Hamptons on Buy to Let

Today’s post looks at an old report from the property agency Hamptons on the state of the UK buy-to-let market in 2021.

The background

I came across this report on Twitter and found it interesting before I realised it was a couple of years old.

- The 2021 report is sub-titled “Has the door closed on buy-to-let?”

- We’ll catch up with the current (2023) report in a forthcoming post.

Although I’m not an investor myself, buy-to-let is always of interest because I meet so many people who swear that the path to riches is through property.

BTL was a great idea 20 years ago (when I almost got into it, but was distracted by romance), but it’s not so great now, for several reasons:

- House prices are up, so lots of gains have been made

- Interest rates are rising (this happened after the report was published), so the target yield to cover payments has increased

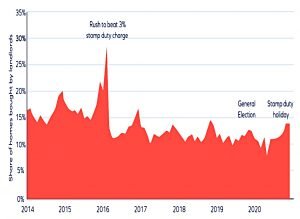

- Tax changes (discounting of interest fixed to 20% [Section 24] and a 3% surcharge on stamp duty) have impacted after-tax returns.

For me, adding in the hassle of dealing with tenants and the maintenance required on deteriorating physical assets means that BTL is too much like a real job for me.

- But what does Hamptons think?

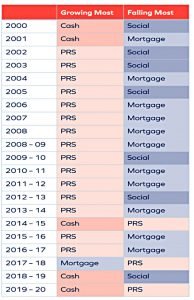

Typically, the tax changes have hit newer entrants rather than longer-established landlords. By the end of 2020, there were just under two million outstanding buy-to-let mortgages (both in personal and company names) in Great Britain and around five million privately rented homes.

So only 40% of BTL landlords are geared (compared with 46% of owner-occupiers).

- Even in 2020, 52% of BTL purchases were cash-financed.

This surprises me – without gearing, the returns on property are not great.

Another workaround is putting properties into a company, known as a special-purpose vehicle (SPV).

- SPVs work best for higher-rate taxpayers, those with multiple properties, and those with debt.

More companies were set up to hold buy-to-lets between 2016 and 2020 than in the preceding 50 years combined.

42K new SPVs were formed last year, up 23% from 2019.

The lettings market

Since 2016 weaker house price inflation, increased regulation and punishing tax changes have eaten into the profitability of buy-to-let for some landlords and the growth of the private rented sector (PRS) has slowed.

There are now 4.4M private rental households, down 250K from the 2107 peak, since when the total number of households is up by 700K.

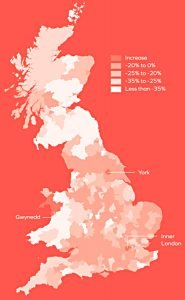

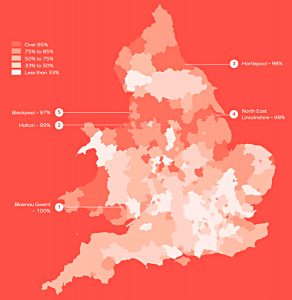

Low yields have made meeting affordability criteria (stress tests) for lending more difficult, which has in turn driven landlords further north (where property prices are lower and therefore yields are higher),

Landlords are now buying properties 40% further away from where they live. Offering the highest average yields, the North East remains the capital of buy-to-let, with one in four homes sold in the region last year bought by a landlord.

Covid

Since the report came out in 2021, there’s a section on the impact of Covid during 2020.

Last year around 23% fewer rental homes were marketed. By comparison, just 7% fewer homes were sold in 2020.

The recovery in rental activity post the first lockdown was focused in more affluent areas, where the impact of job losses was lower.

The maths

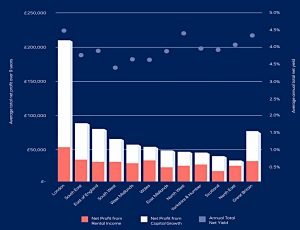

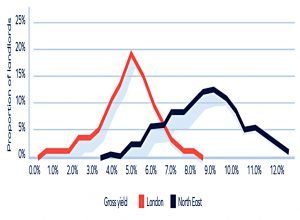

The table shows gross and net yields for a higher-rate BTL investor with a 75% LTV mortgage.

- Across the UK, the average house price was £190K, and the net yield was just 2.0% (down 14% since the tax changes).

Here in London, the net yield is just 1.2% (with a tax change impact of 20%).

