Vanguard on Commodities

Today’s post looks at a report from Vanguard on the role of commodities in a portfolio.

Contents

Vanguard on Commodities

The paper was published in February 2023 and is titled “Commodity Investing and its role in a portfolio.”

- It looks at returns, correlations and diversification and the drivers of return, and in particular at the relationship between commodities and inflation.

Futures

Commodity ETFs buy futures contracts rather than physical commodities, and they collateralise their exposure. This means that their returns can be broken down into three components:

- Collateral return: usually a 3-month Treasury bill

- Spot return: an approximation of a physical commodity price change (based on near-maturity futures)

- Roll return: the price difference between the nearby contract being sold and the distant contract being bought.

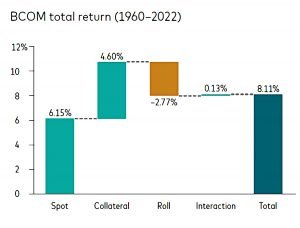

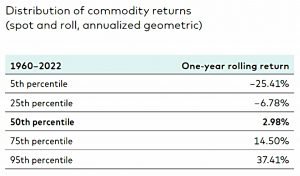

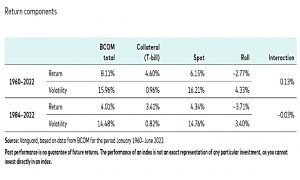

Historically, most positive commodity returns came from spot and collateral returns, while the roll component was negative. Investors should expect a positive long-term premium between 50 and 300 basis points.

Vanguard also split the history of the BCOM index into two periods – before and after 1984, when energy futures were first introduced.

Until 2008, return was one of the main reasons to include commodities as an asset class in an investor’s portfolio. The decade that followed that expansion brought capital destruction via a disappointing ‒6.8% annualized return. One of several reasons for the disappointing results was low inflation.

We’ll look at the link to inflation later.

Theory

There are two reasons for the positive expected returns from commodities:

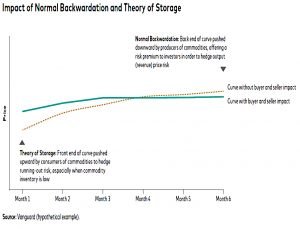

- Normal Backwardation

- Theory of Storage

Backwardation theory assumes that commodity producers hedge (lock-in) their future sales prices.

- This makes the volatility in future prices available to speculators (and processors and consumers) in return for a premium, in the same way that risk transfer through insurance leads to profits for insurance companies.

- Backwardation works to flatten the back end of the price curve.

Theory of Storage says that processors (buyers) push up the front end of the curve because they can’t afford to run out of raw materials.

Taken together the two theories lead to a flatter than expected price curve and a positive premium for investors.

Correlations

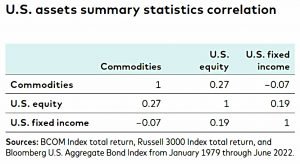

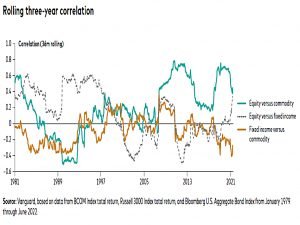

Commodities have low correlations with both stocks and bonds.

Looking at 3-year rolling correlations, the correlation with bonds has been relatively stable, but that with stocks has been volatile, ranging between -0.4 and +0.8

Commodities [are] not driven by discounting expected cash flows. Rather, [they are] directly affected by macro factors and current supply/demand dynamics.

Whether commodity and stock prices move in the same direction depends on whether commodities are being driven by a supply or a demand shock.

- [In] an economic slowdown scenario equities would be pressured by expected lower earnings and commodities would be driven down by lower demand.

- A recent supply shock is the Russian invasion of Ukraine. The expectation of Ukraine producing less grain drove wheat prices up significantly, whereas equities and bonds were not affected by this micro-commodity event.

Inflation

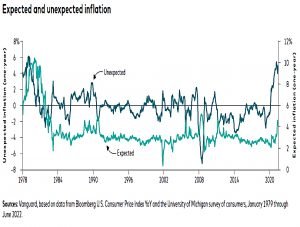

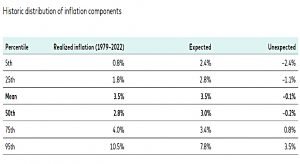

There are two kinds of inflation, expected and unexpected (or priced-in and surprise if you prefer).

- The report focuses on the impact of unexpected inflation, which can be damaging for traditional portfolios.

We decided on the University of Michigan survey of consumers to anchor inflation expectations. Unexpected inflation is therefore the difference between realized inflation and the survey’s expectation.

Unexpected inflation stays close to 0% whilst expected inflation is generally between 2% and 5% (note that the chart above has two vertical scales).

