Weekly Roundup, 7th July 2015

With the Greeks having voted against the troika’s austerity measures, but apparently still wanting to remain in the Euro, the financial pages are yet again dominated by the possibility of Grexit.

We’ll put this aside for another week, and begin today’s Weekly Roundup instead in the FT, with the Chart That Tells A Story.

Contents

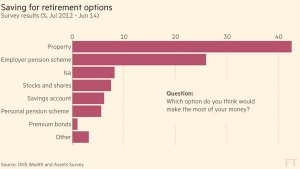

Saving for retirement

And what a sad-looking chart it is this week. James Pickford took a look at the Wealth and Assets Survey from the ONS.

With housing at record prices in the UK, 42% thought that property would be the best home for their retirement savings.

Around 26% were happy to invest in their employer’s pension scheme, which was seen as “safe”, while only 8% believed that stocks are the best place to be. The popularity of property is up 10 points since 2008.

Stamps

Lucy Warwick Ching looked at investing in stamps, which we decided a few weeks ago was too expensive for the private investor.

The Penny Black has just turned 175 years old. Even though 68M were printed, a good specimen will still fetch thousands. Demand for stamps is falling in Europe, but rising in China and other emerging economies, and there are now 60M collectors worldwide.

Prices of UK stamps have tripled over the past 10 years, a compound annual growth rate of 11.6 per cent (according to the Stanley Gibbons GB250 Index). Hong Kong and Chinese stamps have also done well.

The article correctly identifies the main factors in stamp investing:

- quality and condition

- authenticity, backed by a trusted seller

- diversification and the importance of buying a portfolio

But it doesn’t really get to grips with the costs, which are significant.

Stanley Gibbons are launching a rare stamp fund in Hong Kong, but it’s only available to UK investors who go through an advisor.

Benefits

John McDermott looked at taxes and benefits, ahead of likely changes in the budget later this week. The papers have been full of stories that half of UK households get more in benefits that they pay in taxes.

This is true, but only if you count benefits in kind. The ONS, which was responsible for the underlying data, includes things like a state education and the NHS.

There is some merit at looking at these things, since everything needs to be paid for, but it’s not what people understand by headlines about benefits.

Looked at more soberly, since taxes and benefits (in the wider sense) are a zero sum game, it’s not too shocking that about half of us are paying in, and half of us are drawing out.

It would be more interesting to look at who the winners and losers are. Breakdowns by age and geography and size of household might be revealing for instance.

John also mentioned a longitudinal analysis, which might show that those of us who are paying in (during our working age years) might also draw out at other stages of life (whilst at school or college, or when retired).

John moved on to look at inequality, and how the UK tax and benefits system helps to reduce it:

- before taxes and benefits, the average income of the top 20% is £80K, which is 15 times more than the bottom 20% (£5.5K)

- after taxes and benefits, the top 20% earn £60K and the bottom 20% £15.5K; the gap is now down to only four times

The Economist also looked at tax credits. As we noted last week, tax credits have become a big part of the welfare system in the UK and also in the US.

In the UK they account for 14% of welfare, but they are not universally popular:

- left-wing critics claim that the main beneficiaries are employers, who can use the subsidy to pay lower wages

- right-wing politicians, including David Cameron and George Osborne, wonder whether it might not be better (and cheaper for taxpayers) to increase the minimum wage instead.

In practice, tax credits encourage single mothers to work, but have the opposite effect on married women (credits paid to men allow their wives to give up work, and there is a threshold family income beyond which credits are withdrawn).

Men are unaffected, since childless men are ineligible and married men work already. There is still a small net positive effect from tax credits overall.

The credits also seem to benefit workers more than employers. To illustrate the possibilities, the Economist looks at an ice cream shop:

- if the shop is limited to two workers, it will hire the cheapest, which cost say £10/hr

- with a £4/hr tax credit, they now cost £6/hr – all the benefit has gone to the employer

- but if the employer can expand, they can take on a third employee, who might demand £12/hr

- with the tax credit, all three employees would cost £8/hr

- the two original workers are now £2/hr better off, but the shop is paying them £2/hr less than before

- the benefits have been shared (and an extra person is in work)

International studies have shown that in general more than 60% of the benefit of tax credits passes to the employees. But that is still more than a third being “wasted” on employers. Preliminary results from a UK study suggest around 75% of benefit goes to workers, so only 25% wastage here.

The other issue to consider is automation: a higher minimum wage risks the introduction of more machinery, which now appears more competitive. Tax credits have the opposite effect.

So it really depends on whether we want to insulate low-skilled workers from the effects of automation, and how far we are prepared to go down that road as the pressures from robots and software increase.

How long before the tax credit system morphs into some form of Basic Income?

Half year review

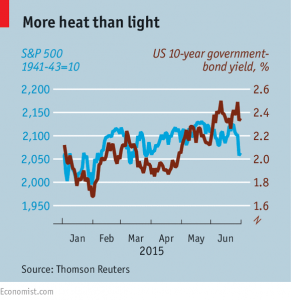

Buttonwood gave a quick half-year review of the markets. The basic message is that we are right back where we started:

- the S&P 500 and the FTSE 100 both ended June very close to where they began January

- ten-year US Treasuries have hardly moved

- and we are still a few days / months / years away from Grexit.

