Weekly Roundup, 3rd October 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about the oil price.

Contents

Oil price

Ed Bowsher looked at the price of oil, which has risen since January to $59 a barrel, a two-year high.

- The most recent climb is down to Turkey threatening to turn off an Iraqi pipeline after a Kurdish independence vote.

- But since January 2016, global supply cuts have been the main driver.

In November, Opec and Russia cut 1.8M barrels a day, 2% of global production.

- Meanwhile demand has risen as the global economy has strengthened.

Further gains could be stalled by a rise in US shale production.

- Scepticism from investors that prices will rise further – or even that current rises will be maintained – have stopped the share prices of Shell, BP and Exxon from rising as much as the oil price.

Advice for the young

The FT also asked a wide variety of people to give financial advice to 18-year-olds.

- The article was collated by Krishan Puvvada, who is the FT’s “student advisor”.

- He’s still at school, but he persuaded the FT and Lloyds Bank to get together to offer free access to the FT in schools.

His personal fears revolved around student debt – which is really a graduate tax, as we have previously discussed.

Contributors to the article – mostly from the FT – included:

- Lionel Barber (FT editor)

- Martin Wolf (FT)

- Claer Barrett (FT)

- Lindsay Cook (FT)

- John Ridding (FT)

- Lucy Warwick-Ching (FT)

- James Max (FT)

- Lucy Kellaway (ex-FT)

- Merryn Somerset Webb

- Neil Woodford

- Theo Paphitis

- Paul Lewis

- Ros Altmann

- António Horta-Osório (Lloyds)

And here are some of the best things that they said:

- Get the best education possible.

- Get a skill that you can offer an employer (coding, or a foreign language).

- Buy property.

- Markets are not efficient.

- Do something you have an interest in / are passionate about – you’ll be working for a long time.

- Cash is king (in the sense of business cashflow, rather than a long-term investment asset).

- Student loans are actually a graduate tax.

- Learn to budget and to make a financial plan.

- Learn to save.

- Invest for growth over the long-term.

- Compounding means that your savings will grow like a snowball rolling down a hill.

- Understand the value of money – don’t be a free intern.

- Keep it simple – all you need is a SIPP, an ISA and an emergency cash savings account.

- Get a pension and a house, and avoid debt.

- Diversify – don’t put all your eggs in one basket.

- Don’t listen to “get-rich-quick-scheme” salespeople.

- There are only three scenarios worth thinking about – best, worst and most likely.

- Taking no risks, while safe, will leave you with nothing.

The worst advice (from more than one commentator) was their negative attitude to stock markets.

- Stocks are the main drivers of growth in your portfolio, and everybody needs at least a third of their wealth in stocks.

Trump’s tax plan

John Authers was worried that Trump’s tax plan could be a turning point for the markets.

- The anticipation of tax cuts has faded since Trump’s election, and the high tax-rate stocks which would benefit have underperformed.

But this week the markets have moved to price in a possible tax cut once more:

- the dollar is above its 50-day MA (as repatriation of overseas cash could support it)

- 10-year bond yields are back above 2.3% pa yield

- and smaller stocks that would benefit from economic expansion (from the tax cuts and the disbursement of repatriated cash to investors) are at record levels

The expectation of stimulus provides further support for raising interest rates.

- Which would be good for the dollar, and bond yields,

- But bad for emerging markets.

The next financial crisis

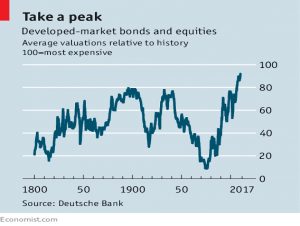

In the Economist, Buttonwood wondered whether the next financial crisis might be triggered by central banks.

- He was looking at the same report from Deutsche bank that John Authers covered last week.

Deutsche’s definition of a crisis is quite wide, being one of the following:

- a 15% fall in stocks

- a 10% fall a country’s currency

- a 10% fall a country’s bonds

- a default on national debt

- inflation above 10% pa

It was rare in the 19th century for more than half of countries to be simultaneously “in crisis”.

- Since the 1980s it has become common.

This is because of credit expansion (government debt) following the abandonment of first the gold standard and then the fixed exchange rates of Bretton Woods.

