Twitter

Reddit

Linkedin

Facebook

Google-plus

Medium

Save yourself

Keep up with events

Read our award-winning blog,

updated three times a week.

Understand

the problem

How much is enough?

Get out of Debt

Spend less than you earn

Learn to invest

Are Stocks right for You?

Save Tax

Get a Pension

and an ISA

Take Control

You need

a Plan for Life

Reach Financial Independence

You need a

Robo-Advisor

Low-cost Passive Investing

You need

a Coach

Affordable

One-on-One Support

You need

to Retire

Do What You Want

With Your Time

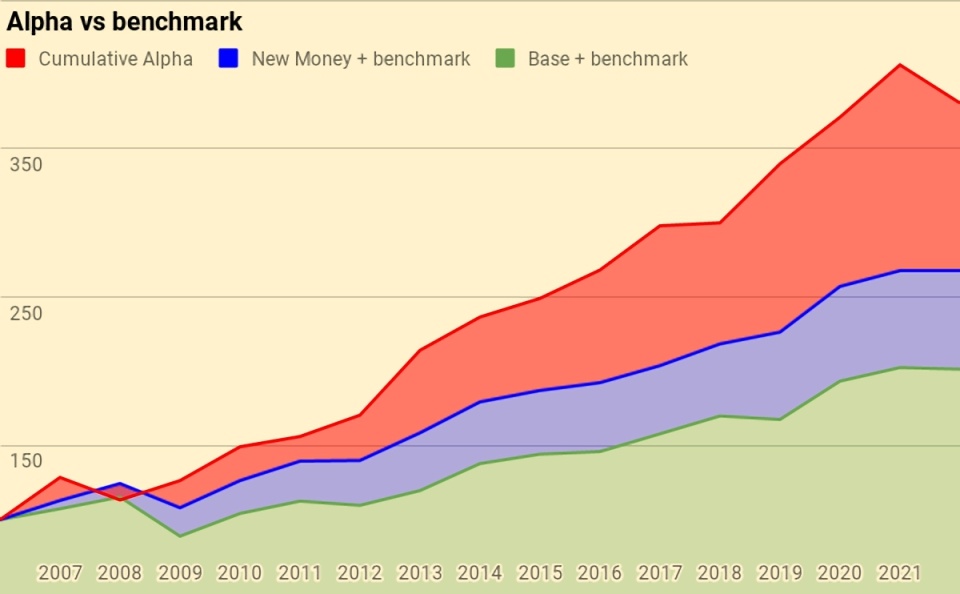

Proven track record

16 Years of Low Volatility Outperformance

2 Down Years in 39 Years of Investing

Keep Your

Costs Down

Don’t pay more

than you need

Join an

Investment Club

Share the Wisdom

of the Crowd

52 Golden Rules

The MoneyDeck

Playing Cards

Elements

A Periodic Table of Investing

Testimonials

“Just discovered your site and have spent most of the evening reading it.”

S*** S****

“Keep up the good work – 7 Circles is by far the best source of personal investment information I have found.”

M***** T******

“Thanks as always for the weekly roundup – always interesting to read the things I had missed.”

F***** L*****

“The most underrated early retirement blog I have seen.”

S*** U****

“Another new, impressed reader.”

H**** S******

“Thanks for all the great info – it’s good to find a blogger who sees the value of a mixed active/passive strategy.”

P*** P*****

“I am new to 7 Circles. Thank you so much for compiling such a fantastic, informative and useful resource.”

L** S*******

“Fantastic resource, have been looking for something UK-centric like this for ages!”

A* B******

Portfolios

Resources

SmallCap

Growth (AIM)

PiggyBack

(Main)

Bonkers (Momentum)

Defensive Dividend

Diversified

ETFs

Investment Trusts

Mike’s

Portfolio

HL (Simple Platform)

-

ETF Master List

-

Investment Trust List

-

Exposure Stocks

-

Sectors

-

Family Firms

-

AIM IHT Portfolio

-

Risk Tolerance Questionnaire

-

Savings Rate – 4-pot Solution

-

Calculators and Data

-

Reddit – UKFinanceOver30

Articles

M

Words

Tweets

Followers

Recent

-

Meb Faber on Trend

Today’s post looks at an old paper from Meb Faber on trend following.

-

Annual Portfolio Review 2022

It’s that time of year again. Today we’ll be taking a look at how my overall portfolio performed last year.

-

Weekly Roundup, 3rd January 2023

We begin today’s Weekly Roundup with a look back to last year.

-

The Psychology of Money – Lessons

Today’s post is our final visit to a recent book – The Psychology of Money by Morgan Housel.

Most Read

Ready Made Portfolios

Hargreaves Lansdown, Fidelity and Nutmeg, plus links to many more.

Ready Made Portfolios

Hargreaves Lansdown, Fidelity and Nutmeg, plus links to many more.

Savings Rate

The four pot solution to when you can retire.

Savings Rate

The four pot solution to when you can retire.

Elite Investor Club

Reasons to be fearful – an Elite Investor Club Summit.

Elite Investor Club

Reasons to be fearful – an Elite Investor Club Summit.

Investment Trust Portfolio

A review of John Baron’s approach to Investment Trusts.

Investment Trust Portfolio

A review of John Baron’s approach to Investment Trusts.

Most Commented

Portfolio Tracking Spreadsheet

A spreadsheet to track our stock holdings.

Portfolio Tracking Spreadsheet

A spreadsheet to track our stock holdings.

DeGiro Stockbrokers

Is cheap dealing worth the risk?

DeGiro Stockbrokers

Is cheap dealing worth the risk?

ETFs – Element number 5

Exchange Traded Funds – index funds listed on a stock exchange.

ETFs – Element number 5

Exchange Traded Funds – index funds listed on a stock exchange.

Pension Drawdown

UFPLS – the uncrystallised funds pension lump sum.

Pension Drawdown

UFPLS – the uncrystallised funds pension lump sum.

Featured

-

Taking a View – Twenty Questions for Investors

Today’s post is a summary of the most important questions that every investor needs to answer for themselves.

-

Annual Portfolio Review 2020

It’s that time of year again. Today we’ll be taking a look at how my overall portfolio performed last year….

-

Stock Screeners December 2020

Today’s post is the regular monthly update on the outputs produced by our stock screeners.

-

AIM IHT Portfolio Update 31 – September 2020

Today’s post is the fairly regular update on the AIM IHT portfolio.

As seen on

Previous

Next

Categories

Twitter

Reddit

Linkedin-in

Facebook-f

Medium

7 Circles 2023

All Rights Reserved