London Forex Show – 20th February 2015 (2)

Today’s post is the second part of my review of the presentations in the main conference room at last week’s London Forex show at Olympia.

Contents

The presentations

In the previous post we looked at the first four presentations and today we will cover the last four.

The Lazy Trader

Rob Colville styles himself The Lazy Trader and his basic message is to get out of day-trading and into what he calls Lifestyle Trading. This is basically trading the daily to weekly timeframe.

He begins by quoting an anonymous broker: “90% of traders lose 90% of their trading account in 90 days.” He gives nine reasons for this:

- No strategy

- Relying on gut emotion

- Absence of Risk Management

- Always having to be in the market

- No patience or discipline

- Over-trading

- Trying to “get rich quick”

- Blind faith in pundits

- Buying into “magic bullet” systems and bots

Unsurprisingly, his solution is to do the opposite:

- trade a strategy with rules

- manage risk (1% of portfolio)

- only trade when the conditions are right (set-up appears)

- manage your expectations

- cut out the noise (news)

- don’t buy anything you don’t understand

His system ((Rob was selling a $250 mentoring / training subscription, discounted on the day to $100)) involves trading support and resistance levels that have held for at least 10 months, with at least two tests in that time.

He recommends using limit orders and trailing stop-losses – “set and forget”. His website contains video tutorials and an archive of weekly webinars.

It’s a simple approach with a lot to recommend it ((I don’t think that day-trading is for everyone)) but whether it’s worth paying money to learn about a simple long-term trend-following system I’m less convinced.

Kevin Ashby

Kevin (the former CEO of Capital Spreads and now chair of ztudium) describes himself with some justification as a Forex Insider. This is not to be confused with the Forex Insider newsletter we looked at in the previous post. Kevin began with a brief history of the retail FX industry.

Before 2005, the market was dominated by a few global players who could afford the costs of a proprietary trading platform. These groups offered “white label” services to the marketing entities who actually interacted with the retail client.

In 2005 the introduction of the MT4 platform reduced the cost of entry to £100K and many FX start-ups were formed offshore. MT4 now dominates to the extent that major players try to add value through differentiation rather than adopting MT4 wholeheartedly.

The FX business model ((like that of other leveraged products)) is based on the idea that retail clients lose money, and leverage accelerates this outcome. Thus Cost Per Acquisition (CPA) is a key factor. Regulatory capital requirements act as a brake.

FX brokers have moved from a “B book” model, where all trades are pooled and th e broker takes the net exposure, towards an “A book” model, where the basket is hedged with a third party. Some operate a hybrid model and some are fully A book.

Regulation varies by territory. The FCA in the UK is seen as one of the toughest regimes. MIFID allows brokers regulated in other EU countries to market into the UK without applying UK rules, so you need to check the small print.

Prices are based on a wholesale feed (either a single provider like Reuters, or an aggregated feed with best bid and offer) and then widened for the retail client. Prices are updated thousands of times a second so slippage is possible but if small it’s usually absorbed by the broker.

Client funds are segregated from the company’s capital, so should be safe. But they are aggregated across clients and so an event like the recent Swiss Franc shock will lead to large losses and a deficit.

This should be covered by the company’s capital but if excessive will lead to insolvency. The FSCS covers the first £50K of each client’s deposit in this situation and the remainder depends on the liquidation process.

Social Trading is a great idea for the future but stiff FCA regulation (the broker is held responsible for “non-mandated” trading by the experts you follow) means that the platforms are all non-UK. Other likely developments include social / news sentiment indicators, but again regulation makes it difficult to offer solutions which guide the retail client.

David Paul – VectorVest

David gave a presentation on some of his trading techniques. He does both intraday and swing trading. The former is based around indices and Forex and later also add FTSE-350 stocks.

He thinks that the three pillars of trading are:

- Method

- Money / risk management

- Managing yourself (psychology)

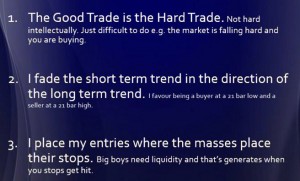

The slide below shows his three trading rules:

David trades a system called Turtle Soup +1, which requires a little history to explain. The Turtle Traders were a team of beginners taught to trade by Richard Dennis. They traded 20-day breakouts (in the direction of the trend). They are widely held to be the most successful group of traders ever.

In their book Street Smarts, Raschke and Connors introduced the concept of trading against these breakouts (Turtle Soup). Changing the 20-day breakout to 21-day gives Turtle Soup plus one. It’s very interesting that the opposite of a famously successful system can itself be successful. I will return to the Turtle Traders in a later post.

