Starting an Investment Club

Today we’re going to look at the practicalities of starting an investment club in the internet era.

Contents

What is an investment club?

As defined by the government, an investment club is a group of people that buys and sells shares together on the stock market.

- There’s no official limit to the number of members in a club, but most tend to have 20 or less.

- This if often because 20 members is the most that a stockbroker will accept onto the same trading account.

It doesn’t have any special legal status, but the government (especially the HMRC) has accepted ways of dealing with a club.

- It would be possible to incorporate a club as a limited company or limited partnership, but this would involve more paperwork for few advantages.

- So most clubs just operate as informal partnerships.

You do have to tell HMRC when you set up a club. Here’s the address to use:

HM Revenue & Customs

Attention: ‘Investment Club’ Services

PO Box 4000

Cardiff, CF14 8HR

Legal status

In last week’s article we looked in detail at the legal status of investment clubs, and amateur investment advice in general.

- Some people worry about the idea of giving or taking advice from friends, neighbours and family.

- Others are concerned that pooling funds for investment amounts to setting up an unauthorised collective investment scheme.

But investment clubs have been around for many decades, and have never attracted regulatory attention

There is nothing to worry about so long as you follow two rules:

- none of the club members can receive any remuneration from the others (payments towards club expenses are fine)

- the club sticks to investments listed on the stock exchange (shares, ETFs and investment trusts)

The only snag here is that it provides no incentive for anyone to organise and operate the club.

Benefits

There are several obvious benefits to the typical club member:

- shared risk (therefore lower risk, in theory)

- better investing from group discussions (less like to suffer from psychological limitations)

- pooled expertise in separate niches

- educational – learn from other people’s experiences

- economies of scale:

- time

- trading commissions

- better diversification

- investment tools and research (ShareScope, Stockopedia, VectorVest, Investor’s Chronicle etc.)

- social fun instead of loneliness (especially if group meetings are physical)

The benefits to the organiser of a group (the Chairman) (( For the purposes of this article, the role of Chairman includes three roles which were once separate – Chairman, Secretary and Treasurer )) are more nuanced, as they have extra work for no pay.

Joining an existing group

There are two ways to get involved with an investment club:

- join an existing one, or

- set up a new one

Finding and joining an existing club is not straightforward.

- The nature of investment clubs – they are usually formed on a selective basis (family, colleagues, customers of the same pub etc) – means they can be somewhat exclusive

- existing members may not trust new entrants

- you may need to be vouched for by someone who is already a member

It can also be hard to find an existing club.

- There is a National Register of Investment Clubs run by ProShare, but listing your club there is not compulsory.

If you do find a club that you would like to join, and you can find a member to vouch for you, you could still be disappointed:

- It might not be run in the way you would like.

- You need to look at (amongst other things) the investment strategy, risk profile, monthly subscription levels and location.

Bank and brokerage accounts

Every investment club will need a bank account and a stock broker.

Lots of banks and building societies offer a “Community” or “Treasurer’s account”, designed for clubs.

- Often they are free on the understanding that there won’t be frequent withdrawals.

- Each member would have a standing order / direct debit into this account.

- Then there would be a monthly transfer to the brokerage account, to make that month’s investment.

Every club member will need to be registered on the bank account.

- Normally two members will be identified who will co-sign for any withdrawals from the club account.

There are fewer brokers that offer a club account.

Here are the ones that I’ve found so far (further investigation required here):

- Share Centre

- Hargreaves Lansdown

- Redmayne Bentley

Let me know in the comments if you find any others.

Some brokers may let members pay directly into an attached cash account, doing away with the need for a bank account.

Whilst one signature (the Chairman) would be fine for trades, a second signature would be needed in this situation for withdrawals from the parallel cash account.

Club rules

There will also be a short contracts to sign, incorporating the club’s rules.

