Finding Bargains – Excess Returns 3

Today’s post is the third in our series on the book Excess Returns, and looks at how successful investors go about Finding Bargains in the stock market.

Contents

Finding Bargains

Successful investors usually have a systematic approach to finding stocks to invest in. Today we’ll look at the different methods that they use.

- The objective is to discover stocks that are mis-priced, typically trading well below their intrinsic value (or above intrinsic value for shorting).

Today we are going to focus on the process of finding bargains in developed markets.

- In the next post in the series, we’ll look at the types of stocks to avoid, and at good stocks to short.

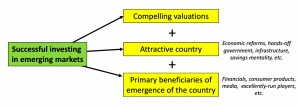

The book also discusses how to find bargains in emerging markets.

- Since I don’t advise buying individual stocks in foreign markets, I won’t cover this section.

Instead, here is the diagram which summarises the process for emerging markets:

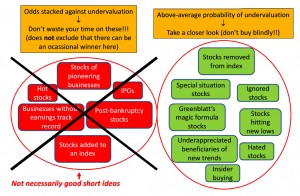

Back to developed markets. Here’s the overview diagram for these markets:

Ignored stocks

The first kind of stock to look for is the ignored stock. These have four features:

- people don’t talk about them

- they are not reported in the media

- they are not covered by analysts

- they have low institutional ownership

- These are likely to be mis-priced, but are equally likely to be undervalued as overvalued, so careful analysis is required.

There are four types of ignored stocks:

- Dull and unfashionable stocks

- companies with an image problem – companies in the funeral business, or in waste management, or that process disgusting raw materials (eg, animal by-products)

- socially irresponsible companies, such as weapons and cigarette makers

- companies in low-growth industries – tobacco again, or railways; perhaps today even gas and oil

- companies in these industries with low valuations, moderate growth expectations and solid dividends can be very good investments

- companies with dull or ridiculous names

- boring and established businesses – utilities and construction

- Small companies

- small companies are usually lightly analysed and more likely to be mis-priced, though as stated above, the mis-pricing cuts both ways

- an individual small companies will have more scope to grow and more potential for efficiency gains along the way (though of course this cannot be true of all small companies at the same time)

- they are often ignored by asset managers because they are difficult to trade (illiquid), or because they have market cap limitations on their funds

- large investors with portfolios of hundreds of millions of pounds cannot buy enough of a small stock to make a difference to them (to “move the needle”)

- small caps are more risky – more volatile and more likely to go out of business – which puts people off them, especially when market conditions generally are turbulent

- ironically, small companies can be easier to analyse, since they usually have a small number of business activities and their managements are sometimes open to communicating with investors

- Companies with little or complex information

- Investors don’t like to study companies that are hard to analyse this is why I only invest directly in UK stocks for example

- Stocks ignored for formal reasons

- penny stocks (priced below £1 in the UK, or below $10 in the US) are risky, but present opportunities

- post-arbitrage stocks – typically after a failed bid – are unpopular and often under-priced – aim for a price at least a third below the bid

Negative sentiment stocks

These are well-known stocks that have received bad publicity.

- Herding, extrapolation and loss aversion lead to investor over-reaction.

Categories of negative sentiment stocks include:

- failed “hot stocks“, eg. after hyped IPOs

- stocks on “most despised” lists

- those with operational issues such as problems opening a new plant

- those with bad news (strikes, oil spills, lawsuits, terrorist attacks)

- good (high-growth, low-debt and low-cost) companies in weak but reviving industries – bankruptcies in the industry can be a catalyst here, as can a standstill in capital investment

- impacts from contingent liabilities (litigation and regulatory actions) are often over-estimated by the market

- distressed businesses (close to bankruptcy) in industries with stable cash-flows and low failure rates, or where government bailouts are likely (utilities, banks, airlines – but beware nationalisation) – buy after the dividend is suspended and sell when it is restored

Investing in these stocks is called turnaround investing.

