Reasons to be Fearful – Elite Investor Club

Today’s post is about the Elite Investor Club’s Summit 2015, held on 7th November.

Contents

Elite Investor Summit

Last Saturday I attended the Elite Investor Summit at Sopwell House, Earl Mountbatten’s former country home just outside St. Albans.

I was given a free ticket by a friend who couldn’t make it. This was apparently worth £200, and there was a VIP level of ticket above my bog-standard one, priced at £300.

I wasn’t busy that day and the speaker line-up was interesting, plus there was a spa in the hotel to keep the girlfriend interested. ((I know lots of women love investing but my girlfriend isn’t one of them )) So I went along.

And do you know what, I enjoyed it.

Elite Investor Club

The Elite Investor Club is “the sophisticated investor network” run by Graham Rowan.

Graham styles himself the Renegade Investor and claims to be “the UK’s leading wealth coach for savvy investors who don’t follow the crowd”.

Graham has a new book out called Encounters with Investment Icons, and we were given a free copy at the show. It’s a series of interviews with figures from the UK finance industry. ((I couldn’t find the book on Amazon, so I’m afraid there’s no link ))

Graham’s website describes the club as “a global network of high net worth and sophisticated investors”, though at the event itself he stressed that investors at all stages of their journey towards financial independence were welcome.

The club offers three services:

- training and coaching

- access to “extraordinary” investments – these are unregulated, as Elite is not a IFA

- networking with like-minded “successful” people

There’s a free magazine called Wealth Watch that you can subscribe to as an Associate Member, but the regular membership level (which provides the access to the services) is £300 a year.

- There are monthly events in London and quarterly regional events.

- There’s a monthly online webinar and a video of an interview with an industry expert.

Elite’s investments

The investments on the club website are mostly property schemes, and often foreign, with a few “bonds” thrown in. I have more than enough property exposure already.

The 5-year bond available at the time of writing offered 9.85% interest for lending to “ethical payday lending companies in North America”. It came with a 4% upfront charge, and was ISA-eligible.

But it was only available to High Net Worth and Sophisticated Investors.

- High Net Worth Investors qualify in two ways:

- income of more than £100K pa

- investable assets of more than £250K outside your home and pension

- Sophisticated Investors qualify in 3 ways:

- already certified by an authorised financial institution

- director of a company with a turnover of more than £1M

- more interestingly, by being a member of the Elite Investor Club for 6 months and making two investments in unlisted equities

Elite suggest that the two investments could be made through CrowdCube, a crowd-funding platform. CrowdCube has a minimum investment of £10, so for £20 as an Associate Member of the club, you could pass as a Sophisticated Investor.

Regular readers will know that I’m not a fan of crowd-funding – it runs all of the risks of micro-cap investing without the tax advantages of AIM shares and VCTs.

To find out that it can be used as a gateway drug to the world of unregulated investments makes me even less fond of it. It’s time that a minimum investment level in the £000s was introduced.

The “Wealth Pyramid” flyer that was handed out at the show will give you a good overview of the type of things on offer from the club:

The numbers on the left are the amount of money than you need to invest, and those on the right are the returns that you can expect.

Structure of the day

The day was split into two parts:

- The morning sessions were entitled “Reasons to be Fearful”

- there were four speakers in the morning

- plus a panel session

- The afternoon sessions were called “Reasons to be Cheerful”

- there were five speakers in the afternoon

- plus a quick presentation from Graham himself on “the best unregulated investments”

In between the two sessions we had a nice buffet lunch (those with VIP tickets were whisked off to a side-room for lunch with the presenters) and afterwards there was an hour of free wine to lubricate networking. ((The catering was pretty good throughout the day – special mention goes to the chocolate french pastries that were available on arrival and at elevenses ))

There was also a small exhibition outside the main ballroom, with stands featuring some of the speakers flogging their books and training sessions, and some property investment exhibits.

This wasn’t a day of hard sell. The speakers were largely entertaining and informative.