This “club manual” would need to cover:

- joining and leaving procedures

- attendance at meetings

- voting majority required

- how to wind up the club

Unitisation

Holdings in an investment club should be unitised, for three reasons:

- it will allow members to pay in different amounts each month

- it will allow members to pay in extra, or to suspend contributions

- it will support members leaving and new members joining

We’ve covered the process of unitisation in detail here.

The basic procedure is quite simple:

- each time you add money to your portfolio, you “buy” a certain number of units, at the prevailing market price

The process for withdrawals is the reverse:

- each time you take out money, this is generated by selling (cashing-in) a certain number of units, at the prevailing market price

So adding or withdrawing money doesn’t change the price of a unit.

Tax treatment

Although there are no special tax breaks for investment clubs, in practice you don’t need them.

Investment clubs can’t take advantage of an ISA allowance, but individual members can use:

- their Dividend tax allowance £5K pa (per member)

- their Capital gains tax allowance £11.1K pa (per member)

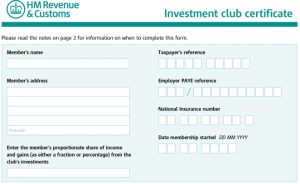

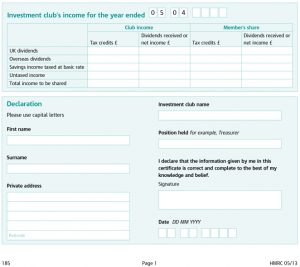

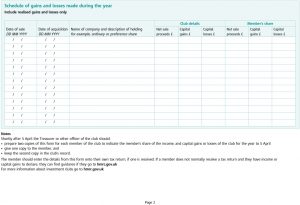

At the end of the year, the Chairman will provide an HMRC Form 185 or each club member.

- It shows the individual’s share of the capital gains (or losses) and dividends for the year

Here’s what it looks like:

7 Circles investment club

Astute readers will have guessed by now that I haven’t done all this research for nothing.

- I’m quite interested in setting up a club, and I want to find out if anybody else is, too.

- I’m under no illusions that I will be swamped by a tsunami of demand, but we only need a few people to get started.

I would act as Chairman, but I would also invest alongside everyone else (to the maximum level that anyone else did).

- That way, if anything went wrong, I would lose as much money as anyone else.

There’s actually the potential for more than one club, by dividing people along two obvious dimensions:

- Level of experience

- There could be a group for experienced investors, acting as peers, and another for novices, who want to be guided more

- The investment strategy for these two groups would differ: the experienced investors would debate which stock to buy, while novices might follow a more passive approach (as discussed here).

- Novices and small investors would benefit from a level of diversification that they couldn’t achieve on their own.

- Geography

- I’m based in London, so for members who can easily travel there, we could have physical meetings

- Those further afield would have to meet online (tools to be investigated, but things like Skype could be of use). (( There’s also the possibility of regional groups, if enough people were interested who lived close together ))

So there could be as many as four groups (or more likely, as few as zero).

- There might also be a split according to Risk Tolerance (you can take our questionnaire here to find out where you stand)

7C Club rules

Here’s how I see the hypothetical club(s) operating:

- Maximum of 20 people per club, to avoid falling foul of broker limits

- Meetings would be once a month, with a view to making a single purchase each month.

- Voting on investments / resolutions would be by units / £s invested, rather than one vote per person

- Admin and communications would be via email and a website

- this would probably be a standalone, password-protected free site from wordpress.com.

- Contributions

- Trading costs for investment clubs are higher than for individuals, so we don’t want to make our purchases too small

- I would suggest that each monthly purchase be at least £2K

- This means that with max. 20 members, average monthly contributions will be £100.

- With some members paying more (say £250), others could pay less (say £50)

- We could also go higher if there is any interest in that

- Members could also make extra one-off payments when they have spare cash

- Each potential / actual investment should have a “champion”

- They would be responsible initially for research and then for tracking progress and news, obtaining annual reports and ideally attending AGMs.

