Category: Leverage

Improving Risk Parity

Today’s post looks at a couple of articles on how to improve Risk Parity portfolios.

Leverage for the Long Run

Today’s post is about a second paper from Michael Gayed on using Leverage for the Long Run.

HFEA 8 – Leveraged Neapolitan Portfolio and Factor Tank

Today’s post is another in our series on Leveraged Portfolios. We look at applying leverage to OP’s Neapolitan Portfolio and take a quick look at the Factor Tank Portfolio.

HFEA 7 – Leveraged Permanent Portfolio and Golden Butterfly

Today’s post is another in our series on Leveraged Portfolios. We look at applying leverage to Harry Browne’s Permanent Portfolio and to the Golden Butterfly Portfolio.

Concentration and Leverage

Today’s post looks at a paper from AQR on the choice between Concentration and Leverage.

HFEA 6 – Leveraged All Weather and Risk Parity

Today’s post is another in our series on Leveraged Portfolios. We look at applying leverage to Ray Dalio’s All-Weather and Risk Parity Portfolios.

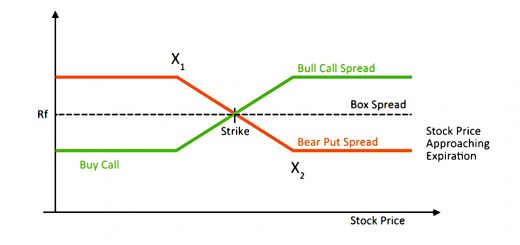

Box Spreads for Leverage

Today’s post looks at using options to create box spreads as a cheap form of leverage.