But there was selling none the less. The morning’s speakers were from the doom and gloom camp, and we had the time at lunch to consider what we were going to do about the problems we faced.

In the afternoon the cavalry arrived, in the form of books, training, investment funds and unregulated investments. Things we could spend money on, to buy our way out of the doom.

And now, after a rather longer pre-amble than I had intended, on to the speakers. There were no handouts or slides, so I’ve had to rely on my scribbled notes.

Apologies for any gaps in the thought processes of the speakers for which I am responsible. Several of the speakers covered similar ground, so hopefully a more rounded picture will emerge from the talks as a whole.

Russell Napier

Russell Napier is an independent strategist and co-founder of ERIC, the Electronic Research Interchange, an online platform selling independent investment research.

He is on the board of a couple of investment trusts (Mid Wynd International and Scottish) and runs the Library of Mistakes, a business and financial history library in Edinburgh.

Russell was concerned with the potential for mean reversion in the Schiller CAPE, and Tobin’s Q, two valuation measures which currently indicate that the US stock market is overvalued.

CAPE uses a PE smoothed over the business cycle while Q compares stock values to the replacement value of the companies assets. ((We have mentioned previously a critique of the CAPE over long time periods – it only ever seems to give sell signals – even in 2009 – despite the long-term growth of the market ))

The CAPE is currently predicting real growth in US stocks of 2% pa (including dividends) over the next 15 years. This is very poor compared to the historic average of rolling 30 year returns from 1831-2001 of 6% real (best 10%, worst 3%).

- Russell is also worried about the threat to stocks from possible deflation, or inflation above 4% (historically, high inflation is bad for stocks).

- US corporate profit margins are also at historic highs, or over 30%, and “must come down”.

He’s not keen on bonds either. For the first time ever, bond returns over the past 30 years have beaten equities, so they will likely do worse in future.

Older people in the US are paying down their debts (saving more) so that they can retire. The US savings rate is closely linked to baby-boomer demographics.

Russell then moved on to the US current account deficit. Fifty percent of the world has its currency linked to the dollar, and their trading surpluses create the US deficit.

As the US deficit decreases, China will either have to slash wages or devalue its currency relative to the dollar. Russell is expecting a 30% devaluation, which will send a “wall of deflation” around the world.

He notes that the massive printing of money since 2009 has failed to create inflation. Globally inflation is still falling.

But governments need to generate inflation as old people (soon, the baby boomers) don’t want to give up their money. Inflation is the way that they are tricked out of it.

Russell had more to say about China:

- China can’t sell stuff to the increasing number of old people (demographics again) because they want services, not goods

- Chinese people think prices everywhere (even London) are cheap

- Inflows and outflows of money are growing in China

- China is becoming increasingly indebted

- Locals are pouring money out of the country, so it would be a bad idea for us to pour money into the country

Russell’s prognosis for the future was bleak. He expects that whatever solution the governments of the world come up with, it will have “something of the night” about it.

- He expects cash to be abolished, so that negative interest rates on deposits can be imposed

- He expects capital controls – limits and taxes on the amount of money that can be taken abroad – to be re-introduced

- This will drive up the price of gold

- Equities will have significant drawdowns

- Japan should do OK, if you are currency hedged

Tim Price

Next up was Tim Price, who amongst other things writes for MoneyWeek. He is also Director of Investment at PFP Wealth Management and co-manager of the VT Price Value Portfolio.

Tim’s talk was about Surviving Financial Repression (FR). Tim took his definition of FR from Gordon T. Long. I think this is the one:

Financial repression is not a conspiracy theory, it is rather a collective set of macroprudential policies focused on controlling and reducing excessive government debt through 4 pillars – negative interest rates, inflation, ring-fencing regulations and obfuscation – to effectively transfer purchasing power from private savings.

Quite a mouthful.

Tim expects the following to happen:

- negative interest rates (8 countries in Europe now have negative rates out to at least 2 to 5 years of the yield curve)

- competitive devaluation – currency wars

- helicopter money / more QE

- capital controls

What should we do about this?

