Tech Stocks 2 – Spread Bets

Today’s post is a long-overdue update on the construction of a Tech stocks portfolio.

Tech stocks

Way back in April, we started looking at building a Tech stocks portfolio.

- Most of the stocks involved were from the US (19) rather than the UK (4).

- And there was an additional wish list of non-UK, non-US stocks that we didn’t think that we could find information on, or easily trade.

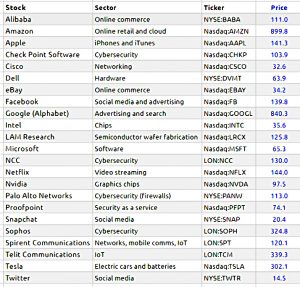

Here’s how our list looked back in April (23 stocks):

We had been planning to come back to this in May, but life intervened.

- Oh, the gains we have forsaken in the meantime.

Anyway, now we’re back.

Non-US, Non-UK

A little more effort has shown that Google data is available on the 10 non-US, non-UK stocks:

- The HK, FRA and KRX exchanges are available directly.

- For Tokyo and Shanghai we have to use ADRs in the US.

So now we have “shortlist” of 33 stocks:

This is sorted in descending order of recent gains (20 trading days, or one month).

- I propose to remove Telit from the list because of its recent scandals.

Of course, Google data being available doesn’t mean that the stocks will be easily tradeable.

- I’m planning to use IG spread bets to access these tech firms, but we’ll cross this bridge later.

Recent articles

Since the earlier post, quite a few articles have been published on this topic.

- So let’s see if we can make our shortlist any longer.

Ben Judge had an article on data-mining in MoneyWeek.

He mentioned a lot of stocks that are already on our list:

- Amazon

- Microsoft

- Google (Alphabet)

- Baidu

- Tencent

- Alibaba

- Cisco

There were three new stocks to add:

- Hewlett Packard Enterprise (NYSE: HPE)

- Splunk (Nasdaq:SPLK), and

- Hortonworks (Nasdaq HDP)

Frederic Guirinec wrote about listed incubators and accelerators, and came up with six:

- IP Group (LON:IPO)

- Touchstone Innovations (LSE:IVO, now merged with IPO)

- Allied Minds (LSE:ALM)

- Rocket Internet (FRA:RKET)

- LVenture Group (Milan:LVEN)

- NetScientific (LSE:NSCI)

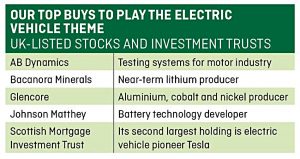

Daniel Coatsworth looked at how to invest in “the electric vehicle revolution“.

- This was a wide ranging article that mentioned a lot of stocks that are either blue sky or only tangentially involved in electric vehicles.

I’ve added the following stocks:

- AB Dynamics (LON:ABDP)

- Bacanora Minerals (LON:BCN)

- Johnson Matthey (LON:JMAT)

- Albemarle (NYSE:ALB)

David Kempton looked at stocks for the “power revolution“.

- One was Bacanora, mentioned above.

The other two were:

- ITM Power (LON:ITM – hydrogen for fuel cells), and

- RedT Energy (LON:RED – batteries from vanadium).

I also came across a couple of stocks on the Stockopedia discussion boards:

- Intuitive Surgical (NASDAQ:ISRG) – surgical robots

- Mazor Robotics (NASDAQ:MZOR) – also surgical robots

And after completing the first draft of this article, I came across an article on Business Insider about a report from HSBC on how to invest in AI and the robot revolution.

They had a number of additional stocks:

- Emerson Electric (NYSE:EMR)

- Parker-Hannifin (NYSE:PH)

- Salesforce dot com (NYSE:CRM)

- Rockwell Automation (NYSE:ROK)

- Honeywell (NYSE:HON)

- NXP Semiconductors (NASDAQ:NXPI)

- Fortive (NYSE:FTV)

- Broadcom (NASDAQ:AVGO)

And when the list was 49 stocks, I also added IBM – for sentimental reasons and to make the list up to 50 (at the time).

ETF and Investment Trusts

We can also play the tech trend via funds and trusts.

The obvious generalist investment trust is Scottish Mortgage (SMT), which holds most of the FAANGs.

David Stevenson recently looked at the main holdings of this trust.

Many were still private, but there was one listed stock that was new to me:

- Illumina (NASDAQ:ILMN) – Genetic sequencing

There are also a few dedicated Technology trusts:

- Herald (HRI)

- Allianz (ATT)

- Polar Capital (PCT)

Amongst ETFs, there are:

- ISE Cyber Security (ISPY)

- iShares Digitalisation (DGTL)

- iShares Automation and Robotics (RBOT in $, RBTX in £)

- Robo Global Robotics and Automation (ROBG in £ – ROBO is a $ version)

So that’s eight funds in total.

Conclusions

By my count, we should now have eight funds and 58 stocks to play with.

- In practice, my list of stocks has 63 entries.

- I think I must have added a few more UK stocks without keeping track.

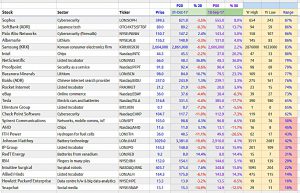

Here’s how the list looked when there were “only” 50 stocks.

- It’s in descending order of position within yearly price range:

Since then I’ve added the stocks from the HSBC article.

- I’ve also started to rank stocks on momentum, using a 3-month sampled moving average.

While the bull market party continues, I will treat the stocks as momentum plays, investing via spread bets.

- When the party ends – who knows when – I’ll look to buy into the funds and some of the bigger firms as longer-term investments.

I’ll be back in a few weeks with an update on which stocks I bought.

Until next time.

Hi Mike – wondering if LON:XPP crossed your radar during this research. It’s served me well in the last year or so – possibly making it a tad expensive now.

Afraid not, though it looks a decent stock – it’s on my main market watchlist, but I can’t remember ever owning it.

Tricky to know where to draw the line with tech – what global market share does XPP have in its niche?

I should also say, I’ve been mostly concentrating on the US tech stocks over the last few weeks.