Buttonwood sees the most likely trigger of the next crisis as the withdrawal of support (asset purchases and low interest rates) by central banks.

- And the problems will be felt by those who have borrowed money to buy assets.

Digital disruption

Schumpeter looked at the lack of any effect on corporate profits from digital disruption.

At least six conventional industries have been eviscerated by digital innovation in the past two decades—music, video-renting, books, taxis, newspapers and clothes retailing.

But these industries were not big ones, only accounting for 2% of S&P 500 profits even in 1997.

If technological disruption was about to inflict a new and more devastating blow on traditional firms, you would expect to see lots of them with miserly valuations, as investors discounted a slump in their profits.

But only 40 companies in the S&P 500 have a PE below 12.

- That’s the same as 20 years ago and half the level in 2007.

The only industries that are cheap are cars and airlines, and with airlines the threat is regulation and price wars, not disruption.

- Those that are not include TV, credit cards, banks, electricity and food retail.

The five largest tech firms (Apple, Amazon, Alphabet, Facebook and Microsoft) have valuations that suggest their combined share of total corporate profits will rise from 7% now to 13% in a decade.

Existing big firms have raised their game. Most giants, from Walmart to General Electric, have digital or e-commerce divisions. America’s incumbents spend five

times more on research and development than the five big technology companies do.

Performance strength

In MoneyWeek, John Stepek reported on an academic paper that finds that a strong record of beating expectations is a key indicator of a company that’s about to go bad.

- Performance strength is often a precursor to earnings manipulation.

Companies start by beating the market honestly. But as expectations and valuations rise, it becomes ever harder to maintain that record. So companies turn to “aggressive accounting” and “ultimately, earnings manipulation”.

Companies where power is concentrated (with a dominant CEO) are most at risk.

- John cites Elizabeth Holmes at Theranos as a good example.

If a company is enjoying a strong, smooth run of growth then trawl its accounts with a particularly fine-tooth comb. Look for changes to accounting policies; “one-off” items that seem to be anything but; and rising profits not being reflected in rising cash flows.

PSD2

The Adventurous Investor (David Stevenson) wrote about the Second Payment Services Directive – PSD2.

- This is the piece of legislation that will enable open banking services like Yolt and Bean.

At the moment the banks don’t support the sharing of credentials with third parties.

- They claim this is for security reasons, but it’s also about keeping their customers to themselves.

These new apps will bring all your payments together on your phone and pad.

- They’ll show you where you are spending your money,

- help you to find cheaper alternatives to your utilities,

- and even organise the switch-over for you.

They also have the potential to nudge people into saving more, though as I pointed out last week, probably not into saving enough.

David rightly points out that the sector currently worst served by online comparison sites – the old and the poor – will be the people least likely to adopt PSD2.

- He also foresees personal data becoming valuable, and sold to the highest bidder.

Pension trustees

On his blog The Vision of the Pension Playpen, Henry Tapper highlighted a reader comment on the lack of balance in the DB pension system:

Now that DB schemes are fully mature, the most important thing is how they are invested.

Our system is fundamentally out of balance with the trustees choosing the investments and the employer then picking up the consequences with higher contributions.

The point is the trustees – who must act in the interest of members – will always pick the safest (lowest-yielding) investments, which means that higher contributions are needed to close the deficits.

- The only other option for employers is to reduce future benefits (eg. by switching from RPI to CPI indexation).

- And to make such changes acceptable, there needs to be lots of scare stories of mounting deficits and potential defaults.

Another consequence is the ludicrous level of DB transfer values used to bribe members to leave.

- The reader quoted an example of a transfer at 54 times annual payment.

Corbyn

I’ve been trying to keep away from politics in recent months, but last week was the Labour party conference.

Amongst other things, Corbyn proposed to nationalise some or all of the current public/private partnerships under the private finance initiative (PFI – which boomed under Gordon Brown).

- He also plans to nationalise utilities railways and Royal Mail, all at below market prices.

- And he would implement caps on credit card interest rates and rent controls.

Each of these measures would be negative for the sectors concerned and the country as a whole.

As Mark Littlewood, Director General at the Institute of Economic Affairs, said:

Jeremy Corbyn’s agenda would be a race to the bottom for the economy, entrepreneurship and living standards in the UK. It’s a socialist agenda that pretends the 1970s never happened.

