Speed in Trend Following – MAN

Today’s post looks at a recent paper from MAN Group on speed in trend following.

Today’s post looks at a recent paper from MAN Group on speed in trend following.

Today’s post looks at a recent paper from AQR on whether you should prefer tail risk protection that works in slow drawdowns or in rapid crashes.

Today’s post looks at some non-intuitive ideas around tail risk protection.

Today’s post looks at an old paper from State Street Global Advisors on Tail Risk Strategies.

Today’s post is about an update to an asset allocation paper we looked at last year – Hawk and Serpent, from Artemis Capital in Texas.

Today’s post looks at an article in the Hedge Fund Journal about the performance of trend- following in a crisis.

Today’s post is about crisis-proofing your portfolio.

Diversification / Crisis Alpha

by Mike Rawson · Published March 17, 2020 · Last modified July 8, 2021

Today’s post is about a paper on asset allocation called Hawk and Serpent – from Artemis Capital in Texas.

Today’s post looks at a report from a few years ago on how to handle large price drops in your stocks – it’s called Managing the Man Overboard Moment.

Reports / Factors / Crisis Alpha

by Mike Rawson · Published August 15, 2019 · Last modified May 14, 2020

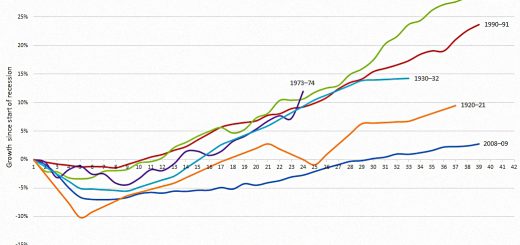

Today’s post looks at the potential impact of a recession or market crash on my portfolio, and what I might do about it. Let’s take a look at my recession playbook.

Defensive / Mike's portfolio / Crisis Alpha

by Mike Rawson · Published December 11, 2017 · Last modified May 14, 2020

Today’s post is a look at the steps you can take to protect your portfolio against a possible downturn.

UK budget breakdown – income and spending

UK budget breakdown – income and spending

Freakonomics 4 – Names

Freakonomics 4 – Names

Minervini 5 – Charts and Primary Bases

Minervini 5 – Charts and Primary Bases

Switch at the highs – Meb Faber

Switch at the highs – Meb Faber

Irregular Roundup, 8th July 2024

Irregular Roundup, 8th July 2024

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

Becoming a Lloyd’s Name

Becoming a Lloyd’s Name

Irregular Roundup, 1st July 2024

Irregular Roundup, 1st July 2024

Irregular Roundup, 15th July 2024

Irregular Roundup, 15th July 2024

NEST vs The People’s Pension

NEST vs The People’s Pension

More

Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.