Order Book for Retail Bonds (ORB) – Bond Ladder 2

Today we’re going to look in more detail at the Order Book for Retail Bonds (ORB). Is it really suitable for the private investor?

Contents

Order Book for Retail Bonds

We learned a couple of weeks ago that the Order Book for Retail Bonds (ORB) is an initiative from the London Stock Exchange (LSE).

- Launched in 2010, the ORB aims to make bond investing accessible to private investors.

- The main advantage is that ORB bonds can be traded in small amounts (£1K to £2K, say) via regular stockbrokers

- The bonds can also be held in ISAs and SIPPs

Market information

ORB data is not easy to come by.

- The LSE has a statistics page for the ORB.

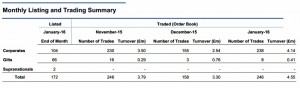

This has a monthly archive file which features three tables:

- trades and turnover

- listings and trading summary

- top 10 traded bonds by turnover

The tables for January 2016 are shown below.

There’s also a weekly spreadsheet which reports spreads, but can also serve as a list of the available bonds.

The official list of ORB bonds can be found here.

- Today’s list had 179 bonds on it and did not include any price data.

The LSE site also has live prices, but presented in a really unhelpful way:

- There are nine pages like this, with no download option

- The coupon and maturity information isn’t separated out in the price data

But the Code and ISIN fields should allow us to combine this price data with the official list of bonds in order to work out the yield to maturity of every bond (more on this below).

Yield calculations

Let’s catch up on some bond characteristics we didn’t cover in the previous article.

The yield is the rate of return on a bond.

- Flat Yield only accounts for the coupon return (the interest), and not any capital gain / loss when the bond is redeemed

Flat yield = (annual coupon / price) x 100

Flat yield = 4% / 102.5 x 100 = 3.9%

- As the price of the bond rises, its yield falls.

The Gross Redemption Yield (GRY – or Yield to Redemption, YTM) takes both coupon payments and capital gain / loss into account.

- It is based on the present value of the cash flows of the bond and is the ‘internal rate of return’ (IRR) of the bond.

- This can also be thought of as the discount rate which, when applied to the future cash flows of the bond, produces the current price.

The YTM allows investors to make comparisons between bonds with different maturities and coupons, as it is the annual return over the life of the bond.

Clean and dirty prices

We also forgot to explain about clean and dirty prices. It’s all about accrued interest:

- Bond prices are expressed per £100 nominal – a price of 101.25 means that for every £100 nominal, you would pay £101.25

- Bond prices are usually quoted ‘clean’ – without including the accrued interest since the last coupon payment.

- But when an investor buys a bond, they pay the ‘dirty’ price – the clean price plus the accrued interest.

- The accrued interest is paid to compensate the seller for the period during which they have held the bond.

- When the next coupon date rolls around, they will no longer own the bond, and won’t receive the interest from the issuer.

- Gilts use the ACT/ACT (actual / actual) convention to allocate the interest.

- Many corporate bonds use a 30/360 days convention, where there are assumed to be 30 days in the month and 360 days in the year.

Now we know a bit more about how bonds work, let’s look at how we can trade them.

Which brokers?

Money Week had an article in 2015 on the best brokers for bonds in an ISA. They recommended five:

- YouInvest

- Hargreaves Lansdown

- iDealing

- iWeb

- X-O

I have accounts with four of these though I’m in the process of closing the iDealing account.

- This is a pity, since along with Hargreaves Lansdown, iDealing are one of the only two brokers to offer online bond trading.

I took a quick look at the other three websites to see what was on offer:

- YouInvest had no reference to bonds that I could see

- iWeb stated that you could trade bonds, but had no further links

- Hargreaves Lansdown had a standard price page, as shown below

Online trading has become a deal-breaker for me, so this is another case (as with pension drawdown) where I am somewhat surprised to be recommending Hargreaves Lansdown (HL).

In this, there are a few caveats:

- The price pages list 700 bonds, with no obvious tools to filter by

- The vast majority of bonds are not tradeable online – only those with a green arrow in the right-most column are part of this service

- Only 3 of the 15 bonds in the picture are tradeable online – if this proportion is typical, then being able to filter for online dealing would be very useful

- The data in the table is very limited – the addition of yield to maturity (YTM) would be particularly useful

- The page itself is unreliable – the picture above is sorted in reverse alphabetical order because that was the only way I could get the data to refresh.

So it looks as though we’ll need to treat HL as a dealing site only.

Other sources

I came across another couple of sources of information, which I’ll explore in more detail next time:

- Fixed Income Investor is the bond site that I was looking at ten years ago

- Retail Bond Expert is a less active site, but has some articles about ORB and ORB bonds

Here’s a chart from the second site showing ORB bond issuance:

It looks as though the platform may be struggling a little – peak issuance was back in 2012.

- This is probably not a problem in the short-term – the beauty of a bond ladder is that it’s “buy and forget” – but it’s a potential worry for the long-term.

We’ll know more next time when we look at the available bonds in detail.

Term duration bond funds

Before we finish for today, a quick update on those term-duration bond funds I mentioned last time:

- I still like the sound of them, but the bad news is that they don’t seem to be available in the UK.

I did find a paper from Vanguard suggesting that they might not be so useful after all.

- But they would say that, wouldn’t they – they seem to offer only traditional bond funds themselves.

Conclusions

We’ve narrowed down our options considerably today:

- term duration bond funds don’t seem to be available in the UK

- only two brokers allow online dealing of ORB bonds

- I have accounts with both, but will only have an HL account moving forward

- there is no ready source of live YTM data

I think we can finally decide whether a bond ladder is feasible for the UK private investor with one more push.

We’ll approach the problem from two directions:

- using the LSE official list and screen grabs of the live prices pages, we can cross-match on one of the bond codes to find the coupon, maturity and price information, and hence calculate the YTM (via a new spreadsheet)

- we can slog through all the HL bond price pages to build a list of the bonds for which online trading is available

I think we’ll try option 1 first:

- collate the LSE data and build a spreadsheet to produce a list of bonds we want in our ladder (with reserves)

- check which of these bonds are available for online dealing on HL

- hope the resulting ladder passes muster

So that’s the chore for next week.

Until next time.