- own non-electronic assets

- have cash at home

- hold physical gold and silver

- hold assets offshore

Tim is not a fan of buying consumer brands, as they don’t last. He put up a slide showing the top ten brands for the next decade as selected by Fortune magazine in August 2000 (six month after the dot-com bubble burst):

- Nokia

- Nortel

- Enron

- Oracle

- Broadcom

- Viacom

- Univision

- Charles Schwab

- Morgan Stanley

- Genentech

It’s not an inspiring list with fifteen years of hindsight.

The next topic was equity valuation. Tim’s favourite measure is Price to Book (PB), which currently suggests that US is expensive, but Japan is cheap.

In fact he likes all four measures from James O’Shaughnessy’s What Works on Wall Street:

[amazon template=thumbnail&asin=0070482462]

- Price to Book

- Price to Sales

- Price to Cashflow

- Price to Earnings

He’s particularly fond of the first two, which show greater historic outperformance.

The next topic was asset allocation. Tim likes Harry Browne’s Permanent Portfolio: ((We like this too, but when we looked at a variety of asset allocations, the El-Arian portfolio came out on top ))

- 25% stocks

- 25% government bonds

- 25% cash

- 25% gold

Dylan Grice calls this the “cockroach” portfolio, as it’s designed to survive anything.

The only thing that Tim would consider adding to this is an additional “uncorrelated asset”: trend-following funds.

Tim also agrees with us (and Warren Buffet) that risk is not volatility, it’s the threat of the permanent loss os purchasing power.

He also observed that “the role of the regulator in a crisis is to wait until the battle is over, and then shoot the survivors”.

Finally, he touched on demographics: the rise of the Asian middle class is the key secular change of the future. They will eventually be many times bigger than the middle class in Europe and the US combined.

James Ferguson

Third up was James Ferguson, who also writes for MoneyWeek, as well as working for the MicroStrategy partnership. His talk was on the effects of QE.

A financial crisis (negative lending) is not like a normal recession, and the recovery should not be expected to be the same.

QE fills the gap left by negative bank lending and prevents deflation. It won’t produce inflation so long as there is a deflationary environment. So QE has worked.

The basic purpose of QE is to pump money into the system, to recapitalise the banks. This happens at a rate of 1% to 1.5% pa, so a 7% to 8% hole should be plugged in 5 to 6 years.

- The US banks are fixed now, so no more QE is needed there, which means that the dollar should go up.

- European banks are not fixed yet, so more euro QE is needed, which means that the euro should go down.

Banks in UK and Europe are well behind those in the US and Japan in terms of crystallising their loan losses.

When interest rates finally rise, property loans are likely to go into deficit, and more of them will have to be written off. There is more bad news ahead for UK and European banks.

James put up a chart showing how QE drives stocks up in the US and the UK, and that the markets are flat in between periods of QE.

He pointed to the recent divergence between the US and he UK markets, but I couldn’t help feeling that this was at least in part due to the high commodities content of the FTSE 100 index.

Japan had already used the term QE for something else, so they call our version QQE. They only started this in 2012, and it drove the stock market up and the currency down. (Japan’s stock market had been lower in 2012 than in 2009.) These two effects cancel each other out.

Although the currency devaluation is easy to predict, it’s not easy to profit from as the currency markets move quickly (FX first, then bonds, then stocks).

QQE is also not as effective in Japan: their money supply is 2.5 times larger relative to GDP that the west. Also, their bonds are 50% owned by local banks already, which means that half of the effect of QE is wasted.

Combining both these factors means that Japan needs five times as much QE as the West.

James also warned against the “lifestyling” approach to retirement investing. At age 45 an investor might have 50% bond exposure, which is currently a very risky position. ((I have warned about this approach on several occasions – with people living into their 80s, equity allocations need to be kept higher for longer ))

QE should keep bond prices high (and yields low) so it’s the end of QE that bond holders need to worry about.