- The best region is the North East, with a net yield of 3.3% (and a tax change impact of 11%).

My investing target would be 3% real, say 5% pa over the long term, so BTL doesn’t cut it for me.

- Add in the hassle of managing a BTL portfolio and things look even worse.

So you would need to be optimistic about future capital growth.

The report looks at the breakdown of returns to BTL investors.

The average landlord sold their buy-to-let for £78,010 more than they paid for it, having owned it for an average of 9.2 years. After maintenance or improvement costs, and when stamp duty and capital gains tax are added, the average 40% taxpayer landlord in Great Britain made a net profit of £43,340 after selling.

The figure is a lot higher for London, where property price growth had been strong in advance of the report.

The average landlord in Great Britain made a total net profit of £76,820 in 2020. This represents a 39% return on their initial investment, or an annual net yield of 4.3% after costs and taxes.

Again, the numbers are better in London (£290K or 4.5% pa, with 80% from capital growth).

- In the North West, returns were 4.4% pa, but 57% came from rental income.

These numbers are still a little bit low for me, and I expect capital growth to be lower in the coming decade.

Yield chasing

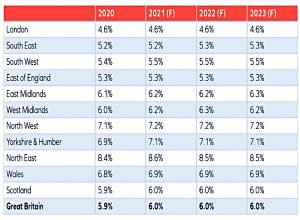

Hamptons expects the yield to become more important, for two reasons:

- capital growth will be lower going forward

- securing finance on lower-yielding properties will become more difficult as lenders incorporate full tapering of mortgage interest relief into their affordability calculations.

As the chart above makes clear, this will mean a focus on the North of England.

Hamptons has a few tips for new investors:

- More affluent areas rarely offer the highest yields. In general, cheaper places offer higher returns.

- While received wisdom suggests owner-occupiers should buy the worst house on the best road they can afford, this means investors end up paying a premium, too.

- Avoid competing with owner-occupiers. [This] can mean buying a home which needs more work doing to it.

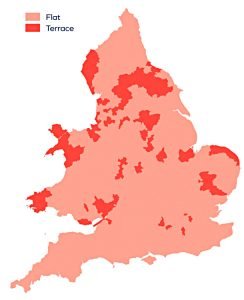

- Flats offer higher yields than houses [apart from some Midland and Northern towns]

- Buy smaller with fewer bedrooms.

- Working out who the optimal tenant is will ensure you can offer them exactly the right sort of space.

- Purchasing a property with a sitting tenant can mean avoiding a void period and receiving rent from the day of completion.

Build to rent

Build-to-rent (BTR – institutional construction for the PRS) has become more popular in recent years, but still only accounts for 1% of let homes.

- Hamptons thinks that the small landlord has little to fear from build to rent.

The build-to-rent model of the last decade has been to offer high specification city centre apartments with additional services that will command a rental premium. Ttenants who have bought into the model tend to be considerably more affluent than the average renter.

And growth will be slow:

Even if the market share increased ten-fold over the next decade, build-to-rent would still only account for 20% of lets agreed to tenants earning over £50,000, which equates to around 5% of homes let in the private rented sector last year.

Problems for small landlords would arrive when a high market share forced BTR operators to diversify into the suburbs at lower price points.

- Existing additional services (concierge, gym, co-working space etc) will be a harder sell in the suburbs.

But perhaps car hire, laundry and cleaning will take their place.

Forecasts

Hamptons are basically predicting that gross yields will b =e flat over the next three years.

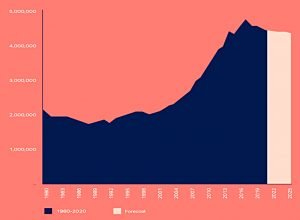

The number of PRS households peaked in 2016 before falling back slightly.

- Hamptons are predicting a further small contraction.

Coronavirus has shrunk the population of large cities across the world. Typically, those that have left have been the most mobile, living in neighbourhoods where most people rent. Some have left to buy, while others have returned overseas.

Which is a drag on the rental sector.

- Support was expected to come from low interest rate and therefore attractive rental yields (we now know this has changed).

Smaller investors who own up to a handful of properties account for more than 95% of all landlords.

These guys must now be reassessing their position.

That’s it for today – it’s been interesting stuff for someone like me who is sitting on the sidelines.

- We’ll be back soon with the lastest report to see how things turned up.

Until next time.