Weekly Roundup, 3rd April 2018

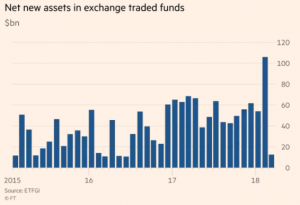

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about ETF inflows.

Contents

ETF flows

Kate Beioley reported that cash flows into ETFs have fallen sharply in February, after the market sell-off in January.

- I think something must have gone wrong with the chart, as it looked to me that February was a record month, and the fall-off happened in March.

Either way, one month’s data is too little to draw any conclusions from, but it does raise an interesting question:

- Will the passive investors (mostly fans of Vanguard index funds) who have done so well over the past 10 years stick to their plans if markets fall?

I’m not convinced that all of them will.

Tax the old

Since the article was published on March 30th, it can’t have been an April Fools’ joke, but Tim Harford was calling for an extra tax on the over-55s.

- He points out that NI is cancelled when you reach pension age, but that’s because you are then entitled to the benefit towards which you have been contributing.

It’s a bit like the fact that only graduates pay towards student debt, or road tax being paid by car owners.

- Age is a bit of a red herring – we restrict the benefit by age so the contributions must also be defined by age.

Tim also thinks that tuition fees (student debts) are an intergenerational transfer, but really they are just a tax on people who will earn more in the future.

- And he thinks that planning laws benefit those who already have property, and they tend to be older.

Why stop there? We might as well get rid of the NHS, since the old are its biggest customers.

The whole old / young obsession that the mainstream media propagates ignores the human capital that the young possess, and the old are unable to hang on to.

- The young have potential, and it’s up them to use it to their advantage.

Penalising people who have successfully done this is perverse.

- And just looking at money ignores the advantages enjoyed by the young in the areas of health, sex, innocence, happiness, technology and infrastructure domains.

I plan to write at more length on this in the future.

- In the meantime, If someone wants to put forward a formula that takes into account the present value of future earnings, and the investment gains up on them, then please do so.

Otherwise, tax rates should not be varied by age.

Tim concludes by mentioning a report from Angus Deaton, the economics Nobel Laureate who looks at inequality.

- He finds that those aged between 40 and 60 would benefit most from a wealth transfer, since the young and old are happy already.

Try selling that proposal to the electorate.

Gridlock

Ken Fisher was back with another instalment of “whatever it is, it’s good for stock markets“.

He thinks the pullback since January is:

A model-conforming bull market correction (a sharp, sentiment-driven drop of 10 per cent or worse) not the beginning of a bear market (a slow, silent start, hardly noticed, and fundamentally driven).

I think it’s too early to say and we could yet see a real bear in 2018.

Ken is bullish about economic indicators and positive yield curves, but his column focuses mostly on politics.

- There is uncertainty in Germany and Italy, which Ken thinks is great for markets.

November’s US midterm congressional elections should also lead to gridlock, with either party taking the House by a narrow margin.

- If the Republicans win, the paralysis will be intraparty rather than inter-party.

Ken sees gridlock as providing capitalism with the opportunity to innovate around existing rules.

- This explains the good returns in years three and four of presidential terms, when Presidents are usually weaker.

Four questions

John Authers had four questions to reflect on over Easter / Passover:

- Why are Treasury yields still falling?

- Higher global growth and inflation (if they happen) should mean higher yields and a secular bear market in bonds.

- Central bank purchases of bonds are also ending, and will be reversed.

- But insurers need to buy for regulatory reasons, higher yields than elsewhere attract foreign buyers to US bonds, and ageing populations buy more bonds.

- Why are stocks suddenly volatile?

- Despite good corporate earnings and macroeconomic numbers, stocks have had their first down quarter for three years.

- The immediate cause was rising US wage inflation and bond yields, but these have dissipated and stocks are still down.

- If feels as though this is partly because the business models of the FAANGS are now under attack, but the FANG+ index is still ahead for the year.

- Trumps tax cuts are done, and the focus is now on potential trade wars, and a loss of growth.

- Why is the dollar falling?

- Higher US yields should pull in money and support the dollar.

- One problem is the rising oil price – producers are left with more dollars to get rid of.

- And the rising oil price is linked to growing global economic confidence, reducing demand for the dollar as a safe haven.

- The possible trade war is also a likely factor.

- Why is inflation so low when unemployment is falling?

- This is probably down to hidden unemployed rejoining the workforce as prospects improve.

- But eventually we should run out of hidden yet employable people, and wages will rise.

- The alternative is that the Phillips Curve doesn’t work anymore, which means that rates and inflation (and growth) will all remain low.

