Idle Investor 2 – Anomalies, Foundations and Two Strategies

Today’s post is our second visit to Edmund Shing’s book The Idle Investor. Today we look at market anomalies and the first couple of Ed’s strategies.

Contents

Market anomalies

Ed identifies five market-beating anomalies (or phenomena, as he calls them):

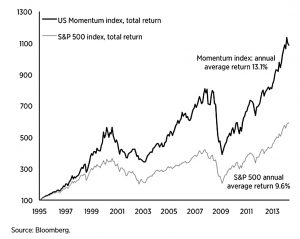

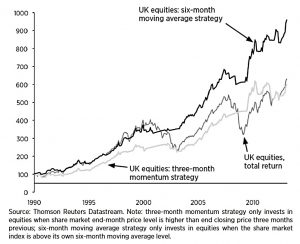

- Momentum

- shares that have outperformed tend to continue to outperform

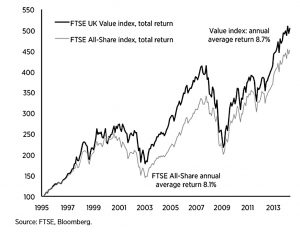

- Value

- cheap shares (according to price/earnings or price/book value), tend to outperform expensive shares (and the market)

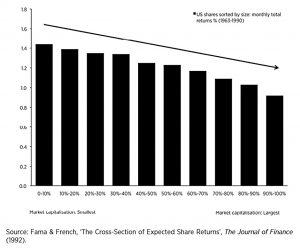

- Size

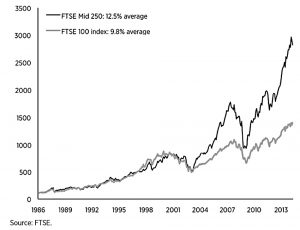

- mid-cap and small-cap shares do better than large-cap shares

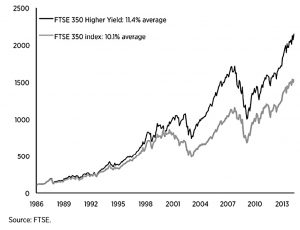

- Dividends

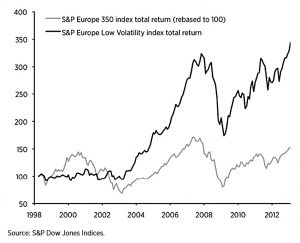

- Low Volatility

- shares with more stable prices tend to outperform, and offer much better risk / return ratios

Ed adds a lot more detail on each of these issues, but regular readers should be familiar with all of these outperformance factors by now.

Here are the most important points:

- momentum works best over 3 to 12 months (eg. 3 month look-back implies outperformance over next 3 months)

- 6-month momentum works best

- high dividend yield, low price/book ratios and low P/E ratios are Ed’s favoured value measures of value

- Ed favours FTSE-250 ETFs over FTSE- Small Cap ETFs for exploitation of the size effect

- this is because they have better liquidity (are easier and cheaper to trade)

- the low volatility effect is surprising because CAPM predicts that riskier assets have higher returns

- of course, CAPM uses price volatility as a measure of risk, which it isn’t

Strategy foundations

As well as the anomalies above, Ed’s three strategies have some other things in common:

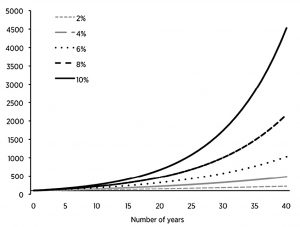

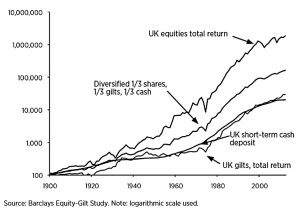

- compounding

- diversification

- ETFs (to keep costs low)

We’ve covered each of these before:

Ed adds a couple of points:

- diversification means not just lots of shares (via ETFs) but also lots of asset classes and geographies (and share sizes, etc)

- diversification reduces returns as well as risk, but optimises the risk / return ratio

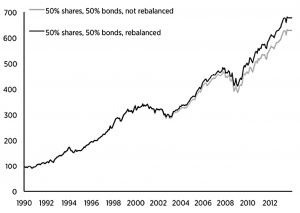

- rebalancing is an important aspect of diversification

- it acts as a contrarian value strategy, taking money out of the best-performing assets (say each year) and putting it into underperforming assets

