Jim Rogers – Value and Hysteria

Today’s post is a profile of Guru investor Jim Rogers, who appears in Jack Schwager’s original Market Wizards. His chapter is called Buying Value and Selling Hysteria.

Contents

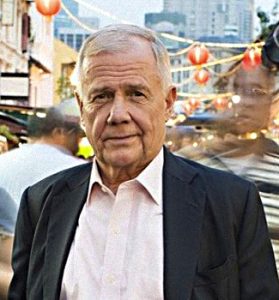

Jim Rogers

Jim Rogers appears in Jack Schwager’s original Market Wizards.

- His chapter is called Buying Value and Selling Hysteria.

According to Schwager:

Jim Rogers began trading with $600 in 1968. In 1973, he formed the Quantum Fund with George Soros. In 1980, Rogers retired.

In practice, he became an independent trader and started to teach classes at Columbia.

Rogers didn’t want to be interviewed by Schwager as he didn’t consider himself to be an expert trader.

I think of myself as someone who waits for something to come along. I wait for a situation that is like the proverbial “shooting fish in a barrel.”

I often hold positions for many years. Furthermore, I’m probably one of the world’s worst traders. I never get in at the right time.

Early days

After college, Rogers got a summer job on Wall Street.

- He started trading when he went to graduate school in Oxford (1964-66).

Then he was in the army for a couple of years, and then he went back to Wall Street as a junior analyst.

In January 1970 he became convinced there would be a bear market, so he bought put options.

- He tripled his money at first, but by September he was wiped out.

I saved everything I had and put it back into the market. I didn’t care about a TV or a sofa. The wife got rid of me.

Since then–I don’t like to say this kind of thing–I have made very few mistakes. I learned quickly not to do anything unless you know what you are doing.

I learned that it is better to do nothing and wait until you get a concept so right, and a price so right, that even if you are wrong, it is not going to hurt you.

Rogers hasn’t had a losing year since.

Soros

In 1970, I went to work for [Soros] at Amhold and S. Bleichroeder.

We left in 1973 because new brokerage firm regulations did not allow you to get a percentage of the trading profits. We left and started our own firm.

That was the Quantum fund.

We invested in stocks, bonds, currencies, commodities, everything – long and short – all over the world. It certainly was unique.

I still don’t know anybody who trades all the markets. I don’t see how you can invest in American steel without understanding what is going on in Malaysian palm oil. It is all part of a big, three-dimensional puzzle that is always changing.

He was the trader and I was the analyst. Usually if we disagreed, we just did nothing. There were no rules. Sometimes we would disagree and do the trade anyway, because one of us felt more strongly.

Until we ran out of money, we were always leveraged to the hilt. When we bought something and ran out of money, we would look at the portfolio and push out whatever appeared to be the least attractive item at that point.

Value

Whenever I buy or sell something, I always try to make sure I’m not going to lose any money first. If there is very good value, then I’m probably not going to lose much money even if I’m wrong.

[But] you always need a catalyst to make big things happen.

Patience

One of the best rales anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do. Most people always have to be playing.

I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. You should sit there until you find something.

Hysteria

Sometimes the chart for a market will show an incredible spike either up or down. You will see hysteria in the charts.

When I see hysteria, I usually like to take a look to see if I shouldn’t be going the other way. I wait until the market starts moving in gaps.

Just about every time you go against panic, you will be right if you can stick it out.

News

The market is going to go higher than I think it can and lower than I think it will.

I had a tendency to think that if I knew something, everybody knew it. What I now know is that they don’t know what I know. Most people don’t have the foresight to look six months, one year, or two years out.

It is amazing how sometimes something important will happen, and the market will keep going despite that. Just because I see something doesn’t mean that everyone sees it.

A lot of people are going to keep buying or selling just because that has been the thing to do. If the market keeps going the way it shouldn’t go, especially if it is a hysterical blow off, then you know an opportunity will present itself.

Options

I don’t buy options. Buying options is another fast way to the poorhouse. Someone did a study for the SEC and discovered that 90 percent of all options expire as losses.

Well, I figured out that if 90 percent of all long option positions lose money, that meant that 90 percent of all short option positions make money. If I want to use options to be bearish, I sell calls.

Shorting

Whether I am bullish or bearish, I always try to have both long and short positions – just in case I’m wrong.

