Weekly Roundup, 5th July 2016

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about credit card debt.

Credit card debt

The papers are still full of post-Brexit talk, along with the Tory leadership election and the Labour leadership challenge.

We’ll try to steer clear of politics as much as possible, except where it impinges on investment, so it will be another short and sweet update this week.

Credit cards are 50 years old this week (in the UK at least), and more than half of UK adults have one. ((I thought this figure might be even higher ))

In the FT, Hugo Greenhalgh looked at how borrowing on them has increased over the past 10 years.

- In fact, the data (from the Bank of England) covers all consumer lending, so it includes car loans as well. Student debt and mortgages are excluded.

- The chart also looks at month-on-month changes, rather than the total outstanding debt.

The average monthly rise over the past six months has been £400M, with an annual growth rate pf 7.4%.

Hugo is pretty cavalier about debt, saying that “all that matters is whether you can pay it back”.

- While that’s certainly crucial, it also matters what you are using the money for, what the borrowing interest rate is, and what else you could do with the money.

Unlike a mortgage, credit card debt is likely to be used to finance more “stuff” – junk you don’t need that will be worthless by the time the debt is paid off.

- On top of that, the interest rate on a credit card is likely to bear no resemblance to the bank base rate (currently 0.5% pa).

Mortgages – used to finance an appreciating asset that you can live in for the rest or your life – are a different thing entirely.

Two million people – 6.9% of cardholders – are “in arrears or have defaulted”.

- Close to ten million households in the UK have no savings, whilst average debts (including mortgages) per household are now £55K – that’s £1.5 trn for the country as a whole.

- The problem is that if we all stopped spending – as in Japan over the last couple of decades – we risk deflation.

More on this in a future post.

Brexit strategy

I’m no fan of financial advisers in general, but former IFA Jason Butler had a nice checklist of things to look at following the Brexit vote.

The first point is that the Autumn Statement (usually in November) is likely to raise personal taxes.

Things potentially in the firing line include:

- higher rate pension relief

- the tax-free lump sum

- NIC exemption on employer contributions

I doubt that things like the tax-free lump sum will be removed retrospectively by a Tory chancellor, but the other two look fair game.

- Try to make as much of your annual pension contribution (personal or employer) before the Statement as you can

The second point was that Brexit has sent long-term Gilt yields to record lows.

- This in turn means that transfer values for DB pensions are at record highs (you need more cash to produce the pension income that you’ve been promised).

- So it’s worth getting a quote from your employer

Also in the FT, John Lee advised us to Keep Calm and Carry On.

- Most of his small cap stocks trade globally, so UK market weakness will be offset by Sterling weakness.

As John points out, Brexit is not like 2008, or the 1970s secondary banking crisis.

In the same paper, Neil Collins recommended we take a look at the housebuilders who have been hit hard by the referendum result.

- Redrow, Taylor Wimpey and Persimmon were all mentioned, along with the Goldman Sachs bearish view on the sector as a contrarian indicator.

Pollsters

Still with the FT, John Authers looked at how the pollsters (and the markets) got it wrong this time.

He began with a quote from Michael Gove: “I think the British people have had enough of experts”.

This quote is being used to bash Gove, but I think that it’s true, for three reasons:

- the experts don’t often agree with each other

- the experts often seem to have a political or commercial axe to grind

- the experts have failed to protect us (“the people”) from the major recent shocks such as the 2008 financial crisis

I have a science background, and I’m a great believer in evidence-based policy-making – but I can’t see much evidence of it.

I have a suspicion that the fragmentation of media has something to do with all this.

- When I was young, there were only two – and then later three – TV stations, and millions of people read the same few popular newspapers each day.

- People thought largely the same things as each other, and when they didn’t, there would be debate.

Social media and the underlying stratification of society mean that most people today live in a communications bubble, receiving only confirmatory messages from a homogeneous peer group.

John comes to similar conclusions.

- While the polls were generally close, the betting markets (and the FX and stock markets) gave Brexit around a 10% chance as the polls closed.