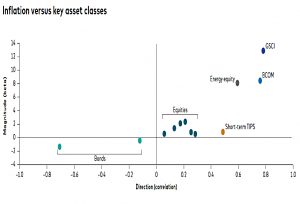

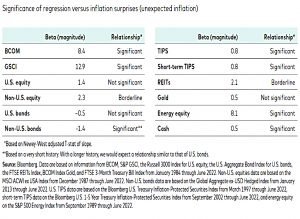

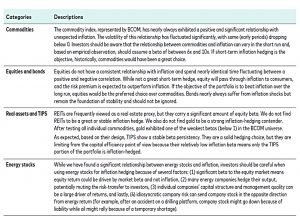

Bonds do not fare well during inflation shocks as they have a consistently negative correlation to unexpected inflation changes. On the other hand, commodities and energy stocks are very responsive and historically have provided a great buffer against inflation shocks.

This is not surprising because commodities are directly linked to the CPI basket. As of May 2022, nearly 43% of the Consumer Price Index for All Urban Consumers’ weight was linked directly or indirectly to commodities.

TIPS also have good inflation-hedging abilities.

Commodities in portfolios

The paper uses Vanguard’s own Asset Allocation Model (VAAM) to look at the effects of adding commodities to a strategically balanced portfolio.

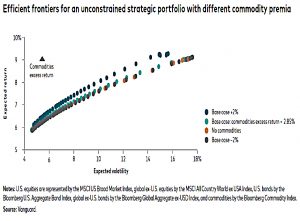

Adding commodities with the expected excess return of 2.85% (our base case) yields a marginally better risk-adjusted return than a portfolio without commodities. However, the difference is not significant.

In the case of positive excess returns (base case +200 bps), the efficient frontier shifts upward with a steeper curve and material commodities loading. In the case of negative excess returns (base case ‒200 bps), the frontier shifts marginally downward as the model decides not to load commodities.

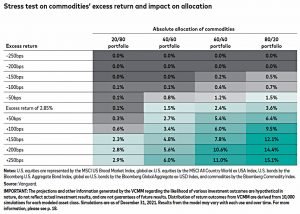

The optimum allocation to commodities depends on the underlying allocation to stocks and bonds (as well as the projected commodities return).

- For the neutral case of 2.85% excess returns from commodities, and the standard 60/40 stock/bond split, the allocation is 2.4%

For a conservative 40/60 portfolio, it falls to 1.5%, and for an aggressive 80/20 portfolio, it rises to 3.6%.

Inflation hedging with commodities

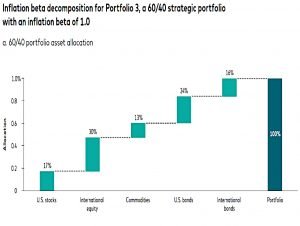

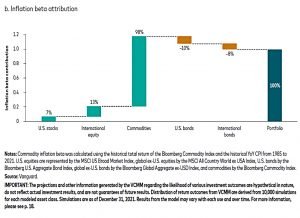

Inflation beta provides the most relevant measure of portfolio sensitivity for investors seeking to hedge inflation. It measures an asset’s predicted reaction to a unit of inflation.

Over the last three decades, commodities had a beta to inflation of about 6 to 10. This suggests that a small commodity position can offer outsized protection for the overall portfolio.

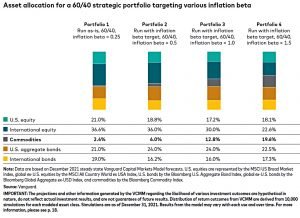

The report looks at a set of four portfolios based around 60/40, but with different target inflation betas (0.25, 0.5, 1 and 1.5).

If inflation rises 1%, we expect Portfolio 3’s value to rise 1% [it’s infaltion beta], helping to preserve wealth.

Optimal commodity allocation increases with target inflation beta, from 2.4% through 6%, 12.8% (for an inflation beta of 1) to 19.6%.

- These are high allocations – there will be few retail investors who are happy to allocate more than a few per cent of their portfolio to commodities.

For portfolio 3 (with an inflation beta of 1), some 98% of the inflation beta comes from the 12.8% allocation to commodities.

Unfortunately, inflation protection comes at the cost of lower returns.

While commodities offer protection against inflation, over the long run they have a lower risk premium than equities. Replacing equities with commodities in a strategic portfolio may result in underperformance compared to a market-capitalized portfolio.

Time-varying portfolios

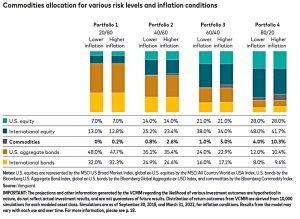

The optimal percentage of commodities in a portfolio will vary based on different inflationary and economic conditions.

Vanguard’s model adds more commodities to the underlying portfolios (20/80, 40/60, 60/40 and 80/20) in high-inflation scenarios and less in low-inflation scenarios.

The allocation for the “neutral” 60/40 raised to 5% in high-inflation conditions and falls to 1% under low-inflation conditions.

- For the aggressive 80/20, these numbers are 10.3% and 4%.

- For the conservative 40/60, they are 2.6% and 0.8%.

These lower allocations will be tolerable to more private investors.

That’s it for today.

- We’ve looked at the drivers of commodity returns, at how they can help diversify a portfolio and help with inflation.

The allocations required to fully inoculate against inflation (inflation beta = 1) are probably too high for private investors, but those from the time-varying portfolios (high vs low inflation) are more practical.

- Until next time.