James moved on to talk about equity valuations, and mean reversion. Long term, the only thing that interferes with mean reversion in the stock markets is losing a war. Losing countries don’t do as well as might be expected.

James thinks that stock markets should trade at a total market cap of around GDP, with tram lines (cf. Bollinger bands) at 2 times GDP above and half GDP below. ((Note that market cap to GDP is a favourite measure of Warren Buffett ))

This suggests that the US is currently 60% over-valued, but the UK market is about right.

The FTSE also currently yields more than an annuity, which is another argument for still having lots of equities at age 55 or 60.

James thinks that UK house prices are around their long-term average relative to GDP. He doesn’t expect a crash outside London, and even London would need a rapid increase in interest rates for any serious impact.

Note that if house prices did fall by 10%, UK banks would be technically insolvent again.

Bonds are very over-priced (at close to 2 x GDP) and there could easily be a 30 to 35 year down market coming.

Harry Dent

The last speech of the morning was from Harry Dent, and it was about the looming demographic cliff (the title of his new book):

[amazon template=thumbnail&asin=1591847885]

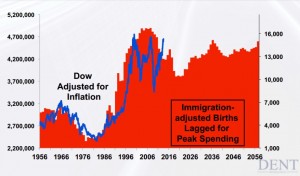

I’ve managed to find an old set of Harry’s slides – from 2013 – online, so this section of the article will be at least partially illustrated.

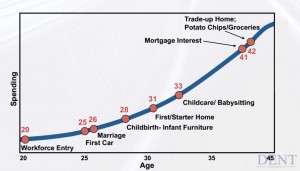

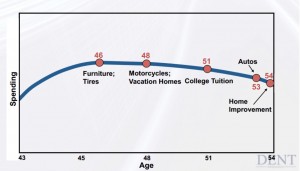

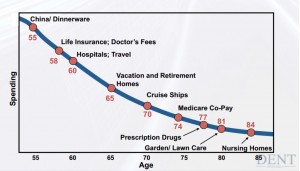

Harry believes in the power of consumer spending, and in how the changing habits of the baby boomer generation will drive economies.

US peak consumer spending is at age 46, with a high plateau from 39 to 54.

The baby boomers hit 46 (on average) in 2007, so the economy was bound to stall at that point. The boomers are now 54, and so an even more severe fall can be expected from now.

The economic slowdown should normally translate to a fall in the stock market, but QE has boosted this.

Inflation can be predicted by adding a 2.5 year lag to the growth in the labour force:

Young people cause inflation – they buy everything and produce nothing. It costs $250K to raise a kid in the US now. Old people cause deflation – they spend nothing and then die.

You can imagine the prediction for future inflation – it’s deflation in the US until 2023:

The UK won’t do too badly, as there is an “echo boom” coming after around 10 years of the downturn.

Germany and Southern Europe have worse problems coming than Japan in the 1990s. There is no precedent in Europe for the new generation being smaller than the last. Japan now has 8M vacant homes.

The best countries for the near future are:

- Australia, New Zealand, Norway, Sweden, Switzerland and Singapore

OK countries include:

- US, UK, Denmark, Canada and France

Countries with unfavourable demographics include:

- Germany, Japan, Southern Europe, China and Russia

Harry didn’t mention India, but I would assume that it has favourable

Different sectors have different prognoses, since the age of peak spending varies by product.

The demographics for car dealers are looking bad, and those for nursing homes are looking good.

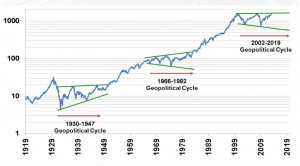

Harry also believes in macroeconomic cycles.

His four cycles are:

- 39 year generational

- 36 year geopolitical

- 45 year innovation

- 10 year boom and bust / sunspot

The slides I have are two years old, and then Harry was using the commodities cycle rather than the innovation cycle.

