July 2017 – Trades, Tips and Funds

Today’s post is another in the series of monthly roundups of the interesting investing tips I’ve come across, plus a summary of any trades that I make. Welcome to July 2017.

Trades

Another month has passed without me trading.

- I’m still wary of the tech sector in the US (and Bitcoin).

- Here in the UK, Brexit looms large.

I also had quite a lot of work to do for my mother-in-law.

- The six-month protection to the cash proceeds from the sale of her flat in January expired this month.

- So we’ve had to split the money into multiple accounts (of various flavours).

On top of this, we managed to break our washing machine and then fridge / freezer in successive weeks.

- So I’ve spent rather more time than I would like doing online research and actually walking around bricks-and-mortar white goods stores. (( Though of course, our new fridge / freezer is the currently popular stainless steel rather than white ))

As always, I remain optimistic for next month.

Tips

The tips section seems to have been subverted for the time being into the tax-advantaged investments section, and so our first article comes from Hugo Greenhalgh in the FT:

This was about VCTs, and the answer was a qualified “yes”.

- He’s not keen on the high charges (close to 3% pa).

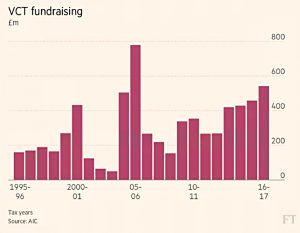

Hugo also had a nice graph of VCT investments by year:

I think the peak in 2005/06 reflects two things:

- Gordon Brown introduced the pension freedoms in 2006, which suddenly meant that you could put up to £250K pa into your pension.

- The income tax relief on VCTs was reduced from 40% to 30%.

Since then, as the annual and lifetime limits for pensions have been reduced – from £1.8M to £1M, and £250K pa to £40K pa respectively – interest in VCTs has risen once more.

VCT and EIS are becoming a big topic for me just now.

- I want to avoid a repeat of the scramble to get my money invested back in March 2017.

So you can expect a dedicated post on this subject before next month’s roundup.

Funds

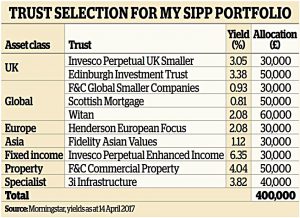

In Money Observer, Heather Connon revealed the 10 investment trusts she has picked for her SIPP.

It’s a reasonable spread for such a concentrated portfolio, though perhaps a little UK heavy.

- With £400K to invest, Heather could have many more trusts in there, allowing her to access the US and technology in particular but also perhaps private equity.

We have most of the trusts on our list already, and I won’t be adding any of the others (unless someone can convince me to in the comments).

Over on Master Investor, Nick Sudbury wrote about the UK technology trust delivering market-beating returns.

- It turned out to be Herald, which is already on our list.

Nick had another article about a 3-fund portfolio that pays 6% pa.

The funds were:

- Funding Circle SME Income (FCIF – on our list)

- Invesco Perpetual Enhanced Income (IPE – on our list)

- Impact Healthcare REIT (IHR – new to me)

- This is a new fund with an IPO in March 2017

- It invests in established care homes and targets a 6% yield

- I’ve added it to our list

Nick’s third article of the month was about Private Equity.

- He listed quite a few companies, all of which were already known to us.

- They were divided into those that invest directly, and fund of funds.

First the direct companies:

- 3i Group (III)

- Apax Global Alpha (APAX)

- Electra PE (ELTA)

- HgCapital (HGT)

- Better Capital (BCAP)

- LMS Capital (LMS)

- JZ Capital Partners (JZCP)

- Princess PE (PEY)

And now the funds of funds:

In CityWire, Nick Greenwood of Miton Global Opportunities (MIGO – on our list) was interviewed about “hidden income” trusts.

He mentioned four:

- Real Estate Investors (RLE – on our list)

- Ecofin Global Utilities and Infrastructure (EGL – on our list)

- Phaunos Timber (PTF – on our list)

- Unfortunately, Phaunos shareholders have since voted in favour of a wind-up, so it won’t be around for much longer.

- Downing Strategic MicroCap (DSM – not on our list)

- We already have two micro-cap funds (MINI – from Miton themselves – and RMMC) and I’m not convinced that we need another, but I’ve added it anyway.

CityWire also reported on the flotation of a second social housing REIT.

- This is Residential Secure Income (RESI – added to our list).

On the other hand, the launch of the Hipgnosis Songs Fund – a music royalties IT – has been delayed “to give time for a second big investor to decide on whether to back the trust”.

In MoneyWeek, Max King warned us to be wary of the social housing trusts.

In a second article, Mex wrote that tech stocks still have room to grow.

He recommended gaining access via two trusts, both already on our list:

- Polar Capital Technology (PCT)

- Allianz Technology (ATT)

Chris Sholto Heaton also had a couple of articles.

- The first was about emerging markets funds. He listed five, but three were OEICs.

- Only one of the two investment trusts was known to us:

- Scottish Oriental Smaller Companies (SST, known)

- Aberdeen Asian Smaller Companies (AAS, added)

That brings us up to 200 funds on the investment trust list, by the way.

Two weeks later Cris was back with a look at global funds.

- Again, most of the funds were open ended, but there were two ITs:

- Scottish Mortgage (SMT, known)

- Ballie Gifford Shin Nippon (BGS, known)

Pipping Max and Cris, and tying with Nick, David Stephenson also had three articles this month.

The first was about cybersecurity, and recommended one ETF and one IT:

- ISE Cyber Security ETF (ISPY, known)

- Polar Capital Technology (PCT, known)

The second recommended the new Supermarket Income REIT, which doesn’t appear to have launched yet.

The third was about the investment trust fundraising spree of recent years.

- David had some worries about recent launches.

(( Surely this should be a stacked bar chart? ))

The only fund mentioned by name that was new to me was the AEW Long Lease REIT (AEWL, added).

- This targets specialist properties (car parks, care homes, leisure centres) on long leases (more than 17 years on average), and offers a 6% pa yield.

I’m going to leave it there for today.

- There’s still quite a backlog of articles to get through, but the pile is gradually shrinking.

Until next time.