- note that this is the opposite of a momentum strategy and so it is important not to rebalance too often

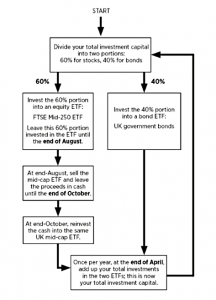

Strategy 1 – Bone Idle

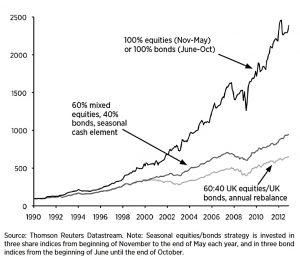

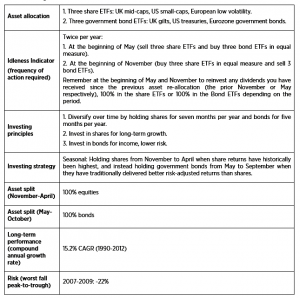

This is a basic 60% shares, 40% bonds strategy.

- You rebalance once a year (Ed says in April, which I think is based on seasonal effect rather than the UK tax year)

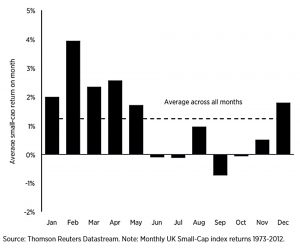

Ed tweaks this basic system by using mid-caps rather than the FTSE-100 (size effect) and staying out of stocks in September and October

- These are the worst months of the year for shares – a seasonal effect he hasn’t mentioned before.

The 60/40 allocation would suit someone with a moderate risk tolerance, but the ratios can be moved up or down without destroying the outperformance.

- Note that there would be a trade off between increased returns (from more equities) and increased volatility.

Note also that the key feature of this strategy is not stellar outperformance, but lower volatility.

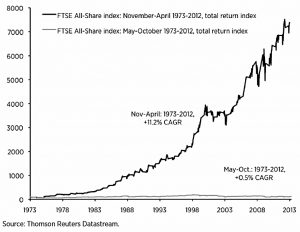

Strategy 2 – Summer Hibernation

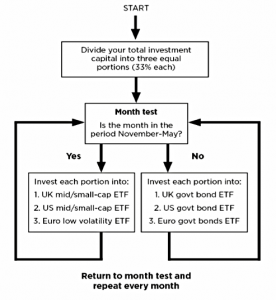

Ed’s second strategy is more aggressive in its approach to seasonal effects.

- It sits out of stocks over the summer, essentially using the old market adage:

Sell in May and go away; don’t come back until St. Leger’s day.

I have mixed feelings about this one, which I have discussed in a previous post:

Strategy 2 also abandons the 60 / 40 split between stocks and bonds, in favour of 100% stocks in the winter and 100% bonds in the summer.

- You switch twice a year, at the beginning of May and the beginning of November.

Ed has two problems with Strategy 1:

- it didn’t fully protect against the 2008 crash, falling 14%

- low bond yields mean that future performance won’t be as good (( Note that bond yields have continued to fall since Ed wrote his book, but I see what he is getting at ))

Strategy 2 has much better performance overall than Strategy 1 (5% pa better at 15% pa) but would have done even worse in 2008, losing 22%.

- Strategy 2 also has regular long periods where it either loses money or stalls.

Ed uses three ETFs when in shares:

- UK mid-caps (iShares FTSE 250 ETF, code: MIDD)

- European low volatility (iShares MSCI Europe Minimum Volatility ETF, code IMV), and

- US small-cap (iShares S&P SmallCap 600 ETF, code ISP6).

He uses three bond ETFS when in bonds:

- UK gilts (Vanguard UK Government Bond ETF, code VGOV),

- Euro government bonds (iShares Core Euro Government Bond ETF, code SEGA), and

- US government bonds (iShares US Aggregate Bond ETF, code SUAG).

Conclusions

It’s a short post today, but we have covered another third of the book, leaving us with just another third to go.

- Few words have been needed because much of the material discussed in this section of Ed’s book is already familiar to us, and has been documented elsewhere on 7 Circles.

We now have two strategies for outperforming the market, but neither appeal massively to me.

- In their favour, they are simple to implement for beginners.

I do however approve of Ed’s anomalies and foundations, and I’m hoping for a better (and probably more complicated) way of exploiting them.

- So I’m holding out for the third strategy, which we will cover in the third and final article on the book.

Until next time.