He believes that the 10 year boom / bust cycle is closely linked to the 8-13 year sunspot cycle – which affects UV levels and rainfall – comparing it to the “full moon” effect on accidents and murders :

The cycles are all badly aligned at the moment – they all point down until 2020.

Harry believes that we are at “peak internet” – almost everyone now has a smart phone and broadband. He rates email and Google search, but thinks that Facebook has a negative productivity impact.

He sees this as a symbol that the developed world has peaked, and that future growth is all about emerging markets. India will be the next big thing – China has already peaked in workforce terms.

He worries about global debt (286% of GDP – over 350% in UK and China, though the UK is supported by its large financial sector) and zero interest rates.

Harry expects falls in stocks and real estate of at least 40%. He sees the Down falling from 16,000 to 6,000. A lot of dollars will be destroyed, which should push up the dollar’s exchange rate.

As “dyers” outnumber “buyers”, property demand will fall, and prices will come back into line with rental yields.

Harry includes the UK in this, but I’m not sure how immigration, rising population and constrained supply factor into his analysis.

He thinks London property could go back to 1995. I bought my house that year, and I’m up 600% since then, so I think he is probably off-beam here.

And that concluded a doomy but interesting morning. After a pleasant lunch we came back for a more cheery but less interesting afternoon.

Justin Urquhart Stewart

Justin woke us up after lunch with an entertaining but light speech about how we would all probably muddle through.

I’d heard the same speech at the London Investor Show two weeks earlier, so I’m afraid it rather passed me by second time around.

He was gently pushing the smart beta funds he sells at 7 Investment Management.

Luke Lang

Luke is the boss of Crowd Cube, an equity crowdfunding platform founded in 2011. He now employes 70 people and £115M has been invested via the platform, £60M of this in 2015.

He has 225K investors, who are 60% “sophisticated” (see why in my rant against crowd-funding above) and 25% female (cf. only 3% of angel investors). Their average age is 42, they have a £70K salary and 6 years of post-age-16 education.

Translation: “come and join the sexy rich people”.

Three hundred businesses have been funded, with only 6% failures to date. But 60% of startups fail within 5 years, so either CrowdCube has great due diligence, or we just haven’t waited long enough yet.

They’ve just had their fist exit, a car club bought by Europcar for 300% profit.

Actual quote: “we’re making capitalism cool”.

The bad news is that the government plans to invest £5M through CrowdCube- via its London Investment Fund – in projects that have a “social and environmental” impact.

Luke then told a story – about a £1M investment made at midnight from a smart phone – that made me shudder.

To me, equity crowdfunding looks like a disaster waiting to happen.

Andrew Craig

Andrew Craig works for the financial education charity Plain English Finance. He has written a book call How to Own the World:

[amazon template=thumbnail&asin=1517254469]

Here’s where it gets a bit funny. Plain English Finance was set up by Graham Rowan – he’s the chairman – but there is no mention of this at the event.

The charity’s website has links not only to the Elite Investor Club, but also to another of the event’s speakers – Siam Kidd, the “Realistic Trader”. ((I’ll leave you to judge how realistic he is when I cover his talk further down the page ))

Siam teaches people FX trading, which is not what I would have expected from a financial education charity. Even more unexpectedly, Andrew turns out to be one of Siam’s students. ((He put his hand up for a roll-call during Siam’s presentation ))

Anyway, back to the talk. There was some decent stuff here.

The average UK wage is £27K, and for a £27K pension you need a £650K pot. The average UK retirement fund is £30K (£50K for men, only £10K for women).

But, if you invest £5K for 55 years (ie. you invest for your children) then at 10% pa compounded, you have £945K. It’s a somewhat ambitious and unrealistic scenario, but it illustrates the point.

Andrew’s big point is diversification – all assets, all geographies. He sees it as an updated version of the permanent portfolio we met earlier in the day.

He also likes smart beta, particularly equal-weighted indexes and the small company factor. He mentioned WisdomTree, but also plugged Justin’s 7 IM funds.

Mark Dampier

Mark is the investment director of Hargreaves Lansdown, which has 730K clients.

