Masterworks.io – Fractional Fine Art

Today’s post is a look at Masterworks.io, which offers fractional fine art ownership to the common man.

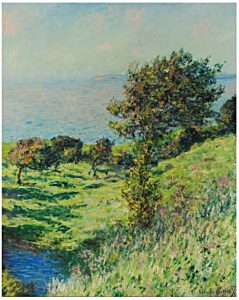

Fine art

Regular readers will know that my first loyalty in investment is to diversification.

- I am always on the lookout for a new asset class to add to my collection.

I am also a massive fan of fine art, (( Galleries are fourth on the list of what I miss during a lockdown, after pubs, restaurants and football matches )) so why don’t I own any?

- The short answer is that it’s too expensive – the prices for the good stuff are so high that I could never expect to assemble a diversified portfolio of art.

Prints of masterworks offer some hope, as they are surprisingly cheap.

- But I might have left it too late, as long holding periods are necessary to achieve your target returns.

Another option is Masterworks.io, which I have only just discovered, but which has been offering fractional ownership of fine art for several years.

- The platform was launched by collector Scott Lynn in 2017.

A new asset class

So what do we need in order to add fine art to our list of asset classes?

I can think of five requirements:

- Positive expected real returns

- These don’t need to be as high as from equities, but they should beat inflation plus our target withdrawal rate (SWR)

- Which means anything above 3% real pa is of interest.

- Lower returns (down to 0% pa, as for gold) can be useful in small amounts if the correlation to equities – see below – is low enough)

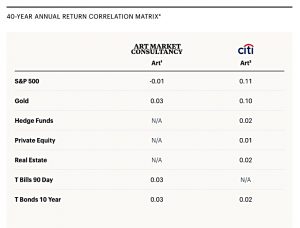

- Returns not correlated to those from the main developed equity market indices

- For UK investors, this means the FTSE All-Share and the S&P-500

- Liquidity

- We need to be able to buy and sell (rebalance our asset allocation) when we need to

- Deal size is part of this – we want our purchase increments to be of the same order as our stocks trades (say £2K to £10K for most UK private investors), so that we can build a diversified portfolio within the asset class.

- Regular re-pricing (mark to market) is also part of this – we need regular updates on what our holdings are worth – I would say annually is the bare minimum, but monthly would be better and daily would be best

- Low costs

- Transaction costs need to be low – ideally less than 1%

- Holding costs need to be low – again, less than 1% or ideally 0.5%

- Many esoteric assets get away with 2% pa in charges, but they usually have high expected returns and/or a relevant tax break (see below)

- Favourable tax treatment

- The key tax shelters in the UK (ISAs, SIPPs and your main residence) come with restrictions on what can be held within them.

- Outside of that, we have VCTs and EIS (both very restrictive) and an annual GCT allowance of around £12K (which is currently under review and might be cut to less than £5K pa).

- Assets which won’t fit in the tax shelters need to add a 25% surcharge to the return target in order to pay the tax bill – so let’s say we need 4% pa real now.

Masterworks

So what does Masterworks do?

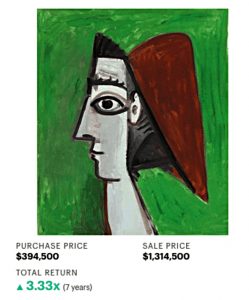

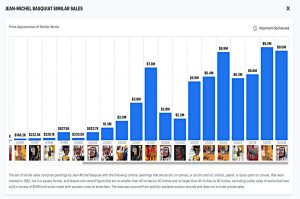

- Masterworks sources and buys individual artworks

- The art includes famous historical names and also “contemporary favourites” that are more likely to attract “new money”.

- Artworks are intended to be representative of the artist’s mature (read “popular”) style.

- We hope that these are acquired at competitive prices (relative to those we might achieve for ourselves) because of dealer relationships and perhaps more advanced auction strategies.

- My understanding (( I’m not a member, so I don’t know for sure )) is that prospective acquisitions go through a “crowdfunding” stage to see if they will attract the necessary support from members.

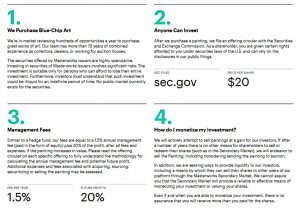

- Masterworks then lists this artwork as an investment offer with the SEC (Securities and Exchange Commission) and sells shares to (qualified) members of the public.