- Philp Tetlock’s “Good Judgement” prediction market gave Leave a 25% chance.

Dr Tetclock thinks that experts in his market were too socially removed from Brexit voters.

- Because they didn’t know anyone who thought that way, they assumed that few people actually did.

I live in central London, and I noticed a huge disparity between people originally from the home counties, and those – like me – who were born in the North.

- I always though that the vote would be close, since I expected lots of Northerners to vote Leave.

People in London do very well out of the EU, so why wouldn’t they want to Remain?

- But that doesn’t mean that people elsewhere might not think differently.

Diamonds

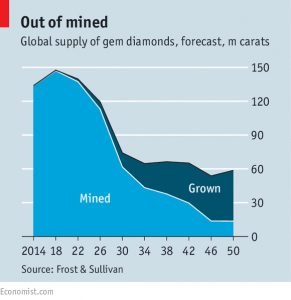

As the auction last week of a big rough diamond called the Lesedi La Rona flopped badly – it had a $70M reserve – the Economist ran a couple of articles – one and two – on artificial diamonds, and their chances of displacing the real thing.

Synthetic diamonds are made in two ways:

- using presses to simulate the high pressure and temperature found deep underground

- using vapour deposition to grow diamonds one atom at a time

They are hard to distinguish from natural diamonds, and already dominate the industrial market.

- As costs come down and the technologies improve, they are likely to move into the jewellery market too.

- Note that this will take decades, however.

A second problem for natural diamond producers is the socially aware consumer.

- When it emerged in the 1990s that dubiously sourced “blood diamonds” were being sold to finance wars in Africa, the industry set up the Kimberley Process certification scheme to identify “clean” stones.

Man-made stones don’t need certification.

- Leonardo DiCaprio – who starred in a film about conflict diamonds – is an investor in Diamond Foundry, a synthetic diamonds startup.

The third problem is tighter finance since 2008, which has squeezed the diamond processing industry.

- The complicated network of industry middlemen has always facilitated money laundering and tax evasion.

As with all change, incumbents initially fight rather than embrace it.

- India and Israel have restrictions on synthetics, and industry PR is spinning the effects of man-made stones on poor miners.

The industry has also come up with a new slogan: “Real is Rare”.

- Not quite “A Diamond is Forever”, but it might keep the romance alive – and the price of stones high – for a while.

Until next time.

“people today live in a communications bubble, receiving only confirmatory messages from a homogeneous peer group” – and annoyingly from search engines too (Google mostly). If you’re logged in then results are skewed to what they think you’ll mostly likely want to see.

Personally I much prefer to run across a large amount of stuff that I didn’t think I’d want to see, which is then often more interesting than what I wanted to see in the first place.

Absolutely – use an incognito window if you want to see the awful truth.

Hi Mike, what would really be useful post Brexit vote (regardless of how anyone voted) would be a review of your portfolios to establish what you would still buy and what you would avoid given the potential volatility we face in the coming year or two. I am trying to model my portfolio around your excellent article on Asset Allocation from a while back and whilst the diversification insulated me against losses post Brexit I am concerned about buying into Emerging Markets with the volatility of the Pound and Bonds seem increasingly risky. Within the AIM and Piggyback portfolios one could say these shares are much cheaper now but would the fundamental analysis you conducted still hold true if there is a hard Brexit option and business models have to change as a result? I have resisted selling any assets up to this point, but am not inclined to buy any further into the current market – what are your thoughts please?

Hi Martin,

You’re right, but I’ve been waiting for the dust to settle (no post-Brexit trades as yet for me).

I agree that investing abroad is hard with sterling down more than 10%, but those still accumulating for the long term will just have to bite the bullet. It’s not particularly risky (£ not likely to go back up in the short term) but it’s psychologically hard.

I’ll probably look at the SmallCap next week – there have been some crazy moves outside the FTSE-100 and I’m expecting an interest rate cut next Thursday.

UK-focused stocks will definitely suffer in the short-term, it’s just a question of trying to work out by how much, and whether the new prices are fair.

I’m more likely to buy than sell at this stage, but we’ll see next week.