The Turtle Traders #5

Today’s post is our fifth look at the Turtle Traders, and our third visit to Michael Covel’s book on the subject.

The group

In our last visit to Michael Covel’s book we covered the Turtle system itself.

- Today we focus more on group dynamics.

Chapter six starts with a discussion of who can be counted as a “true Turtle”.

- The gist is that some people learned the rules without (a) answering the ad (b) trading Dennis’ money or (c) either.

Once their training was complete, the Turtles were essentially unsupervised.

We might have seen Rich, Bill, or Dale once a week on a Friday afternoon for two hours.

They would walk in and say, How did you guys do this week? Anybody have any questions? That was it.

If one of the Turtles did not follow the rules, Dennis and Eckhardt, who reviewed their daily statements, would call up and ask for an explanation.

Covel once again stresses the diversity of the group – educationally, politically, ethnically, religiously.

- The key takeaway is that people from all kinds of back grounds could learn to apply the Turtle rules.

He also notes that the Turtles has a lot of free time, since trend systems don’t usually generate signals every day.

They were not expert traders out of the gate – far from it. The first- year class was down 50% percent each on average six months into the program.

Allocations

Behind the scenes Dennis was making unequal allocations to his students. His action created tension within the ranks, but no one was about to complain openly. After all, they, were making more money than they ever had before.

With different amounts of money being allocated, the Turtles started to earn wildly different amounts.

Midyear, when the Turtles in the first class were all in the red, Dennis came in and said that they were all trading well. He then increased their equity. This made no sense to the Turtles.

Some Turtles spoke up about the allocation of money. Some of the biggest losers were given even more money to trade. Many Turtles thought Dennis was subjectively guessing who was going to be a great trader, as opposed to letting the actual trading results dictate greatness.

Things came to a head with Jeff Gordon:

[In 1986] I produced plus 65 percent that year without a double- digit drawdown.

Dennis wanted “big rewards” (absolute returns), not a “decent” risk- adjusted return.

- He decreased Gordon’s allocation and his incentive fee.

It’s possible that this was down to a political falling-out – Dennis was very left-wing, and Gordon was not.

- The same issue cropped up with Jerry Parker.

Gordon was not happy:

After that I wasn’t terribly enthusiastic about remaining in the Turtle program.

But he had signed a contract to trade exclusively for Dennis for five years.

- Nevertheless, he left in July 1987.

Faith

It became apparent that the Turtle who got the largest allocation of all was purportedly not following Dennis’s rules.

This was Curtis Faith, who despite erratic trading:

had perhaps half the money in the program at one point. He’d have great months, but he took enormous risks.

Jeff Gordon said:

When it came to handling Richard Dennis’s money, Curt could have cared less if he lost it all. In retrospect that appears to be what Rich wanted. Rich wanted people who would be really aggressive.

Covel says:

Cavallo knew Dennis had become very successful as a very young man by taking big risks. The implication was that Faith was Dennis’s chosen one. The C&D brain trust were enamored with the fact that Faith was so young.

The entire Turtle group made around $100M, of which Faith made $31.5M.

Of course:

Faith was trading upwards of twenty times the equity base of other Turtles.

In 1984, Dennis decided that trading grains wasn’t worth his time anymore. He gave those grain accounts to Howard Seidler, Faith, and Cavallo to trade.

Everyone in the room knew about these grain accounts. They all knew they created the potential for trading much larger, with the chance to earn much more.

It’s just human nature. People who are now making six-figure incomes for the first time, get jealous of the people making seven-figure incomes.

Performance

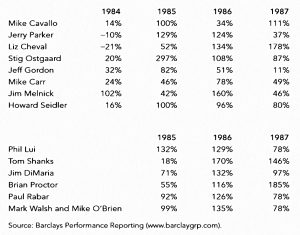

Covel has a performance table for some of the Turtles (Faith is noticeably absent):

The Memo

Four Turtles from the second class (Tom Shanks, Paul Rabar, Erle Keefer, and Jiri George Svoboda) formed a small group to do trading research. They wanted to validate their rules instead of just playing by them.

They built a systems testing platform and determined that Dennis had everyone taking far too much risk.

They blended the S1 and S2 trading systems and found that instead of a worst-case -50% drawdown, they were getting a worst-case -80% drawdown. The problem occurred when both systems got the entry breakout signal at the same time.

They told Dellutri, who ordered everyone to reduce their position sizes by 50%. On the heels of Dellutri’s order came the official memo from Dennis.

Some Turtles thought Dennis had kept bad habits from the days when he was in the pit. He was always worried about “skid” (not getting great fills).

Dennis himself said:

I really am a contrarian at heart, and that’s really probably not good if you’re a mechanical trend follower.

Game Over

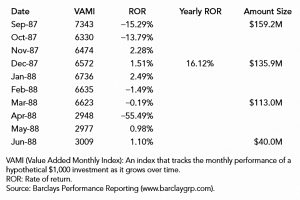

In early 1988, Dennis suddenly pulled the plug. His losses were 55% in April 1988. Not only that, his father had recently died.

Dennis was also running a couple of public funds for Drexel Burnham Lambert (run by Michael Milken) and they showed heavy losses, too.

Dennis said:

I wouldn’t trade a public fund now even if it were a cure for cancer. (( Interestingly, such a fund – called BACIT – was started about 10 years ago in the UK; it’s now known as Syncona ))

Covel said:

Lawsuits followed as his former clients argued that Dennis had deviated from his own rules. Eventually the settlement awarded nearly six thousand investors a share of $2.5M and half of Dennis’s trading profits over the next three years.

The Turtles lost 10% to 12% for that month – their losses were nowhere near the size of Dennis’s.

Shannon said: ” We calculated one day that his risk was probably one hundred times greater than the risk we were taking.”

Amazingly, even though Dennis was losing money on his own trading. the Turtles were keeping him in the black.

How much money did he make? “Tons. I think they grossed $150 million and we made $110 million.”

Dennis declared that he was retiring and would move full time into political causes.

He actually became a libertarian.

- And after appearing in Jack Schwager’s Market Wizards, he also hit the speaking circuit.

Conclusions

This section of the book has been an interesting read, and a revealing insight into human nature.

- Even when a group is doing much better than expected, some members will be disgruntled.

- People demand fairness, but there are as many definitions of fair as there are people.

All we learned about the system was that if you use both S1 and S2 together, you need to halve your position size.

- I will probably start by using just S2, so that shouldn’t affect me.

I’ll be back in a couple of weeks with the next section of the book.

- This looks at what happened to the Turtles when they couldn’t rely on Dennis as their safety net.

Until next time.