Even in the best of times, there is always somebody fouling up, and even in the worst of times, there is somebody doing well.

I feel more comfortable having the protection of some short positions.

Scapegoating

Politicians and people who lose money always look for scapegoats. In 1929, they blamed the crash on short sellers and margin requirements.

In the 1987 crash – which Schwager discussed at length with Rogers, since it was still recent at the time of the interview – people blamed program trading.

Cycles

It’s always the same cycle. When a market is very low, there comes a time when some people buy it because it has become undervalued.

The market starts to go up and more people buy because it is a fundamentally sound thing to do or because the charts look good.

In the next stage, people buy because it has been the thing to do. My mother calls me up and says, “Buy me XYZ stock.” I ask her, “Why?” “Because the stock has tripled,” she answers.

Finally, there comes the magical stage: People are hysterical to buy, because they know that the market is going to go up forever, and prices exceed any kind of rational, logical economic value.

The whole process then repeats itself on the downside. The market gets tremendously overpriced and it starts to go down.

More people sell because the fundamentals are turning poor. As the economics deteriorate, more and more people sell.

Next, people sell just because it has been the thing to do. Everybody knows it is going to go to nothing, so they sell. Then the market reaches the hysteria stage and gets very underpriced.

That’s when you can buy it for a pop. But for a long-term investment, you usually have to wait a few years and let the market base.

Paper losses

There is no such thing as a paper loss. A paper loss is a very real loss.

Technical analysis

I haven’t met a rich technician. Excluding, of course, technicians who sell their technical services and make a lot of money.

I look at [charts] every week. I use them for knowledge, to see what is going on. I learn a lot about what is going on in the world by looking at charts.

But you don’t ever look at charts and say, “I’ve seen this type of pattern before and it usually means the market is topping.”

I look at charts to see what has happened. Not what will happen.

I guarantee that you can go back 100 years in the market and not find a single decade where there hasn’t been some kind of system, some kind of new formula developed to play the markets.

So the markets today are basically the same as the markets in the 1970s, 1960s, and 1950s. The same as the markets in the nineteenth century.

The same things make markets go up and down. They have not changed the rules of supply and demand.

Principles

- Good investing is really just common sense.

- But it is astonishing how few people have common sense – how many people can look at the exact same scenario, the exact same facts and not see what is going to happen.

- Ninety percent of them will focus on the same thing, but the good investor will see something else.

- Always invest against the central banks. When the central banks try to prop up a currency, go the other way.

- The market is nearly always wrong. I can assure you of that.

- You have to learn to go counter to the markets. You have to learn how to think for yourself; to be able to see that the emperor has no clothes.

- Most people can’t do it. Most people want to follow a trend.

- A trend that is economically justified is different.

- You have to see the supply/demand balance change early, buy early, and only buy markets that are going to go on for years.

- The world is always changing.

- Be aware of change. Buy change.

- You should be willing to buy or sell anything.

- You should be flexible and alert to investing in anything.

- Don’t do anything until you know what you are doing.

- Wait for something to come along that you know is right.

- Then take your profit, put it back in the money market fund, and just wait again.

Conclusions

That’s it – another fascinating chapter looking at an investment legend.

- And there are more lessons for the private investor than I would have expected.

Schwager says:

Jim Rogers’ unique approach may be difficult to emulate in its entirety, but many of his trading principles are of great relevance to all traders.

Here are the Rogers rules:

- Buy value.

- That way, you will not lose much even if your timing is wrong.

- Wait for a catalyst.

- Markets can go nowhere for long periods.

- Sell hysteria.

- Easier said than done.

- Even if you can predict long-term macroeconomic trends, you also have to be able to sit tight against the hysteria until it breaks.

- Be very selective – wait for the right trade to come along.

- This is easier to do once you have made your money, which Rogers did pretty young.

- Be flexible.

- Be prepared to trade any market, and to go short.

- Never follow conventional wisdom.

- I’m not so sure about this one, as it seems to be a warning against trend-following, which works.

- Contrarians are wrong most of the time.

- Know when to hold and when to liquidate a losing position.

- Another one that is easier said that done, but I think that Rogers means that you should get out when your thesis is wrong, but stick with your position if simple hysteria is moving the market against you.

- Which still makes it hard to implement.

Until next time.