- Selling rule

- A mechanical selling rule would work best, so that most discussion is centred around the next purchase.

- This would most likely be trailing stop loss, from 10% to 20% depending on type of assets (more leeway for smaller stocks)

- Sometimes the selling rule would need to be over-ruled to avoid CGT implications (see below)

- Capital gains

- With typical annual growth of 7%, £11.1K pa (the allowance) will cover a £159K share in the club.

- Note that this assumes that the gains are crystallised each year.

- In fact they can be timed to make the best use of everyone’s annual CGT allowance.

- Dividends

- The best approach with dividends would be to pay them out, since you can’t rollover your dividend allowance.

- Individual members could always put the money back into the club for re-investment.

- With typical yields of 3%, £5K will cover a £166K share in the club.

- So there’s a good chance that the first £150K share in a club will not result in a tax bill on its own.

- With monthly contributions almost certain to be below £500 (and most probably below £100), such a stake would take many years to accumulate.

- Filling in the Form 185 by hand for lots of members looks like a pain.

- I’ll need to investigate if there’s a way of automating this, or substituting a computer printout for this form.

- I don’t believe that using the government’s form is mandatory.

- We’ll probably use PDFs that can be emailed to each member.

- Leaving the club

- existing members can buy out a leaving member (with extra cash)

- if nobody wants to do that, then the club would need to sell some stocks to raise the cash to buy out the leaving member

- this could take 6 weeks or so (including a month for the members to decide which stocks to sell)

- there could also be capital gains tax considerations for the leaving member if they have big gains

That’s it for today.

- If you have any interest in joining a club, let me know in an email (the email address is at the bottom of the left column on this page).

I need to know three things at this stage:

- your level of experience with investing in general, and buying individual UK stocks in particular

- where you live (roughly – nearest big town is fine)

- how much money you can spare each month

If there’s any interest at all, I’ll write a follow-up article in a few weeks.

Until next time.

Hi Mike, https://timetotrade.com/ have always had good functionality for investment clubs. They’re also tied to a broker now (not sure of the details) so I think you can have the actual broker accounts there as well.

Hi Mike,

Did you ever find or start an Investment Club. I’m actually a member of one of the clubs advertised on the ProShare website – Black Monday Investment Club.

We meet in London every 6 weeks or so and follow most of the rules you set out in your article; with the exception of weighted voting.

We are a pretty diverse group and whilst making money is obviously the aim we also definitely do it for the educational and social (we meet in a pub near Bank).

Happy to chat it through some time if you are interested – our next meeting also happens to be our AGM in January (15th I think)

Hi Ross,

No – we barely got past 50% of the monthly contributions I was looking for to make it interesting. I’m still up for it if more people sign up.

Thanks for letting me know about your club – I’ll drop you an email.

Mike

Hi Ross,

Sorry to hop on and hijack his thread but I was hoping you may be able to offer some advice? Im looking to set up an Investment Club also with some friends and have had meetings, assigned roles etc but I’m struggling with opening a free bank account. A lot of information I’ve found says you can do this but I’m struggling to find one. Does your club use free banking or have you had to open a business account?

Thanks in advance for any help you can offer.

Regards.

Alan

Hi Alan,

Don’t worry, you’re not hijacking. From what I hear, a lot of the trad banks have tightened up in recent years. Places like the Co-op and Santander used to offer “community” accounts for clubs, but sometimes they won’t recognise an Investment Club as “Not for Profit”.

It might be worth looking at some of the challenger banks, like Metro.

Good luck, and let us know how you get on.

Mike

Ok I’ll try that, thanks Mike

Look forward to your Newsletter. Eager to learn.

Dear Mike,

I am figuring on setting up an investment club here in East Sussex. I have just contacted a few people but replies are slow.

