Energy price cap

Today’s post looks at the energy price cap announced this week by new PM Liz Truss.

Contents

What is the cap?

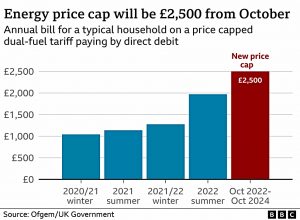

The cap (called the Energy Price Guarantee) is a limit on unit charges such that the average household will pay £2,500 pa for energy from October this year.

- If you use more than the average household, you will pay more than £2,500.

- If you use less, you will pay less.

There is no cap on individual usage or charges.

There’s a similar deal available to businesses and public sector bodies like schools as well.

How long will it last?

The cap begins on 1st October and lasts two years for households.

- The deal for businesses only lasts for six months.

After that, those sectors “most at risk” will be helped (Liz mentioned hospitality and manufacturing).

How good a deal is this?

The current price cap is £1,971 pa and the projection for October was £3,549 pa, so this is a slight increase from current prices, but a massive saving against future costs.

- Estimates for January 2023 were above £5,000 and for April 2023 were around £6,000.

At the same time, the cap is around double the rate for the same time last year.

- This means that the price signal to reduce consumption remains to a certain extent.

What about the green levies?

The £150 green levies have gone for now, but the savings are included in the price cap.

What about the Sunak support?

The previously announced £400 payment (the Energy Support Scheme, paid as £66 a month over the winter months) is staying.

- So the real cap is £2,100 – much closer to the current level (around 6.5% higher on average).

This implies that the squeeze on consumer spending will be small, and any recession potentially shallower.

- The cap on energy prices should also help to bring down inflation, which will in turn save the government money on interest payments on inflation-linked gilts.

And it might even mean that UK interest rates don’t need to rise as much as they might have done.

The extra £650 to those on benefits will also still be paid out (half of this has been paid already).

- There’s also £150 for those with disabilities and £300 for pensioners.

If prices remain above the cap next winter, no doubt these payments will be repeated.

What about VAT?

VAT was not reduced, though we have the Chancellor’s fiscal statement (( It’s no longer being called a Budget as this bypasses some parliamentary red tape)) to look forward to.

What about people not on gas?

Something similar is promised for those on LPG and heating oil (presumably via direct payments), but there are no details.

- People who pay caravan park owners and other landlords for their energy should benefit from the support to businesses.

What about fixed tariffs?

The initial reaction was that those on fixed tariffs would be able to move back to variable at no cost.

- Martin Lewis later said that fixed tariffs will have the same per pound unit rate reduction as variable tariffs (around 30% off), which would mean that only those who fixed very recently would need to move back.

Are there any other changes?

The new administration plans to grant up to 100 new oil exploration licences, and a new Energy Supply Taskforce will negotiate revised long-term contracts with suppliers to reduce charges.

- At the moment all suppliers get the highest rate, so when gas is pricy, renewables are very profitable.

Pooling by production type could lower overall costs.

- Contracts will probably be reasonably generous in the long run, in order to offset the short-term hit to profits.

There’s also a new £40 bn liquidity facility to help suppliers deal with cash flow crises arising from volatile commodity prices.

The commitment to Net Zero by 2050 will be reviewed so that it can be delivered ” in a way that is pro-business and pro-growth”.

- The ban on fracking has been lifted and nuclear power will be expanded, with a target of 25% of the total electricity supply by 2050.

Another target is to make the UK a net energy exporter by 2040.

How much will it cost?

We don’t know yet, but estimates are in the £100 bn to £150 bn range (or even more if support to business is extended).

- Not exactly chicken feed.

We’ll find out more in the fiscal statement.

Who pays for all this?

Initially, the payments to energy suppliers to keep prices low will be funded from the government deficit for the current tax year, and then added to the national debt.

- Further down the road, taxpayers will need to pay the money back, but how fast is not clear (and of course, this impacts exactly which set of taxpayers will be stung).

What there won’t be is a windfall tax on oil and gas companies.

- Although I’m in a minority, I think this is the right approach, as extra tax in the good years will discourage investment, and I think we will need to extract more oil and gas in the future than is the consensus view.

What did Liz say?

Announcing the cap, Liz Truss said:

This government is moving immediately to introduce a new energy price guarantee that will give people certainty on energy bills. It will curb inflation and boost growth.

This guarantee – which includes a temporary suspension of green levies – means that from 1 October, a typical household will pay no more than £2,500 per year for each of the next two years while we get the energy market back on track.

This will save a typical household £1,000 a year. It comes in addition to the £400 energy bills support scheme. This guarantee supersedes the Ofgem price cap and has been agreed with energy retailers.

Addressing the energy market reforms. she added:

Renewable and nuclear generators will move on to contracts for difference, to end the situation where electricity prices are set by the marginal price of gas. [This] will mean that generators are receiving a fair price reflecting their cost of production, further bringing down the cost of this intervention.

Introducing the new liquidity function, she said:

This will ensure that firms operating in the wholesale energy market have the liquidity they need to manage price volatility. It will stabilise the markets and decrease the likelihood that energy retailers need our support like they did last winter.

By increasing supply, boosting the economy and increasing liquidity in the market. We will significantly reduce the cost to Government of this intervention.

Conclusions

I’m not a fan of interventions in free markets, but the UK retail energy market isn’t free.

- The existing mechanism for setting the price cap (as a constant price across all producers) doesn’t make sense to me, so I’m glad to see that go.

I also think that the level of the cap is reasonable, as it preserves some of the price signal that should reduce consumption.

- The plan should reduce inflation, make the forthcoming recession more shallow and lead to a lower peak in UK interest rates.

So it’s a tentative thumbs up from me.

- Until next time.

Martin Lewis’s clarification re Fixed Tariffs sounds interesting.

However, I doubt it really means what it says; taken literally I read it as saying there will be savings for all tariffs – even if they are below the current OFGEM cap.

I guess time will tell!

In any case, thanks for highlighting this.