Nationalising utilities and ending competition would lead to less supply and higher bills. Rent controls would do nothing to solve the housing crisis.

Politicians should stop worrying about inequalities in income and focus on raising living standards across the board.

In MoneyWeek, Merryn said:

Rent controls have a long history of making housing both more squalid and less available.

PFI is an insanely expensive, mildly dishonest way to commission mediocre infrastructure. But contract law and confidence in private property ownership underpins all prosperity

There is no such thing as a rich country where property and contract law are not respected.

She recommends more gold.

As David Stevenson points out, we should be afraid of a Corbyn government.

Much of domestic politics bores him. He’s a man of international politics, of liberation struggles, of friends and comrades.

He is in very simple terms, an enemy of The West. His Marxist fellow travellers hate everything about liberal capitalist democracy.

David sees four looming problems:

- taxation of “wealth”, presumably via dividends, capital gains and property, as well as higher corporation taxes that will drive companies out of post-Brexit Britain

- transaction taxes and regulatory changes to “nobble the City”

- expropriation (nationalisation) of pension pots

- foreign capital will flee the UK, causing stocks and funds to plunge (as well as property prices)

This will lead to a run on the pound (as Labour themselves admitted) and to high inflation and interest rates which would swamp any short-term gains from taxing “the rich”.

As David says:

Be afraid, very afraid. Start internationally diversifying now and make sure you have safe assets in real safe havens such as the EU and the US. Winter is coming…

Twitter pics

There were lots this week – so many in fact that I will hold some over until next time.

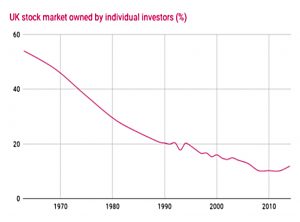

First up is the falling level of stock ownership by private investors in the UK.

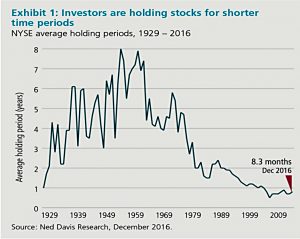

Next is the shrinking holding period for stocks in the US.

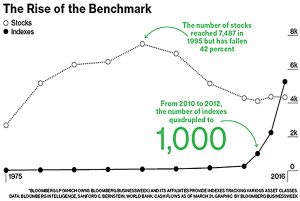

And here is the rise of the benchmark – they now outnumber stocks.

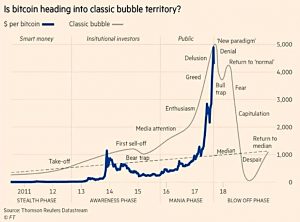

This one shows that the Bitcoin bubble is steeper than the classic model.

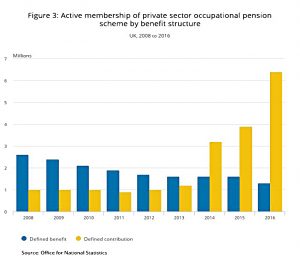

Next up is the increase in workplace pension scheme membership under auto-enrolment (note that the average level of contributions per person is falling, though).

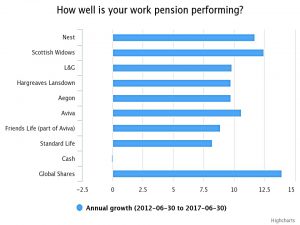

And here is how those workplace pensions are performing.

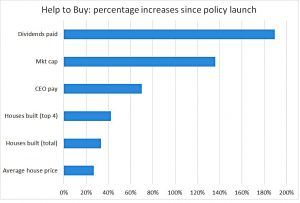

Here’s a summary of the impacts of the Help to Buy scheme.

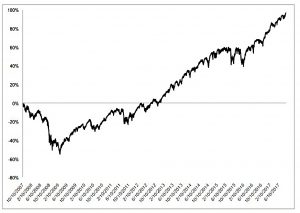

This one shows that an investor who bought at the 2007 peak and held on through the crisis has now doubled their money (in the US at least).

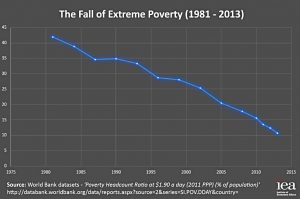

And the final one shows the decline in extreme poverty since the 1980s.

Until next time.