Amati on AIM stocks

Today’s post is a brief summary of a presentation on AIM stocks given by Amati Global Investors at the Retirement Money Show in June 2015.

I found the talk so entertaining that I wanted more people to know about it.

Contents

The AIM market

The AIM market has become more attractive to private investors since the stocks listed there were first exempted from stamp duty and then admitted to ISAs.

Success stories from many of the famous UK Private Investors also centre around stocks which are now AIM-listed.

7 Circles is never one to ignore a bandwagon, and we began our own portfolio of AIM stocks (called the SmallCap growth portfolio) back in Match 2015. You can read all our articles about it here.

We also recently wrote an article looking back on twenty years of AIM.

Amati Global Investors

Amati is an independent fund manager specialising in UK smaller-company funds, which include:

- two Venture Capital Trusts focused on AIM quoted companies

- a UK smaller companies fund (OIEC)

- selected AIM stock portfolios designed to reduce inheritance tax within ISAs

Douglas Lawson

Douglas Lawson is a Chartered Accountant who co-founded Amati following the management buyout of Noble Fund Managers in January 2010. Prior to this he worked as an investment manager in the private equity team at Noble.

Douglas has co-managed the TB Amati UK Smaller Companies Fund since 2009, and has been co-manager of Amati VCT since 2009 and Amati VCT 2 since 2010.

The presentation

After the usual disclaimers about the risk to capital from equities, and the impermanence of tax breaks (the IHT exemption and the 30% up-front and dividend income tax relief for VCTs), Douglas began with the structure and history of the market.

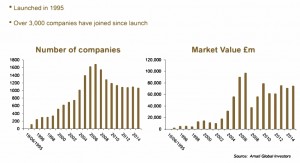

More than 3,000 companies have listed on the AIM market since it was launched in 1995, though not all have survived of course. The index of the market as a whole has a bad track record.

This is a market for stock-pickers, not for benchmarking. You must be wary of:

- over-priced stocks

- “next big thing”, blue sky stocks

- very small and illiquid stocks

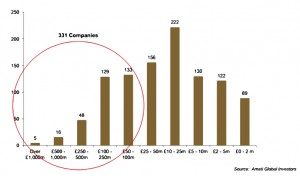

The market capitalisation of current listings varies from stocks under £2M, up to giants value at more than £1bn.

Amati restrict themselves to stocks above £50M ((As do we in the 7 Circles SmallCap Growth portfolio)) which gives them 331 companies to choose from.

Stock selection

Amati use seven measures when selecting AIM stocks:

- High barriers to entry

- Competitive advantage

- Revenue visibility and growth

- Pricing power

- Appropriate Financing

- Positive Company Culture

- Business Momentum

And there are eight things they try to avoid:

- Aggressive accounting

- Lumpy, irregular income

- Strong competitive threats

- Unexpected cash calls

- Excessive liabilities

- Weak company culture

- Sinking Ship

- Fashion stocks

The AIM Car Showroom

The remainder of the presentation was built around a car showroom metaphor. Amati distinguish seven brands of AIM vehicle:

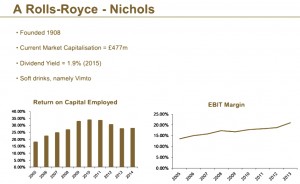

- Rolls Royces (IHT service)

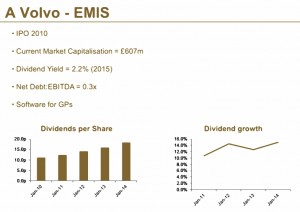

- Volvos (VCT, IHT service)

- Mini Coopers (VCT, IHT service)

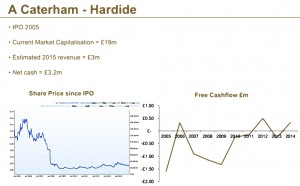

- Caterhams (VCT)

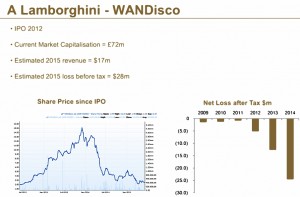

- Lamborghinis

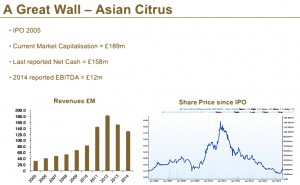

- Great Walls (Chinese copies)

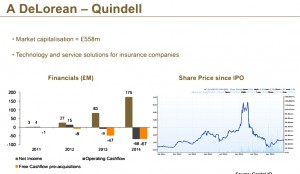

- DeLoreans

Sadly Douglas’ slides don’t entirely explain the characteristics required for a firm to fall into one category or another.

He does provide plenty of examples however, and makes it clear which categories Amati are interested in:

- The Amati AIM IHT Portfolio Service focuses on Rolls Royces, Volvos and Mini Coopers, and has a weighted average market capitalisation of £254m per company.

- The Amati Venture Capital Trusts focus on Volvos, Mini Coopers and Caterhams, and have a weighted average market capitalisation of £122m (Amati VCT) and £139m (Amati VCT 2) respectively.

The interesting stuff

Rolls Royces are quality companies that are perhaps now too expensive to buy.

Volvos are also quality, reliable companies, but less expensive than Rollers.

The bad stuff

I hope you found the presentation as instructive and interesting as I did.

Until next time.