- No investor may purchase more than 10% of the shares in an individual artwork.

- Share ownership is recorded on the Ethereum blockchain “to provide transparency to investors” (and possibly to ride the Zeitgeist).

- Vetting of prospective investors apparently involves a live interview (presumably online or by phone these days, even if you live in New York).

- I would imagine they are trying to get a feel for how much money you plan to invest.

- Don’t be fooled by the $10,000 minimum investment (originally $1,000) – with expected fees over five years of around 17% of your original investment (see below), you will need to interesting in committing many thousands to make you an attractive prospect.

- As of October 2020, the waiting list was over 300 people. (( Source: Bezinga.com ))

- Lynn says that the platform has been attracting 10,000 members per month during lockdown (( Source: Business-Standard.com ))

- Masterworks operates a secondary market so that holders can trade shares in artworks.

- There are no market makers here, so deals are negotiated between interested parties (matched bargain).

- You don’t need to be a pre-existing owner of shares in an artwork to buy more.

- Data from Masterworks shows that secondary prices rarely fall below $20, but of course, this is not guaranteed.

- Masterworks also provide live estimates of value on your personal account dashboard.

- The art is largely held in museum-grade art storage facilities, but there is also a (members-only) gallery in New York (SoHo).

- This is nice, but not much use to someone who lives in London.

- After several years – usually, three to seven – the artwork is sold again at auction and the net proceeds (after “expenses”) are distributed to the shareholders.

- If offers come in from collectors before the artwork is due to be auctioned, shareholders get to vote on whether to sell.

- Masterworks also provides rudimentary education material such as artist biographies and a blog (Masterworks Insights).

- There are also auction data for its own artists and more general price material on the global art market.

Costs

The good news is that the minimum investment is $20 in each artwork ($10,000 across the platform as a whole).

- The bad news is that fees are hedge-fund steep – 1.5% pa and a 20% performance fee (taken from profits after all fees and expenses).

Masterworks initially separated out three closing expenses but these have now been rolled into the annual fee.

Returns

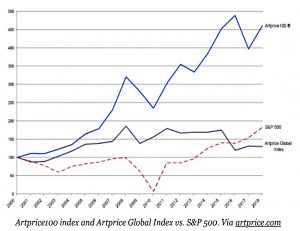

Fine art has a good track record and coped well with the 2008 crisis and the 2018 flash crash.

- Of course, tracking art prices is somewhat subjective, and loss aversion and the disposition effect combine to mean that winning investments are more likely to be sold (and indexed) than losers).

Masterworks targets gross appreciation rates of between 9% pa and 15% pa (based on historical appreciation rates for the artist).

- After fees, these rates become 7.5% and 13.5% pa.

Over the average holding period of five years, these net rates produce terminal values of 144% and 188% respectively.

- Removing the 20% performance fee reduces these values to 135% and 170%.

Which translate back to 6% pa and 11% pa.

- If we take off 2% inflation we are left with 4% pa and 9% pa real.

So if Masterworks hits their targets we hit ours, with a potential 5% pa upside (4% pa net of tax).

- But art valuation is a subjective process, and prices vary from one auction room to the next.

Note that I’m assuming here that the Masterworks annual fee covers all buying and selling expenses.

Scores on the doors

So how does Masterworks score on our asset class requirements?

- Positive expected real returns

- WIN – fine art has a good track record and the Masterworks targets just about stack up.

- Returns not correlated to those from the main developed equity market indices

- WIN – returns are less correlated to the stock market (and the wider economy) than I expected.

- Liquidity

- DRAW – the minimum investment is acceptably low but the secondary market is private and the pool of assets is limited (around two dozen artworks at present, I believe).

- Low costs

- FAIL – costs are high but not deal-breaker high for a small allocation within your overall portfolio.

- Favourable tax treatment

- FAIL – no tax breaks, so we are depending on strong underlying returns.

So we’ll give it five out of ten at the moment.

Masterworks is an interesting idea, and if they can establish a liquid global market in $20 (or even £100) shares in artworks themselves valued in the low millions, they could dominate an exciting niche in investing.

- I am tempted to register in order to keep abreast of developments, but I don’t feel a pressing need to invest at the moment.

That might change if I find myself with a lot of cash outside of tax shelters.

- I’ll maybe check back on this again in 2022.

Until next time.