Fundamentals Matter

Today’s post looks at a recent note from O’Shaugnessy Asset Management which explains why fundamentals matter.

Momentum

The note was published in August 2022 and was written by Jamie Catherwood of O’Shaugnessy Asset Management (OSAM).

Jame notes that when things are going well, investors usually ignore fundamentals – momentum is king.

The reduced focus on critical details like earnings and valuation benefits the type of company that usually captures investor enthusiasm during speculative booms. These companies are generally unprofitable, have vague financials, and trade at high valuations.

Such firms have future earnings projections that are difficult to evaluate and/or criticize.

- Reference is made to the few similar predecessors that went on to great success, rather than the many who failed.

Cheap money

Cheap money makes things worse.

Since many investors must re-allocate capital from low-yielding assets to riskier investments, these speculative companies attract investors with exciting narratives and promises of future growth.

This speculation drives share prices higher, creating a feedback loop.

- This works fine until something causes markets to fall.

Fundamentals

The basic issue is that future profits are not a sustainable driver of performance.

Every company is a business, and every business needs profits. Our research highlights three enduring drivers:

- Business Growth – The earnings of the business increase over time.

- Return of Capital – Management returns cash to shareholders via buybacks, dividends, or both.

- Multiple Expansion – Investors become willing to pay more for each $1 in

earnings (Higher P/E).

Note that multiple expansion reflects the hope that future earnings will be greater than current earnings, and will justify the higher valuation.

- Needless to say, humans are over-optimistic, and hopeless at predicting the future (including future earnings).

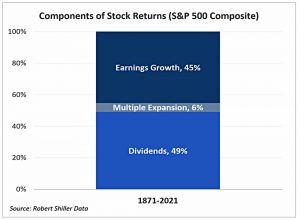

Since 1871, dividends have been the biggest driver of the S&P 500, with earnings growth a close second.

- Long-term, multiple expansion has contributed just 6%.

Recent Trends

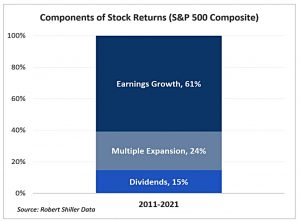

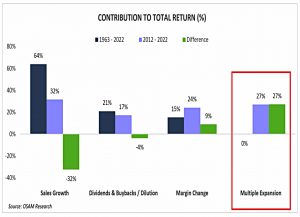

Over the ten years to 2021, however, multiple expansion (ME) has contributed 24% of returns.

- Earnings growth is the biggest contributor, with dividends providing just 15%.

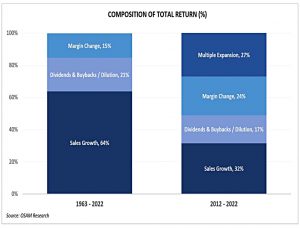

OSAM uses its own US Large Cap Index and splits Earnings Growth into Sales Growth and Margin Change.

- They also add share Buybacks and Dilutions to Shareholder Returns.

From 1963 to 2022, the net effect of ME was zero.

- From 2012 to 2022, ME accounted for 27% of returns.

Why this matters

The more ME, the greater is the speculative element in share prices, and the more we are relying on future expectations.

Jamies makes reference to the pandemic:

When many people were preaching that life as we knew it had irrevocably changed (e.g., no more in-person meetings, the death of business travel, etc.), shares of work-from-home stocks like Zoom traded at 464.8x next year’s earnings.

But when the market changes, so do investor attitudes:

When asset prices are rising, investors typically require less conviction or belief in an asset to purchase it. When prices are falling, however, investors meticulously study the merits of an investment and make sure they have strong conviction in its prospects.

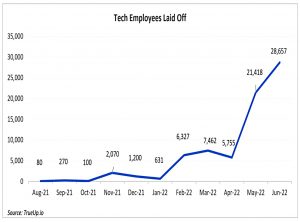

And we are now starting to see the effects, particularly in tech:

Many of these companies are unprofitable. Jamie quotes journalist Derek Thompson:

If you woke up on a Casper mattress, worked out with a Peloton, Ubered to a WeWork, ordered on DoorDash for lunch, took a Lyft home, and ordered dinner through Postmates only to realize your partner had already started on a Blue Apron meal, your household had, in one day, interacted with eight unprofitable companies that collectively lost about $15 billion in one year. (( I mostly sleep on an Eve mattress – which is very good – and the company has just gone into administration ))

When interest rates were zero, investors were keen to put money into long shots, and these companies could survive.

- In the markets, Buy The Dip (on tech) was a winning strategy.

Jamie says those days are gone and fundamentals are back in fashion.

Investors should ensure that they have conviction in the underlying businesses of stocks they own, and not just their share price.

Conclusions

It’s pretty clear where Jamie stands on this issue, but we each need to make up our own minds.

- Over the long run, ME hasn’t mattered (there has been a reversion to the mean)

- This implies that looking at the recent impact of ME could have predictive value

- In recent years – a period of low interest rates – ME has been more significant

- There are other possible drivers too – increased returns to capital over labour, and the rise of intangible assets (intellectual property)

- Is that period of low interest rates over, and if so, will multiples contract again?

It’s hard to be certain, but as the saying goes “trees don’t grow to the sky” – and neither will multiples.

- Even if low interest rates and permanently elevated multiples return, how much further in that direction can we travel?

Until next time.