NEST vs The People’s Pension

Today’s post looks at a report from Defaqto on Workplace Pensions. We’re particularly interested in two of them – it’s NEST vs The People’s Pension.

Contents

Context

I run a limited company and so I am required to provide a workplace pension (even if all of my employees and directors opt-out of making contributions).

- A couple of years ago I chose NEST, as the charges were low-ish and the fund options were decent.

Recently, The People’s Pension announced that from summer 2019, it would be reducing its charges.

- So the primary purpose of this article is to work out whether it’s worth me switching.

NEST

Nest’s charges are pretty simple:

- 1.8% initial charge on contributions

- 0.3% pa charge on balances

That initial charge is pretty steep (and I think it’s increased since NEST started), but what makes NEST interesting is that it’s not levied on transfers in.

- So employees who won’t make making massive contributions, but who have an existing pension that they could transfer in, might find NEST attractive.

There’s also no employer set-up charge with NEST.

People’s Pension

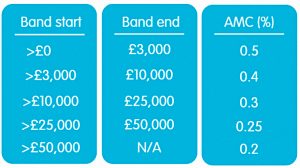

The People’s Pension are moving to tiered charges from this summer.

Tiered charges are difficult to evaluate, so here’s a helpful table:

The PP average fee gets down to the NEST level at a pot size of £50K.

- From there on it will be cheaper.

Unfortunately, there is a £500 employer setup charge with PP.

Scenario

My pension is full, so I’m opted out of my company’s workplace pension.

- My other half (OH – the only other employee) is enrolled.

She also has an old pension that she can transfer in.

She’s around four years from qualifying for a full State Pension, and so is likely to stop making contributions (and indeed, stop taking a salary from the company) around then.

So the basic scenario is:

- Four or so more years of contributions

- A transfer in of an old pension (around £155K)

- Running down the pension before the LTA review at age 75

I’ve assumed an investment growth rate of 4% pa real.

The numbers

Over nineteen years, the NEST fees work out at 0.31% pa, which is fine.

- PP works out at 0.25% pa, which is even better.

But the difference over £20 years is only £1,147, or £60 a year.

- So it’s worth getting around to, but not exactly top of my to-do list.

If PP didn’t have the employer set up fee, and I wasn’t already up and running with NEST, it might be a more compelling proposition.

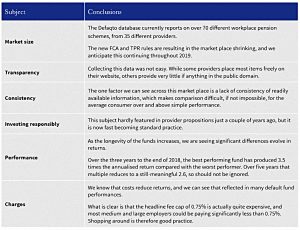

Defaqto report

On to the Defaqto report, which I am using as due diligence on my potential switch.

- NEST and PP are two of the sponsors of the report, so I’m not expecting either of them to come out of it too badly.

Objectives

Here’s a summary of the learning objectives behind the report.

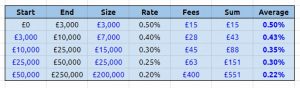

And here’s a fairly sad list of the benefits that employees look for from their employers.

- Pensions are only number five, way behind dental cover.

Here are the key review factors when looking at workplace pensions.

Investment management

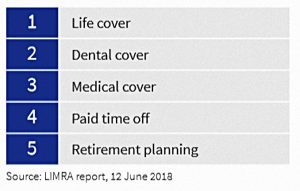

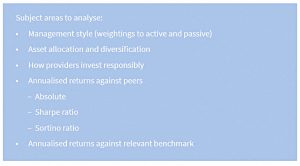

Here’s how Defaqto look at the investment management process.

And here’s their list of possible benchmarks:

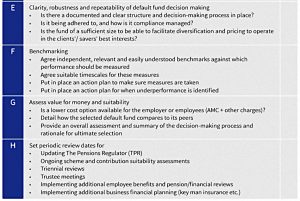

Due diligence

Here’s the final due diligence checklist.

Costs

Defaqto identify twenty possible sources of fees.

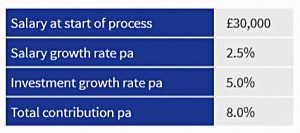

These are the assumptions they use when looking at the impact of fees.

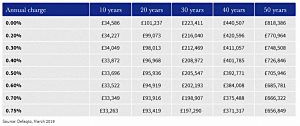

And here are the final pot sizes for various fee levels and time horizons.

- Over the long term, saving 0.5% pa can make a big difference.

Value for money

But there’s more to “value for money” than just costs.

Funds

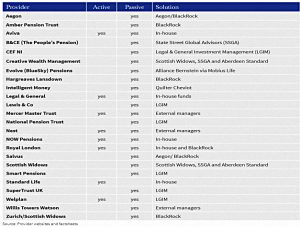

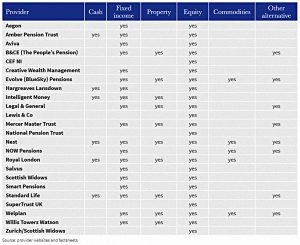

These are the default funds from the main workplace pension providers.

And here’s how they are implemented.

- PP use State Street and NEST use several external managers.

- NEST also offer active as well as passive funds.

NEST has a wider range of asset classes than PP.

Performance

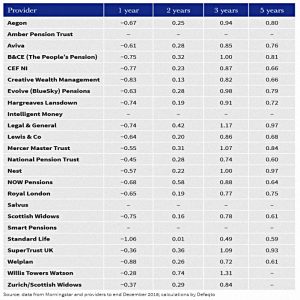

Both NEST and PP have good returns over three and five years.

They both have very good Sharpe ratios.

And good Sortino ratios.

Conclusions

Defaqto had different objectives to me, and their conclusions are not the same.

I came in hoping for a clear cut choice between PP and NEST, but it’s more nuanced than I would like:

- PP is a bit cheaper, but only on average by £60 a year.

- The breakeven point would be five years away (because of the employer set up fee).

- The PP fund looks slightly inferior to the NEST fund.

I think I’ll park this issue for now, and revisit it towards the end of the year.

- Until next time.

Hi!

Could I give your advice or furher update this article (if you can)? I am afraic the COVID19 could change on it since January.

I have been redundant because of the crisis and started to work as self-employed with UTR number. My gross earning per month about 640GBP now. I have NEST Retirement Date Fund and People’s pension from the previous employment.

I would like to add some money in my pension pot but I do not know which one is better?

Could you advice anything?

Thanks,

Regards,

Zsolt

I’m afraid I’m not authorised to give specific advice to individuals. This process would involve documenting your entire financial situation, including your long term goals and attitude to risk. “Better” depends on your particular circumstances.