- larger stocks are safer bets here (since the market is more likely to notice any improvement)

- investors should also look for a potential catalyst or some evidence that the turnaround is happening (eg. insider buying)

New stocks

There are three types here:

- Special situations securities, that are not well understood and often distributed to investors who didn’t ask for them:

- merger securities

- preferred stock in going-private securities

- new stock of companies that emerge from bankruptcy

- recapitalisations, where a company buys most of its shares or swaps them for debt

- the highly leveraged new stock will be unpopular

- parent companies after the spin-off of a complicated division will often become takeover targets

- Spin-offs tend to outperform the market in the first three years

- the best time to buy is usually around a year after the spin-off

- look for insiders buying or receiving stock options

- small and/or illiquid (eg. high share priced) spin-offs

- parent shareholders receiving stock or rights issues in the spin-off, particularly those with over-subscription rights

- this can indicate management interest in the stock, and can also lead to selling pressure

- spin offs that look like “toxic waste” (come with liabilities)

- Bargain IPOs – IPOs are not usually attractive, except for those where the issue price can be expected to be low:

- privatisations

- de-mutualisations

Opportunities in new trends

New trends and industry booms are often well-publicised before they hit, and their effects should be discounted in stock prices.

But there are still opportunities:

- Stocks that are penalised too much – some companies that are expected to suffer from a trend will be over-punished.

- Indirect beneficiaries of new trends – some companies (usually suppliers to the booming industry) will not be recognised as beneficiaries because the link is unclear.

- this is the “picks and shovels” effect in the Gold Rush, or Cisco during the internet boom;

- oil services companies had done similarly well during the commodities boom

- unit trusts companies rather than their own funds when stocks are booming

- Clones of a successful innovator (Microsoft of IBM, Wal-Mart of Kmart).

- Multinationals with high exposure to emerging markets.

- Underappreciated beneficiaries of sudden events (eg. glass manufacturers after an earthquake)

- Beneficiaries of long-term secular trends – investors are generally too focused on the short-term, and can overlook things like long-term (c. 18 years) commodity bull markets.

- Companies with new future revenue sources – another aspect of short-termism

Recommendations (from the right people)

Most stock tips should be ignored, and even when you accept them as a source of ideas, you should nevertheless DYOR (Do Your Own Research) to confirm them.

Sources of useful information include:

- Competitor companies – they will usually know who their great rivals are

- frequent takeovers at significant premiums can indicate that companies in that industry are undervalued

- Respectable investors – this is not so much subscribing to tip sheets as following the trades of gurus

- there are subscription sites in the US to do this

- many UK investors look at which companies their favourite fund managers (Neil Woodward, Mark Slater) have been buying

- shareholder letters (such as those from Warren Buffett) cover similar information

- Insiders – director’s dealings (and dividends)

- many investors use the 6-month insider NPR (net purchase ratio):

NPR = (purchases - sales) / (purchases + sales)

- insider buying is especially significant for smaller and lower-valued companies

- the CFO and the CEO are the crucial insiders to follow

- sustained and large buying by three or more insiders is most significant

- purchases after a rise in the stock price are significant

- corporate stock purchases (buy-ins) are not significant

- dividend increases are also significant of insider confidence

Stocks with catalysts

The problem with catalysts for a share price recovery is that if everybody knows about them, they should be already priced in.

So we need to focus on events that will probably increase the company’s future cash flows, but are being ignored by the market

- Internal catalysts

- new management (this can be a negative as well as a positive factor),

- new strategy (again a double-edged factor),

- expected operational efficiencies,

- liquidation of an unprofitable division.

- External catalysts

- activist shareholders (sadly these are more common in the US – Carl Icahn, Bill Ackman, Dan Loeb and Barry Rosenstein),

- industry M&A activity,

- political or economic events (eg. wars)

Stocks that are removed from an index

These stocks “benefit” from forced selling that pushes down their stock price.

- All funds that use the index as a benchmark – and index funds and ETFs that track the index – must sell the stock.

The under-performance will usually come before the expulsion, and can be profitable purchased very soon afterwards.

