Contents

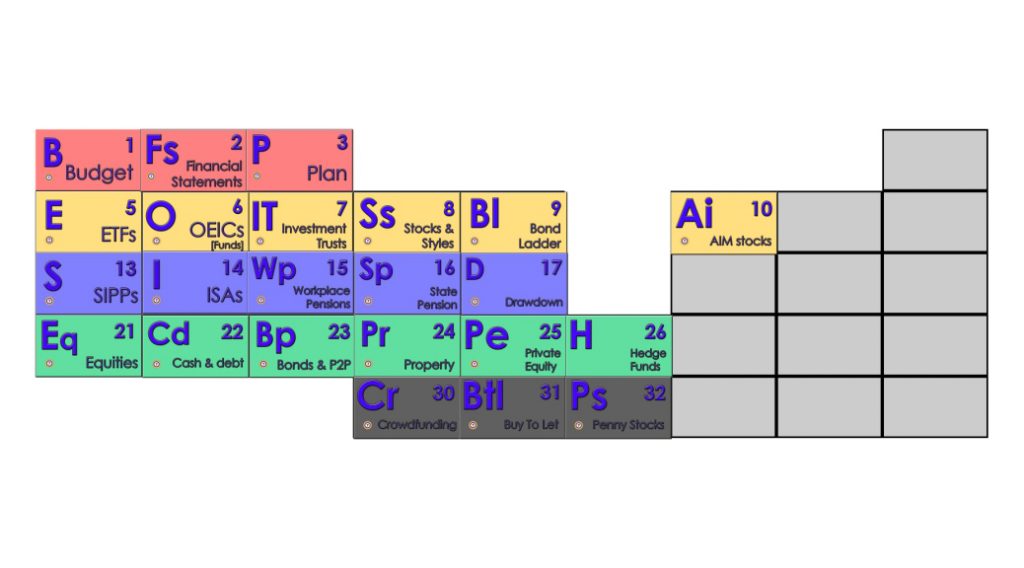

Periodic table of investing

This is the home page for our series of articles on the fundamental elements of investing, as practiced by Private Investors in the UK.

There are 37 elements in total, and together they form what we’ve grandly titled the Periodic Table of Investing.

- Like the physical elements, each element has a number from 1 to 37, and a one or two-letter symbol.

- They are also arranged into five series (explained below) and colour-coded accordingly.

They are also arranged from left to right in order of decreasing importance, and / or the age at which they are needed.

The articles

Each article is written in a question and answer format, and explains – amongst other things – what the Element is, why you need it, where you should get it, what good and bad looks like, and the main risks and how to deal with them.

If you can think of a good question that we’ve forgotten to answer, please let us know.

The advent calendar

The image at the top of the page is the “advent calendar” version of the Periodic Table of Investing.

- It starts out with 35 grey rectangles, and as each article is published, another square will be coloured in.

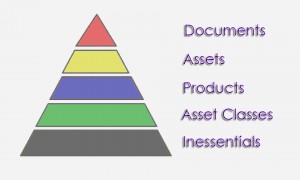

The hierarchy

The Periodic Table is divided into five series:

- Documents

- Assets

- Products

- Asset Classes

- Inessentials

These five series form a hierarchy, modeled after Maslow’s classic Hierarchy of Needs.

Core, optional and not required

Sixteen of the 35 elements form the Core Elements.

- These are things that everybody will need, or should at least consider, at all times

- They are formed from the left-most four elements in the top four series

Another thirteen of the 35 are Optional Elements

- These are things that only some people will be interested in, depending on their age and risk tolerance

- They are formed from the right-most five elements from Assets, Products and Asset Classes

The final six elements are Not Required:

- These are things – often newfangled or fashionable – that don’t provide any additional benefit beyond the other 29 Elements, and may expose you to additional risks and costs or to poor returns

- These form series five – the Inessentials

Documents

These are the papers and spreadsheets that allow you to control your finances

- Expect things like Budgets, Financial Plans and Wills to appear here

Assets

These are the actual things that you own

- Expect things like ETFs, OEICs, Investment Trusts and Stocks to appear here

Products

These are the wrappers and services offered by providers and platforms

- Expect things like ISAs, SIPPs and Workplace Pensions to appear here

Asset Classes

These are the underlying asset classes that you need to understand so that you can get your asset allocation right

- Expect things like Equities, Bonds, Property and Cash to appear here

Inessentials

These are the things that nobody needs, and arguably nobody should have

- Expect things like Annuities, Crowdfunding, Stamps and Coins to appear here

Links

Here are the links to the articles that have been published so far:

- Documents

- Assets

- Products

- Asset Classes

- Inessentials