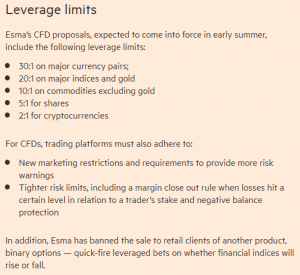

Leverage

Hannah Murphy reported on the new leverage limits from the European Securities and Markets Authority (ESMA).

- The new rules – which come into force this summer – apply to contracts for difference (CFDs) but apparently that also includes financial spread bets (which have the advantage of being tax-free).

Binary options have also been completely banned for retail traders.

ESMA says that between 74% and 89% of CFD traders lose money.

Spread betting and leverage aren’t a bit part of my investing strategy, so these limits won’t make much difference to me.

- But 5:1 on stocks and 2:1 on crypto feel a bit mean.

It’s also unfortunate timing for the EU to bring in new rules just before we leave.

You can get around the new rules by self-certifying as a “professional trader”.

You have to meet two out of three criteria to do that:

- experience as a financial professional

- a portfolio exceeding €500,000

- proven trading experience.

The potential downside of this is if a future (eg. Labour) government decides to treat professionals differently (eg. by taxing profits).

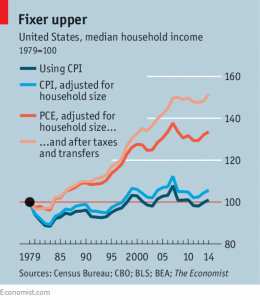

US income growth

The Economist reports that – following some changes to the methodology used to make the calculation – US average incomes have actually risen substantially over the past 40 years.

Raw CPI income has barely increased in real terms since 1979 but the non-partisan think tank the Congressional Budget Office (CBO) has come up with a rise of 51% in median household income from 1979 to 2014.

- The first change is to take account of household size – people have fewer children and more people live alone, so households are smaller.

- The second is to use the Personal Consumption Expenditure (PCE) measure of inflation, which includes things that are bought on consumer’s behalf, such as employee health insurance.

- This basket is also updated more quickly (quarterly, compared to once every two years for CPI).

- The final change is a switch from pre-tax incomes to post-tax incomes including benefits.

- Tax rates for middle income families have fallen, and benefits have risen.

Other data suggests the CBO are right:

- Food and clothing are cheaper than they used to be, and health care and housing have stayed in line with CPI since 1972.

- So houses are bigger than they used to be, and people have more cars.

It remains true that the richest have creamed off more of the money, and that non-coastal states and low-skilled men have not done well.

- But the typical American is much better off than 40 years ago.

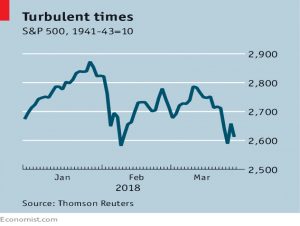

Market volatility

Buttonwood felt that we should buckle up in anticipation of a bumpy ride for markets in 2018.

- Inflation fears from January and February have been replaced by fears of a trade war between the US and China.

- And the appointment of ultra-hawk John Bolton as national security advisors means there could be more tension with North Korea (despite the possibility of a Trump / Jong Un summit).

Copper, bank stocks and the tech stocks have all been hit.

- And sentiment is down.

Most worryingly, the yield curve has flattened, which often signals an impending slowdown.

Twitter pics

I have eight for you this week.

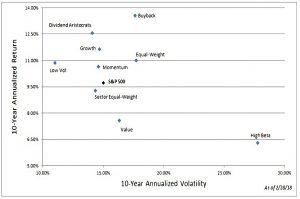

This one shows that it’s been a bad decade for value (in the US).

The second shows that it’s been a bad year for the FAANGs so far.

This one shows that investors have started dumping stocks as we approach the daily close.

This chart shows that only the richest decile have done well since 2007 (because they had a lot of assets to begin with).

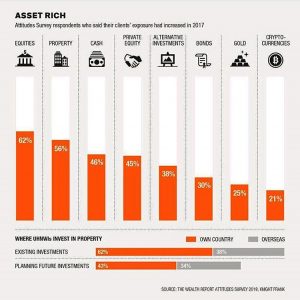

Chart number five shows where UHNW individuals put their money during 2017.

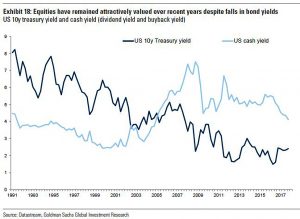

The sixth chart shows that if you take into account the effect of buybacks, US share valuations are not as high as they appear.

The same is true of cash flow, in the US and in Europe.

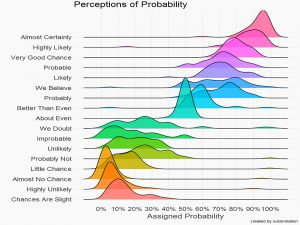

And finally, here’s a chart showing how the various terms we use for the probability of events are actually perceived by the listener.

Until next time.