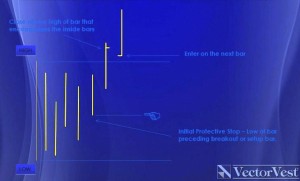

David also gives credit to William Gann, who almost 100 years ago wrote of a technique called “Lost Motion” which is similar to the 20-day breakout. The next slide illustrates this.

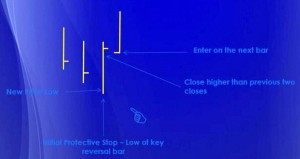

David also recommends candle patterns such as Doji, Morning & evening stars, hammers and shooting stars. He also likes bar patterns such as multiple inside bars (minimum 3 bars):

And multiple outside bars, and the two bar outside reversal:

David also mentioned Popguns, Arrows and the Three Drives formation. At the end of the slideshow there was an offer for a free 60-day trial of the VectorVest package.

Overall, it was a very entertaining presentation, but there was so much material for the time allowed that it was difficult to take it all in. The basic Turtle Soup +1 / Lost Motion technique was well explained though.

Darren Winters – Wealth Training Company

We first saw Darren’s presentation at the World Money Show in November 2014, and it hasn’t changed at all. I’m going to focus on the slide content, as this is the first time I’ve had access to them.

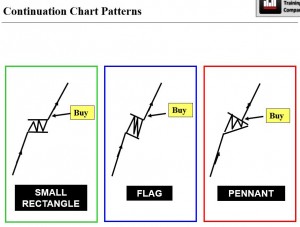

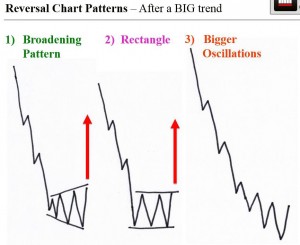

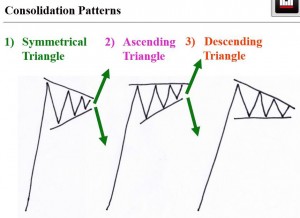

Darren began as usual with continuation, reversal and consolidation chart patterns:

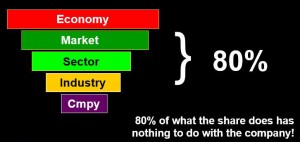

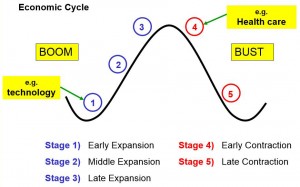

He then moved on to cover sector rotation;

Darren recommends using the FTSE Leaders and Laggards table to identify which stage of the cycle we are currently in. Alternatively, sector heatmaps can be used.

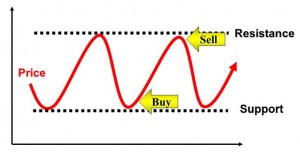

The third part of the presentation was about channelling – swing trading between support and resistance lines:

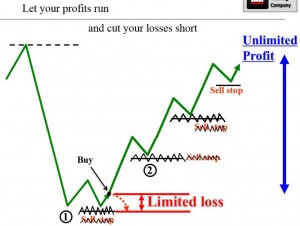

Darren advised traders to cut their losses and let their winners run:

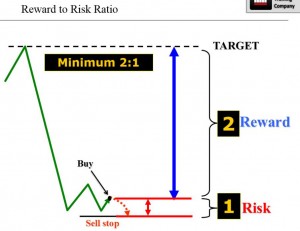

He also recommended looking for trades with a minimum 2:1 reward to risk ratio:

Darren concluded with his usual sales pitch for his training seminars, with the normal reduced on-the-day prices and the statement that he would personally be taking the next five courses to test new material (just as he was back in November).

Conclusions

And that was the end of my day-long webinar marathon. As with the first four presentations, while there have been some entertaining half-hours, I hadn’t seen a service I could recommend spending money on.

- The Lazy Trader and Wealth Trading Company presentations include lots of common sense, but offer no compelling reason to attend a course / take up mentoring. This stuff is better and more cheaply learned from books.

- The VectorVest presentation was great fun, but told me almost nothing about the service itself. I guess I’m supposed to take the free trial and see for myself. David did convince me to look into the Street Smarts book.

- Kevin Ashby’s presentation was useful background for someone like me who is new to FX.

I might tune in to the webinars again next year, but I doubt that I’ll go along to the show in person.

Until next time.