the internet

Another article looked at the true cost of free stuff on the internet.

- Companies like Facebook and Google don’t charge for their services, and indeed, many of their “valuable” products (their content, search data and product associations) is created by their users.

And online, scarcity is not an issue, as data is cheap / free to copy and to transport.

- So normal accounting, as per GDP, doesn’t apply.

- Economists have calculated that $19 bn of “free” activity is missing from the US GDP number.

Internet giants cover their costs (of data centres and engineers) through advertising.

- Each Facebook user generated $4.65 in advertising during 2Q17, but only paid for $0.08 in add-on services.

A recent study looked at what users get in return, by offering money to people in return for giving up Facebook for a month.

- The average annual value to the consumer was $750.

When asked to value other services, search came in at $16.6K pa, maps at $2,800 and video at $900.

- These sound like crazy figures to me, since they would put a severe dent in most people’s budget.

- For comparison, imagine buying $2,800 worth of physical maps.

Other issues with “free” include:

- It leads to poor decision making by consumers, particularly in the area of privacy.

- It can disguise monopoly situations – for example, it looks as though people could switch away from Google search, but in many countries it has a 90% market share, which can in turn be used to influence other areas (eg. shopping comparisons).

Possible solutions include:

- Micropayments, to nudge online “labour” into more productive activities.

- More regulation, perhaps mandating paid versions of services that come without ads and the collection of user data.

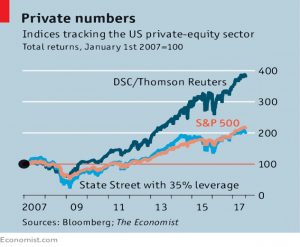

Private equity

A third article reported on indices that track the performance of private equity firms, and allow investors to mirror their gains.

- This feels to me like a problem that has already been solved, with more than 20 private equity investment trusts listed on the London stock exchange (see here for the list).

There’s even an ETF tracking a listed private equity index – IPRV.

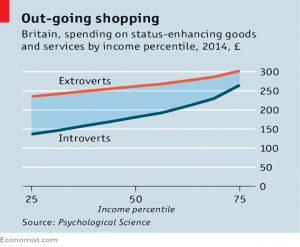

Status spending

The Economist also reported on how personality affects spending, and in particular, spending on status goods.

People with lower incomes are known to spend a higher proportion of their money on things that they they consider status enhancing.

- And it turns out that extroverts are more likely to do the same, across the wealth spectrum.

So the “worst” thing to be is a poor extrovert.

- The good news is that total status spending in the UK only amounts to a few hundred pounds a year, and the gap between introverts and extroverts is never more than £100 pa.

The researcher envisages the government using this in policy making, though it’s not clear to me how you would persuade people to let their degree of extraversion be kept on file.

Gender in trading

Sticking with psychology, it’s been a long-held view that women are better investors than men.

- They do seem to produce better returns, but it looks as though this might be down to them saving on commissions by trading less frequently. (( This is similar to the cost-savings basis by which the average passive fund beats the average active fund ))

Other research has shown that women are more cautious than men, and less-prone to overconfidence.

- Except, it would seem, in China.

A new study used students in both a US and Chinese university and found that as before, in the US, all-male trading groups produces market bubbles, whereas all-women groups often traded shares at a discount.

- But in China, both groups produced bubbles.

Pension Age

In FT Adviser, Natanje Holt said that people need to act their age with pensions.

She began by looking at various rules for pension saving:

- 16% pa from your early twenties

- 20% for ever

- half your age in %

- 15% if you start at age 25, or 21% from age 30, 30% from 35 or 43% from 40

But the main focus of the article was the “pension age” that will form part of the new pensions dashboard.

- This will use a person’s age, their income, existing savings and contribution rates to calculate an effective “saving age”.

If the person’s actual age is greater, then they are not saving enough.

- They could then be presented with options to try and catch up.

- These might include a higher savings rate (temporary or permanent) or the addition of a one-off lump sum.

I quite like this idea, as it might make people’s (lack of) progress more tangible to them.

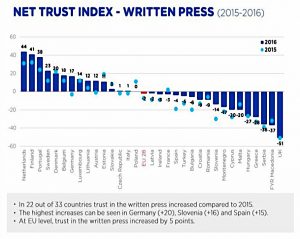

Twitter pics

I only have one this week.

It shows how trust in the written press changed from 2015 to 2016.

- In many countries trust increased, but the UK was bottom of the pile, with a fall of 51%.

- I think we can put that down to the Brexit campaign.

Until next time.