One thing I am doing is writing a spreadsheet which will instantly calculate all Unit Valuations and associated data over a full year. This is primarily for use with an online stockbroker. It is coming along well, but it will be a lot bigger than I envisaged.

Did you get fixed up with an investment club?

All good wishes, Ray.

Hi Ray – Sadly I did not. People only want to put in a hundred a month and I couldn’t get enough people interested to make it worth the effort.

I’m hoping to get a Family Investment Company off the ground soon. That would operate on similar principles but have more money and probably fewer people.

Hi,

I’m in a club that’s been running since June 2000 (so have been running for almost 21 years now). We use Equi as our dealing account and Barclays as our community account.

I hope that helps everyone.

Hi Mike,

By way of introduction, i’m only working now part-time due to health reasons, so I have more free time than most.

I have an RICS qualifications in property investment, a great interest in finance in general and have been investing quite successfully on the stock-market with my son. through Etoro and other sites, with annual returns in the order of 20 to 40%, with relatively low risk structured portfolio, based on investment strategy and lots of research. A number of friends are keen to join.

I would not propose to charge fees, but would need payment on profit share basis to cover my time e.g. first 7% return free, then an agreed split thereafter. Thus if 7% not made, no charges are applicable.

Otherwise the limited company would operate similar to an investment share club with no more than 10-12 members, with strategy and investments recommended mainly by myself and my son, but would obviously consider propositions in line with agreed portfolio structure and agreed investment strategy.

How did you get on with your family Investment company?

Did you set up as a Ltd Company or a Ltd Partnership?

Do you know if the individual investors can make use of their individual HMRC tax allowances through a Ltd Company / Partnership structure?

Keen to hear your thoughts.

Kind regards

Frank

Hi Frank,

I think you might need to be careful with the profit share agreement. You can charge expenses, but profiting directly for specific investment advice is tricky. An investment club (which meets to agree on decisions) has a legal exemption, but I saw the FIC as more of a cost-sharing and diversification play on a passive style. For example, it could be a good way into crypto at the present time.

Neither the investment company nor the FIC got off the ground – I couldn’t persuade people to invest enough money to make it worth my time. You are lucky to have friends who are keen – I have never been able to interest anyone. Most people with a lot of money are fairly old and stick to investment trusts and picking their own stocks, often on the AIM market. Long-term thinking and considerations of generational wealth seem to be rare in the UK.

Be careful with your historic returns though – unless they stretch back to the 1970s. The last 12 years have been very easy and will not be repeated going forward – 20-40% pa is not going to happen and you shouldn’t imply to your friends that it will. You’ll be doing them a favour just by making it harder to tinker with their investments.

I would have used a limited company since that’s what I have experience in operating, but I’m sure you could make a partnership work also. With an LC the tax allowances are completely separate, though with a bit of thought they end up comparable. The only interactions are dividends from the LC and any share purchases and sales. I think a partnership might act more as a pass-through entity. That would be less useful for me as I’m using my personal allowances already.

Good luck,

Mike

Hi,

We have a small investment club up and running that invested in a range of things such as equities, start ups, crypto wine etc. Unfortunately the challenger bank we were using has closed our account down. So has anyone found or worked with a bank that is willing to open accounts for investment clubs? To date we’ve tried Metro, CashPlus and Starling with lots of time waster and no luck.

Thanks

David

Hi David

We are also a small investment club, and Barclays recently closed our Community Bank A/c because we are not a Sole Trader. Have tried to get a Treasurers Current A/c at Santander, Lloyds, NatWest,

Metro, Bank of Scotland, Virgin Money with no success. Like you, a lot of wasted time and effort.

Hoping to open a Joint Personal A/c with 2-3 members, after getting permission from all Members.

Fiona M

Does amyone know of any banks who offer current account facilties to investment clubs? Thanks

I can’t speak from personal experience, but it might be worth looking at a “Treasurer’s account”, designed for clubs. Lloyds, Bank of Scotland and Santander seem to offer them.