He has a book out, called Effective Investing:

[amazon template=thumbnail&asin=0857194674]

Here are a few bullet points from his chat with Graham:

- He doesn’t have much time for pundits and forecasters.

- We live in an age of information overload.

- The CAPE has only ever given one buy signal, so it’s not much use.

- He expects US rates to go up in December, but come back down again later.

- There will be no UK rise in 2016, but there will be more QE.

- He likes things to be 2 standard deviations cheap or expensive (cf. Bollinger bands) before he buys or sells.

- He expects a lifetime cap on ISA contributions or fund size to be introduced.

- Exotic and new things go wrong to often. He likes dividends, and tax-free dividends (VCTs).

And a few quotes:

Only trust people who have been successful with their own money, or even better, managing other people’s money

There’s not enough content to go around on the internet.

When an investment decision feels uncomfortable, it’s probably right.

The Government just wants you to have enough money to stay off the bread line.

I’m plain vanilla.

Siam Kidd

The last speaker of the day was Siam Kidd – the Realistic Trader – introduced by Graham as the man who made £420K in a day, back in August 2015.

Siam has been an FX trader for 12 years. For the first 6 years he lost money. He is not a day trader.

Siam believes that we are in for a “perfect economic storm” for the next 5 to 10 years. But never fear, disaster equals opportunity, and it is “very easy” to profit.

He had a complicated flowchart with lots of arrows spreading over several Powerpoint slides to explain how we would get there (to the storm).

Siam also believes that oil will be back at $100 a barrel within 18 months, and that the dollar will be replaced by the IMF’s SDR as the global reserve currency within 10 years.

Siam teaches people to trade FX – he can help you avoid his own 6 year learning curve.

He lost all credibility for me when he revealed his own portfolio:

- 97% silver

- 2% gold

- 1% FX trading float (presumably geared up with significant leverage)

His rationale was that the gold / silver ratio is way out of sync, and he sees rising industrial demand for silver as the Asian middle class expands.

Even if you buy all this, would your conclusion be “I must have 97% silver”? Would you want someone who does think like that to train you?

He showed lots of (winning) spread bet examples. His key technique seems to be using straddles to profit from movements in either direction.

He doesn’t believe in get rich quick, but he does think you can become rich in 6 to 7 years. That sounds quick to me.

He did make a nice point about compounding:

- 90% of the growth is made in the last 1% of the time, and 99% in the last 5%

I’m sure this depends on the growth rate, but there’s a real point in there somewhere. ((We noted a few week ago that 99% of Buffet’s wealth was made after he was 50 years old ))

Conclusions

It’s been a bit of a marathon today. Congratulations to anyone who’s made it this far.

A week ago I had no plans to attend an Elite Investor Club event, but I would go again with the right set of speakers.

But what a curate’s egg. Lots of provocative macro analysis mixed with selling of books, training courses and property investments.

I liked the speakers, the relaxed environment and the catering. I didn’t find anything that I wanted to invest in.

Until next time.

That was a very interesting post thankyou. You have to admire the set up. Charge people to attend. Throw bad news at them in the morning, feed and water them, let them stew a bit and then gently sell the solutions.

I always end up with the question “if X is so good at trading and predicting the future, why are they wasting time publishing books, selling courses, taking paid speaking jobs ? ” IF I was that good I would make my first billion pounds from trading and then do everything for free. We laugh at gullible dieters that follow the latest fads and “snakeoil” salesmen and seem blind to it in the financial world.

Thanks Stephen. I actually enjoyed the show, but the structure did gradually dawn on me.

I’ve never understood the trading courses either. I think the idea that there are “secrets” is daft. You can learn the basic rules from a book and then it’s down to your attitude.

Having just read this posting, I agree it is very interesting but share Stephen’s views on these events – crystallised by Siam’s predictions of Oil hitting $100 a barrel and where Silver has gone since the presentation (pretty much flat – a problem if you have 97% of your portfolio invested in the stuff!