Other opportunities

This section is a roundup of other areas to look for potential bargains:

- Pre-merger / acquisition stocks

- – many shareholders sell soon after the merger-induced price rises, which can leave additional profits for patient arbitrageurs

- Stocks with asymmetric payoffs

- excellent upside (if something works out) and limited downside

- eg. an oil explorer with a productive well and many additional test sites whose value is not reflected in the stock price

- Companies with outstanding qualities

- the market is better at evaluating numbers than qualitative characteristics, and companies with great corporate culture, management, brands etc. can out-perform.

- lists like “The 100 Best Companies to Work For”, “100 most valuable brands” etc. can help here.

- Parent of a spin-off

- when American Express span off Lehman Brothers, the volatile earnings of the bank made it hard for investors to work out the future earnings of American Express, so of course they erred on the low side.

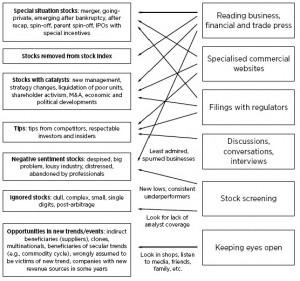

Finding ideas

The diagram above shows how the sources of ideas relate to the various categories of stocks we have looked at:

- Reading

- this is the best source of investment ideas

- virtually all top investors are avid readers of the business and financial press

- they read newspapers, broker reports, books, “best of” and “worst of” lists, letters to shareholders

- the business press can point to special situations, turnarounds, great or despised companies, catalysts (e.g., new management or restructurings), new trends, and so on

- Company reports and regulatory announcements

- it’s another form of reading, but more focused on the companies you want to know more about

- Stock screening

- this includes the free screeners on websites and the “data-mining” packages like ShareScope / SharePad and Stockopedia

- always DYOR – there may be errors in the data and favourable (eg. “cheap”) stocks may appear so for a very good reason

- value criteria are most commonly used

- price falls (eg. 52-week lows) and price momentum (price rises) are also used

- “guru screens” (eg. Joel Greenblatt’s “magic formula” – non-financial stocks with low P/E and high return on capital -ROIC) are also popular

- Specialised data sources

- directors dealings

- institutional holdings

- fund manager reports

- guru stock lists (actual or via screening criteria)

- activist investor holdings

- Keeping your eyes and ears open

- Peter Lynch used to recommend that investors wander through retail stores and shopping malls

- listen to what ordinary consumers (including your family and friends) are saying about products

- bizarrely, this can mean that you notice new trends before professional investors who rely on broker reports and research

Conclusions

- Successful investors usually have a systematic approach to finding bargains – under-valued stocks

- Ignored stocks (no analyst coverage, low institutional ownership) may be mispriced (too high or too low – DYOR). There are five types:

- dull and unfashionable companies

- small companies

- companies with little or complex information

- penny stocks (risky)

- post-arbitrage (failed bid) stocks

- Negative sentiment companies also present opportunities:

- failed and despised stocks

- companies with operational issues or “bad news”, including contingent liabilities

- weak but reviving industries and distressed businesses

- New stocks are of interest – special situations, spin-offs and privatisations

- There are opportunities in new trends:

- indirect beneficiaries

- over-penalised companies

- clones

- multinationals

- long-term secular trends

- new future revenue sources

- Recommendations can be helpful:

- competitors identifying their rivals

- guru and fund manager investments

- insider buying

- Stocks with under-appreciated catalysts can be mis-priced

- Stocks that are removed from an index usually outperform

- Ideas are best found by reading a lot, but other sources include:

- regulatory announcements and company reports

- stock screeners

- specialised data on eg. directors’ dealings

- keeping your eyes and ears open

- The most attractive opportunities for UK private investors are in:

- dull and unfashionable companies

- small companies

- spin-offs and parent companies of a spin-off

- privatisations

- guru and fund manager investments

- insider buying

- stocks with under-appreciated catalysts

- stocks that are removed from an index

Until next time.