According to Buttonwood, there are three main points to take home:

- political risk is real, despite the many near misses (middle east, US legislative jams, Scotland, Russia, the refugee crises and Greece again) of recent years;

- in a low growth world, international compromise is hard to achieve, since concessions for one group come at a cost for another ((Hence the rise in nationalism and anti-immigration parties – it’s always easiest to blame the foreigners))

- investors are still relying on central bank policy to support markets, and at some point the Fed will raise rates ((Though recent events in Greece have probably pushed this back from September))

- reduced liquidity is making markets move quickly, particularly bond markets

- German 10-yr Bund yields went from 0.5% to almost zero, then up to nearly 1% and then fell back again

- an unforseen shock (not Greece) could cause big problems

No to fracking

In a surprise decision last week, Lancashire County Council rejected a planning application by Cuadrilla for fracking.

The reasons given were “unacceptable noise impact” and “adverse urbanising effect on the landscape” – known to people living elsewhere in the country as NIMBYism.

Cuadrilla believe it will need the government to make fracking into a “nationally significant infrastructure project” – taking it outside of the local planning system – to overcome local opposition.

Given Tory backing for local decision making in general, an appeal to the government minister responsible, and a slow, wasteful public enquiry is more likely. This will delay the development of a supply chain infrastructure to support the many wells required for fracking.

Without fracking, 70% of gas will be imported by 2019. With fracking, even recovering 10% of the estimated deposits would provide 50 years’ supply.

Suggestions for the pensions minister

With the appointment of Ros Altmann, the Centre for Policy Studies issued a short paper of suggestions for the new pensions minister.

The paper was written by Michael Johnson, who we met previously in March when we looked at a report which claimed that “pensions are finished” (we didn’t agree).

The CPS says that as a set, the suggestions are cost-neutral, and are designed to create:

- a national savings culture

- greater independence and prosperity for individuals

- sustained economic growth for the country

Here are the thirteen (!) of Michael’s suggestions that I found most interesting:

- Aim to raise savings from 5.9% (Q4 2014) to the 1980’s average of 13%, say.

- this would mean a modest move away from the consumer-driven economy

- hard to argue with this one, but not easy to implement politically

- the CPS gives few details on how this might be achieved

- Rapidly increase today’s private pension age of 55 (scheduled to rise to 57 in 2028) to 60 in 2024, ie. by a year every two years from 2016, and then to 65 by 2030-35.

- this is a proposal from the earlier report, which I can’t support

- personal freedom to access your savings trumps the nanny state’s obsession that nobody should run out of money

- life expectancy is increasing, but I personally know many people put off already by the lack of access to pensions until age 55 ((I have also found it a significant inconvenience myself))

- we need people to save more not less and lack of access is one of the problems

- Remove percentage fees on decumulation (drawdown) products, in favour of a small flat fee

- this is a good idea – as Michael points out, many ISAs charge nothing at all

- Raise auto-enrolment contribution rates beyond the current target of 8%, and extend to the self-employed

- another good idea – 12% pa would make a better target

- Bring ISAs into the auto-enrolment scheme (the Workplace ISA)

- another good idea – those put off by the deferred access to pensions might then contribute to an ISA instead

- Establish “value for money” benchmarks for accumulating and accessing savings.

- this seems to be an attempt to highlight that passive funds are cheaper than active ones

- again, this is a good idea

- Encourage NEST to develop collective drawdown based around retirees pooling their longevity risk.

- another good idea

- Establish a not-for-profit national annuities auction house to automate the process of shopping around, improving pricing and transparency.

- this is another policy from the previous report

- Michael is a much bigger fan of annuities than I am, though I concede that the picture might change if / when interest rates return to “the old normal”

- so long as people are allowed to ignore annuities, improving conditions for those who want to buy them must be a good thing

- Simplify the regulatory framework for DC under the FCA and for DB under The Pensions Regulator.

- this is another good idea

- Combine NICs and Income Tax into one Earnings Tax.

- I approve of this one, but what happens for un-earned income?

- You then need a separate rate for income from investments and pensions

- Cease the triple lock indexation of the State Pension in 2020, in favour of CPI.

- I understand the cost logic here, but the bigger question is what level of pension do we want to pay?

- The £8K starting level of the new state pension in 2016 is hardly generous. ((We are not back to the levels of pensions we had in the 1980s))

- I would prefer to wait for the gap between the pension and the minimum wage to close a little before abandoning the triple lock.

- Set pension contribution tax relief at50p per £1 saved (ie. 33%), up to an annual allowance of £8K; cap ISA and pensions contributions at £30K pa; and scrap the lifetime allowance.

- Three proposals in one here. It’s hard to object to a single rate for everyone, though I am not sure that £8K pa of pension savings is enough.

- The £30K combined cap is enough, but with no tax relief on £22K of that, not many people could afford to save that much.

- I think Michael is being too severe.

- Move public service pensions to DC

- totally agree – the survival of the public-sector gold-plated pension is divisive and skews many areas of UK public life

So two proposals than need further clarification, three I can’t support, and eight good ideas. Not bad overall.

Until next time.